Passive Thoughts

... actively held.

Indexing is generally a good place to start your investing journey. There are tomes written about how active managers fail to beat their benchmarks over long periods of time while charging a premium to do so, and how most managers have low active shares, how they hug their benchmarks, for the fear of trailing them. There is also the problem of cyclicality in style performance that poses a challenge in convincing investors to stay the course in actively managed funds. And last but not the least, the business of fund management is different from the fund management business - even though managers might be skilled at stock picking, the fund house has a business to run.

Given the amount of noise and will she/won’t she heartbreaks, more and more investors are deciding to quit the whole circus and go passive.

Indian passive AUM has grown with the rest of the market…

… sitting north of 16% of total AUM.

Passive funds tend to be pull products that requires massive scale. Their low fees means that the existing fund distribution network will not push it. If you assume that each fund needs to pull in Rs. 25 crores a year to breakeven, then at 20bps, each fund needs to garner at least Rs. 12,500 crores in AUM. While there has been a definite push from SEBI towards passive, half-hearted attempts by funds facing this classic innovator’s dilemma means that not all funds tracking an index are equal.

The index Tracking Difference data collated by AMFI brings home the point that not all fund managers are equally competent, and investors need to look beyond just the marquee and fees: Index Fund/ETF Tracking Difference.

In the grand scheme of things, passive is going to take a larger and larger share of the market. Some research to get you started:

The Rise of Passive Investing and Active Mutual Fund Skill (SSRN)

As passive investment rises, investors identify the skill of active managers faster, leading unskilled managers to exit the active mutual fund industry. Because unskilled active managers increase noise in stock prices, greater passive investing improves market efficiency as unskilled managers exit.

Generating alpha contains the seeds of its own destruction (tebi)

Generating alpha is what active fund managers are paid to do. The problem is, when a manager succeeds, more people are persuaded to invest. And the larger the assets under management, the harder it becomes to continue generating alpha.

Diseconomies of Scale in Investing (alphaarchitect)

Fund size causes fund performance erosion due to the illiquidity effects. A larger fund must place bigger orders in the market. This moves the prices against the fund… In addition, while the research shows that fund managers are skilled, skill doesn’t translate into outperformance due to the diseconomies of scale.

Mutual Fund Managers Are Wrong More Than They’re Right (morningstar)

On the whole, active managers tend to be right about stocks as often as the market overall. The fact that they consistently underperform passive options exposes their Achilles’ heel: portfolio construction. Active managers do not appear, in the aggregate, to be able to weight a portfolio more effectively than the collective wisdom of the market.

Performance Evaluation of Actively Managed and Passive (Index) Mutual Funds in India (SSRN)

Over the period April 2006 – March 2019, actively managed funds were not able to outperform the market. Also, there was no significant difference in the performances of actively managed funds and passive (index) funds on account of fund returns, Sharpe ratio, and Treynor ratio.

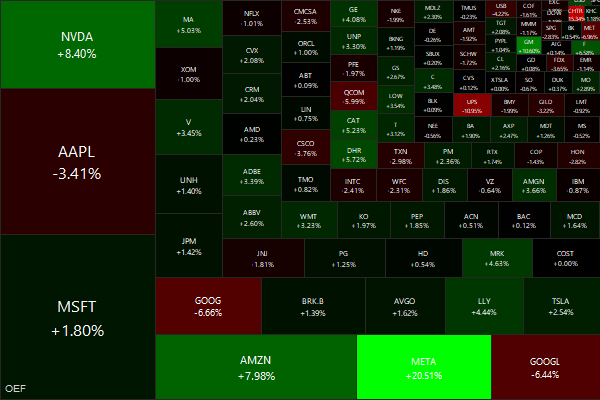

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

Links

Everything you wanted to know about Asset Management & Portfolio Optimization: University of Evry/Paris-Saclay

How To Create Value For Shareholders (Tokyo Stock Exchange)

India

We had a budget! No major changes (reuters)

World-beating growth? Not for India's rural majority (reuters)

Modi’s Thriftiness May End Up Shortchanging India (bloomberg)

Each of the Big Four CEOs said that the overall sentiment among clients across various industries remained cautious, and discretionary spending by clients was minimal. (livemint)

Rise of the uber-rich drives luxury brands in India (livemint)

Major drama with PayTm: the RBI froze Paytm Payments Bank’s license (rbi, reuters, reuters).

Byju’s cuts valuation ask by 99% in rights issue amid cash crunch (techcrunch)

RoW

How it started: UPS drivers can earn as much as $172,000 without a degree

How its going: UPS to cut 12,000 jobs

The looming trade tensions over China’s subsidies (ft)

China's growth model pushes Beijing into more trade conflicts (reuters)

China’s economy is no longer about to dash past the US, but its ability to mobilise capital, people, resources and military muscle for specific purposes remains enormous. (afr)

When investors have a gnawing anxiety that there are unresolved losses in the financial system they cannot quantify, this creates a stealthy, self-reinforcing deflationary mindset. And once a deflationary mood takes hold, it becomes even harder to tackle bad loans

China needs to learn lessons from 1990s Japan (ft)

China employment pressure ‘worsening’ this year in absence of solutions to shore up jobs (scmp)

What China’s E.V. City Says About the State of the Economy (nytimes)

Elon Musk says Chinese EV makers will 'pretty much demolish' most competitors without trade barriers (cnbc)

Odds & Ends

The baby bust that we all know about has gotten worse (nytimes)

Inventing the Perfect College Applicant (nymag)

Tire Dust Makes Up the Majority of Ocean Microplastics (thedrive)