Sharpe(r) Image

roll with it

With a bull market in full swing, investor managers and advisors are back to waxing eloquent about the joys of compounding, buy & hold, and moats and what not… However, people with an attention span that is at least a minute more than an ant’s can’t help but roll their eyes. Because this is when every backward-looking metric will look good.

For example, here’s the rolling Sharpe ratio of different indices over time:

Not only do short-term performance metrics look great in a bull market, averages and life-time metrics are of little help in gauging the actual return vs. risk profile of investments. So, before you get comfortable with an investment, make sure you roll these over at least two legit bear markets, say 2018 onwards, to get a clearer picture.

This is something we discussed this week in our post: Rolling Sharpe.

Unfortunately, this is a pretty challenging task with actively managed funds that have churned through investment managers (Mutual Funds: A quick note on performance metrics [2018]). Who’s performance are you actually measuring?

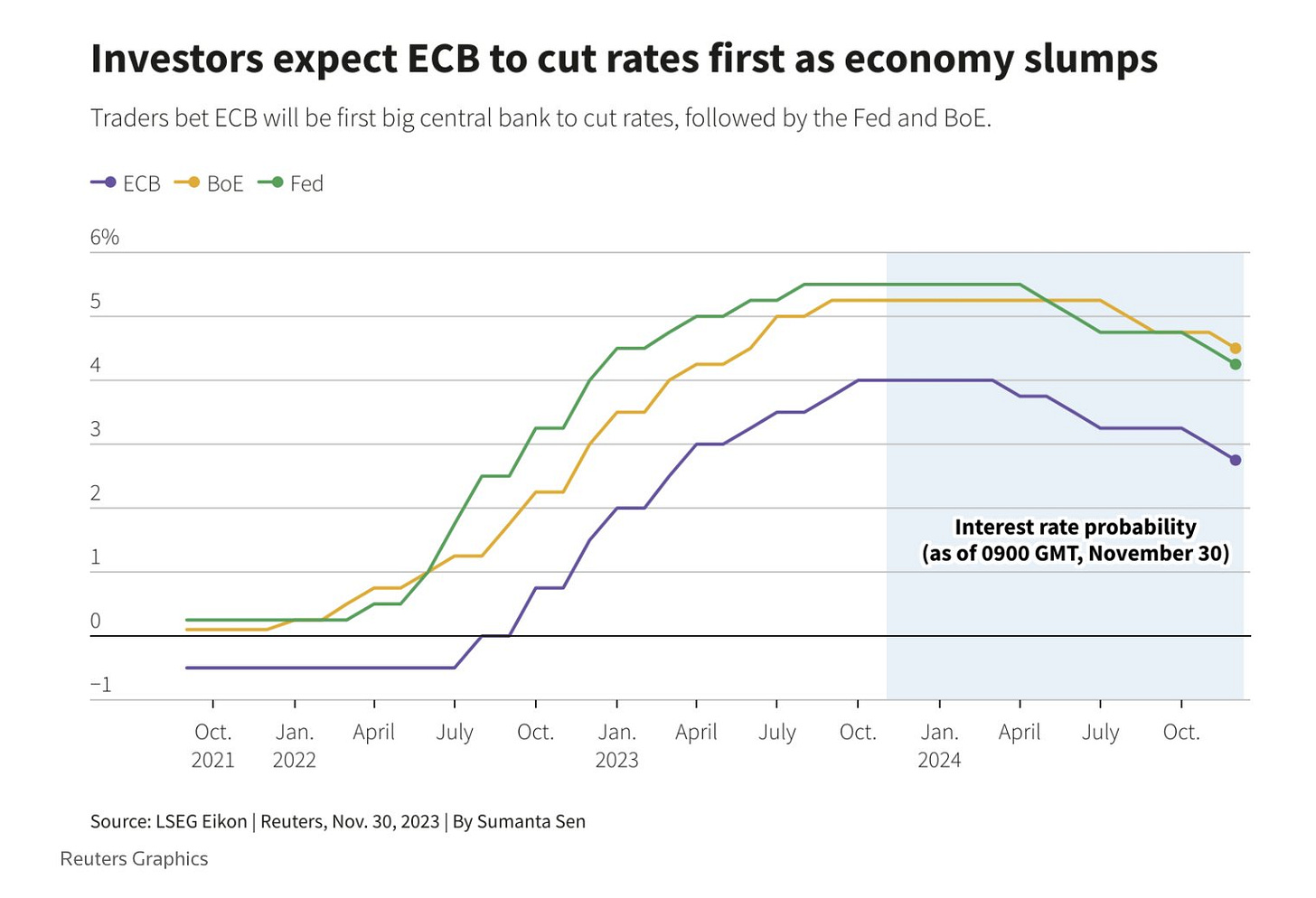

Also, get yourself acquainted with the inputs. One of our posts earlier this year, Sharpe vs. Rates, discusses the impact of risk-free rates on Sharpe Ratios.

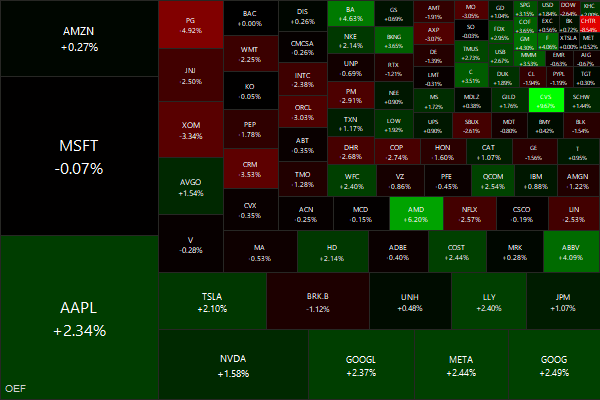

Markets this Week

Dollar investors of India ETF still waiting for the outperformance they were promised…

… meanwhile, Google comes out with an AI marketing video that added over $80 billion to its market cap.

