Whenever there’s a blowup, the postmortem almost always points to excessive leverage and inappropriately sized bets as the main culprits. The fraud is the coverup.

Theoretically, if you knew what your edge was, then the Kelly Criterion is the way. Thorp’s book is a must-read for wannabe traders. However, the problem with Kelly is that it requires you have a reasonable idea of your edge/alpha. In the real world, this is next to impossible. So, full-Kelly is the absolute theoretical limit to which you can push - anything beyond that guarantees ruin. The recommended limit in practice is half-Kelly. And if you are not a hedge-fund with a credit-line, you should size lower than half-Kelly.

We had discussed Sequence Risk before, and it is worth repeating again that “averages” in finance are a lie.

Market participants like to focus their energy on stock picking, i.e., improving the win rate, when the primary determinant of performance is in fact SIZE. Betting $1 or $100 will yield different long term geometric returns.

You might think you are a hero and that you can weather the drawdowns when it occurs, but you are fighting against math.

Mathematically if you have potential future bets, you have to keep capital dry to play them, so that one bad current bet doesn’t destroy you. Kelly maximizes this for you.

Sometimes, a bull-market goes on for so long that people forget that everything is cyclical. What’s worse is that a one-way market reinforces bad behavior. Here’s Michael Pettis on the Chinese real-estate market:

And sometimes, people confuse the winner of a lottery ticket to be a genius in picking winning numbers.

When it comes to investing, size matters.

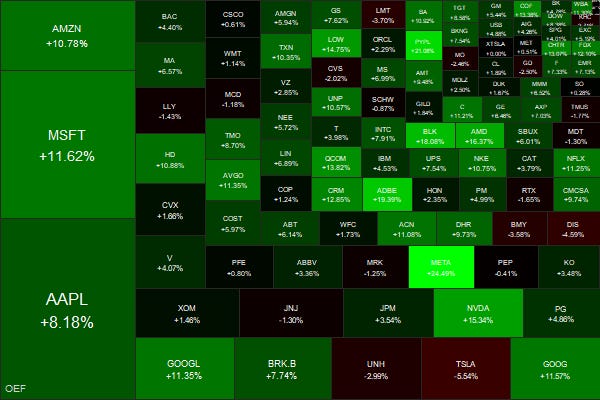

Markets this Week

US inflation print came in below expectations triggering a massive “soft-landing hopium” rally. Indian IT rebounded, obliterating shorts. The HDFC twins took off like a rocket.

Crypto was a total mess thanks to the SBF/FTX saga.

Dollar down, every other currency up.

Links

There is so much bullshit around that debunking them is a full-time job.

~

On Biofuels - ethanol from corn, sugarcane, etc.

The U.S. biofuel mandate fails at its stated objectives, worsens food security, and increases costs for consumers. The government’s mandate was justified by claiming it would reduce emissions, increase U.S. energy security, spur the development of more advanced biofuels, and help American farmers. In practice, the Renewable Fuel Standard has delivered on only one of its initial promises: boosting the incomes of American farmers. Conventional biofuels have proven to be more carbon intensive than fossil fuels, the technology advances that Congress had counted on have not come to fruition, and the U.S. is incapable of producing biofuels at the level the law requires. Rather than increasing American energy independence, the U.S. has become a net biofuel importer in order to meet the biofuel blending mandate.

~

If you were in your mid-20s in the early 2020s and did not run a crypto scam, did you even shoot your shot?

In a bubbling stock market, you can become a paper billionaire long before your company generates a profit. In a bubbling crypto market, you can become a paper billionaire without a company. In fact, becoming a paper billionaire is a key step towards making real money.

But over the long run, unsubstantiated valuations revert and perpetual motion machines stop. When this happens, the illusion of wealth bursts and the inside game is revealed. Some people end up with dollars, others end up with tokens. Choose wisely.

Human nature doesn’t change.

We, the public, give the tin-can-banging Pied Pipers power when we humor their empty ideologies as anything but absurdities. SBF was openly running an offshore casino out of an incestuous frat house of twenty-somethings who were skimming billions off the public through rigged market making, and this was all a matter of public knowledge. And yet institutions like the New York Times run full-page stories declaring him as some secular saint who will herald in a new future that will reshape human civilization, and our elected leaders line up to kiss the ring. While technology may change, human nature does not; these self-professed messiahs prophesizing salvation through technology are far less enlightened than they would have you believe. They only want to pick your pocket; they just now have a better story to distract you while they do.

~

Regulations need to walk a fine line between protecting “retail” and allowing new entrants and products - a tough job where everybody is always a little pissed off.

~

The Enron of our time.

Sam Bankman-Fried’s main international FTX exchange held just $900mn in easily sellable assets against $9bn of liabilities the day before it collapsed into bankruptcy. (FT)

Meme of the Week

Musk “democratized” twitter blue-checks and chaos ensued.