Long-only investors has a great 2024. As long as you HODL’d, you were all set. Any thing you did to “risk manage” your positions probably took away a big bite off your returns. Here’s how things shook out.

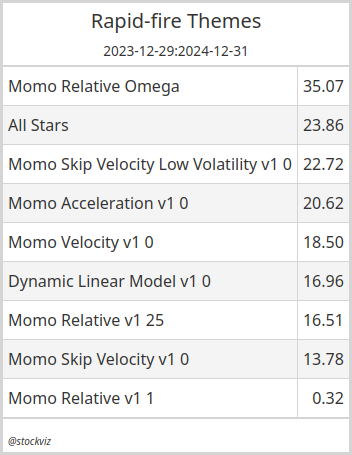

Indian Investment Strategies

Traditional momentum strategies outperformed pretty much everything else…

… anything you did to lower volatility blew up in your face…

… long & strong was the vibe…

… the lesser you did, the more you banked.

Indian Indices

Indices made all-time highs but the large-cap NIFTY 50 index barely beat bonds…

… with momentum indices leading the charge…

… some sectors more than the others…

The post-election drag in the markets is something to be worried about. The government gets another shot at changing the vibes when it present the budget in February. The general mood is sort of subdued but not yet in despair. We’ll know how the rest of the year goes in another month.

Indian Commodities

Gold captured everybody’s imagination with with a 16% return.

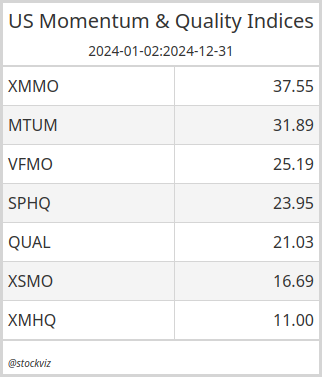

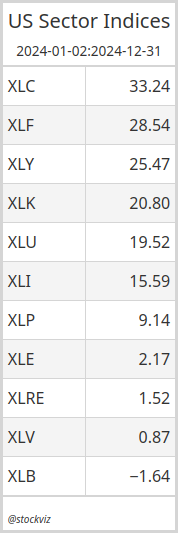

American Indices

Tech, driven by the AI mania, lead the charge…

… one of the best years for momentum…

… if you were not in the Mag-7 stocks, then you probably didn’t make it…

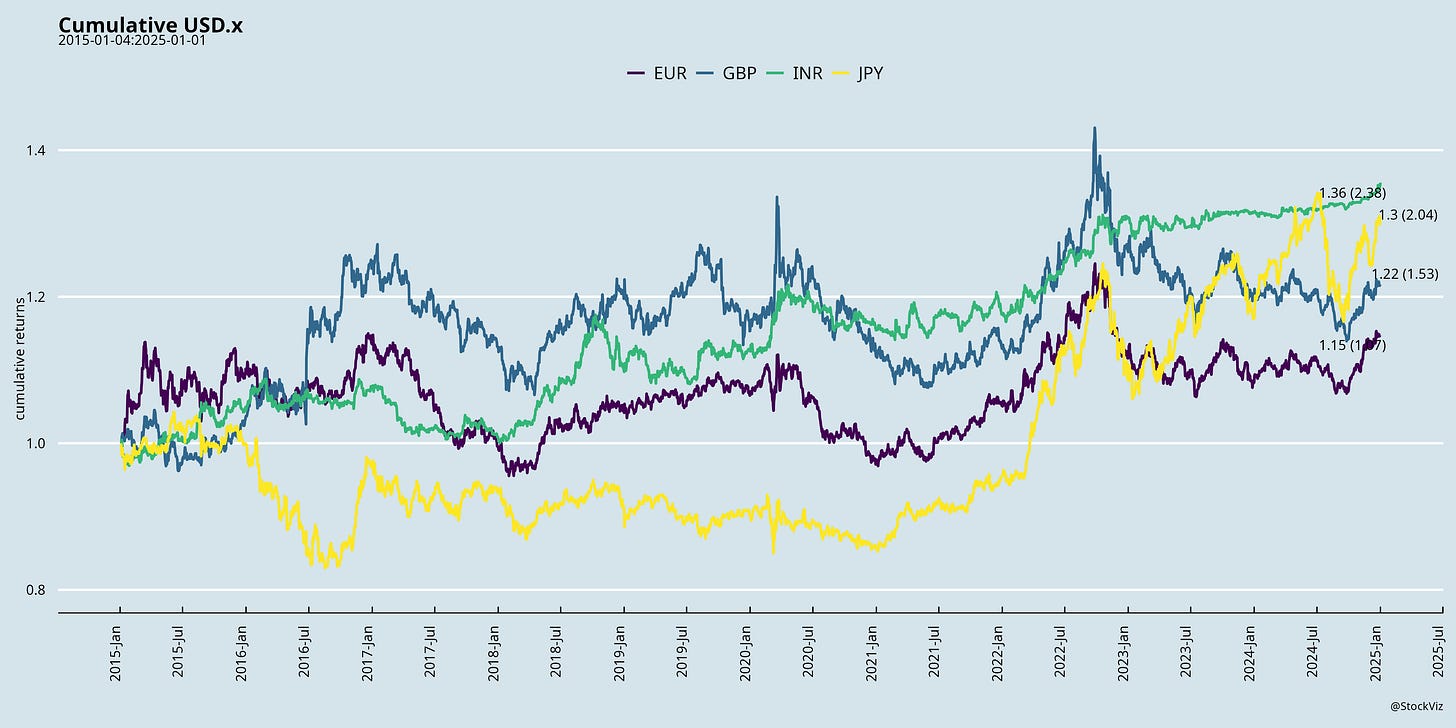

Currencies & Crypto

Did not expect the Japanese Yen to compete with INR but here we are…

… crypto rose up like a Phoenix with Trump ascendant…

World Equity

Overall, a good year for equities.

Have a great year ahead!