Rabbit Holes

breadth first, depth later

The best part about quantitative investing is all the rabbit holes you can go down as part of your work. Most of them turn out to be dead ends but that’s the beauty of it.

We started looking at pair-wise correlations of index constituents a couple of weeks ago to check if tracking them is useful. Turns out, it’s not. We cannot use correlations to time the index. At least, not in the timeframe we were looking at. You can read about it here and save yourself some time if were thinking about chasing this rabbit. Adding trend into the mix doesn’t help either.

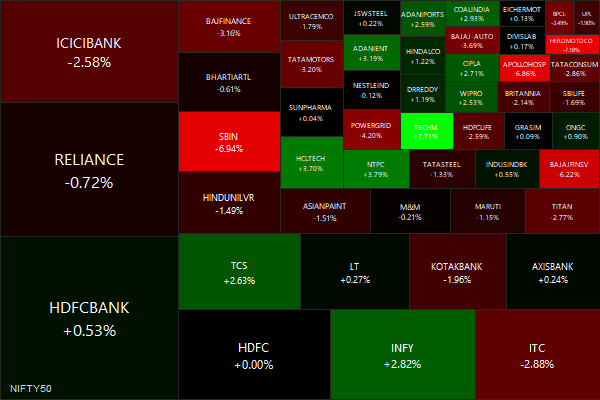

Markets this Week

M&M - a tractor maker - bought a chunk of bank this week. Investors puked and the management tried to walk it back. Totally bizarre.

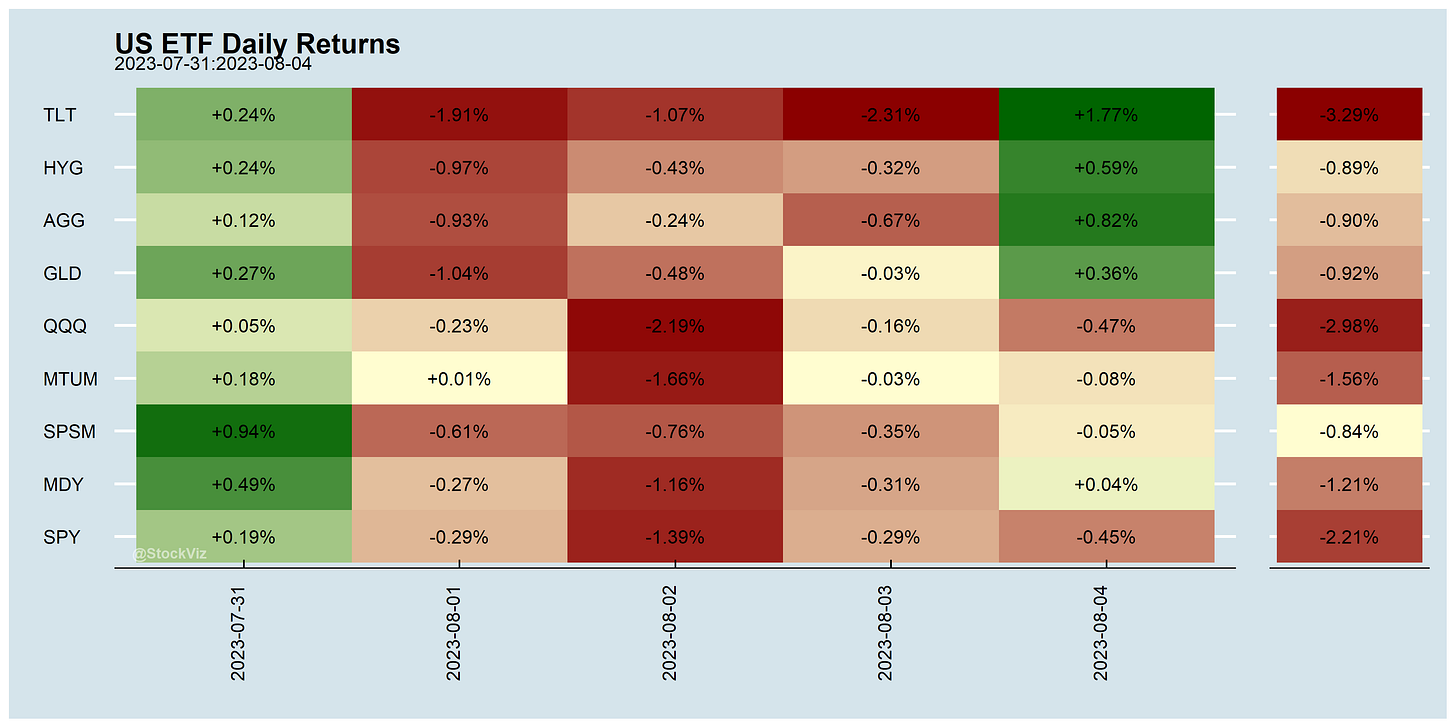

Looks like the Fitch rating cut was the pin that pricked the rally?

Apple is struggling to find new buyers for its overpriced devices while Amazon looks to be firing on all cylinders.

YTD, you have the pack…

… and then you have NVDA 0.00%↑ and META 0.00%↑

More here: country ETFs, fixed income, currencies and commodities.

Links

Laptops and tablets are among a handful of electronics that will require a license to be imported into India. (CNBC, theprint)

The Indian government is actively considering the implementation of a new policy that would require automobile companies to take responsibility for recycling some of the vehicles they sell. (cnbctv18, cnbctv18)

Rising debt is a structural problem in China, and is the result of GDP growth targets that exceed the real underlying growth of the economy. Incremental policies aimed at reducing one form of the debt problem will simply increase other forms.

Facing job scarcity in China, some find work as ‘full-time children’ (nbcnews)

In May, Hindenburg Research accused Carl Icahn's firm of operating a "Ponzi-like" structure to pay dividends. This Friday, it cut its dividend in half. The stock (IEP 0.00%↑) is spiraling. (reuters)

The correlation between stock and bond returns can move considerably over time.

Our overarching finding is that for the post-1952 period with independent central banks, a positive stock-bond correlation is observed during periods with high inflation and high real returns on Treasury bills.

It sucks to be poor (SSRN)

Autoenshittification (pluralistic)