Not a day goes by without Trump gracing our screens. It’s raining Executive Orders, DOGE firings, tariff on/tariff off, yelling matches and name calling with world leaders.

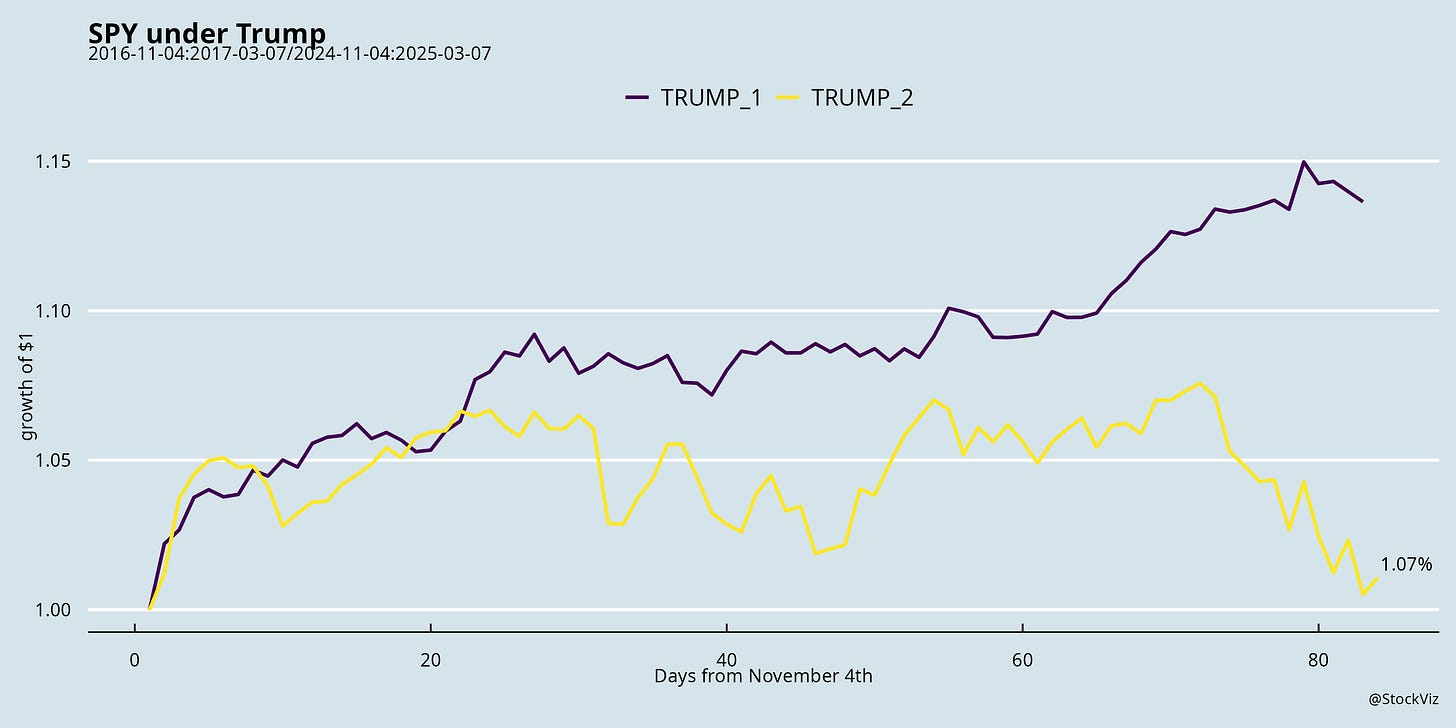

The markets expected a repeat of Trump v1.0 - tax cuts and deregulation. What Trump v2.0 seems to be delivering is chaos.

Tariffs are one such thing.

Keeping track of tariffs itself has become a full-time job.

Trump tearing up the USMCA that he negotiated in his first term baffles the mind. For example, the transmission module of a car manufactured in the US crosses the US-Canada border seven times (lfpress). Imagine paying 20% tarriffs on that each time.

When the stupidty of it finally dawn on him, he rolled “some” of the tariffs back (bbc, npr), but nobody knows for certain on what they remain.

Perhaps chaos is the objective?

