In a span of a year, the Fed went from inflation being transitory to worrisome. And in the last couple of weeks, Powell has gone from promising a soft-landing to warning about a hard-landing.

To be fair, I was in Camp Transitory last year. It looked like a combination of COVID disrupted supply chains and people clicking on the buy-button when self-isolating lead to a spike in prices. But with economies opening up, it was widely believed, the invisible-hand would bring demand and supply to balance.

Then Putin invaded Ukraine and commodities mooned. China, not ready to give up on its Zero-COVID policy, is still busy locking down large cities. These put a stake through the heart of the “transitory” thesis.

Price is simply where demand and supply meet. The problem right now is that the supply side of this equation can only be solved by governments - it is a geopolitical problem. This is a tall order even in the best of times.

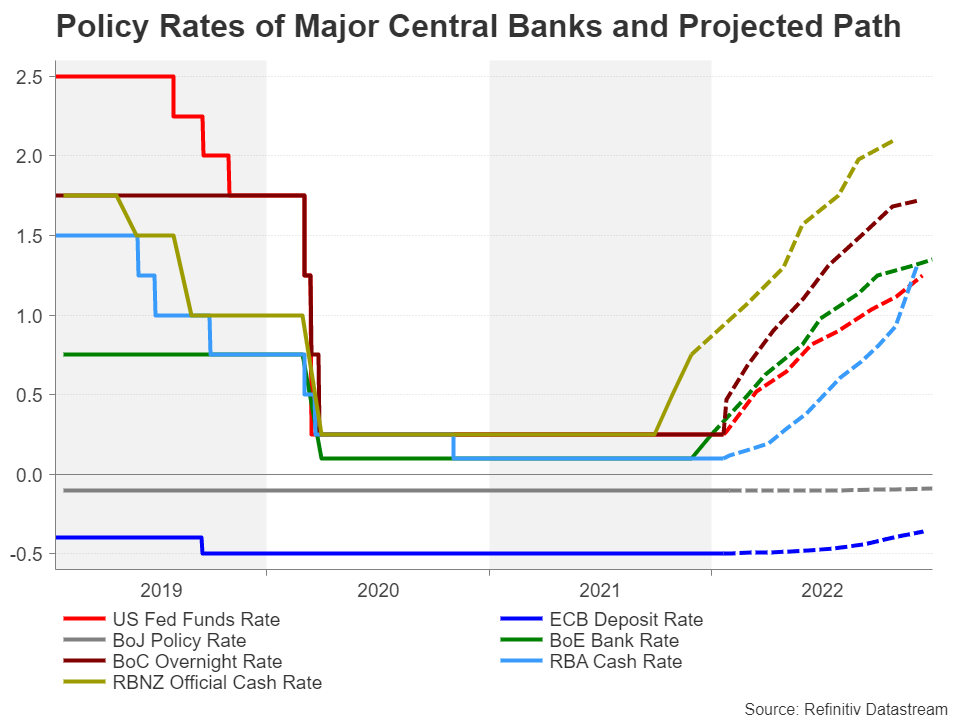

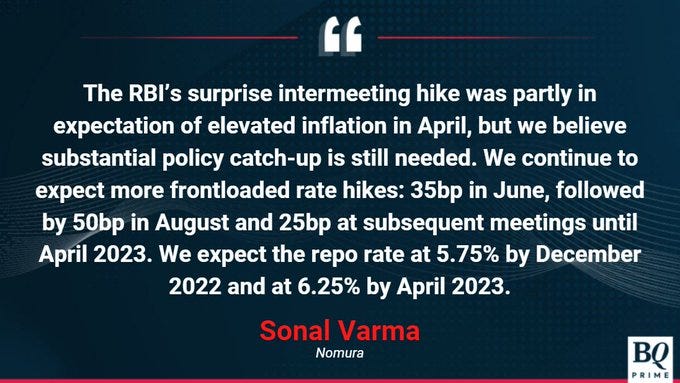

The demand side, however, can be smashed down by central banks by raising rates. And this is what we have collectively chosen to do.

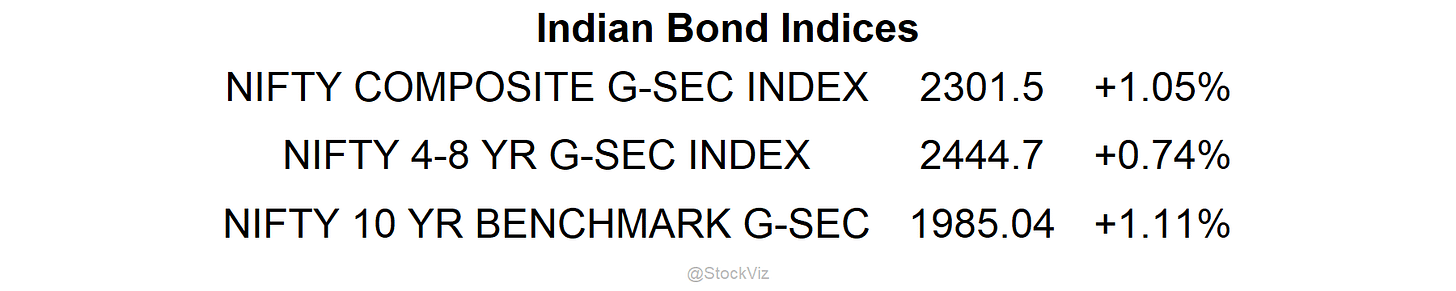

Rates rising in a high-inflation environment has been a huge headwind to pretty much all asset classes. And is probably going to get much worse before it gets any better.

I hope we don’t roundtrip all the way back to April 2020 levels but given how aggressive the US Fed has become, it is not a zero-probability event.

Markets this Week

If you bought a stock for its pricing power, moat or non-cyclicality, now is a good time to go through their earnings-call transcripts and check how they are messaging about inflation.

Links

India April CPI @ 7.79%

Cullen Roche is doing God’s work putting up 3-minute youtube videos explaining money. Subscribe here!

The world will not be left short of oil even with lower output from sanctions-hit Russia. (reuters)

Human civilization is powered by combustion; human beings are a fossil fuel–burning civilization. You can take away the civilization part, which seems to be the end goal for some environmentalists, but bar that, you can’t take away the fossil fuel part.

a low cost consumer friendly alternative to cable that destroyed an industry profit pool

It’s not really the unlimited pricing power / TAM expander juggernaut everyone proposed for the past decade

@BazCap on Netflix

Bitcoin, NFTs, SPACs, meme stocks — all those pandemic investment darlings are crashing. (latimes)

the IPO market is dead meaning there is no clear exit anymore while public market comparable companies have been crushed. Just look at payments - it was a big story that Stripe was marked down by 9%. Meanwhile, Paypal is down 60%. Square is down 54%. Adyen is down 54%. It’s a perfect encapsulation of private market insulation. Everyone knows Stripe is worth less, but as long as we all don’t say Stripe is worth less, we can pretend it’s not worth less.

Greek property sees increased demand from Chinese buyers seeking permanent residency under golden visa scheme. (scmp)

Meme of the Week

With shitcos, cryptos and techcos all crashing, we reached a new level of memes this week.