Most of the trading volume in exchanges are driven by machines that don't care about time as we perceive it. We see the world through chrono-clocks, the year divided by days, days by hours, hours by minutes, minutes by seconds. However, machines trade through event-clocks: if x happens, do y. But most of our algorithms are still based on time-ticks.

This week, we dipped our toes into Volume Clocks. Will be interesting to see what shakes out.

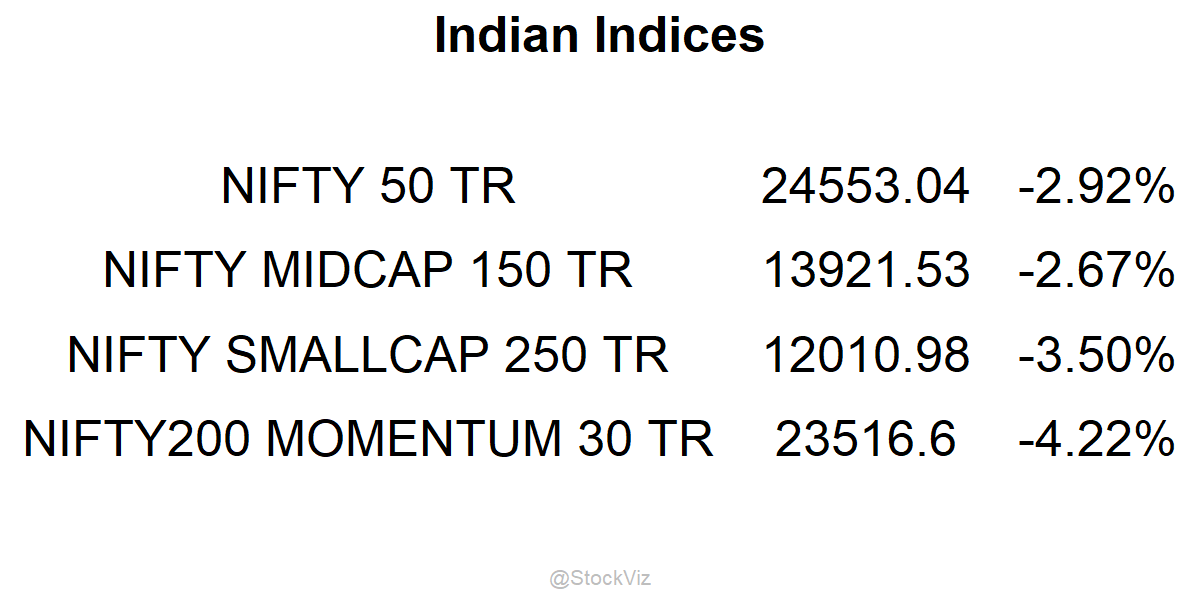

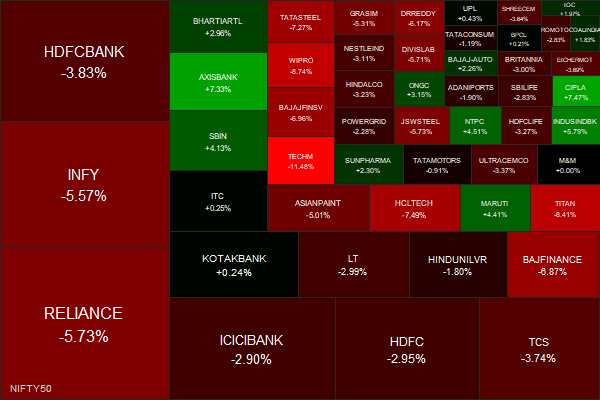

Markets this Week

The Fed Chairman, Jerome Powell, reiterated that

QE stops in March

First rate in March

Second hike in June

QT via simple roll-off starting in Q3

3rd, maybe 4th hike

Indian markets took a spill but the US markets ended positive after a wild ride. We have the budget coming up on Feb 1st (Tuesday). Fingers crossed.

Links

Real U.S. yields in biggest monthly jump since 2013 taper tantrum (Reuters)

Baltic Dry Index continues to collapse and, with a 77% drawdown, is now below its pre-pandemic level (twitter)

The Dunning-Kruger Effect Is Probably Not Real (McGill)

Sri Lanka to pay $200m compensation for failed organic farm drive (aljazeera)

Smoking is cool again. Maybe. (NYT)