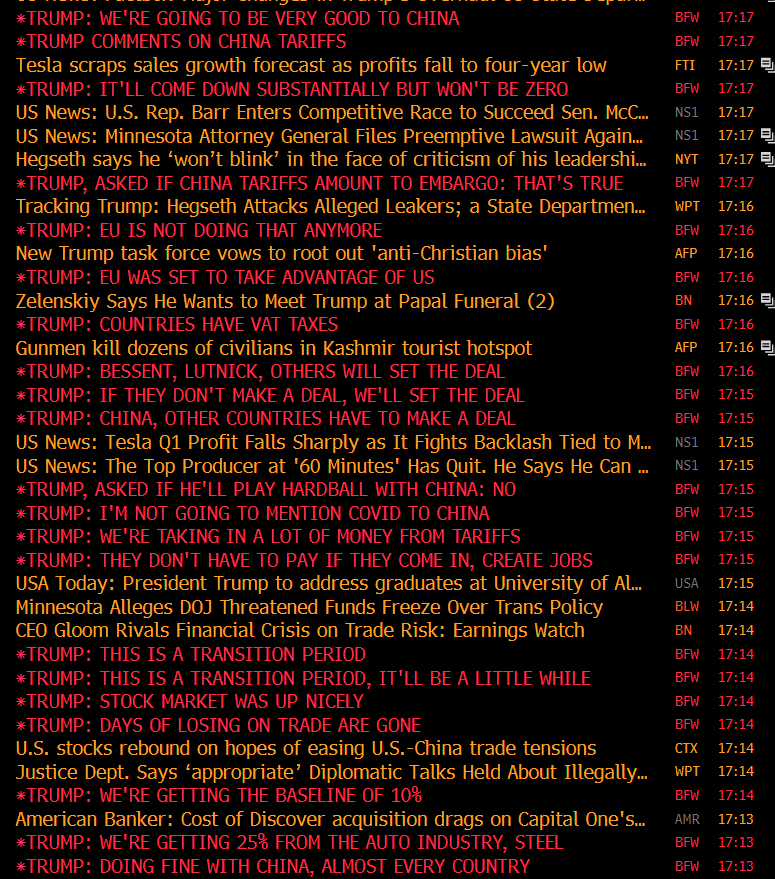

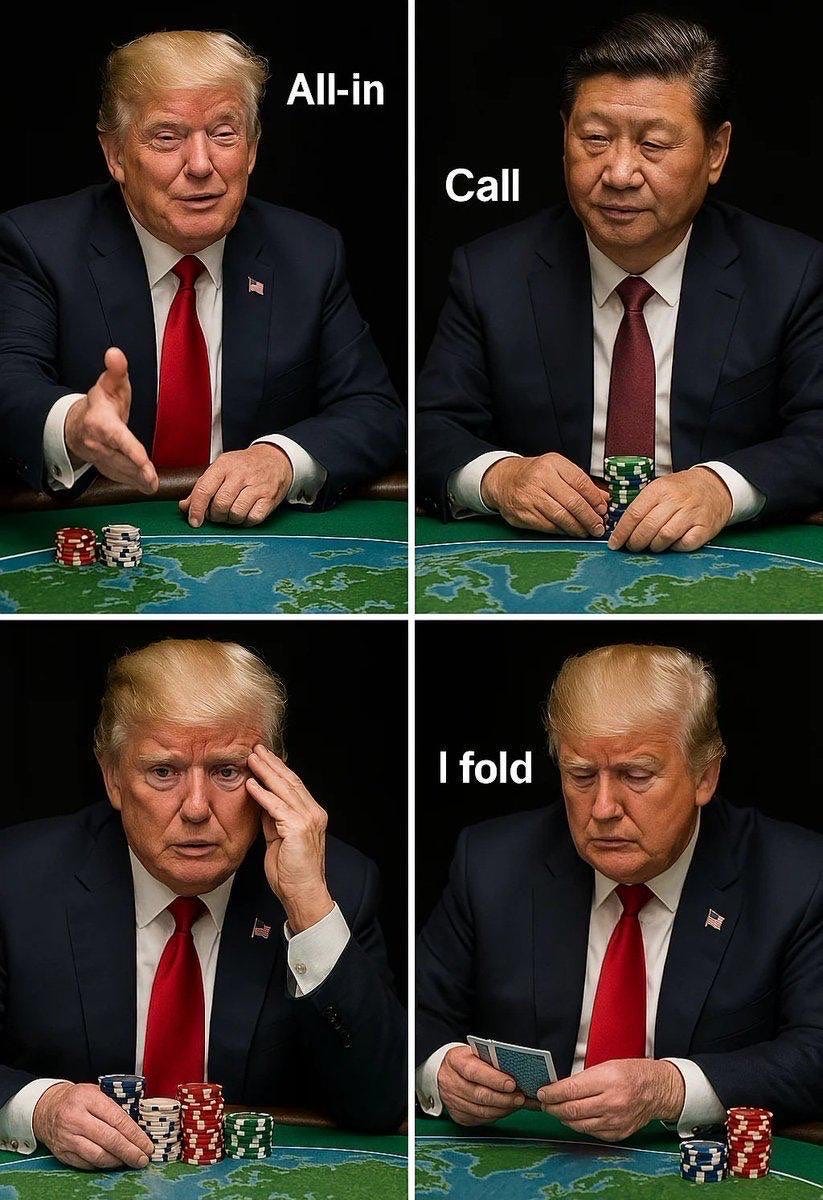

President Trump got a scare from CEOs and markets on Monday. On Tuesday, he blunted some of his sharpest threats — signaling a softer stance on China and retreating from fiery rhetoric targeting the Fed (axios).

Nobody knows if Trump is talking to Xi, including Trump.

On Thursday:

On Friday:

And now, apparently there’s a “new framework” that sounds very much like The Bachelor:

The U.S. is looking to negotiate within the new framework with about 18 major U.S. trading partners on a rolling basis over the next two months, the people familiar with the matter said. The initial plan is for six nations to come in for talks in one week, six nations in a second week, and six nations for a third week of talks—an 18-nation cycle that would then repeat until the administration’s self-imposed July 8 deadline. At that point, reciprocal tariffs would hit nations that can’t reach a deal, unless Trump further extends his 90 day pause.

Trump Administration Lays Out Roadmap to Streamline Tariff Talks (wsj)

Trump’s latest interview for the Time magazine belongs in the Smithsonian. He makes Rahul Gandhi look smart.

Amidst all this, Pakistani terrorists killed 26 tourists in Kashmir (reuters).

A week of extreme chaos.

Markets this Week

It appears that retail investors shed equities under the fear of war…

… why is IT seeing a bid? Were the results not as bad as feared?

Gold down on receding trade-war fears…

… stocks up with signs that Trump maybe backing down from the rhetoric.

Broad-based recovery seen in crypto…

Links

Research

The Effect of Deactivating Facebook and Instagram on Users’ Emotional State (NBER)

People who deactivated Facebook for the six weeks before the election reported a 0.060 standard deviation improvement in an index of happiness, depression, and anxiety, relative to controls who deactivated for just the first of those six weeks. People who deactivated Instagram for those six weeks reported a 0.041 standard deviation improvement relative to controls.

