Regimes

Chaos. Order. Disorder.

This week, we continued our exploration of distance measures. We did a simple backtest to see if Mahalanobis distance can be used to detect regime shifts to help switch between stocks and bonds.

The problem with “regime switching” models, broadly, is that markets don’t give you clean breaks. There are periods where things are murky and there are periods where the market keeps hopping between different regimes. During these periods, you end up giving back a big chunk of profits made in the clear regimes. Add transaction costs into the mix and these models under-deliver on their promises.

To side-step some of these problems, our backtest looked at weekly returns, rolling measures and split datasets. And we feel that there is enough in the backtest to warrant more research.

You can read about it here: Mahalanobis Distance

Markets this Week

Banking stocks continued to drag markets. KRE 0.00%↑ , the US regional bank ETF, is now down 45% from its 2022 peak.

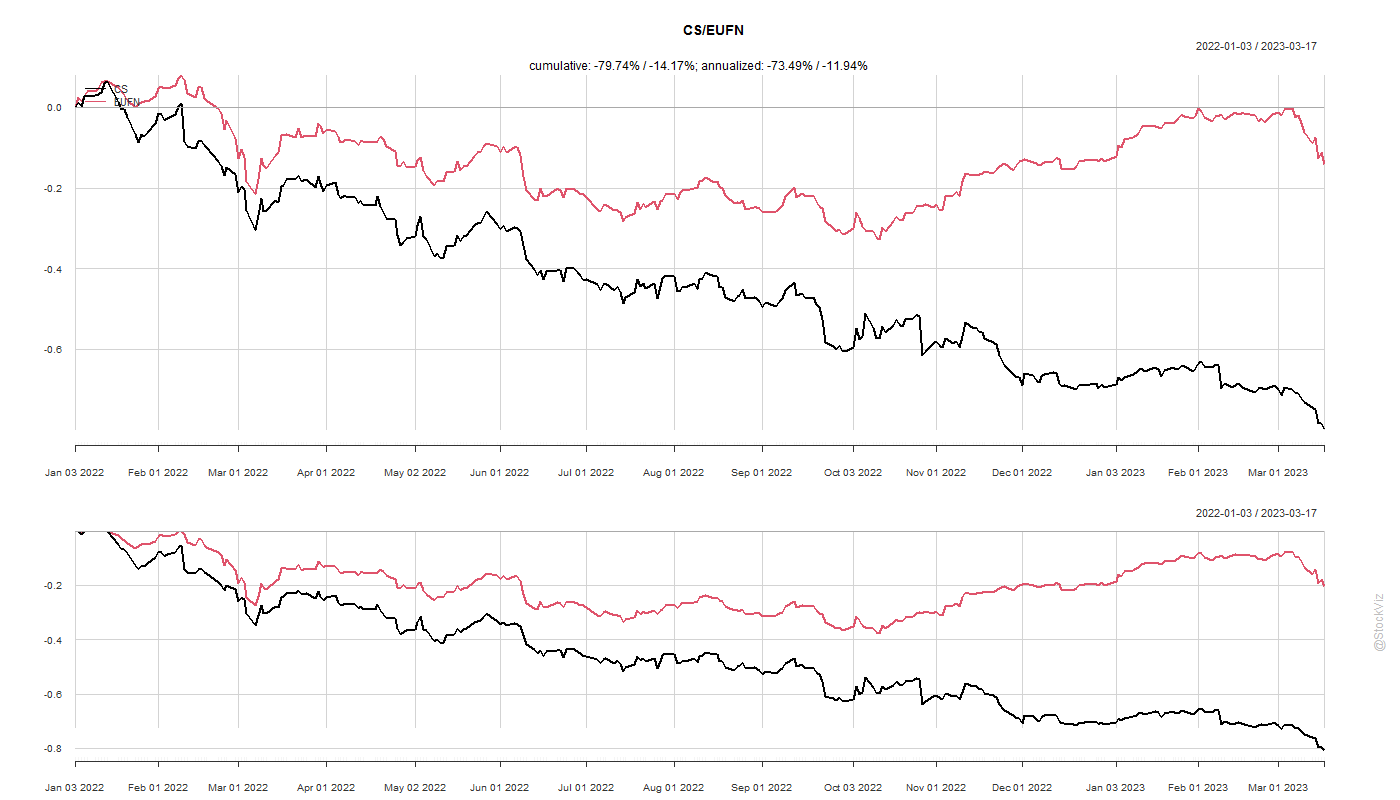

Markets turned on First Republic Bank, considered the weakest among the regional banks in the US. And across the pond, Credit Suisse, considered to be the weakest among European banks, was beat down.

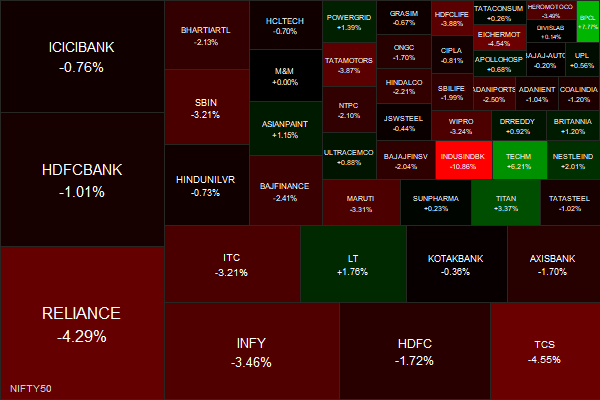

Given all that is going on state-side, Indian indices were remarkably resilient.

However, lots of chaos under the hood.

And it looks like US tech stocks are already celebrating the end of rate hikes.

Nothing gives the gold-bugs and crypto-bros wings like a good ol’fashioned banking crisis.

More here: country ETFs, fixed income, currencies and commodities.

Links

It looks like a lot of regional banks just straight-up speculated on an early Fed pivot and lost.

Nearly 60% of non-dealer banks are not holding any protection against a rise in bond yields. (ifre)

There are 186 U.S. banks where, if half of uninsured depositors quickly withdrew their funds, even insured depositors could face impairments because the bank wouldn't have enough assets to make all depositors whole. (ssrn)

But let’s not ignore the fact that the Fed’s stress-test models in 2022 did not even consider the possibility of rising interest rates. (investing, wsj)

~

Volatility chopped some heads off this week.

Quants lost money. Brokers lost money. Discretionary managers lost money. (FT)

~

DM in the streets, EM between the sheets.

The London Metal Exchange has found bags full of stones at one of its warehouses instead of the nickel they were supposed to contain. (reuters)

~

People are legit pissed at some VCs for yelling “fire!” in a crowded theatre.

Remind me why, exactly, these guys have so much control over technological innovation? (slate)

~

When the Twin Towers went down, was it a single act of terror or two?

As always, interesting and insightful 🙏🏻👍🏻