Markets are where egos go to get burnt. Thinking you know everything there is know about something always gets you in trouble. But at the same time, I’ve seen some really smart people get trapped in analysis-paralysis.

So, in some sense, to be a successful investor, you need to be smart enough to know that your analysis has flaws, your model is imperfect and the information you have is insufficient, but dumb enough to pull the trigger and put on a trade.

Investing and trading are pragmatic endeavors. You are never really sure of anything - if you were, then there would be no money in it.

Markets this Week

Markets recovered a bit from last week’s carnage.

NASDAQ-100 went up like a rocket.

Is it only me or have Indian markets become less volatile than US markets this year?

Links

Jim Simons rarely does interviews that end up in the public domain, but a new one was just posted. (tra)

~

China, US shipping rates continue to tumble as inflation cools consumer demand. (SCMP)

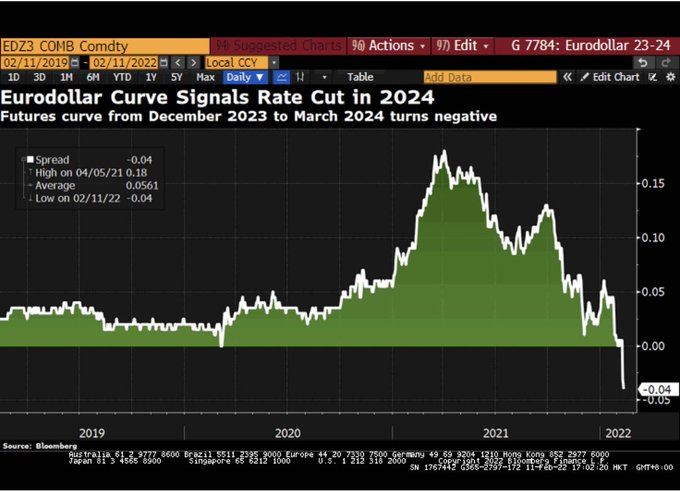

Meanwhile, rate-markets are predicting cuts next year:

~

An anomaly doesn’t exist in isolation. It is typically a combination of factors, including regulations, market conventions, investor composition, etc. In the US, for example, earnings are announced when markets are closed whereas in India, its left up to the management to pick a time. Also, Indian markets end up being price-takers for most of the “macro” moves that usually happen overnight. Be careful before you dive headlong into this one:

The overnight effect refers to the fact that, over at least the past three decades, investors have earned 100% or more of the return on a wide range of risky assets when the markets are closed, and, as sure as day follows night, have earned zero or negative returns for bearing the risk of owning those assets during the daytime, when markets are open. The effect is seen over a wide range of assets, including the broad stock market, individual stocks (particularly those popular with retail investors, and Meme stocks most of all), many ETFs, and cryptocurrencies.

Night Moves (SSRN)

~

~

The Swiss National Bank's U.S. equity portfolio is worth ~ $177 billion, including $12.4 billion in Apple shares, $9.5 billion in Microsoft and $6.4 billion in Amazon. Other holdings included $1.5 billion in Exxon Mobil and $1.1 billion in Coca Cola. And they may be turning sellers. (reuters)

~

Germany risks recession as Russian gas crisis deepens. (reuters)

~

We should stop blaming Central Banks for everything. Legislatures dropped the ball and heaped more and more responsibilities onto unelected academics to a point where now some CBs even have ESG targets. There are no simple answers to complex questions and is up to elected representatives to educate their electorate about the tradeoffs involved.

Easing inflation will disproportionately harm working-class people, who will reap none of the benefits down the road. (theguardian)

~

Machine Learning cannot replace Human Thinking:

~

On Cathie Wood’s marketing brilliance:

Winton/Wood publish outlandish stuff solely to drive interest, debate, ridicule because it’s totally free marketing. They need people to constantly be talking about the names they own to move pricing in the names they own. The important thing is to be driving clicks, interest, and living rent-free in our heads. (tra)

~

Why did Webvan fail? Simple answer - not enough demand At 100% utilization, Webvan's warehouses would be incredibly profitable. At 40-50% utilization, they would break even. In reality? Webvan's warehouses were stuck at 25-30% utilization through all of 1999-2000

~

Smokers have higher per-year medical expenses but they reduce Medicare costs on net by dying earlier. (NBER)

~

What’s becoming clearer over time is that the Trump-era GOP is hoping to use its electoral dominance of the red states, the small-state bias in the Electoral College and the Senate, and the GOP-appointed majority on the Supreme Court to impose its economic and social model on the entire nation—with or without majority public support.

America Is Growing Apart, Possibly for Good (theatlantic)

~

Physical attractiveness is associated with many positive outcomes – greater happiness, higher wages, better jobs, and even higher cognitive outcomes. (psypost)