Roll's

bid-ask bounce vs. volatility

Came across the Roll’s Serial Covariance Spread Estimator while re-reading an exchange micro-structure classic, Trading and Exchanges. The estimator helps you differentiate between volatility due to the bid-ask bounce vs. “fundamental” volatility. Decided to put some code behind it and write a brief post here: Roll’s Serial Covariance Spread Estimator.

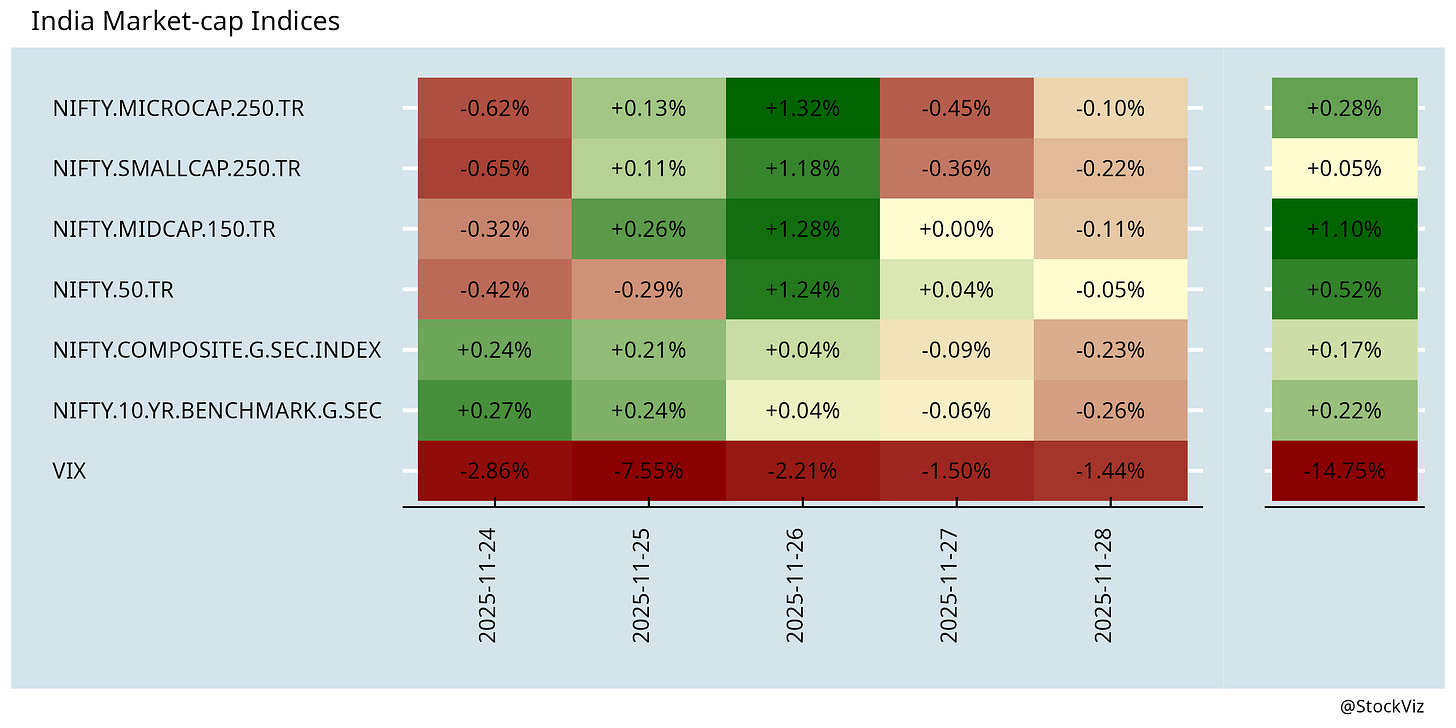

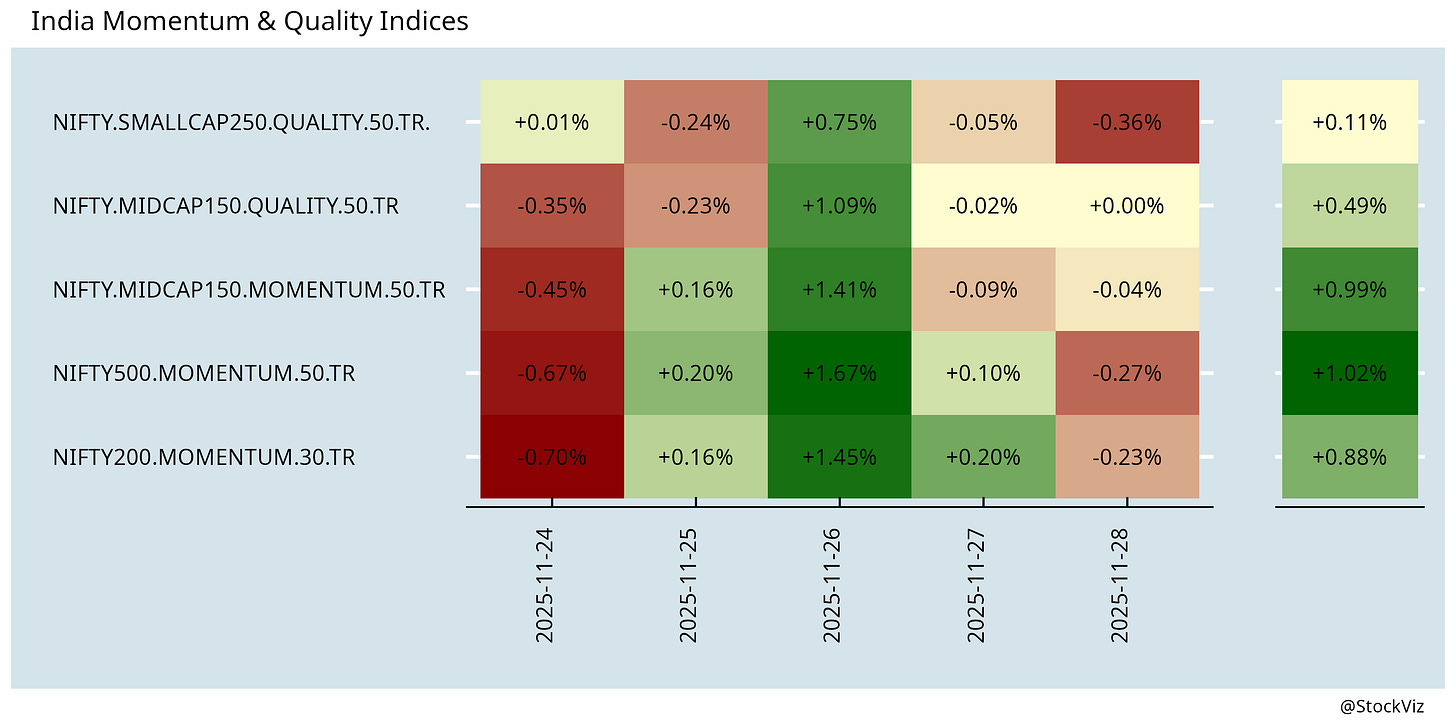

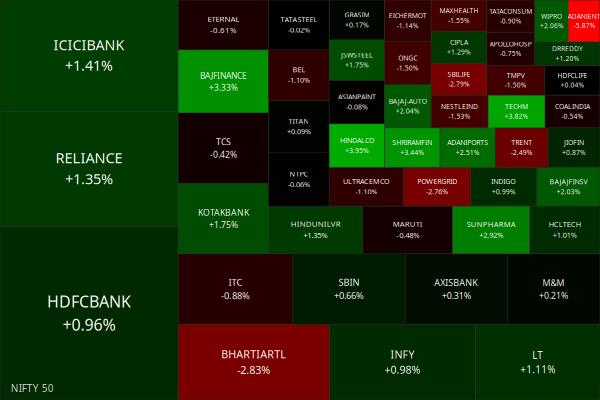

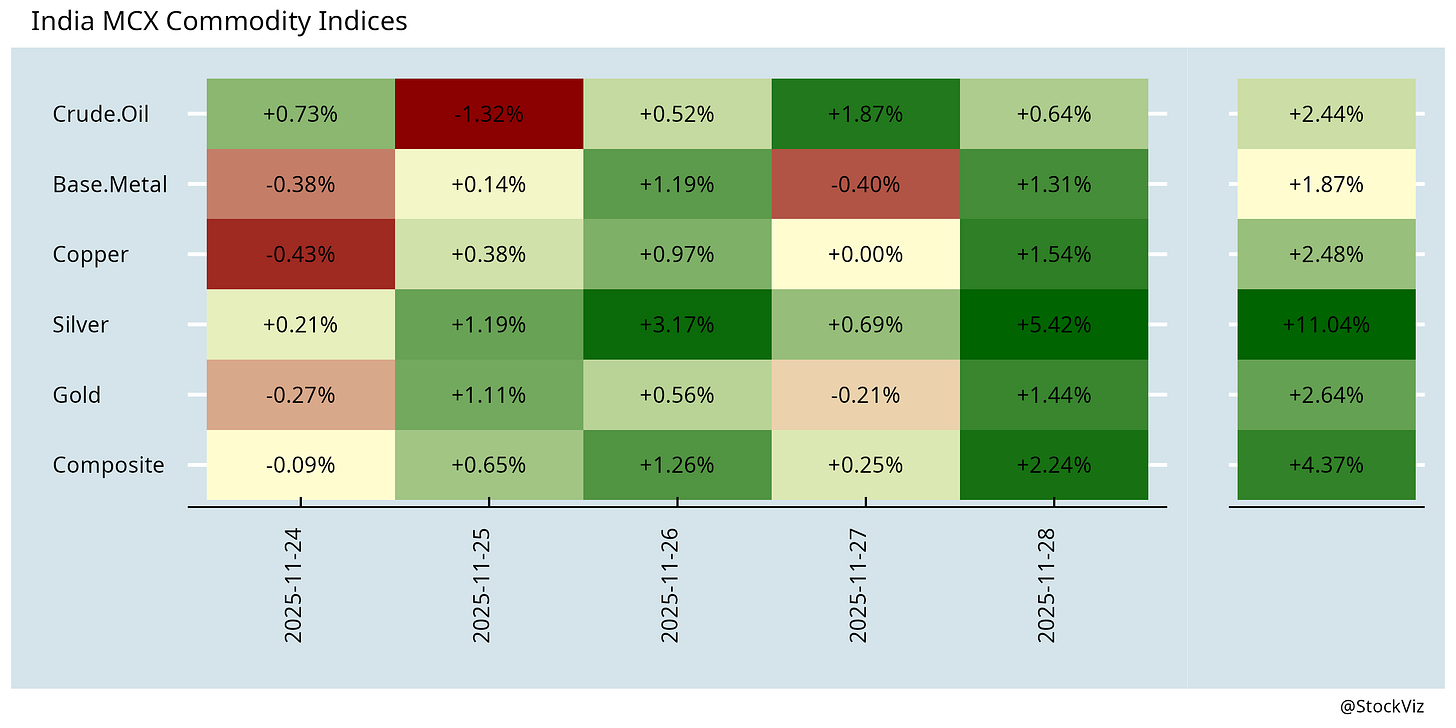

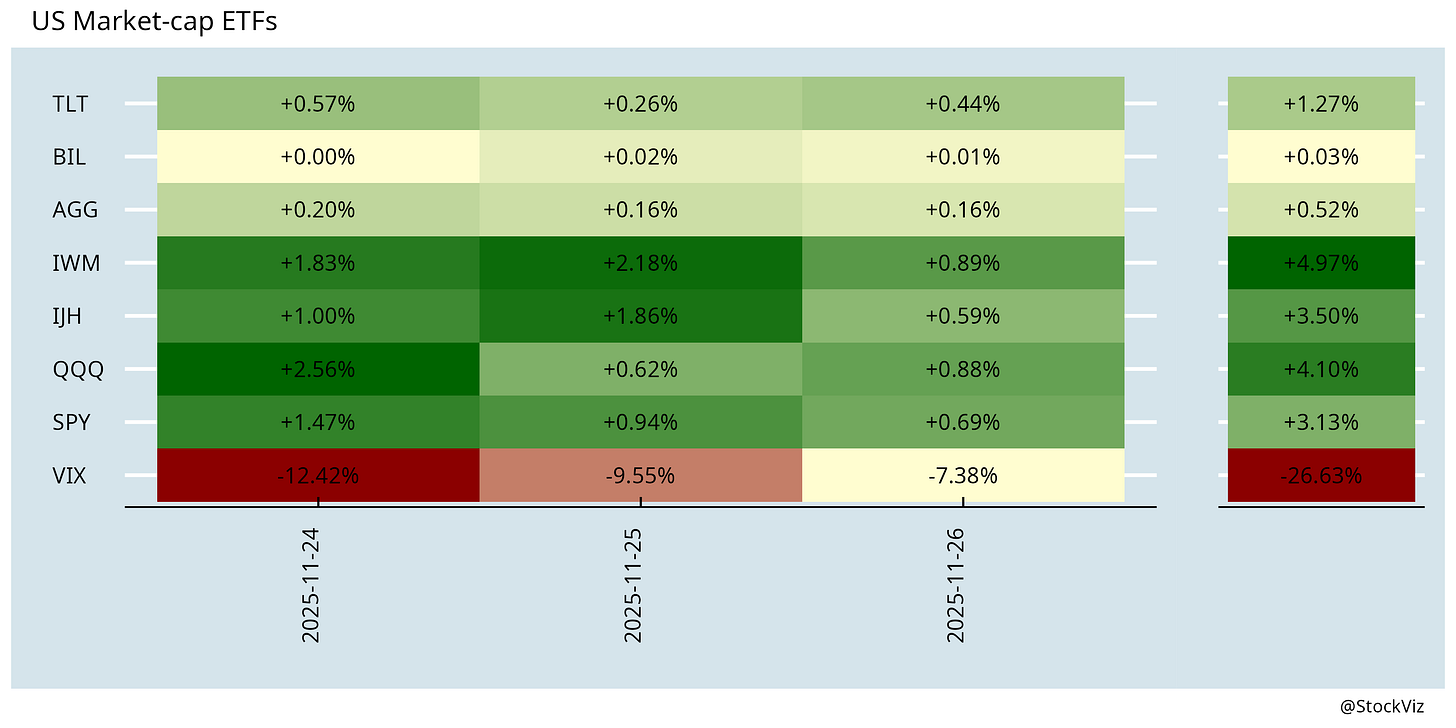

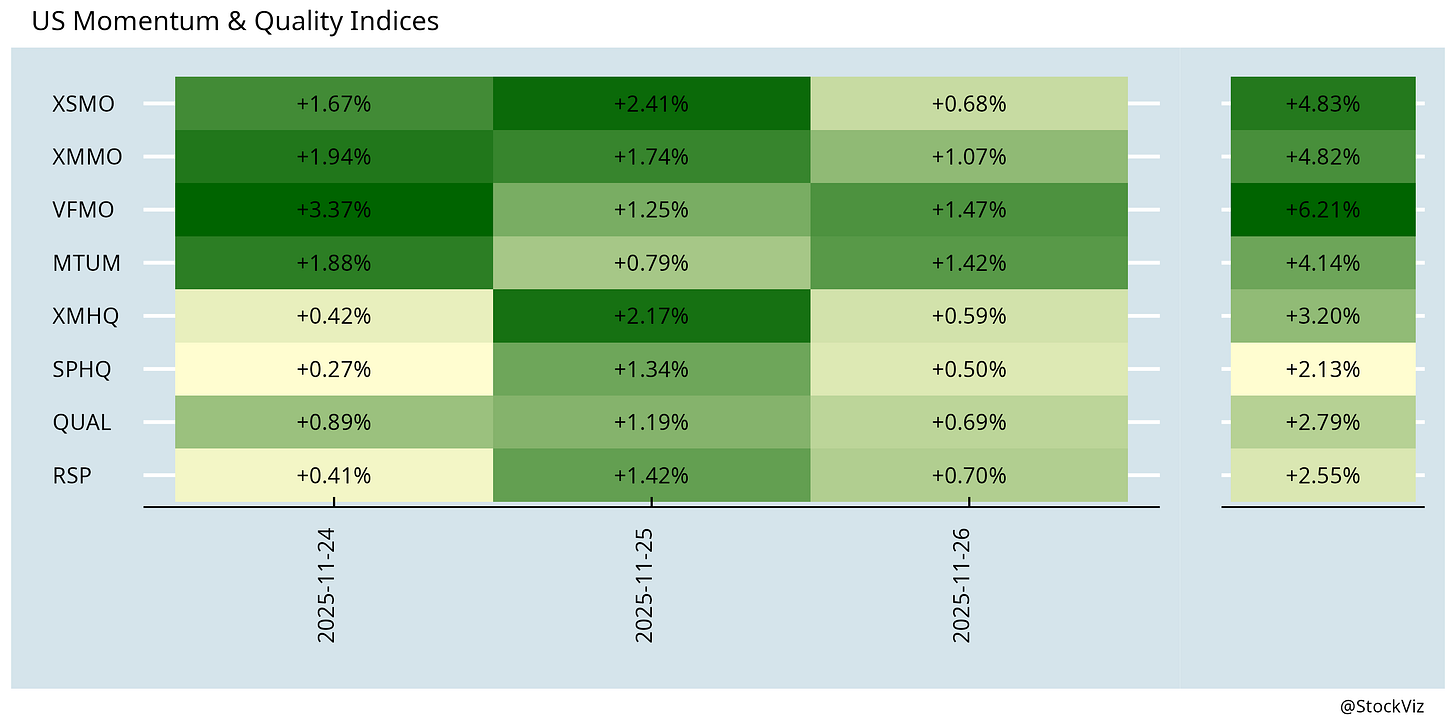

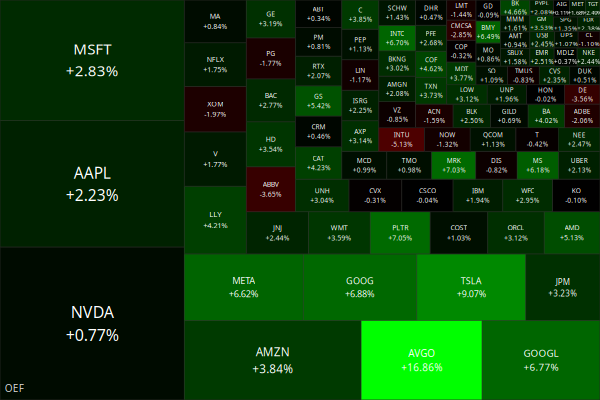

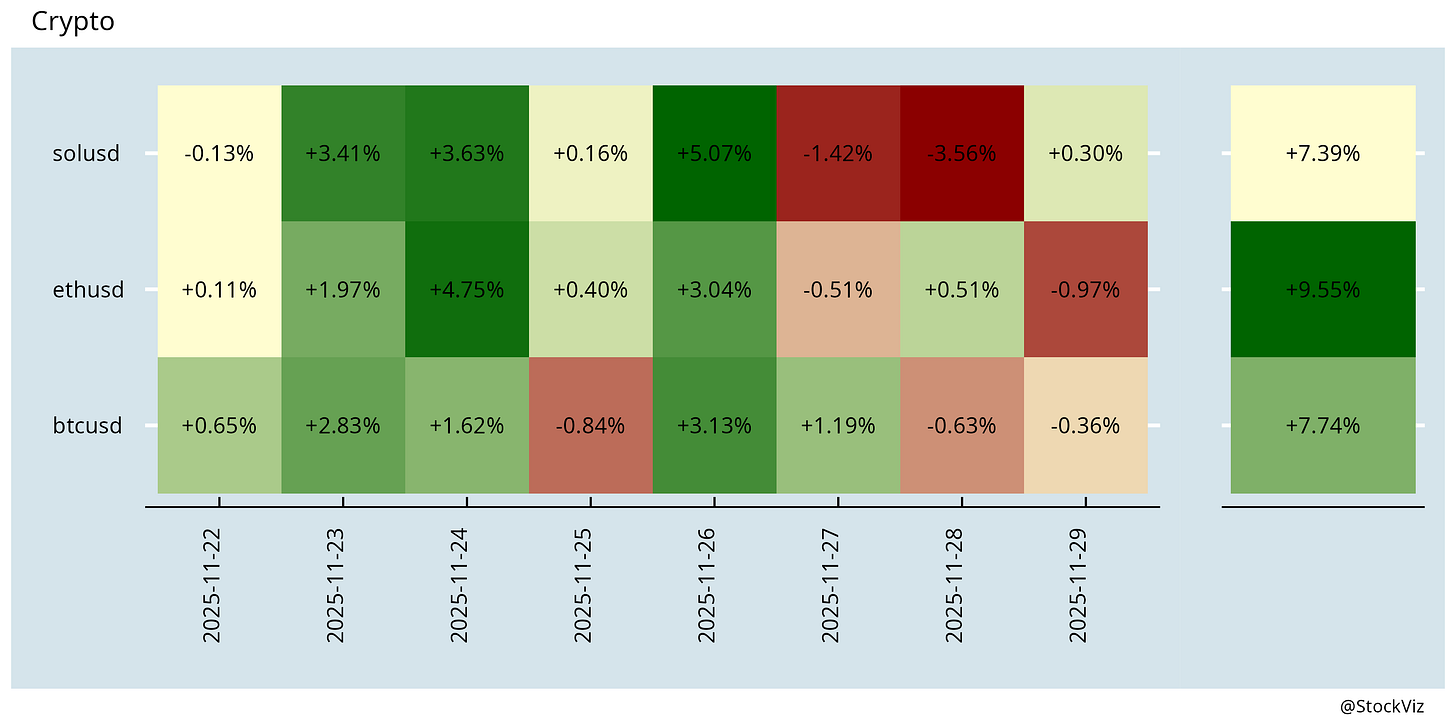

