Return-free Risk

When risk-free rate is no longer zero

Wrote a bit about why you shouldn’t use a zero or a flat risk-free return while calculating Shape Ratios here. It is true for other risk calculations as well. Also, you’d be shocked to know that the Indian small-cap index has given pretty much the same returns as the large-cap index. The only difference: volatility.

Markets this Week

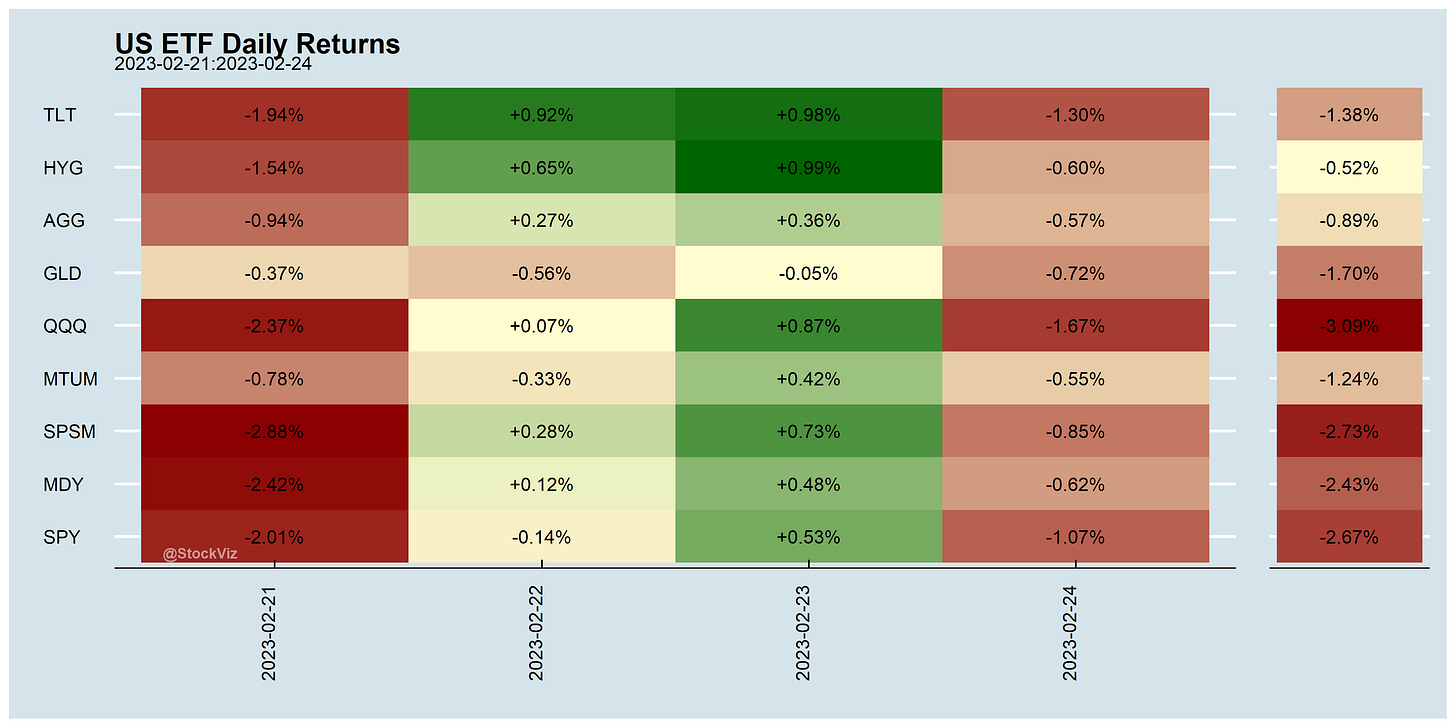

It was a pretty violent week in the markets. The US economy is running hot so rates are going higher until something breaks.

More here: country ETFs, fixed income, currencies and commodities.

Links

US rates not high enough…

The Federal Reserve needs to hike its benchmark interest rate to 8%, versus the current level of 4.5%-4.75%, to stabilize inflation and could still get there. (marketwatch)

… but commercial real estate defaults are ticking up.

PIMCO defaulted on $1.7B worth of loans, while Brookfield walked away from $784M in loans. (therealdeal)

Indian rates are close to neutral.

The Reserve Bank of India need not keep raising rates until prices fall as it risks overshooting the inflation-adjusted real rate, which at around 1% now is appropriate for the economy. (reuters)

Risks to India's growth are higher than the risk of further inflation as major drivers of price increases are dissipating, justifying a pause in further rate hikes (reuters)

It’s the Dollar’s world. We just live in it.

China wants the game to be rigged in its favor now.

The United States exploits the world's wealth with the help of "seigniorage." It costs only about 17 cents to produce a 100 dollar bill, but other countries had to pony up 100 dollar of actual goods in order to obtain one. It was pointed out more than half a century ago, that the United States enjoyed exorbitant privilege and deficit without tears created by its dollar, and used the worthless paper note to plunder the resources and factories of other nations. (US Hegemony and Its Perils)

~

Yes. ETFs contribute to EM volatility.

Using country-level data, we find that where ETFs hold a larger share of financial assets, equity inflows and prices become more sensitive to global risk. (The Review of Financial Studies)

~

This thread is about Andreessen Horowitz but should apply to giga-scale VC funds in general. (thread)

~

A diabetes drug is being prescribed for weight loss. What could go wrong?

~

Most of the time, the best solution is a spreadsheet.

How Levels.fyi scaled to millions of users with Google Sheets as a backend (levels.fyi)

~

Open education resources, including free lectures, courses, course materials, textbooks, and academic content: r/OpenEd