We keep planning for the future but without studying the decisions we made in the past, we are bound to keep repeating the same mistakes over and over again. A portfolio checkpoint once every few years is a good idea to see if any of the assumptions you made holds up to scrutiny.

Yesterday, I was going through my portfolio notes, time-travelling back to 2015, if you will. About half my portfolio is in US equities and the rest in India - it is just the path of least regret for me and not a comment on relative merits.

Caveat: I don’t own single stocks in the US and my India portfolio is based on an automated quantitative momentum strategy. I just don’t think that picking single stocks is a winning strategy over the long term. You’ll not find stock-picks in this newsletter.

America, America

So, its 2015 and iShare’s US Momentum ETF (MTUM) was about two years old, memories of the crash of 2008 was fading and the strategy was making bank.

Having red-pilled myself on momentum, I sold some of the mid-cap ETF (VO) that I had and bought into MTUM. I was not, and I am still not, a believer in P/B based market-weighted “value” strategies. And since I wanted a barbell between momentum and value, I retained the BRK-B that I owned. So my portfolio in 2015 was equal weight MTUM, VO and BRK-B. My goal was to beat the S&P 500 (VOO) while not taking too much risk.

Meh success.

Looks like the MTUM-BRK barbell sort of held up. One of them zigged when the other zagged. But VO dragged - never once out-performing VOO. So overall, my portfolio kept pace with the S&P 500 but did not really beat it.

The reason I bet on US mid-caps was because I was expecting a booming economy to propel them ahead of large-caps. But the FANGMANs dominated instead. I am now seriously considering exiting VO and adding the proceeds to MTUM over time.

Mere Desh Ki Dharti

My India portfolio is a play with two acts.

The first act was done with a smallish allocation. So, thankfully, learnt some lessons in risk-management without losing my shirt. I was long multi-cap, monthly rebalanced momentum from 2015 through March-2016. The strategy had basically doubled in 2014 and Modi hai to munkin hai, right?

It was one hell of a ride.

The portfolio zoomed up for most of 2015 and then came the crash in Jan-2016. Chaffed at having not been able to retain any of my paper profits, I swore “Never again!” and got to work on a suite of Momo strategies.

The second act was driven by an appreciation of automated risk management. The trade-off I made was that the higher transaction cost was well worth the reduced cost of a heart attack.

Was it?

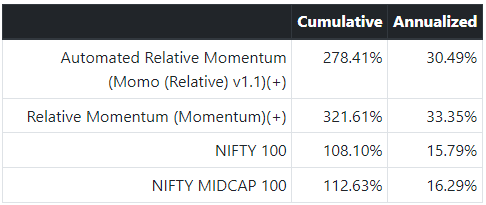

It absolutely was.

In theory, the raw Momentum portfolio I had in 2015 would’ve given me slightly better returns than the Momo version I invested in 2016. Transaction costs are a major drag (I absolutely hate STT for this reason.)

However, I don’t think I would’ve been able to allocate as much as I did either. It is one thing to lose 60% of your portfolio when the amount involved is small, quite another at 10x.

The last change I made was in August 2021. This was a minor one - flipped from Relative momentum to Absolute momentum (Velocity). So far, I’ve managed to lose less than what I would’ve if I had stuck with Relative.

Lessons learnt

Mistakes will be made. Admit it, correct it, document it and move on.

Know the tradeoffs between Returns, Cost and Risk. You can optimize only two.

There is always some worry - PIIGS, European banks, Fragile Five, pandemic, QE, QT… Markets will react, absorb and adapt. There’s no way you can time any of it.

99% of research notes, newsletter, blogs, tweets, etc. are “content marketing.”

Don’t blow up. I’m glad I stayed away from investing in ARKK, crypto, Indian credit funds, ULIPs, P2P lending, shared real-estate investments, whatever the thing was with warehouse receipts…

There is always the option of going long VOO, NIFTY 100 and chill.

