The Martingale strategy involves doubling up on losing bets and reducing winning bets by half. It essentially a strategy that promotes a loss-averse mentality that tries to improve the odds of breaking even, but also increases the chances of severe and quick losses. (Investopedia)

The Martingale, in some sense, is the opposite of trend following’s "Cut your losses short and let your winners run" maxim.

When markets start their drawdowns, the typical knee-jerk response of most investors is to average-down on their holdings. After all, isn’t that what Warren Buffett said? However, where does the money to buy these losers come from? It comes from selling the winners. Or, if you are pumping in funds from your salary, it comes from not buying winners.

Basically, retail investors follow a Martingale strategy.

Its all fine and dandy as long as the losers recover. One might even be remembered a hero with balls of steel to have endured and doubled-down on stocks that were getting cut in half.

But play the game enough number of times and eventually, you will go bust.

Right now, the most prominent fund manager playing the Martingale is none other than Cathy Woods. ARKK, her flagship ETF, is now down to just 35 stocks, from 60. (Morningstar)

It is an interesting game to learn from as a passive observer.

Markets this Week

Links

Sanctions on Russia Won't End the Dollar's Reserve Currency Status. (apricitas)

The new buttresses of the dollar system. (adamtooze)

The Multipolar World Dies in Ukraine. (palladiummag)

When U.S. executives with an MBA take over a company, wages and labor share in the firm go down. (NBER pdf)

Legendary stock picker Peter Lynch made a remarkably prescient market observation in 1994. (TKer)

Just 3 years after 2019’s trucking bloodbath, another is on the way. (freightwaves)

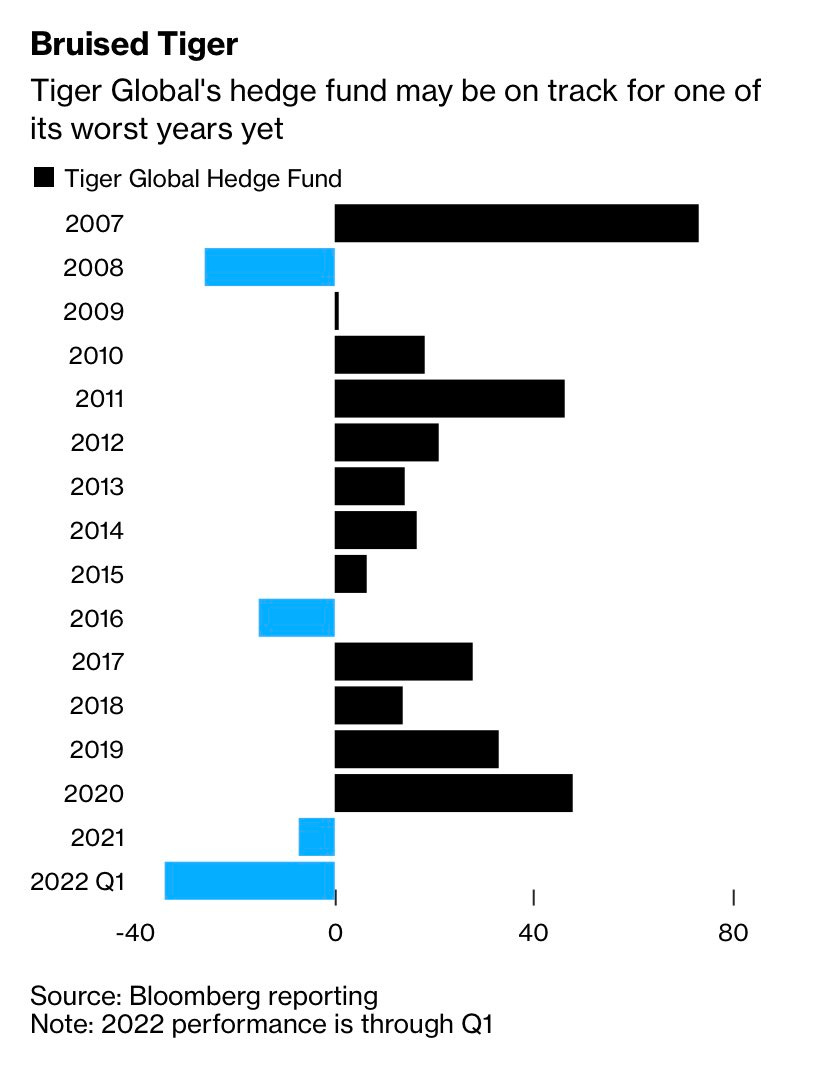

Tiger Global’s Hedge Fund Sinks 34% This Year as Key Stocks Fall. (Yahoo)

Sri Lanka’s agrarian crisis a cautionary tale for India. (LiveMint)

Fuel price control is back from the dead. (LiveMint)

I am convinced that there will soon be room for only two types of people in the ESG space. The first will be the useful idiots, well meaning individuals who believe that they are advancing the cause of goodness, as they toil in the trenches of ESG measurement services, ESG arms of consulting firms and ESG investment funds. The second will be the feckless knaves, who know fully well the void behind the concept, but see an opportunity to make money. - Aswath Damodaran