Pricing Power

Another strat in the arsenal

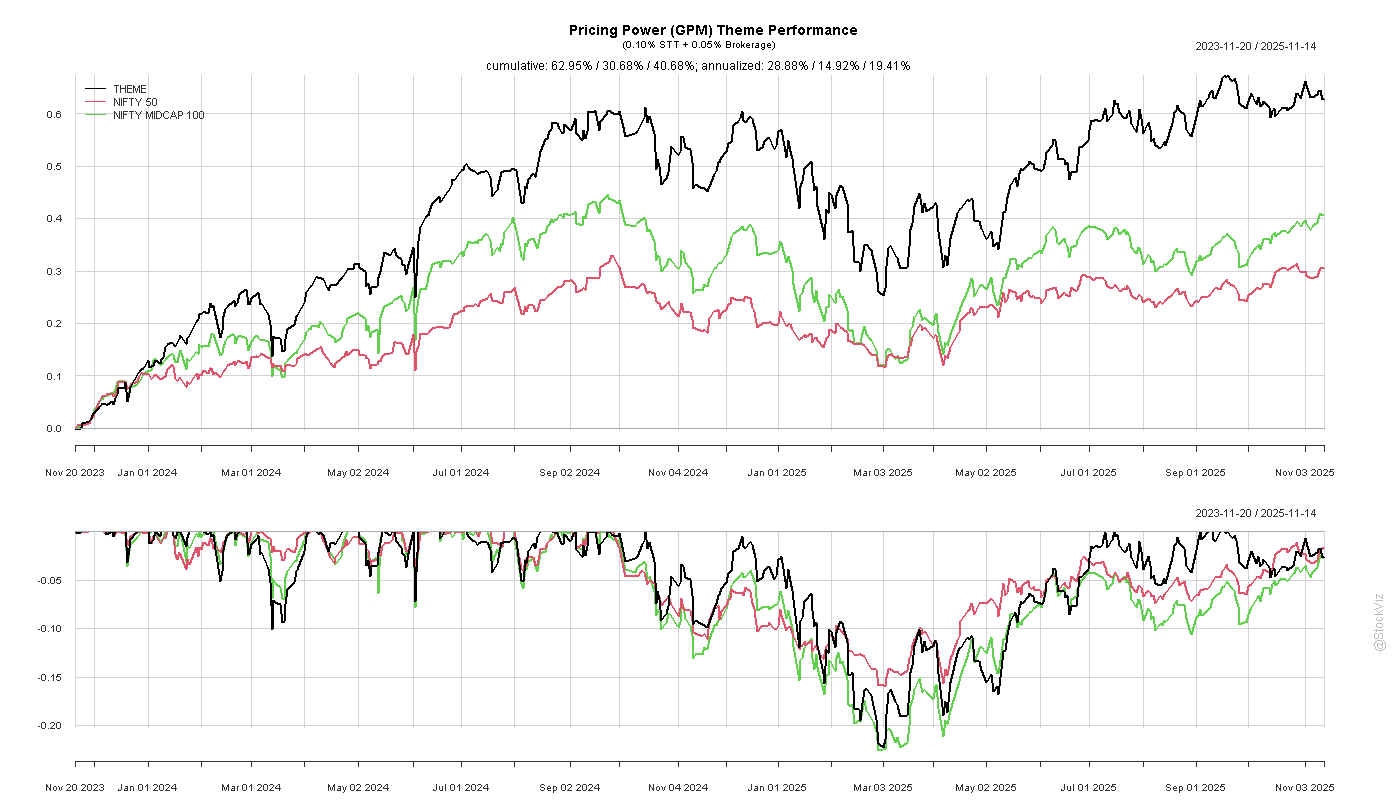

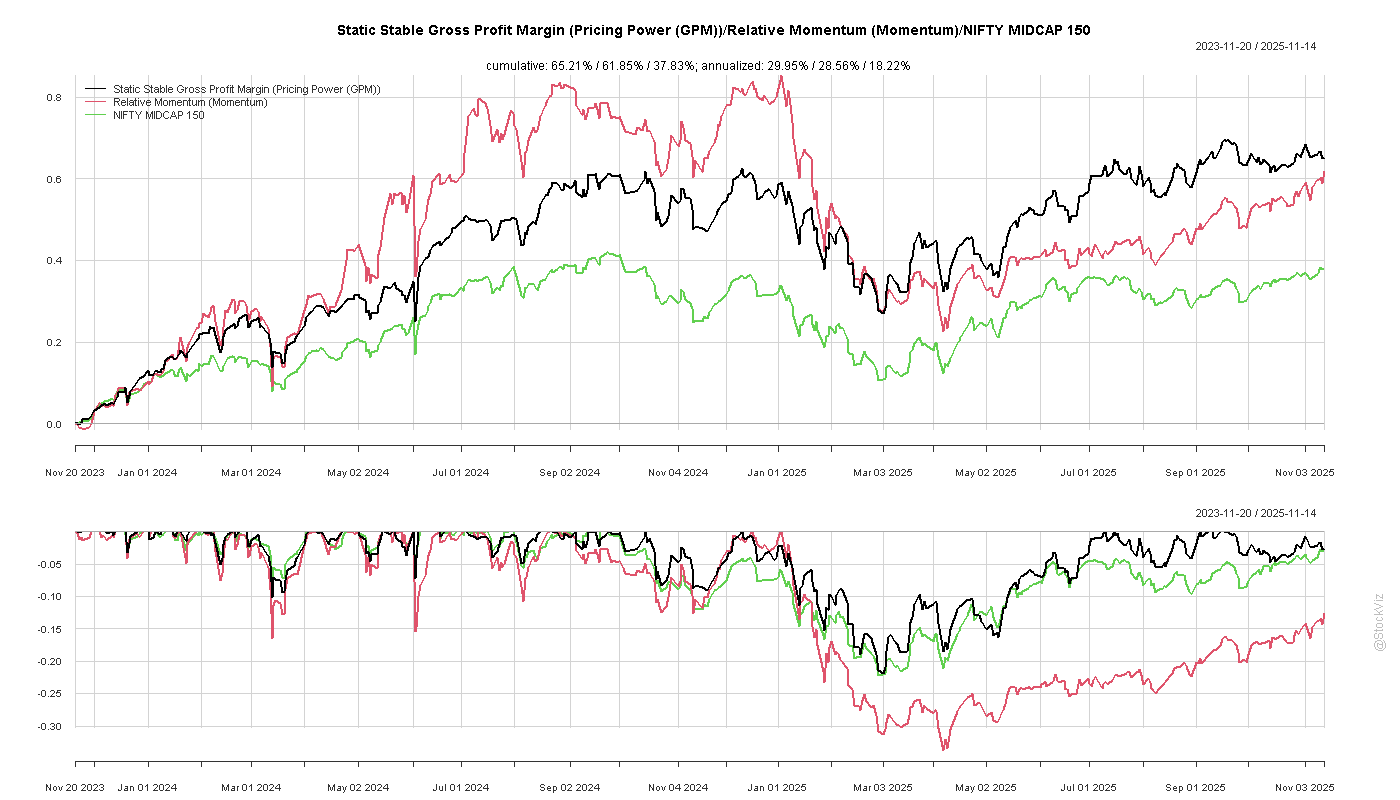

Should firms with pricing power exhibit stable gross margin over market cycles? Will a portfolio of stocks that have stable gross margins over the most recent five years out-perform the market?

While Pricing Power is a legitimate factor in itself (Pricing Power Everywhere), the jury is still out if it actually out-performs the market. To make this easier to track and invest, we setup a Theme just for it.

Over the last two years, it has shown excess returns.

However, it is hard to say how much momentum had to do with it because most of the out-performance occurred when the momentum factor was going strong as well.

For what its worth, the factor did recover faster than momentum. Not bad for a portfolio that has much lesser churn.

One more arrow in the quiver.

