Testing new signals is a frustrating experience. Most of the published ones rarely replicate and those that do have most of the “alpha” wrung out of them already. So, it doesn’t make any sense to waste time on the first pass. Just build the most primitive and basic thing that gets you to a quick “no.”

The first pass will allow you to classify a system into either the “outperforming beta” bucket - one that cannot be levered but still attractive for a cash-and-carry investor (high returns with market drawdowns), or into the “high Sharpe” bucket - one that can be levered to get to a higher return target (lowish returns with a fraction of market drawdowns).

The second pass is all about measuring slippages, taxes and risk metrics. This requires more granular data, compute, etc.

The last step is forward testing in a live environment. Depending on the frequency of trades, this could be a few weeks or a couple of years.

Get to a lot of quick “no”s as fast as possible.

Here’s one: Standard breakout strategy

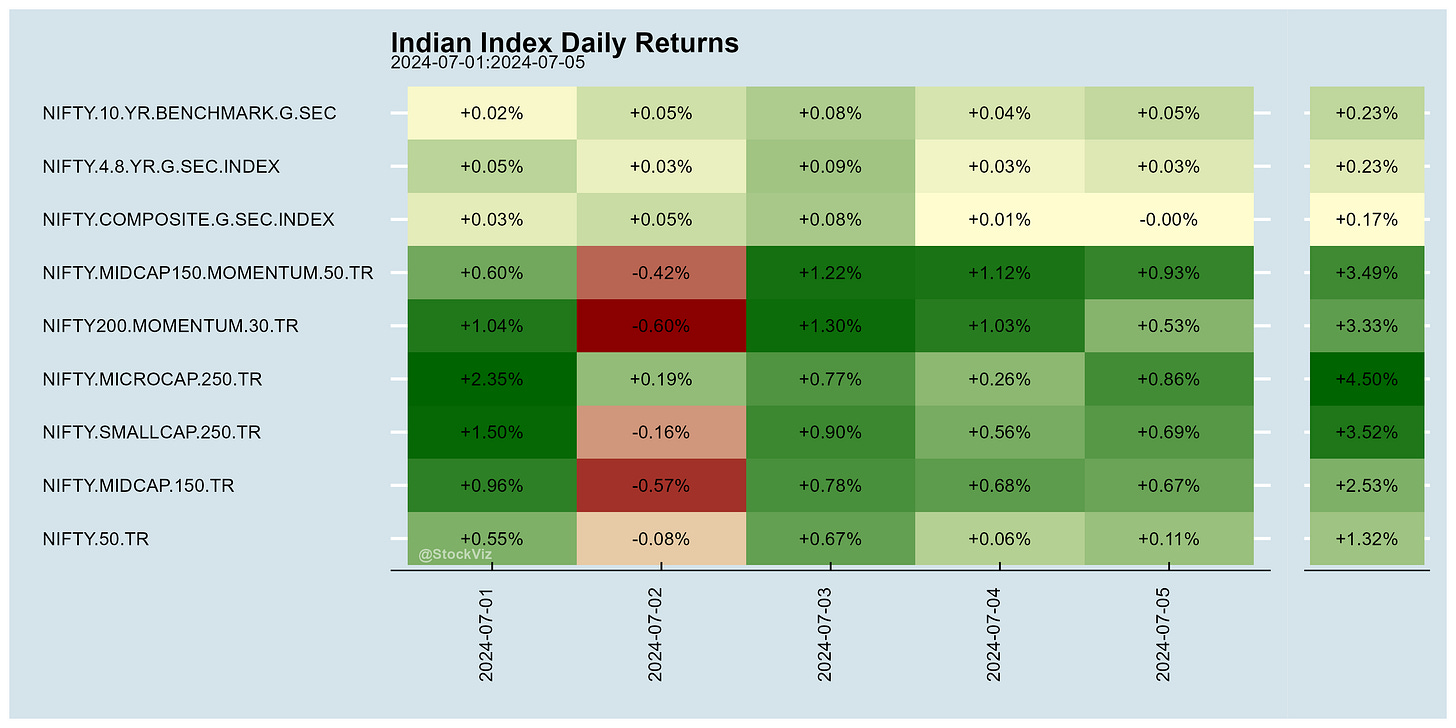

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Do Polluters Outperform Non-Polluters? (SSRN, alphaarchitect)

A portfolio long (short) in the highest (lowest) polluters earns significantly positive alphas based on standard asset pricing models. The highest-emission quintile generates superior reward-to-risk ratios and manipulation-proof performance measures than the lowest-emission quintile.

How Trend Following Explains Alpha in Volatility-Managed Strategies (SSRN)

Why do volatility targeting/management strategies tend to outperform simple buy-and-hold positions in the same assets? We test the hypothesis that this outperformance is mainly due to a loading on trend following that arises because of the negative correlation between return direction (trend) and magnitude (volatility), the so-called “leverage effect.”