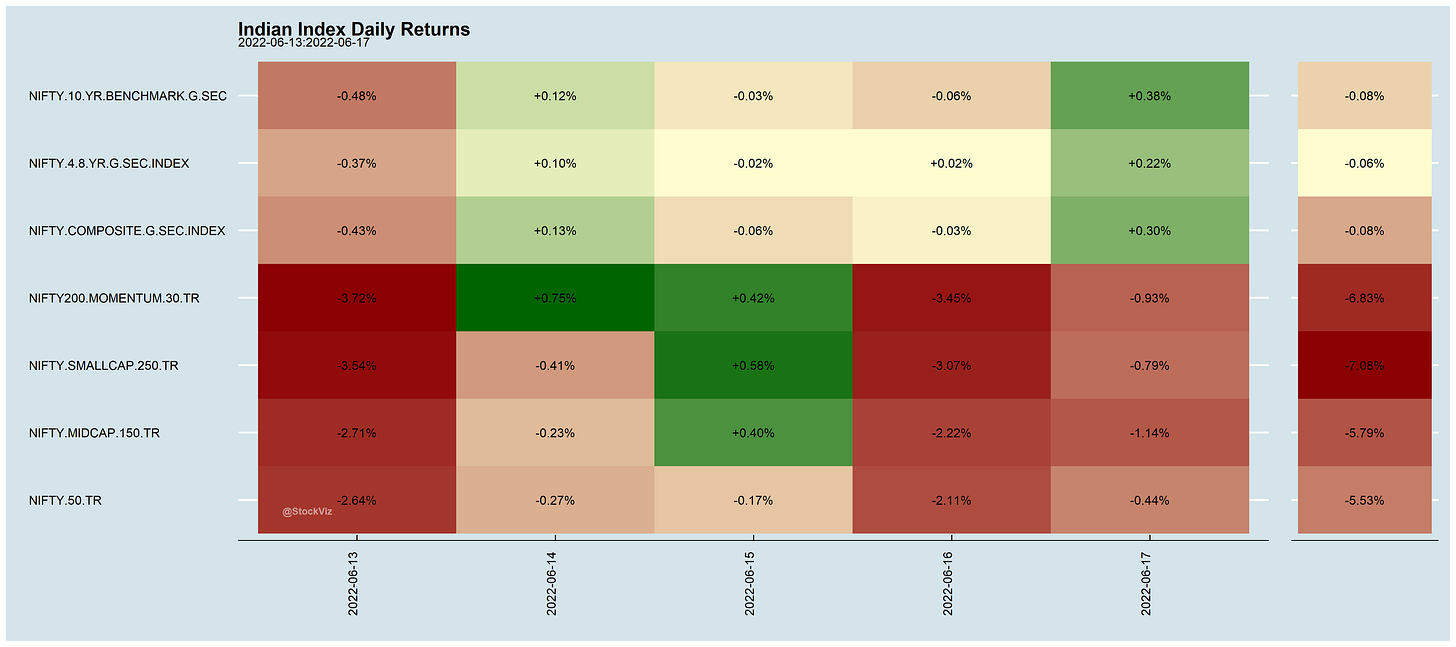

Markets this Week

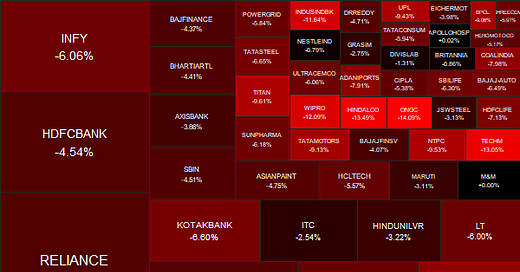

JPow went with a 75bps hike and risk got decimated.

Links

Inflation number turning the corner in the US?

Markets projecting a rate cut in 2024

The probability of a soft landing—defined as four-quarter GDP growth staying positive over the next ten quarters—is only about 10 percent.

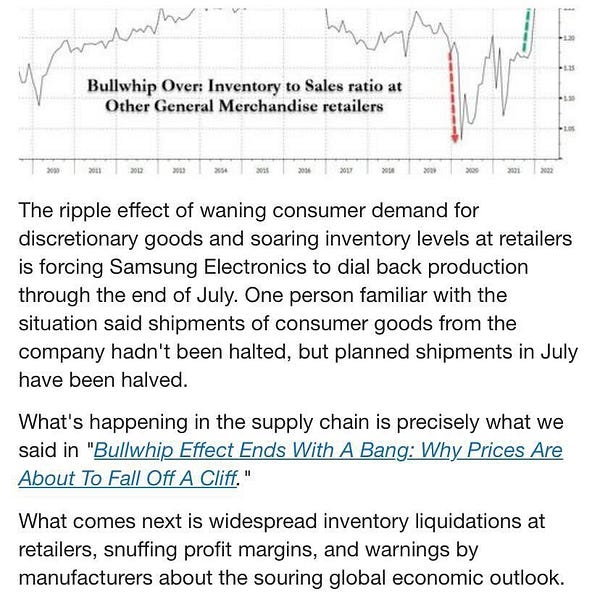

One thing not getting a lot of attention is our government’s PLI scheme. A lot of production is going to come online next year, right in the middle of a soft global economy. Chances are high that Indian consumers are going to be penalized further with higher tariffs aimed at protecting these manufacturers and the banks that financed them.