A mutual fund’s “alpha” is not something that investors should obsess over. It is nothing more than the intercept of a linear-regression fit and when applied to investment portfolios, it is extremely noisy and unstable. Also, alpha doesn’t mean excess returns. We discussed this with an example here: What is Alpha?

Do have a look at the website that updates the metrics discussed in the post here.

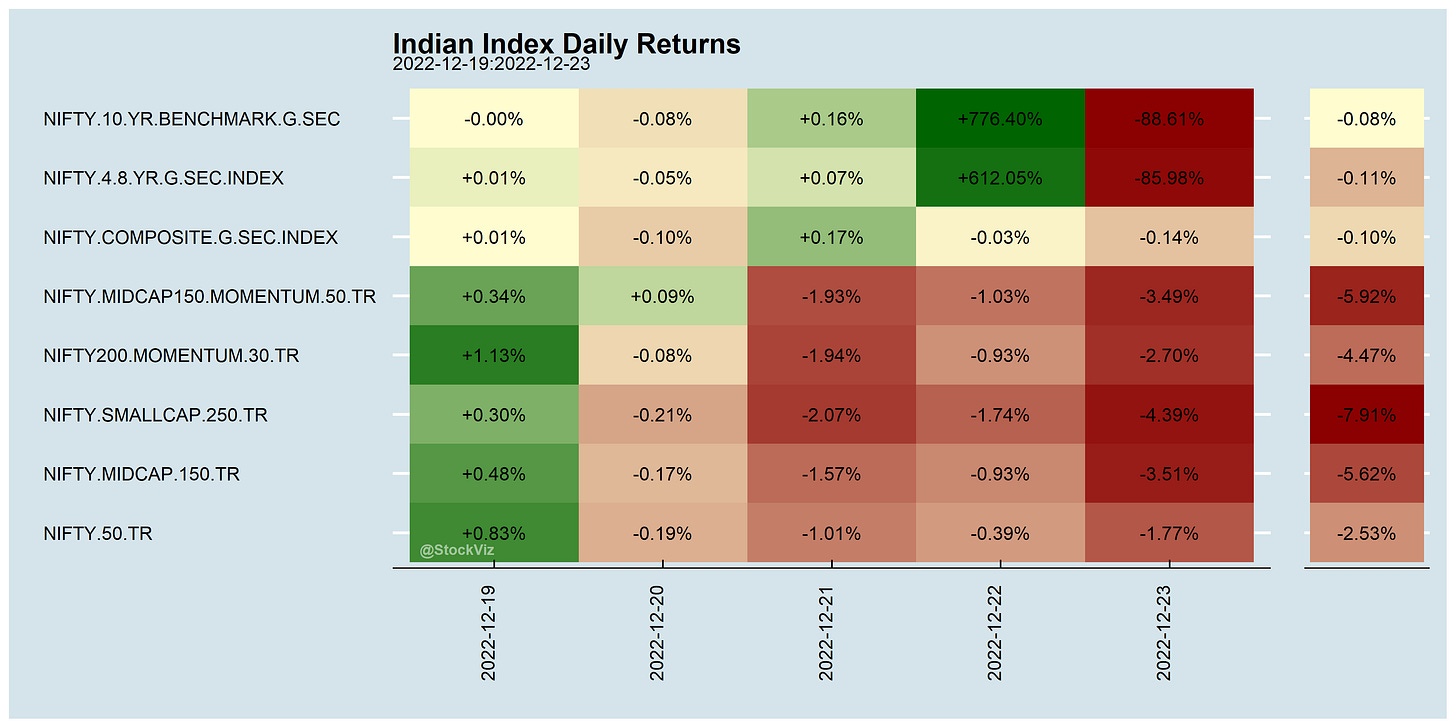

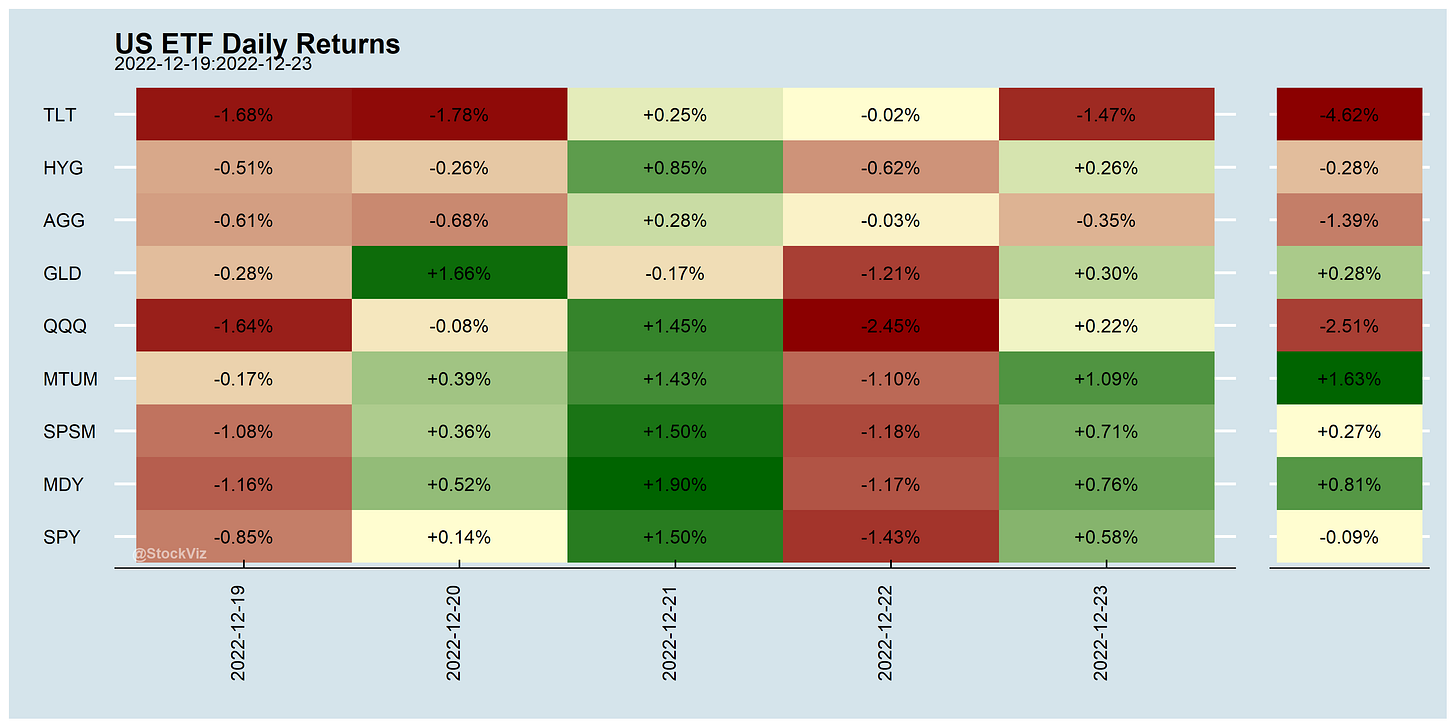

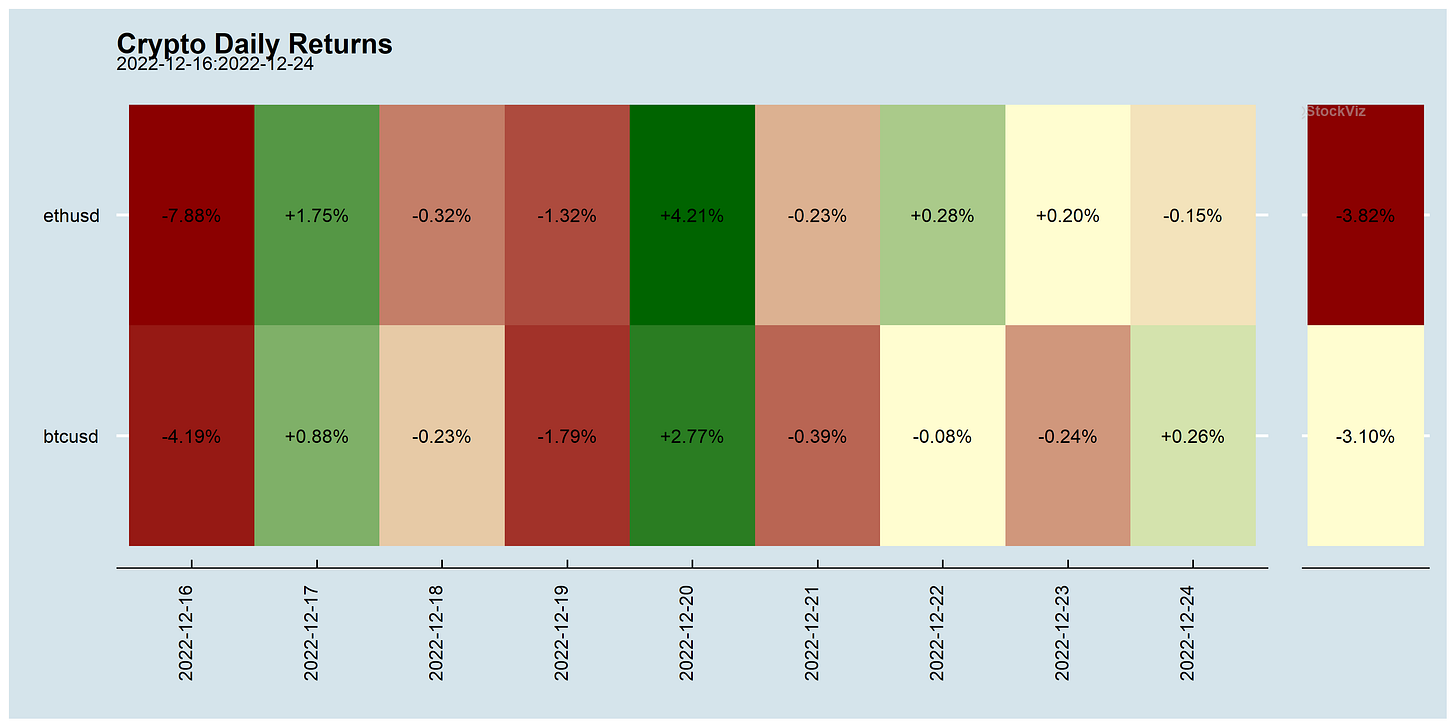

Markets this Week

Still waiting for Santa…

Links

Today’s alpha is tomorrow’s beta.

~

In the US, inflation pressures are abating.

Ocean-shipping rates have collapsed.

The daily spot rate to move a shipping container from Asia to the U.S. West coast is hovering around $1,400, down from about $7,500 in July and roughly $15,000 a year ago, according to the Freightos Baltic Index. The average cost in 2019, before Covid, was around $1,500. (WSJ)