Businesses need certainty and there happens to be a price to make the uncertainty go away: Business leaders are paying as much as $5 million to meet one-on-one with the president at his Florida compound while others are paying $1 million apiece to dine with him in a group setting (wired).

Or maybe he wants to hit reset?

The market and the economy have just become hooked, and we've become addicted to this government spending, and there's going to be a detox period.

If Trump’s treatment of his European allies is any indication, then we are in for a tumultuous ride. He and his admin have already betrayed Ukraine (apnews, cnn, washingtonpost), insulted the UK (theguardian) and pushed Germany to rearm (ft, bbc, politico) and Poland to seek nuclear weapons (politico, bbc).

Trump hasn’t spared India either. Our entire auto industry exists because of protectionism. Taxes on cars imported into India are as high as 110%. We have different tariffs for "Completely Knocked Down" kits, "Semi-Knocked Down" kits, etc. to force the growth of Indian supply chains and logistics. Trump wants these protections gone (reuters). Some commentators seem to think that this will finally force Indian OEMs to innovate and “punch-up”. However, the lala-babu nexus can erect a minefield of non-tariff barriers that can obstruct even the best laid plans (economictimes, economictimes). Who knows how this is going to pan out?

The world has undergone a phase-shift. Investors should be wary of applying yesterday’s playbook to a Trumpian world.

In short: long chaos, short rigidity.

Markets this Week

Indian equity markets rebounded…

… even though FIIs continued to sell…

… oil down, gold up - what more can you ask for?

US equity markets got Trumped…

… with momentum stocks getting hit the hardest…

… with the scoreboard shifting every week.

“Crypto Reserve” was a sell the news event.

Links

Research

Steel Productivity has Plummeted Since Trump’s 2018 Tariffs (cfr)

Since President Trump imposed 25 percent tariffs on steel imports in March 2018, output per hour in the U.S. steel industry has fallen by 32 percent since 2017. For the economy as a whole, output per hour has increased by 15 percent. U.S. steel-using firms, which employ roughly 45 times the number of Americans as steel-producing ones, pay about 75 percent more for steel than do their competitors globally.

Beauty and the feast (sciencedirect)

Attractive servers earn roughly $1261 more per year than unattractive servers.

Patient attractiveness reduces the likelihood of a missed diagnosis (researchgate)

Doctors were 3.67 times more likely to miss the diagnosis of nephrolithiasis or cystolithiasis on the X-rays of unattractive patients compared to the X-rays of attractive patients.

India

Better growth for the Big Five of India's IT industry in the next financial year has come under doubt (livemint).

In recent years, bureaucrats in New Delhi have discovered a new form of non-tariff barrier. This protectionist and statist measure is disguised under the so-called “quality control orders”, or QCOs (business-standard).

The government should think as big and bold as Dr Manmohan Singh did in 1991. It should convert the Trump threat to an India opportunity, re-embracing a more liberal trade regime as a way of reviving manufacturing output and exports (business-standard).

Almost a year’s worth of tax collections are currently stuck in various disagreements. In 2021, the amount being contested was almost six times as much as it was in 2010. When these disagreements go to court, the government wins less than 8% of the time (livemint).

row

Trump looks only at bilateral trade in goods, ignoring trade in services and earnings from capital and labour. It so happens that the income the US derives from its exports of services at least to the Eurozone and the returns on capital and the wages of labour it has exported there offset its bilateral deficits in goods. The overall Eurozone bilateral current account balance with the US is close to zero (ft).

Trump signs order to establish strategic bitcoin reserve (reuters). Cliff Asness: The New ‘Crypto Fort Knox’ Is as Dumb as It Sounds (thefp).

Justin Sun, who pumped $75 million into the Trump family-backed crypto token, finds himself in a fortunate position this week as federal securities regulators are hitting pause on their civil fraud case against him (cnn).

Trump’s Wildest Threats Against Canada (nymag).

Tesla's registrations in Germany plummeted 76% and 44% in France (bloomberg).

More words than deeds from China on consumption keep deflation in play (reuters).

Odds & Ends

Teleperformance, the world’s largest call center operator, is relying on artificial intelligence technology to “neutralize” the accents of English-speaking Indian customer service agents in real time (nypost).

Private spacecraft Blue Ghost lands on Moon (bbc).

Thanks for highlighting my work!