PMS Surveillance

because index funds don't send Diwali gifts

Since 2022, SEBI has been uploading PMS (Portfolio Management Service) performance metrics and other details to their website. While this is a great step in shining some light on this area of the assent management market, it falls short in covering some areas like risk metrics, adhoc benchmarks, etc.

We setup a system to scrape SEBI’s website and added some masala to it. Please check out our PMS Surveillance report and do let us know if you have any suggestions for improving it. The numbers published by SEBI are pre-tax but after all fees.

Caveat! This will reinforce what Bogleheads have been saying all along: it is incredibly difficult to beat the market. This is especially true for PMSs given their pricing (fee + carry) and taxes (Indian mutual funds are pass-throughs.)

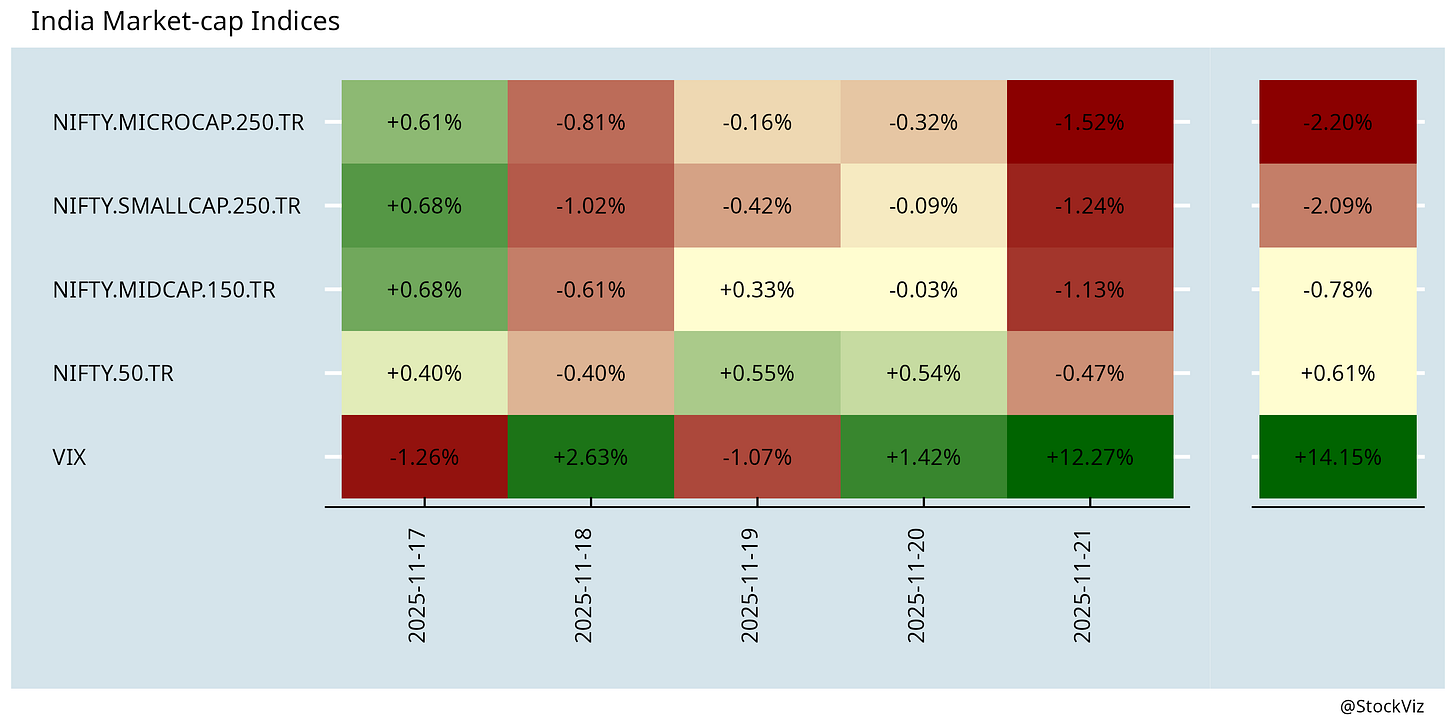

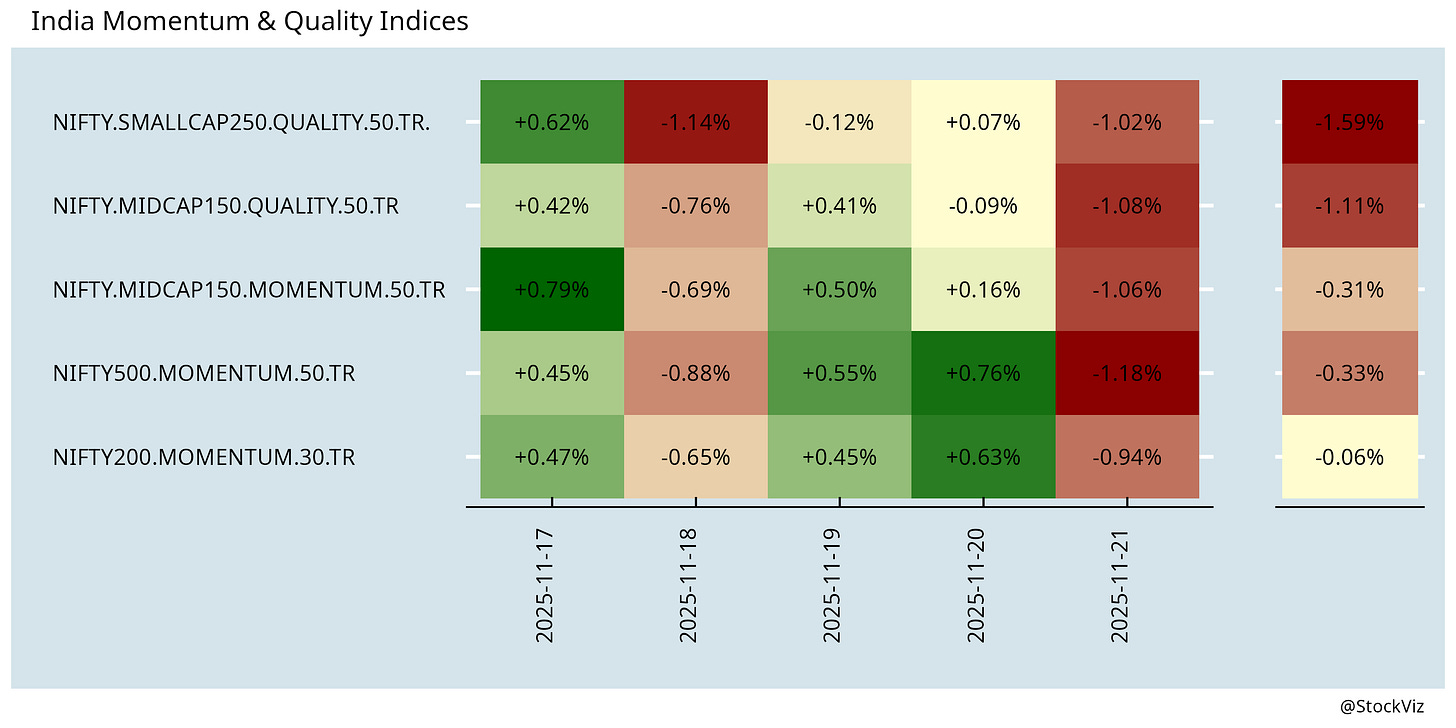