Shipping drained of exuberance. (linkedin)

Goods in deflation, housing peaked, and the rest of services slowing. The trends over the past 3 months are exactly what a "soft landing" would have predicted. (thread)

The US economy is about to hit a wall…

… and the Fed is driving looking at the rear-view mirror.

~

Decoupling will be as painful as coupling.

America has embarked on a difficult challenge: reversing decades of technological integration with China without damaging the U.S. economy or antagonizing allies. Unfortunately, the U.S. is going too far. (politico)

Financial globalization was supposed to usher in an era of robust growth and fiscal stability in the developing world. It ended up doing the opposite. Now, to restore their economic viability, low- and middle-income countries must make the most of deglobalization and embrace the fragmentation of international capital markets. (project-syndicate)

Japan seeks market independence from China (postsen)

~

Will India ever have a “Stock Connect” scheme?

Mainland China and Hong Kong to Expand their Stock Connect Scheme (china-briefing)

~

If everybody follows the trend, then who creates it?

TD Securities estimates that 30% of commodities futures trading flow is from CTAs. (WSJ)

~

Most of green-tech is aspirational advertising.

At least four studies published this year say hydrogen loses its environmental edge when it seeps into the atmosphere. Two scientists told Reuters that if 10% leaks during its production, transportation, storage or use, the benefits of using green hydrogen over fossil fuels would be completely wiped out. (reuters)

~

Apparently, companies have written so much code that they are now drowning in it.