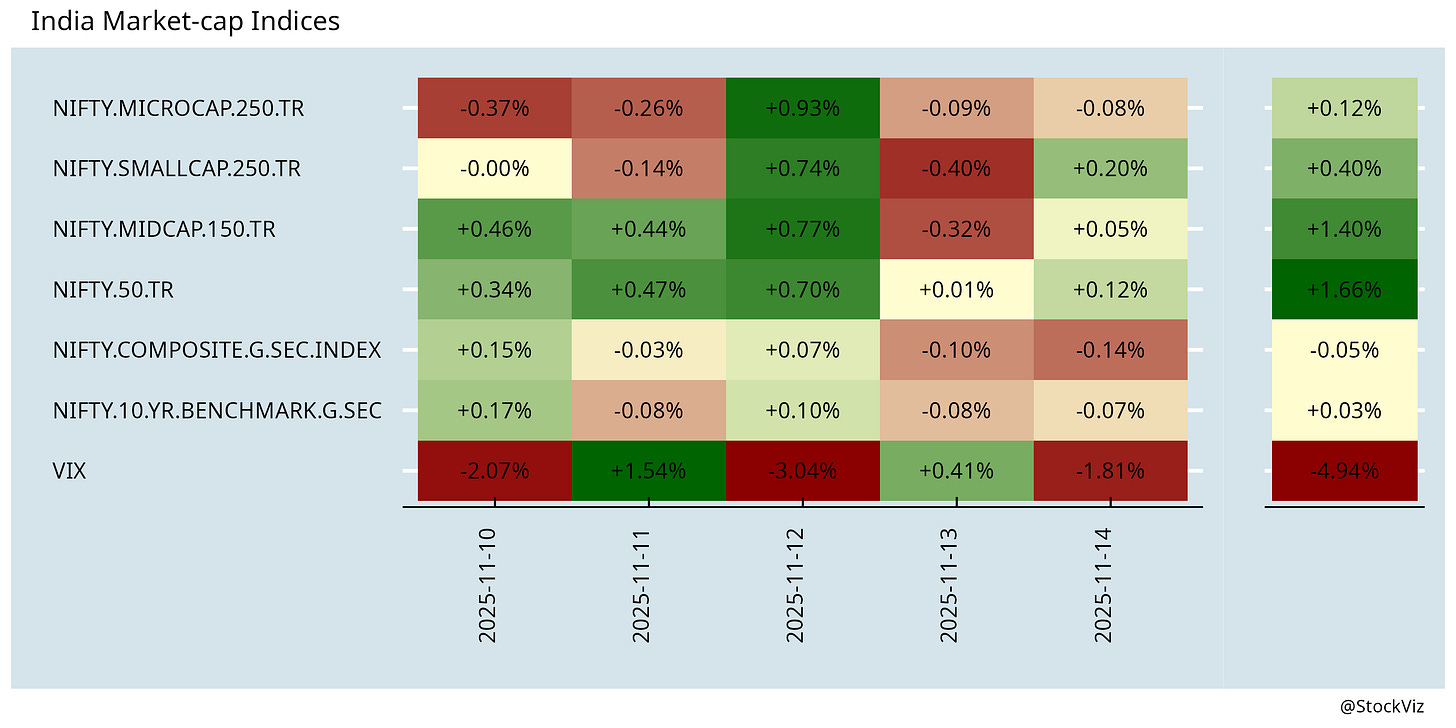

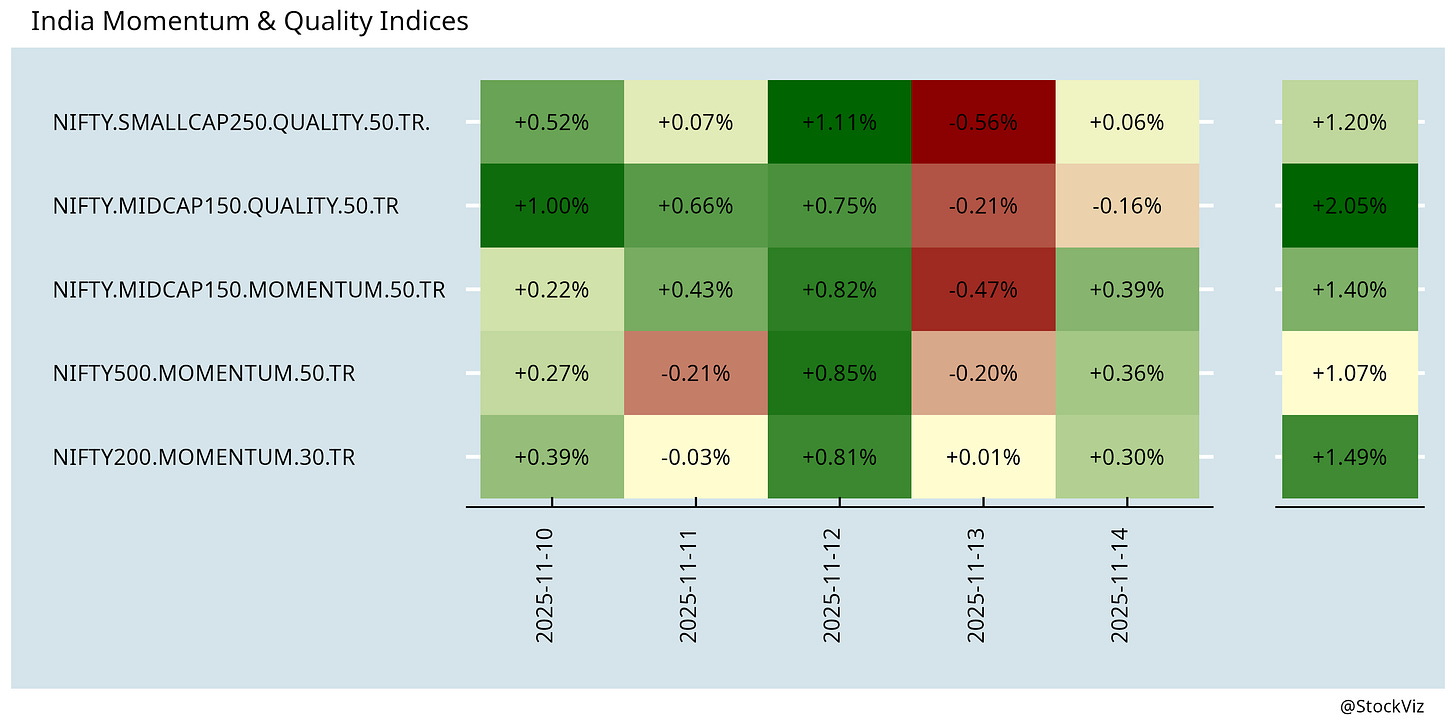

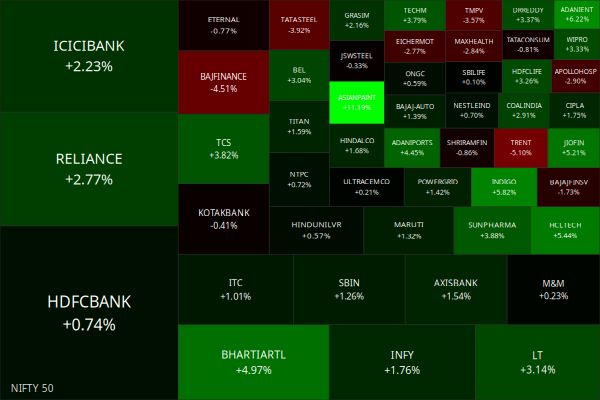

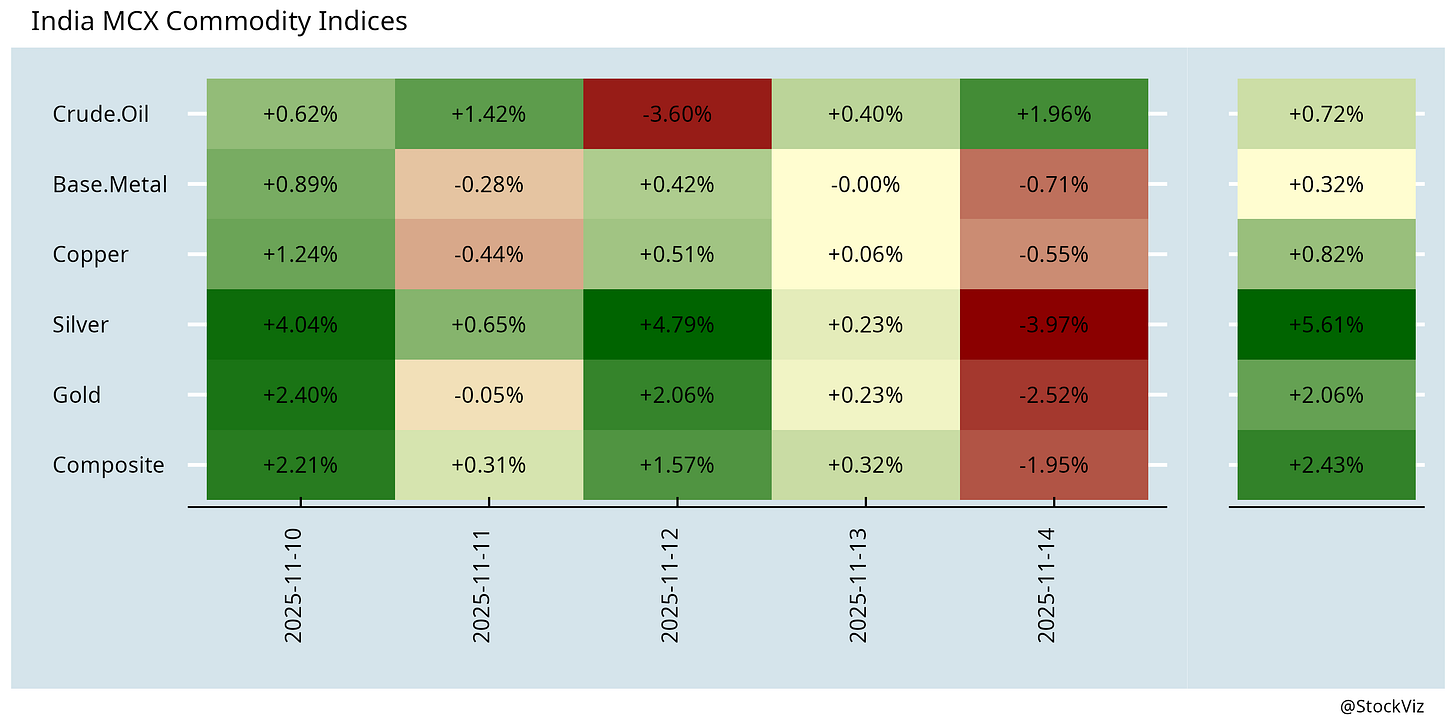

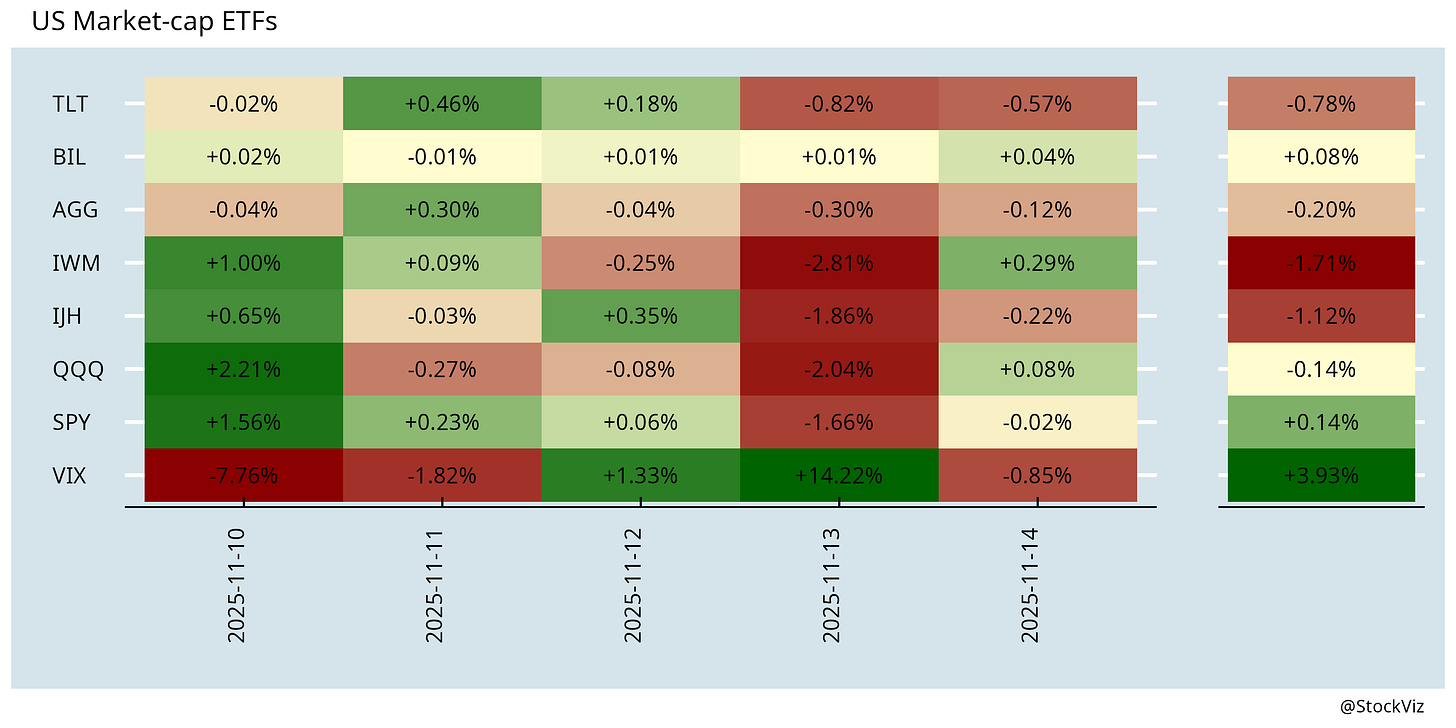

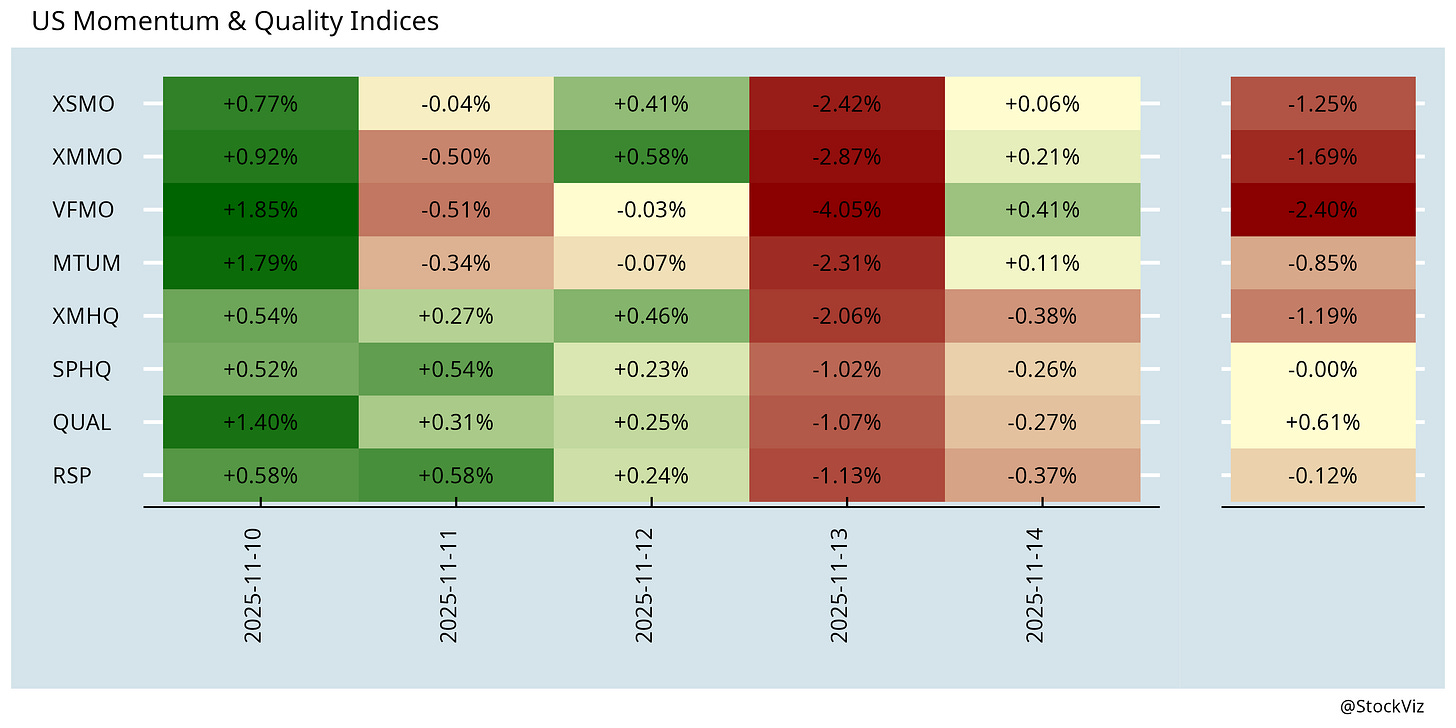

