Have been busy the past few weeks putting together a dashboard of sorts for the Fama-French data library. It’s been a revelatory exercise so far. Here’s the returns quilt for the 5-Factors + Momentum since 1980s:

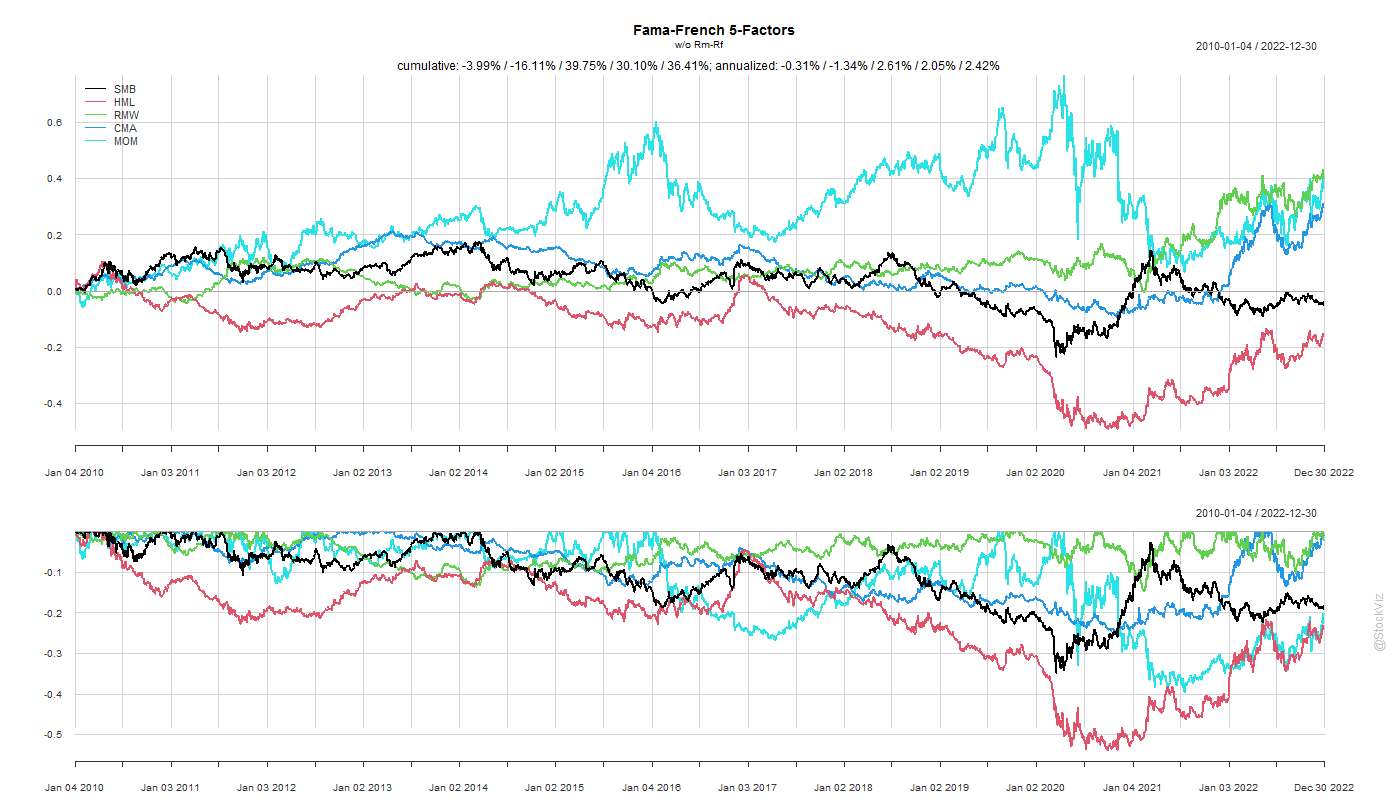

It was absolutely devastating to hear that the value factor was the worst performing factor since 2010:

In order of out-performance, it is RMW (Robust Minus Weak), MOM (Momentum) and CMA (Conservative Minus Aggressive). Adding an annualized ~2.5% on top of market returns.

Also, these factor returns are extremely uneven and often eclipsed by Rm - Rf (Market returns minus Risk-free rate).

The dashboard also has fan-charts of factor returns that give you an idea of how volatile those returns have been. Here’s the one for momentum, everybody’s favorite factor:

We also put together a dashboard for different industry returns. Looks like soda and drugs are the OG GOATs of America.

If this piques your curiosity, do read our introduction to factors. Have fun exploring!

Markets this Week

Cap-weighted indices get less sensitive to idiosyncratic price declines as they continue to fall. few.

One misfired demo and investors dump a $1.2 trillion company as if its going bankrupt.

More here: country ETFs, fixed income, currencies and commodities.