Read (between) the lines (SSRN)

Textual analysis of mutual funds' shareholder letters can enhance mutual fund selection. We find that textual features contain significant predictive power for future fund performance. More confident writing by fund managers predicts significantly higher returns and lower volatility, while more dissimilar shareholder letters are associated with significantly higher fund outflows. The explanatory power of textual features increases during the financial crisis. Sorting mutual funds based on their predicted future returns and volatility reveals substantially higher out-of-sample Sharpe ratios compared to strategies that do not use textual features. Our results show that investors can improve fund manager selection by exploiting qualitative information in shareholder letters.

Volatility of Price-Earnings Ratio and Return Predictability (SSRN)

We show that the volatility of the log price-earnings ratio predicts positive future stock returns. The volatility of the price-earnings ratio outperforms both the level of the price-earnings ratio and market volatility in predicting returns. Additionally, we find that the volatility of the log price-earnings ratio significantly predicts declines in future macroeconomic activities and market volatility.

Tariffs

If the US-China trade embargo continues, Americans are looking at empty shelves in June.

In the 3 weeks since the tariffs took effect, ocean container bookings from China to the United States are down over 60% industry wide (Ryan Petersen).

Factories in China have begun slowing production and furloughing some workers (ft).

US sets tariffs of up to 3,521% on South East Asia solar panels (bbc).

Enormous investments in factory equipment and artificial intelligence are giving China an edge in car manufacturing and other industries (nytimes).

U.S. agencies alarmed by China’s curbs on exports of rare-earth minerals (washingtonpost).

White House is ‘close’ on Japan, India tariff agreements (politico).