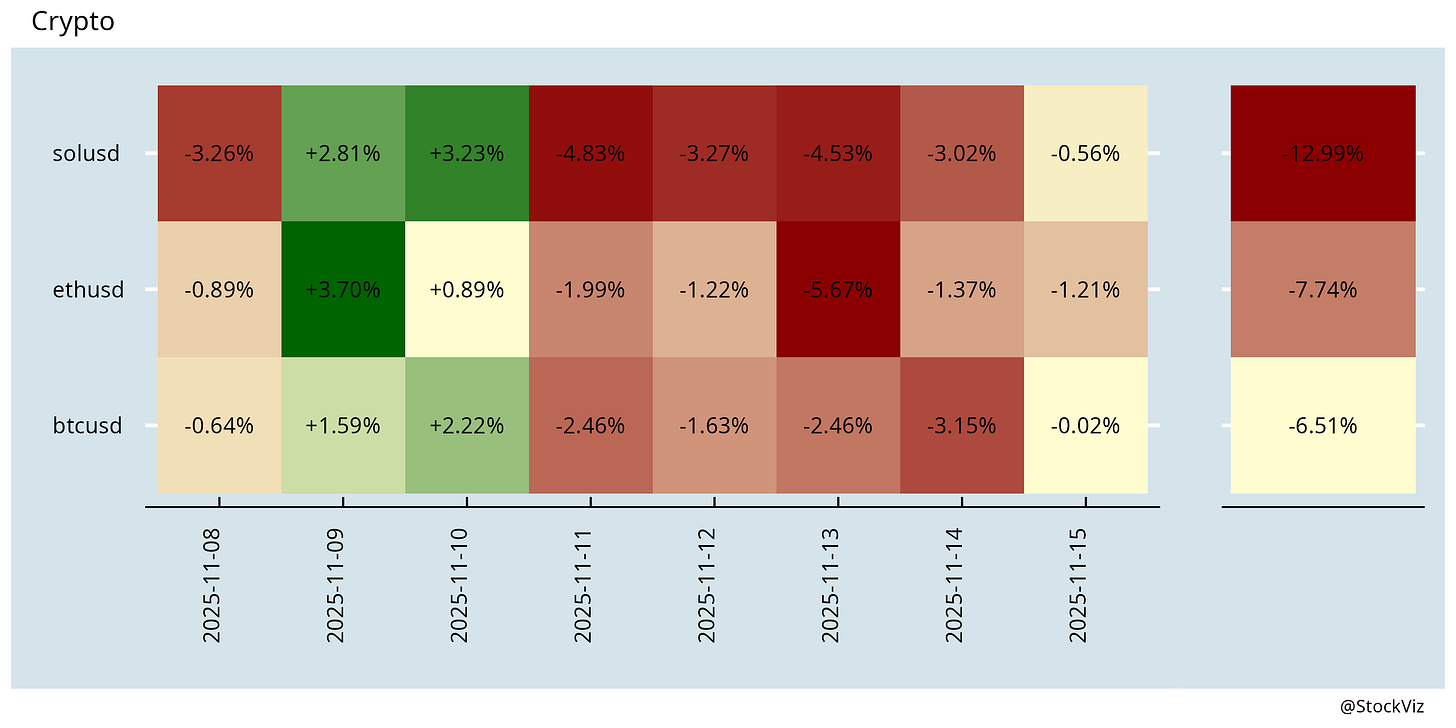

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

BTC dipped below $90,000 for a moment there…

Links

Research

Factor Timing: At Investors’ Own Peril? (SSRN)

Although the idea of dynamically rotating among factors to capture time-varying premia is attractive, the evidence for successful factor timing is weak, especially after accounting for transaction costs and implementation challenges. While some signals like factor momentum or volatility targeting show some predictive power before costs, these advantages largely vanish once realistic trading costs are considered. Moreover, timing strategies often suffer from instability, data mining, and hindsight bias, leading to concentrated risks. Given these challenges, diversified and purified multi-factor portfolios offer more robust and persistent performance, while minimizing unintended risks and costs.