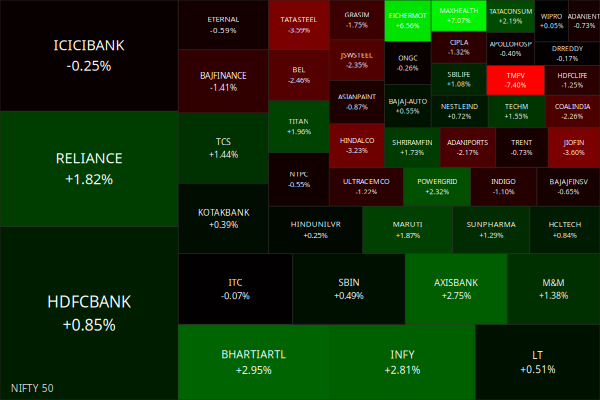

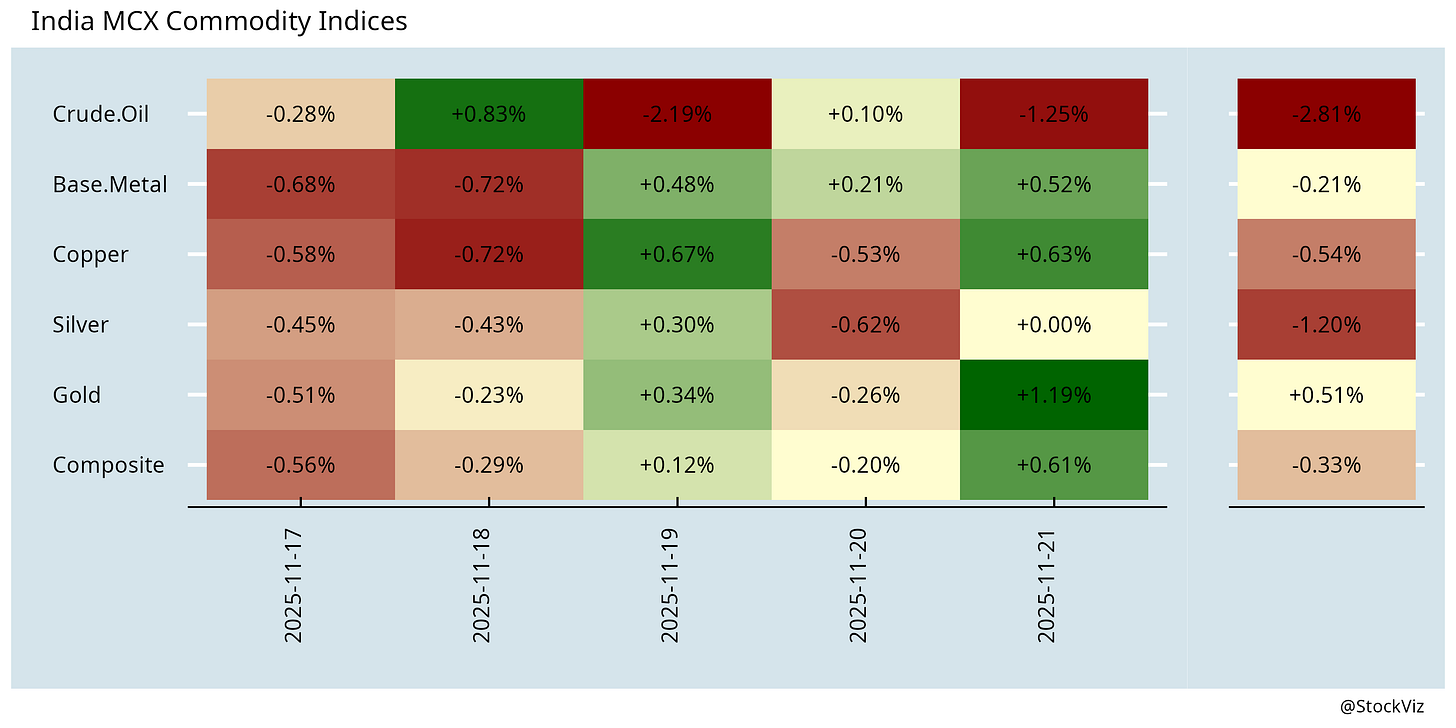

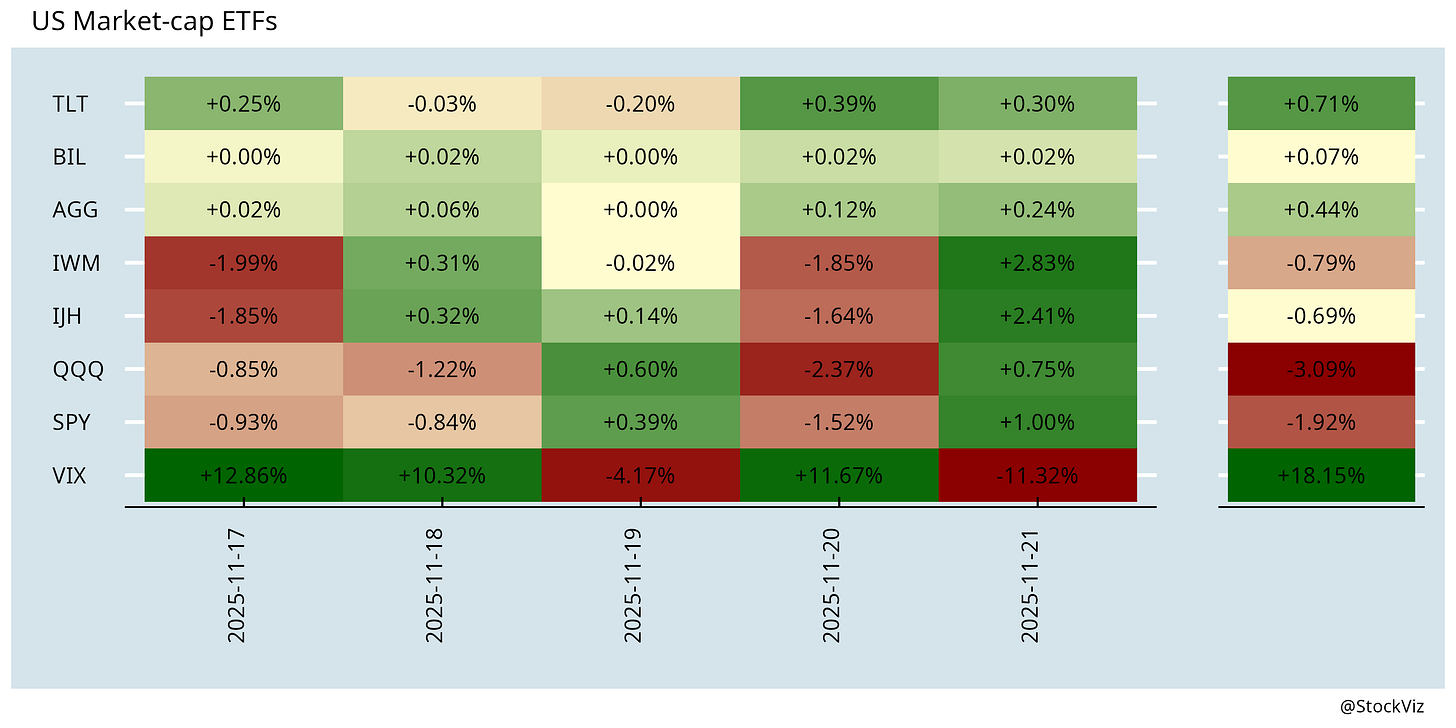

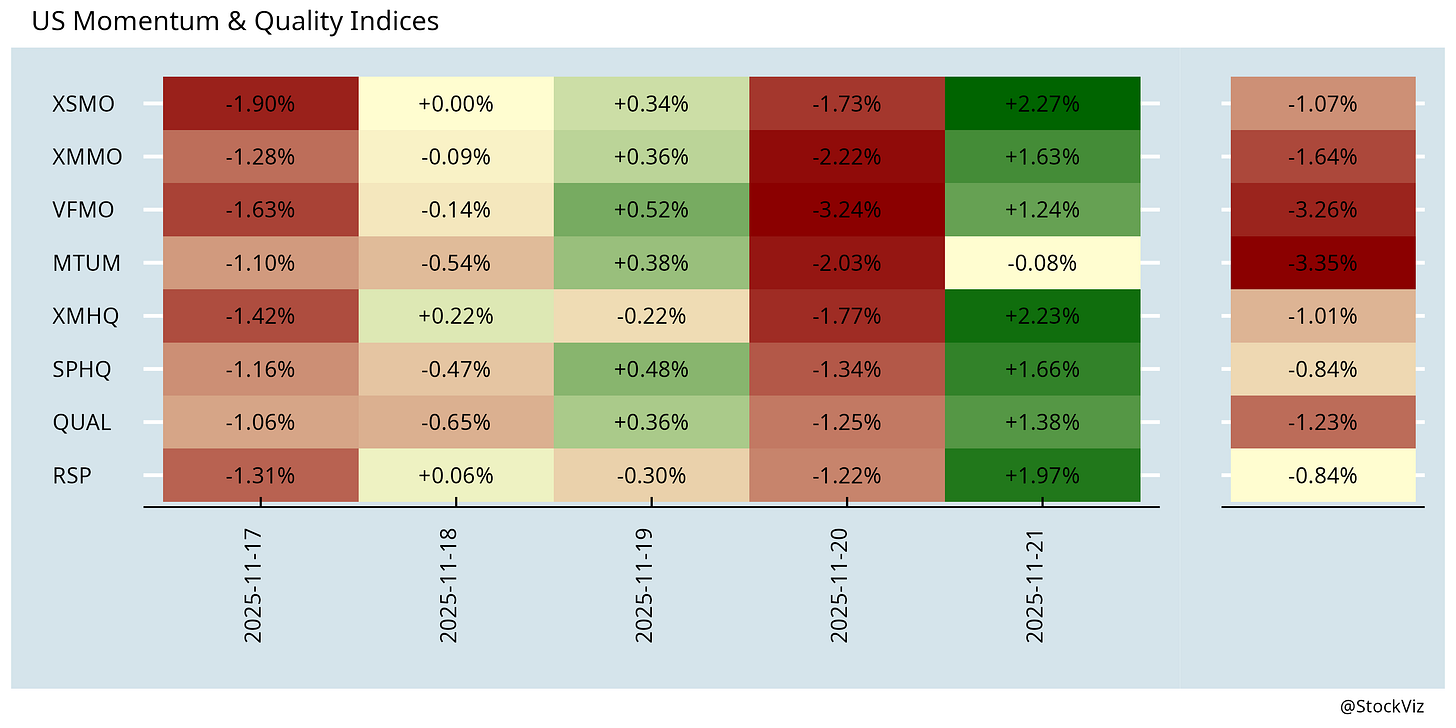

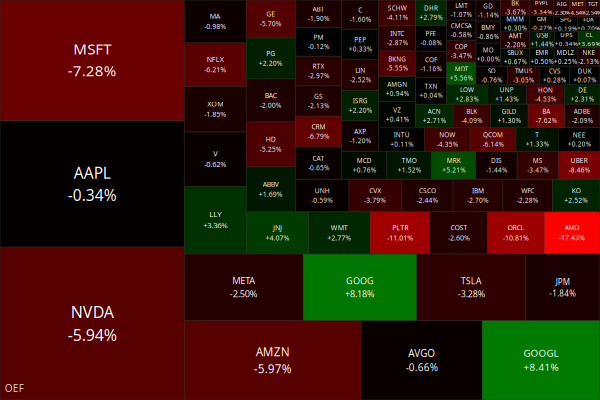

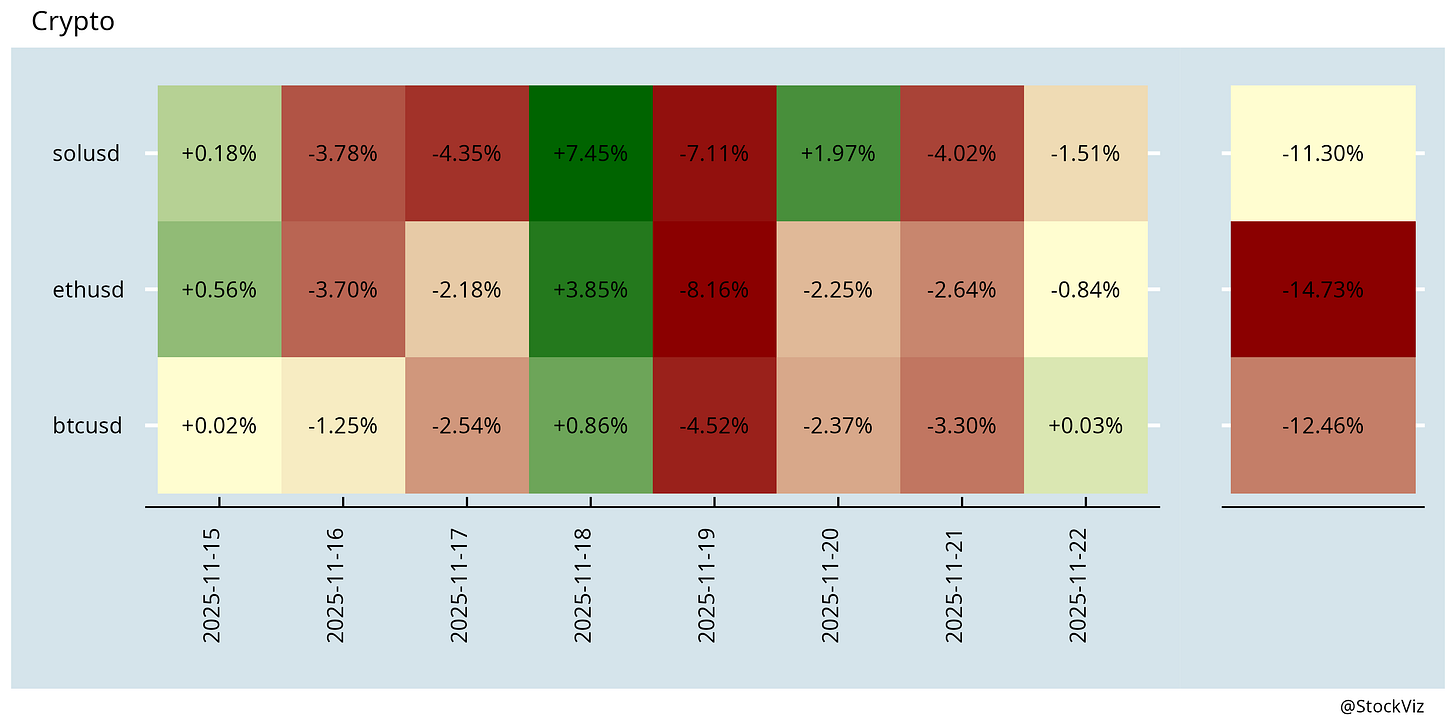

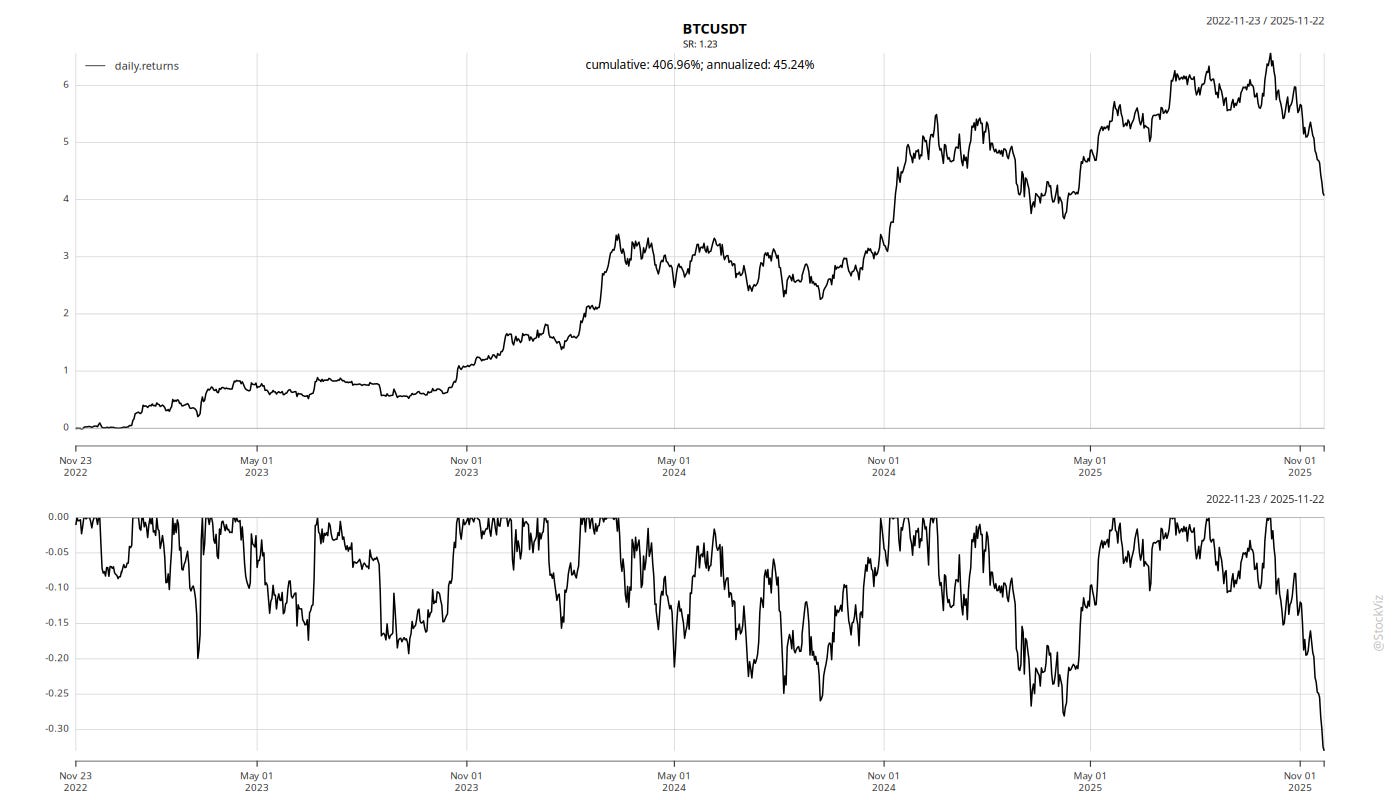

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Bitcoin Price Volatility (SSRN)

We estimate and decompose Bitcoin’s realized volatility into jump volatility and continuous volatility components. We find that innovations in Robinhood retail trading are positively related to the continuous component of Bitcoin’s volatility. The innovations in the (anonymous) trading volume of Monero are also positively related to the jump component in Bitcoin’s volatility.

India

The government notified all four Labour Codes ushering in major reforms including extending universal social security coverage for gig workers, promising gender pay parity, expanded rights and safety for women workers, providing statutory backing for minimum wages, and introducing fixed term employment. The government will now initiate consultations to frame detailed rules and schemes (thehindu, livelaw, indianexpress, reuters). Textile industry says night shifts for women will boost production, exports (livemint).