Volatility Laundering: On the Feasibility of Wine Investment Funds (SSRN)

Volatility laundering is the attempt to make the risks of investments appear lower than they are, potentially misleading investors and counterparties. I highlight that this is a very harmful phenomenon, particularly in undermining the feasibility of wine investment funds. If fund managers provide selection-corrected returns (free of volatility laundering) compared to biased returns, I argue there would likely be limited interest in wine investment fund structures.

Cross-Market Intraday Time-Series Momentum (SSRN)

The US stock market's last half-hour return predicts the next day's first half-hour stock returns in international markets.

The Big Birthday Crisis: Exploring the Influence of 9-Ending Ages on CEO Behavior and Firm Outcomes (SSRN)

This paper provides evidence that firms underperform when their CEOs approach a new decade in life. Research in psychology suggests that individuals frequently enter a temporary period of crisis in 9-ending ages, which is characterized by introspection and self-assessment. I hypothesize that this comes with a diversion from professional responsibilities as CEOs. Consistent with this reasoning, I show that during 9-ending ages of CEO life, firms have decreased operating performance, firm value and long-term investments. I also find that CEOs are more authentic during conference calls, which is consistent with the idea that being in a 9-ending age is associated with deeper reflection that elicits closer alignment with personal values.

India

SEBI wants to discontinue volume-based exchange kickbacks to brokers (reuters, zerodha).

Sell! Sell! Sell! Say the Promoters.

Reliance Retail Ventures will launch Chinese fast fashion label Shein in the coming weeks (reuters).

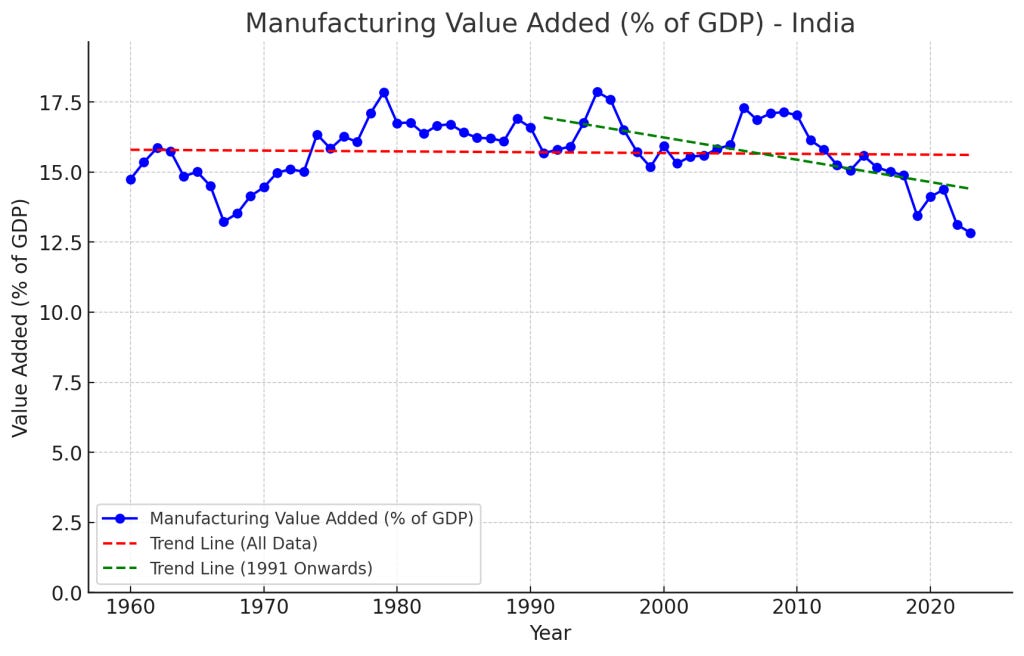

We can talk about increasing GDP all we like, but the real point is to pull people out of poverty, not just to make a big number bigger. A strong manufacturing sector, with its stable jobs and productivity growth, is our best (only?) shot at achieving this goal.

25% (econforeverybody).

Multinational brands that have for decades relied on Chinese factories are expanding to India as they seek to limit the vulnerabilities of concentrating production in any single country (nytimes).

RoW

No one really knows how interest rates work, or even whether they work at all—not the experts who study them, the investors who track them, or the officials who set them (theatlantic).

As long as the US continues to play its role of global consumer of last resort—as long as it continues to run trade deficits large enough to absorb up to half of the trade surpluses of the rest of the world—we are unlikely to see a revival of US manufacturing overall.

Trade and the Manufacturing Share (phenomenalworld).

24-Hour Stock Trading Is Booming – and Wall Street Is Rattled (bloomberg).

China’s Investment Bankers Join the Communist Party (bloomberg). Global investment banks cut jobs in China retreat (ft).

70% of wealthy families lose their wealth by the second generation, and 90% by the third… through a combination of assets being dispersed or capital lost

The great wealth transfer is coming (ft).

In 2022 we were getting 165% more gallons of clean water for the same time price as was the case in 2012. Water abundance from desalination is growing at a 10.22% compound annual rate, doubling in abundance every seven years (humanprogress).

5-6% of UK males are juicing (theguardian).

Why Front-Page News Can Mislead Investors (morningstar).

Meme of the Week

Happy 4th