US forges ahead with plans for steep port fees on China-built vessels (theguardian).

Tariffs without industrial policy won’t work (ft).

India

India forms 3-step plan on Indus water to stop flow to Pakistan (indiatoday).

Apple aims to source all US iPhones from India in pivot away from China (ft).

Bharti Airtel has reached out to the government seeking conversion of more than Rs 41,000 crore adjusted gross revenue (AGR) dues into equity. If approved, the government will get a 2-4% stake in India’s second-largest telecom operator (economictimes).

Auto component suppliers Greaves Cotton, Tube Investments and Pinnacle Industries have suffered combined losses of close to ₹1,600 crore since they began their EV journey (livemint).

Indian electric vehicle and auto component manufacturers will soon face fresh production hurdles as China has restricted the export of rare earth magnets to India (cnbctv18).

Sombre mood grips India’s top IT firms amid tariff tantrums (livemint).

Investments routed abroad through funds in GIFT City more than tripled to $778 million in six months through December. The RBI opened the way for family offices to invest via the Overseas Portfolio Investment route in June. The investment path for the ultra-rich offers reprieve from capital controls that limit individuals from moving more than $250,000 a year out of the country since 2015. Family offices can shift much more than that if they invest in a fund in GIFT City via their own company — up to 50% its net worth - theoretically billions of dollars (bloomberg).

UBS will sell its Indian wealth business to 360 ONE WAM and take a stake of nearly 5%, worth some $220 million, in the Mumbai-based asset manager (reuters).

Paneer or Poison? In inspections conducted between April 2024 and March 2025, 83% of paneer samples failed food safety standards. Even more alarming, 40% of these were found to be outright unsafe for human consumption (m9).

row

Trump to Host Dinner With Top Holders of His Memecoin. From April 23 to May 12, your average $TRUMP balance determines your spot. Get $Trump Memes and climb the ranks. (bloomberg).

Bridgewater Associates founder Ray Dalio’s famous “All Weather” strategy has arrived in the exchange-traded fund market: ALLW 0.00%↑

American retail traders are still in the BTFD model.

Markets Are Discovering the Real Trump Trade Is ‘Sell America’ (bloomberg).

Trump discovers the US is no longer indispensable. The US does not have the aid, the technology or the market access to exert control over global trade the way it once did, and Trump’s erratic behaviour is rapidly increasing the probability that it never will (ft).

Yale and Harward are exploring the sale of their private equity holdings (yaledailynews, reuters).

NSF chief quits as DOGE drives 55% budget cut and grant freeze (rdworldonline). NIH facing a 40% budget cut (washingtonpost). NOAA down by 27% (kcci). NASA around 20% (spacenews).

Colleges and universities are among America’s most competitive international exporters. In dollar terms, last year, the United States sold more educational services to the rest of the world than it sold in natural gas and coal combined (washingtonpost).

The self-inflicted death of American science has already begun (vox).

How the U.S. Became A Science Superpower (steveblank).

Pentagon leaders are calling for thousands of drones to prepare for war in the Pacific. But as Trump’s tariffs escalate tensions with China, they face an uncomfortable reality: Silicon Valley’s drone companies are addicted to Chinese components (forbes).

Why UK is close to becoming only G7 nation without steel production ability (business-standard).

The world needs a new customs union, along the lines of what Keynes proposed at Bretton Woods. States that join would agree to keep trade between them broadly balanced, with penalties for members that fail. But they would also erect trade barriers against countries that don’t participate in order to protect themselves from imbalances outside the customs union. Trade would not be expected to balance bilaterally, of course, but rather across all trade partners. Its members would have to commit to managing their economies in ways that would not externalize the costs of their own domestic policies. In that system, every country could choose its own preferred development path, yet it could not do so in ways that inflict the costs of domestic imbalances on trade partners (foreignaffairs).

Tired of Winning: Why Peter Navarro Hates BMW (agglomerations).

Trump is America’s Mad King. The president has grown more impulsive, more vindictive, and more anarchic (theatlantic).

Odds & Ends

A solo operator can now launch a $1b business powered by ai. our economy's critical dividing line is no longer skill or education — it's will (piratewires).

Slot Machines are the workhorse of the Las Vegas casinos. After decades of design tweaks, the "crack cocaine of gambling" brings in more revenue than every other casino game combined (readtrung).

If you are going to help your children financially, it’s far better to do it when they are younger, not older (ofdollarsanddata).