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Momentum factor investing: Evidence and evolution (SSRN)

Momentum is a foundational factor in equity markets. We review its evolution in the literature and analyze the momentum factor empirically across a wider variety of tests. Our empirical analyses demonstrate robust empirical support for the momentum factor over domestic and global stock markets spanning up to 150 years of data and a wide variety of design choices, establishing momentum’s resilience against data mining and arbitrage concerns. Momentum has transitioned from pure price-based trends to advanced fundamental, firm-specific, and network-based trends that improve the effectiveness of the momentum factor. Finally, momentum is exposed to crash risk, but we find that risk-managed momentum strategies mitigate the crash risk and improve the risk efficiency of the momentum factor. Overall, the momentum factor premium is sizable, robust, persistent, and fundamentally multi-dimensional.

Fundamental Growth (SSRN)

Conventional growth indices suffer from two important shortcomings. First, stocks that are anti-value (very expensive) are not necessarily growth stocks. The decision to include a stock in a growth index should be based on fundamental growth measures, such as growth in sales, profits, or R&D spending rather than price based measures. Second, when these indices are weighted by objective measures of growth (rather than by market capitalization) performance markedly improves.

The Social Rate of Return on Road Infrastructure Investments (NBER)

We estimate that the median social rate of return to installing an additional kilometer of two-lane highway in emerging-market and developing economies is 55 percent—roughly eight times the social rate of return on private capital in the US.

India

India’s economy grew at a faster-than-expected pace of 8.2% in the quarter ended September against a forecast of 7.3% in a Reuters poll and 7.8% expansion in the previous quarter (reuters).

The notification of labour codes empowers chief ministers to craft fertile habitats for formal, high-wage, high-productivity private employers (indianexpress).

High-frequency trading firms have posted strong profit growth in India despite regulatory curbs (livemint).

Safran agrees for full technology transfer for fighter jet engine to India (economictimes).

India is preparing to meet a projected cumulative battery energy storage capacity of nearly 3 terawatt-hours (TWh) by 2047 across electric mobility, power, and electronic components (livemint).

India’s chemical and pharmaceutical industries are pivoting strongly towards Contract Development and Manufacturing Organizations (CDMOs) and Active Pharmaceutical Ingredient (API) production. Specialty chemical manufacturers supplying this pharma-linked ecosystem are outperforming the broader chemicals sector, which is currently struggling with Chinese oversupply, tariff shocks, and weak global demand. Also, India’s bulk drug makers are investing heavily in research and development (R&D) to move up the value chain and secure high-value contract development work from global drugmakers (livemint, livemint).

Apple goes to High Court to avoid $38 billion fine in India (timesofindia).

India exported 3.44 million units of iPhones in Oct 2025, a 40% month-on-month growth from the units exported in September and a 20% year-on-year growth compared to October 2024 (thehindubusinessline).

Samsung’s exports of smartphones, television sets, refrigerators and washing machines from India rose 25% to ₹45,930 crore in 2024-25 (economictimes).

