The biggest challenge with momentum strategies are the drawdowns. The losses mess with investor psychology, leading to a high quit rate.

Quants have tried a number of different ways to reduce these drawdowns. Broadly, there are intrinsic methods — position-wise stop-losses, volatility screens, trend filters, etc. — and extrinsic methods — trend overlay, asset allocation, etc. However, each of these approaches have tradeoffs between returns, risk and costs.

For example, we had setup Momentum Asset Allocation strategies back in late 2020. The goal was to give investors an option to pick the risk level that was right for them. And it has worked out as you would expect.

Shark - a 60/40 split between equity momentum and bonds - ended up with a 2.3 Sharpe and returns bang in the middle of 100% momentum and the other hybrid strategies - Dolphin (50/50) and Whale (40/60).

Drawdown profiles track returns as well: lower equity risk = lower drawdowns = lower returns.

All goes to say that there is no free lunch. Investors need to figure out what they want upfront and stick with it for long enough to allow the market to do the work for them.

Markets this Week

What was surprising was Indian market resilience in the face of US equity market carnage and rising US bond yields.

We had the Adani tamasha, Reliance announcing the listing of their consumer finance spinoff and the end of the earnings season…

… while it seems like the only thing holding up US indices was $NVDA.

More here: country ETFs, fixed income, currencies and commodities.

A brutal week for crypto bros.

Links

Economics

Nice to see Michael Pettis’ theories are slowly percolating through the investor community.

Here is his thread on China’s problems.

China’s abandoned, obsolete electric cars are piling up in cities (bloomberg). Remember their bicycle graveyards (theatlantic)?

Chinese ghost town of mansions reclaimed by farmers (france24)

China’s defeated youth (economist)

~

India imposes 40% export duty on onions (reuters)

India bans the export of non-basmati white rice (reuters)

India has an ongoing ban on wheat exports since May 2022 (timesofindia)

India faces record low August rains, threatening summer crops (reuters)

India's retail inflation surges on food prices (reuters)

Patchy enforcement and lax rules: why the rule pushing doctors to write only chemical names of drugs, and not brand names, is a bad idea (thread)

~

Since 1990, India’s female labor-force participation rate has hit a peak of only 31% in 2000, according to data from the World Bank. Last year, it was 24%.

That rate is among the 12 lowest in the world, a list including Afghanistan and Somalia. Saudi Arabia has a higher percentage of women working or looking for a job.

Four factors that facilitate combining a career with a family: family policy, cooperative fathers, favorable social norms, and flexible labor markets (NBER)

~

If U.S. manufacturing is to be less dependent on China, we think the path will be via Mexico (morganstanley)

50 years of tax cuts for the rich failed to trickle down (cbsnews)

Investing

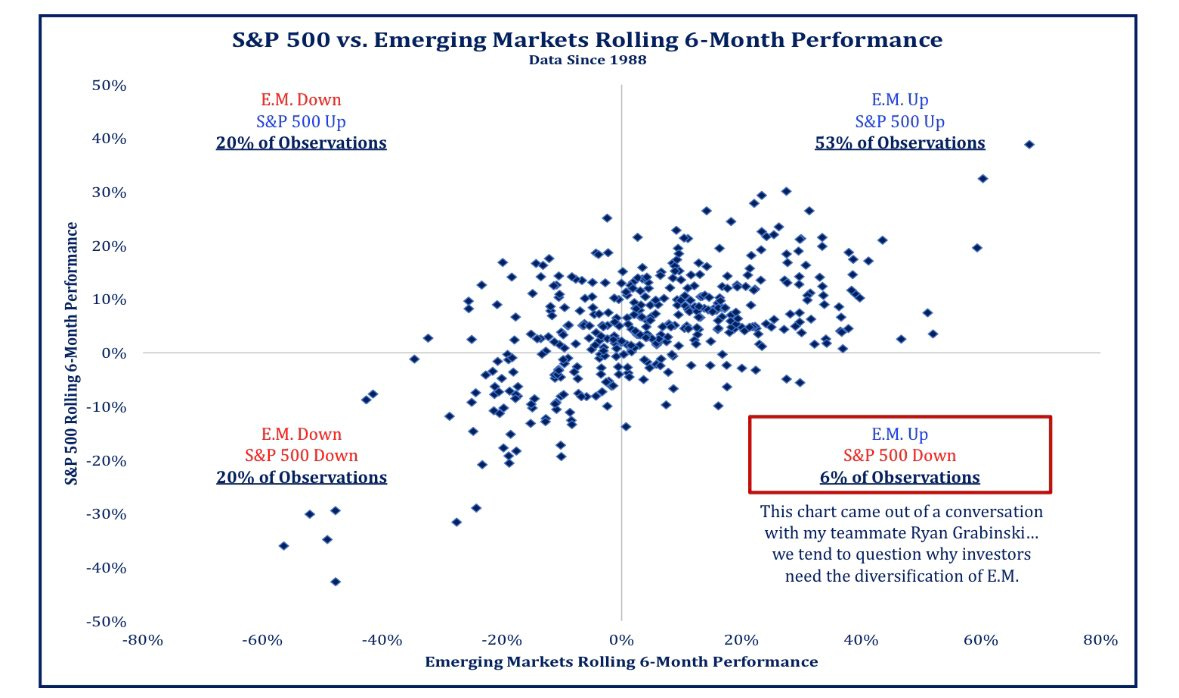

Using 35-years of data, only 6% of observations show a rolling 6m price % change where E.M. is up while the U.S. is down. Makes us question the “why” for E.M. allocations (tweet)

Emerging-markets stocks do not merit being treated as an asset class. Their diversification benefits appear to be dwindling, as the emerging countries become larger and ever-more entwined with the global economy, and their expected returns are suspect. It is not clear that buying a package of stocks from countries labeled as "emerging" makes more sense than, say, buying one from countries whose names begin with the letter B.

Venture capital funds are mostly just wasting their time and your money (ft)

All in all we went from $0 to $100m to $0 because I followed the advice of the VCs. When you raise from a VC you need to build a unicorn (aka 1B+ company) and nothing else. Doing 10M ARR? You are a failure, 50M ARR? Nope… You failed. A lot of amazing startups implode because of this model. (@forgebitz)

Odds & Ends

Studies show a mysterious health benefit to ice cream. Scientists don’t want to talk about it (theatlantic)

Legal risk for AI: Users can be liable for chatbots' mistakes (axios)

Many cancer drugs may end up doing absolutely nothing for patients (studyfinds)

Meme of the Week

Vegetables are not real!