The government is ready with the third edition of the Jan Vishwas Bill, aimed at decriminalising various legal provisions to improve ease of doing business (economictimes). Seven NDA states push sweeping Jan Vishwas-style reforms in biggest deregulation drive yet. The act would push laws and ordinances that will replace jail terms for minor offenses with monetary penalties, in a bid to create more predictable and business-friendly investment environments (businesstoday).

Govt lines up Market Code Bill, Insurance Bill and IBC amendments for Winter session (cnbctv18)

India’s residential real estate market may be nearing its peak, with early signs of pressure building beneath the surface (cnbctv18).

Automation is beginning to reshape India’s tech-hiring landscape, with global capability centres (GCCs) pulling back on routine recruitment (livemint)

India is axing quality control orders on manufacturing inputs (livemint)

India’s corporate earnings are staging their strongest recovery in over a year, with brokerages turning upbeat on profit growth for the second half as they expect a broader rebound in consumption. Cooling inflation, massive tax cuts on consumer goods and monetary policy support are helping revive overall demand, while early festive-season data points to a pick-up in discretionary purchases (reuters).

Over the past two years, 14 states have dangled freebies to win elections pushing the annual tab close to 2 trillion rupees, or $22.56 billion. Spending on poll freebies elbows out more productive spending by states, such as that on infrastructure, and weighs on growth in the economy (reuters).

US court filing alleges $533 million was roundtripped for personal use (economictimes). US court orders Byju Raveendran to pay over $1 billion in default judgement (economictimes).

A new study published in a leading United States academic journal argues that the 1962 India-China war was driven not primarily by border disagreements or diplomatic failures, as long accepted in mainstream historical accounts, but by a deliberate American strategy pursued through the 1950s and early 1960s (thehindubusinessline).

row

If historians someday try to identify exactly when China became America’s geopolitical equal, they might point to the outcome of Mr. Trump’s ill-considered trade war (nytimes).

In Washington, everything appears to be for sale (economist)

China’s legacy chip dominance poses ‘severe’ threat. China is using state subsidies to flood the market for these foundational chips, which are critical for cars, home appliances, and industrial machinery. A dependency on Chinese-made parts would allow production to be “stopped at will.” (digitimes)

China is replacing its diesel trucks with electric models faster than expected. By the first half of 2025, battery-powered trucks accounted for 22% of new heavy truck sales, up from 9.2% in the same period in 2024 (apnews).

European carmakers are looking into ways to scratch components made with parts from China, spooked by deepening geopolitical spats playing out through chipmaker Nexperia and Beijing’s export controls on rare earths (bloomberg). Chinese regulations and competition are panicking European manufacturers (economist).

The Frisian DCI, an inspection club for the shipping and yacht construction sector, was given a new, Chinese parent company at the end of 2019. The new owner left this year with the northern sun. No one now knows where the customer files, full of business-sensitive information, are located (ftm).

Sweden’s Pension Funds Face Eye-Watering Losses After Heavy Net Zero Bet (europeanbusinessmagazine)

The recent wealth tax increase in Norway was expected to bring in an additional $146M in yearly tax revenue. Instead, individuals worth $54B left the country, leading to a lost $594M in yearly wealth tax revenue. That’s a net decrease of $448M+ (citizenx).

Javier Milei Ended Rent Control. Now the Argentine Real Estate Market Is Coming Back to Life (reason)

Odds & Ends

For the past two decades, the strongest moats in technology were built on external forces: network effects and economies of scale. These lock-ins are structural and impersonal. They scale by aggregating people and infrastructure, not by understanding them. Cognition is different. It’s personal, cumulative, and aligned with you. It doesn’t depend on external scale, but on engagement. Unlike network effects, which can often create one dominant ecosystem per category, cognitive effects create millions of microsystems—one per user (forerunnerventures).

Meme of the Week