India will be one of the biggest casualties of AI (frontline).

How French Philosophy Became Indian Murder (sharpbyswarajya).

row

Trump launches the Genesis Mission (reuters, axios)

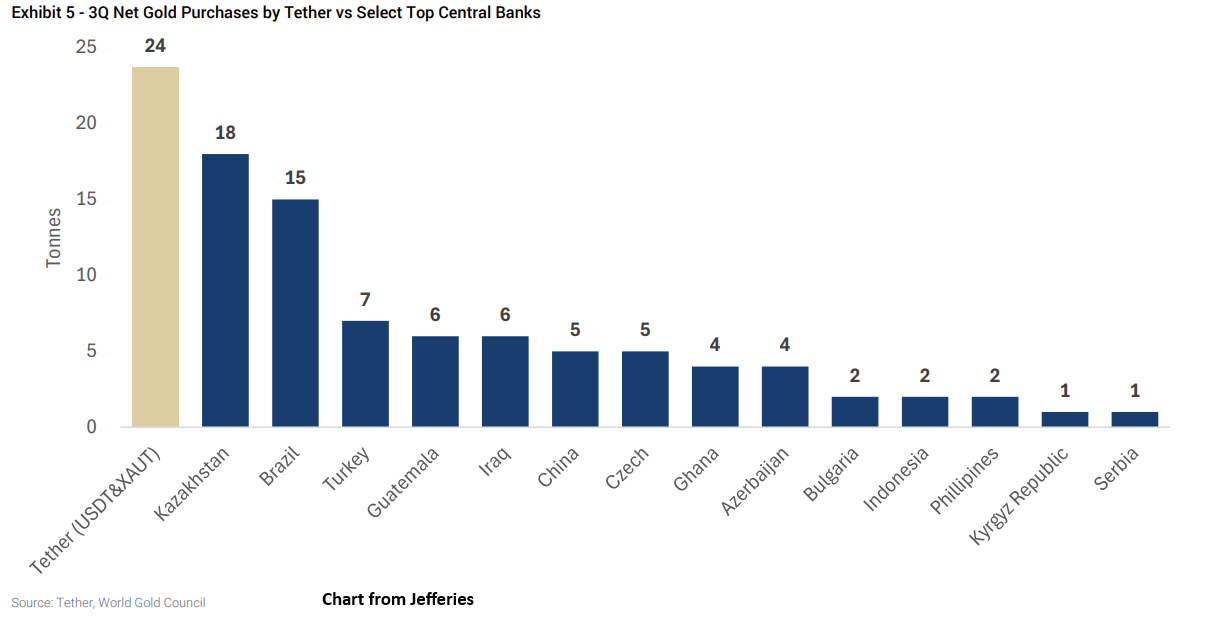

Tether held 116 tonnes of gold for its customers — about $14 billion at prevailing prices. That made it the largest single holder of bullion outside the big central banks, and put it on par with smaller official hoards in countries such as South Korea, Hungary or Greece (reuters).

The global copper market is facing major upheaval, triggered by supply-demand imbalances, the shifting role of China and the uncertainty surrounding Trump’s trade agenda (bloomberg).

Chinese automotive suppliers are inundating Germany with low-cost components. Nearly 70% of European parts makers now face direct competition from Chinese imports — a 12-percentage-point jump over the previous study from late March. Majority of suppliers are expecting profitability to fall below the 5% minimum needed to sustain investment (bloomberg).

China’s Great Wall Motor is targeting annual production of 300,000 vehicles by 2029 in Europe (reuters).

VW says it can halve EV development costs with ‘Made in China’ car (ft).

A robotaxi boom is coming (economist).

Streaming costs keep climbing as platforms chase profit (techspot).

Exhibit A of AI circular finance: CoreWeave (theverge)

Odds & Ends

More and more people began to think twice before buying what influencers were selling. The user-led intervention, which sees an army of self-described deinfluencers discouraging their audiences from buying into overhyped stuff, represents a notable departure from the usual calls to “swipe up” and “buy now.” (vogue)

Major AI conference flooded with peer reviews written fully by AI (nature)

Cutting-edge research shows language is not the same as intelligence. The entire AI bubble is built on ignoring it (theverge).