Putin broke something. Whether he wins the war in Ukraine or not, the virus from China and tanks from Russia has landed a one-two punch that is going to dictate policy for a long time to come.

The ferocity with which the US, EU and multi-nationals imposed economic sanctions and cutoff business with Russia is going to force every country to examine their own vulnerabilities if they were to ever cross the West.

Some links to lose sleep over:

After Moscow attacked Ukraine last week, the U.S. and its allies shut off the Russian central bank’s access to most of its $630 billion of foreign reserves. If reserves aren't money, and if the accumulation of foreign assets isn't net national savings, then running persistent trade surpluses makes no sense unless it is with permanent allies. (WSJ)

"In just a few days, [the U.S. and its allies] turned the world's 11th largest economy into the equivalent of a drug kingpin sitting on a big pile of un-laundered cash they can't spend." - @Neil_Irwin

There is harsher type of sanction that remains to be implemented: secondary sanctions. With secondary sanctions, the U.S. government announces that U.S. banks must cut off not just named Russian entities; they must also stop doing business with any foreign bank (Indian, Chinese, etc) that provides banking services to named Russian entities. Gold seems like it would be good sanctions-proof payments method. It's not. (jpkoning)

So as long as you can refrain from attacking your neighbor, which isn’t terribly hard to refrain from, USTs (+other safe assets in big economies that enjoy unlimited support by the CB that controls the currency the assets are denominated in) are preferable as FX reserves. (thread)

“MSCI received feedback from a large number of global market participants…with an overwhelming majority confirming the Russian equity market is currently uninvestable & that Russian securities should be removed from the MSCI Emerging Markets Indexes.” (pdf)

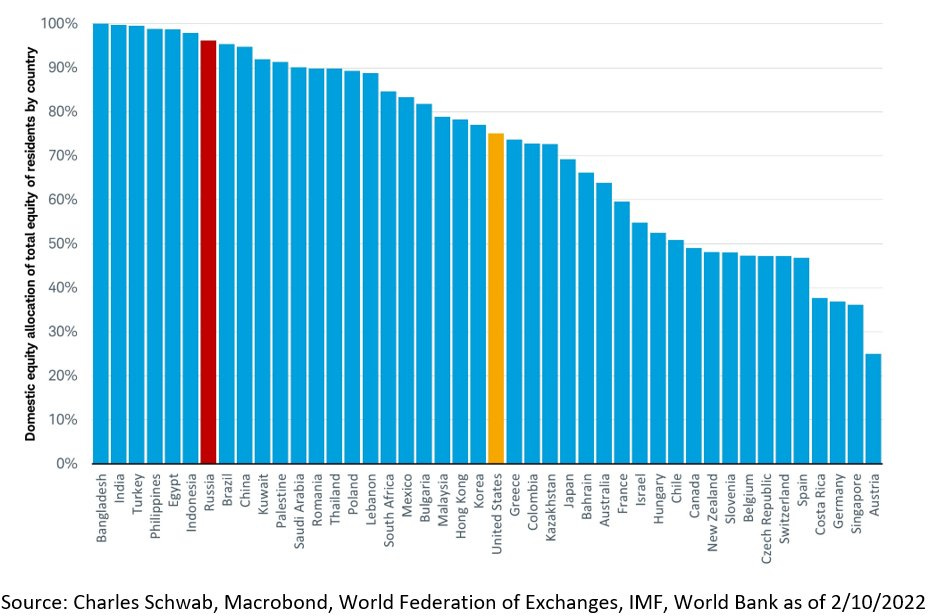

This chart shows the home bias of investors. Russian equity investors are now currently experiencing a 100% drawdown.

I work in the aviation sector, and I can tell you that for all intents and purposes Russian aviation has - at best - about three weeks before it’s show over. (thread)

Shipping: MSC, Maersk, CMA CGM, Hapag-Lloyd, ONE, Yang Ming suspend Russia services; tankers shun Russian oil. (freightwaves)

Visa and MasterCard have halted operations in Russia. (Hindu)

Cogent (Russia's second-largest internet provider) has cut its internet service on Friday. (WaPo, Mashable)

The ripple effects are already being felt. (thread)

“Putin cannot stop this war, because he knows it is either victory or his death in a coup by his own officers. So, he escalates.” (putin’s ruin)

The last time the Moscow Stock Exchange was closed for this long was in 1917. It stayed closed for 75 years.

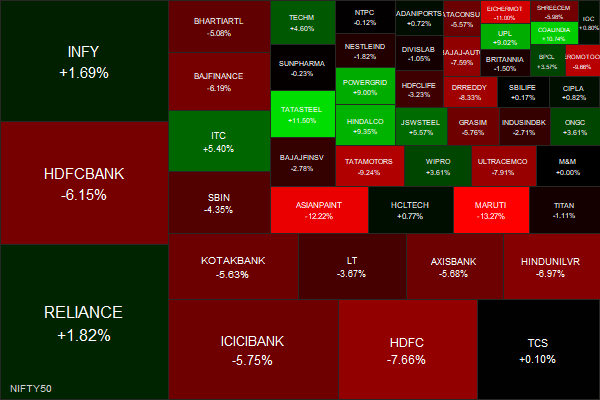

Markets this Week

Fed rate-hike bets are rapidly being rolled back. Markets are trying to figure out if this is going to be a quick hit-and-run sort of affair or a prolonged quagmire that is going to suck the rest of the world into stagflationary jingoism.

Commodities have gone parabolic.

$DBC - Commodities

$DBA - Agri Commodities