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Winners and Losers from the U.S.-China Trade War

We investigate the phenomenon of trade re-allocations across countries as a result of the U.S.- China trade war. Using quarterly data on U.S. imports, we find evidence of trade diversion in a range of industries and products, including products not targeted by U.S. tariffs on China… the countries that export more to the U.S. as a result of the tariffs on China also export more to other countries. This suggests that firms are entering these countries and once there, export not just to the U.S. but everywhere.

Improving the odds of meeting a portfolio return target

Realized returns over a 10-year period are directly proportional to the valuations of assets at the beginning of the period. For example, when stock valuations are high, the chances are greater that stocks will perform below their historical average over the following decade. And for bonds, low 10-year trailing Treasury yields are an even stronger predictor that their returns over the coming decade may well turn out to be below their historical average. Our time-varying portfolio would have produced a higher expected annualized total return than the static 60/40 portfolio in every year shown, with the outperformance per year ranging from 1 to 12 basis points.

Diseconomies of Scale in Investing

Fund size causes fund performance erosion due to the illiquidity effects. A larger fund must place bigger orders in the market. This moves the prices against the fund, especially in the corporate bond market in which most transactions are performed in over-the-counter markets. In addition, while the research shows that fund managers are skilled, skill doesn’t translate into outperformance due to the diseconomies of scale. The evidence demonstrates that decreasing returns to scale implies that the performance of actively managed funds should be expected to decrease after experiencing positive shocks in size. This is a major reason why there is no evidence of persistence of outperformance beyond the randomly expected in actively managed equity and bond funds.

When Product Markets Become Collective Traps

Large shares of consumers use Instagram and TikTok out of a fear of missing out rather than genuine interest and, as a result, are worse off than if the platforms did not exist in the first place.

Trading on Terror?

We document a significant spike in short selling in the principal Israeli-company ETF days before the October 7 Hamas attack. The short selling that day far exceeded the short selling that occurred during numerous other periods of crisis, including the recession following the financial crisis, the 2014 Israel-Gaza war, and the COVID-19 pandemic. Similarly, we identify increases in short selling before the attack in dozens of Israeli companies traded in Tel Aviv. Our findings suggest that traders informed about the coming attacks profited from these tragic events.

Investing & Economy

India

Banks ask fintech partners to limit tiny personal loans (reuters)

Paytm to curtail low-value personal loans (reuters)

The RBI has told peer-to-peer lending platforms to halt certain activities (reuters)

A Supreme Court ruling has given personal insolvency a fresh start (livemint)

SEBI, RBI share concern on some credit funds masking bad loans (reuters)

54 cough syrup manufacturers fail quality norms (cnbctv18)

RoW

The government taxes what it can get its hands on. The economists' analysis of incentives comes much later. So why does the government tax income? Because, circa 1913, income was easier to measure than sales, value added, consumption, or other economically better concepts. When money changes hands, it's relatively [easy] for the government to see what's there and take a share.

The income tax is the original sin. Taxing income made no sense on an economic basis. The government only did it because it was easy to measure and grab. What's the solution? Well, duh. Tax consumption, not income or wealth. Get the rich down at the Porsche dealer. Leave alone any money reinvested in a company that is employing people and producing products. Now we can do it. And we can then throw out the income tax, corporate tax, and estate tax.

China e-cigarette titan behind 'Elf Bar' floods the US with illegal vapes (reuters)

China’s housing boom was the biggest the world has seen, and Evergrande’s rise was powered by rapacious expansion, the system that stoked it and foreign investors who threw money at it. When China’s housing bubble burst, no other company imploded in as spectacular a fashion. (nytimes)

Fueled by loans from state-owned banks and assistance from municipalities, Chinese automakers are building electric car factories faster than sales are rising. Businesses in China installed more industrial robots in 2022 than the rest of the world combined. It exceeded its biggest manufacturing rivals, Japan, the United States, South Korea and Germany. (nytimes)

While Chinese manufacturing accounts for over 31% of the world's total, Chinese consumption accounts for only 13% of global consumption. Globally every dollar of manufacturing is supported by $4.7 of consumption (and by $6.1 in the world ex-China). In China it is supported by only $1.9. This means that if China is to keep growing its share of global GDP, there are literally only two ways it can do so. One way is to redirect resources from manufacturing to consumption, so that Chinese supply growth is balanced by growth in domestic demand. The other is for other countries to agree to accommodate a faster expansion in Chinese manufacturing than in Chinese demand by reducing their own manufacturing shares of GDP. (@michaelxpettis)

Spotify Is Screwed (wired)

A.I.

In the context of the current paradigm of building larger- and larger-scale AI systems, there is no AI without Big Tech (technologyreview)

Animate Anyone: Consistent and Controllable Image-to-Video Synthesis for Character Animation (humanaigc)

Framework from Google DeepMind that defines the different levels of AGI:

Odds & Ends

Lucid dream startup says people can work in their sleep (independent)

FDA Approves First CRISPR Gene Editing Treatment for Sickle Cell Disease (scientificamerican, theatlantic)

Does motherhood have a marketing problem? (vox)