Links

We are obsessed with building new roads and airports without once asking if they make sense.

~

The Geological Survey of India has discovered lithium in Kashmir, with inferred reserves of 5.9 million tonnes (mt).

To put this in perspective, Bolivia has 21 mt, Argentina 17 mt, Chile 9 mt, US 6.8 mt, Australia 6.3 mt, and China 4.5 mt.

However, the 5.9 mt estimate of the Kashmir find is only in the ‘inferred’ category. A lot of work needs to be done before it is established as mineable reserves. (thehindubusinessline)

We also have a lot of coal reserves but we face perennial coal shortages. So, maybe, curb your enthusiasm.

Less than 0.45% of available reserves are being extracted annually, showing that paucity of reserves is not behind the lower supply of coal. (thehindubusinessline)

~

As much as we hate to admit it, geography is destiny.

~

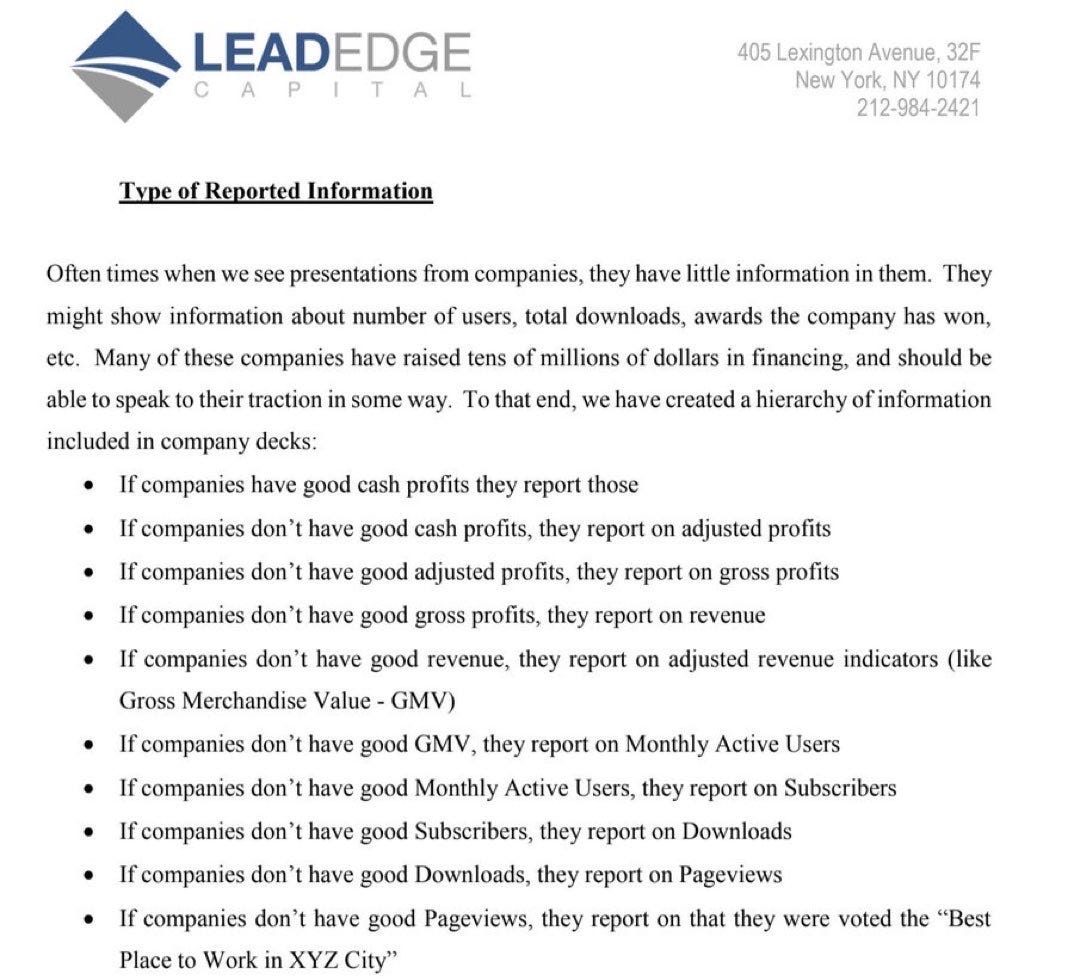

CFOs are getting away with a lot of “adjustments.” It is completely out of control!

~

The AI arms-race is on… again.

If we make it read enough books, it can fake consciousness.

~

A lesson from history:

The amount of inflation that a bunch of new money causes in an economy depends on several things:

What it is used for.

The ability of the economy to expand and absorb the new money.

How quickly each unit of currency gets spent and re-spent, a.k.a. the velocity of money.

Inflation From Spain’s Mountain Of Silver