The role of outsourcing and foreign trade in the structural change of the main European economies (2010–20) (OUP)

Using a multi-country version of the subsystem approach with data from the Eurostat Figaro database, we examine the role of outsourcing and exports in changes in manufacturing employment. The findings reveal that although traditional sectoral analysis indicates deindustrialisation, the subsystem approach shows that the share of employment in manufacturing is stable or slightly increasing. This suggests that deindustrialisation is more ‘apparent’ than ‘real’.

From Asia, With Skills (NBER)

Between 1990 and 2019, migrants from five Asian countries—India, China, South Korea, Japan, and the Philippines—accounted for over one-third of the growth in US software developers and a quarter of the increase in scientists, engineers, and physicians. These inflows boosted US innovation, entrepreneurship, and service-sector productivity while fostering “brain gain” and “brain circulation” in Asia. Together, these trends reveal how talent flows from Asia have become central to the structure and growth of the modern US economy.

India

India markets regulator plans wide-ranging reforms to woo foreign investors (reuters).

India’s retail inflation slumped to a record low of 0.25% in October, driven by a sharp fall in food prices and tax cuts on consumer goods, paving the way for a rate cut by the central bank in December (reuters). India’s wholesale prices fell 1.21% year-on-year in October (reuters).

Expansion of the country’s power network has not kept pace with a surge in renewable projects. More than 50GW of capacity is stranded (ft).

The government has withdrawn quality control orders (QCOs) on a wide range of polyester and petrochemical inputs, in a move that spells relief for user industries such as apparel and footwear, while raising competition from imports for local manufacturers of these key inputs (livemint).

Dixon, Amber and Syrma are venturing into making components across industries, as they chase margins and profits (livemint)

Digital Personal Data Protection Act notified (thehindu, smefutures)

In 2018, India’s banking sector was on the verge of collapse. NPAs had hit 11.2% - the worst crisis since independence. However, by 2024, NPAs had dropped to 2.6% - a 12-year low. Banks recorded a profit of ₹3.1 lakh crore. How did India pull off this remarkable turnaround? (threadreaderapp)

row

Leveraged single-stock ETFs don’t work as advertised (morningstar)

The Department of War finally killed the last vestiges of Robert McNamara’s 1962 Planning, Programming, and Budgeting System (PPBS). The DoW has pivoted from optimizing cost and performance to delivering advanced weapons at speed (steveblank).

Should economic conditions in the tech sector sour, the burgeoning artificial intelligence (AI) boom may evaporate—and, with it, the economic activity associated with the boom in data center development (publicenterprise).

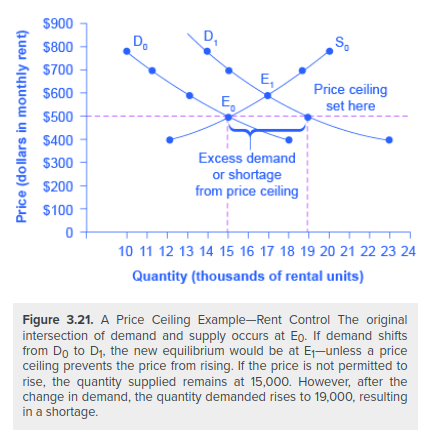

The Los Angeles city council overhauled its rent control rules, sharply lowering the annual rent increases facing tenants (politico)

Can anything halt the decline of German industry? (ft)

Unraveling China’s Productivity Paradox (gavekal)

Odds & Ends

Why Gen Z Hates Work (thefp)

Monks in a casino. Risk-aversion in the social sphere has combined with their risk-chasing in the market, and it’s created a genuinely berserk modern life script (derekthompson).

People can’t tell AI-generated music from real thing anymore (cbsnews)

Researchers at Google’s Threat Intelligence Group (GTIG) have discovered that hackers are creating malware that can harness the power of large language models (LLMs) to rewrite itself on the fly (futurism).