A memory hole (wikipedia) is any mechanism for the deliberate alteration or disappearance of inconvenient or embarrassing documents, photographs, transcripts or other records, such as from a website or other archive, particularly as part of an attempt to give the impression that something never happened.

While the purveyors of the “New Normal” narrative are busy memory-holing their webinars and newsletters, let’s take a step-back and take stock of the sheer grandeur of the wealth destruction that it caused.

Books are going to be written about ARKK - the embodiment of the “New Normal” narrative - sinking 80% once the Fed started tightening. Cathy Woods was supposed to be the “New Warren Buffett”. Turns out the new Warren Buffett is the same as the old one.

Over a 15-mo. period, ARKK saw $16.7B in losses, equiv to ~66% of its AUM.

It also gained far less in dollar terms before the losing period. ARKK racked up ~$7B in mkt appreciation. But that was swamped by the subsequent $17B loss.

ARKK lost more money over a 15-month period than all but 63 funds (of more than 21,000 funds total through history).

Investment fads will eventually incinerate your capital.

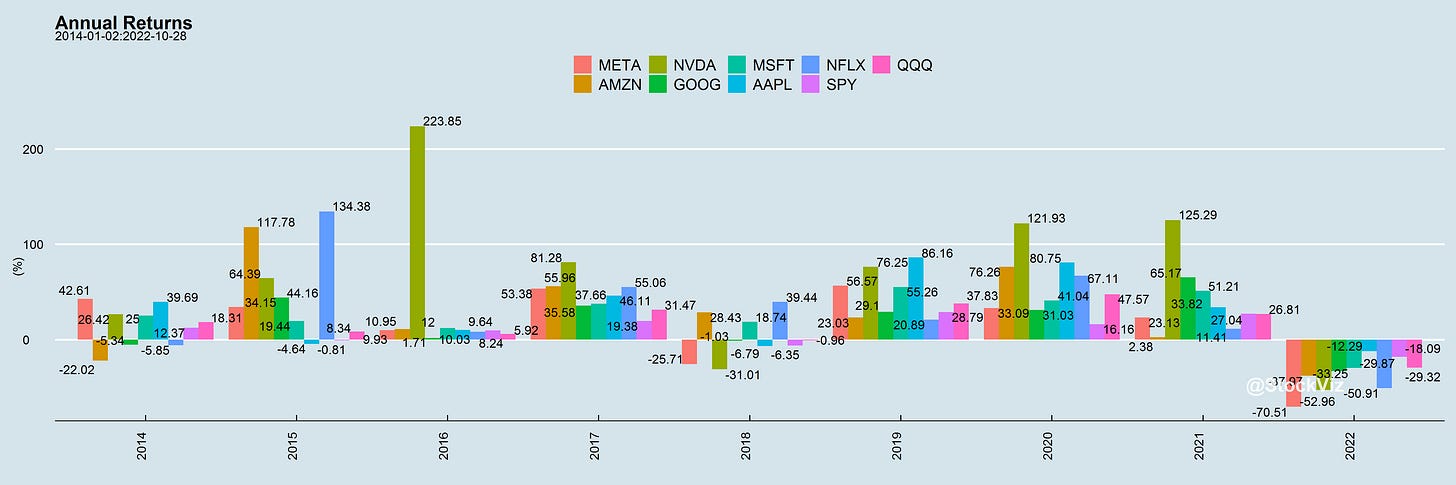

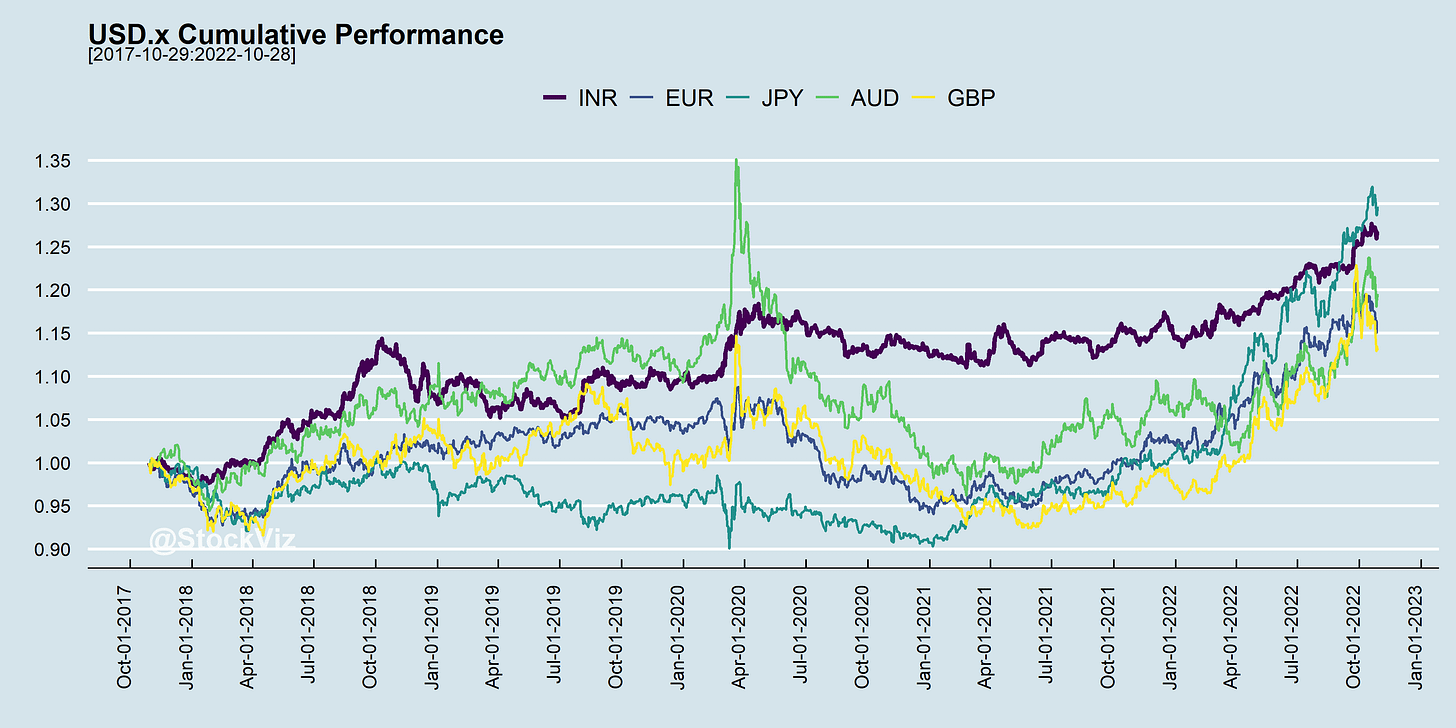

Even if you avoided the shitcos ARKK invested in and stuck to the FANGMANs, it’s not like you are immune to the interest rate cycle.

From their COVID-peaks, the Generals have crashed-and-burned like the rest of them.

Some of these are down because of increased competition (Netflix) and some because of self-immolation (Zuck’s metaverse gamble). But whatever the reason, the narrative that these were unshakable world-dominating monopolies with infinite pricing power and Teflon-coated management has been demolished.

Investment narratives will eventually incinerate your capital.

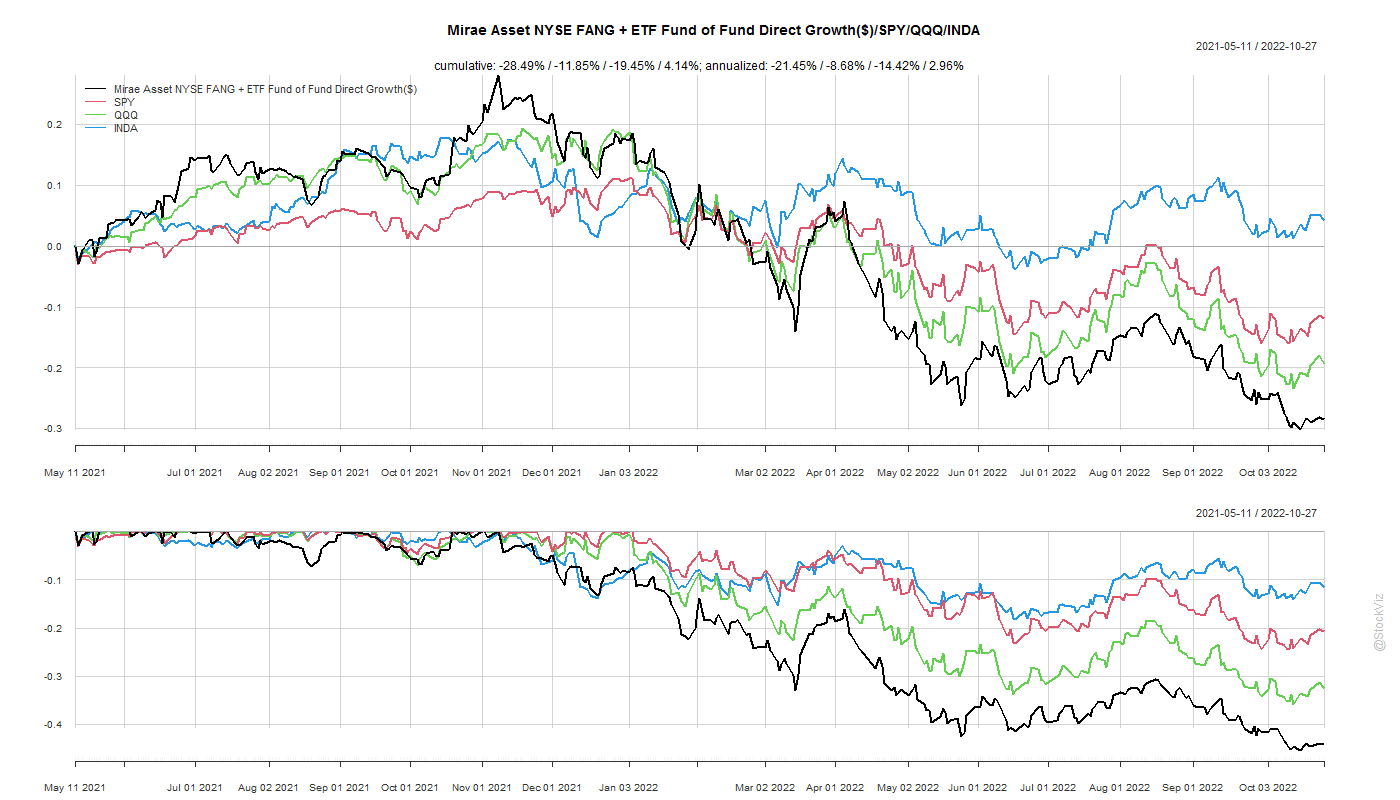

Remember China?

Munger and Dalio as Xi’s fanboys. High-profile asset managers advocating that India should emulate the “Chinese system”. The FANG+ ETF.

Thesis driven investing will eventually incinerate your capital.

By trying to beat the market, you don’t even get the market.

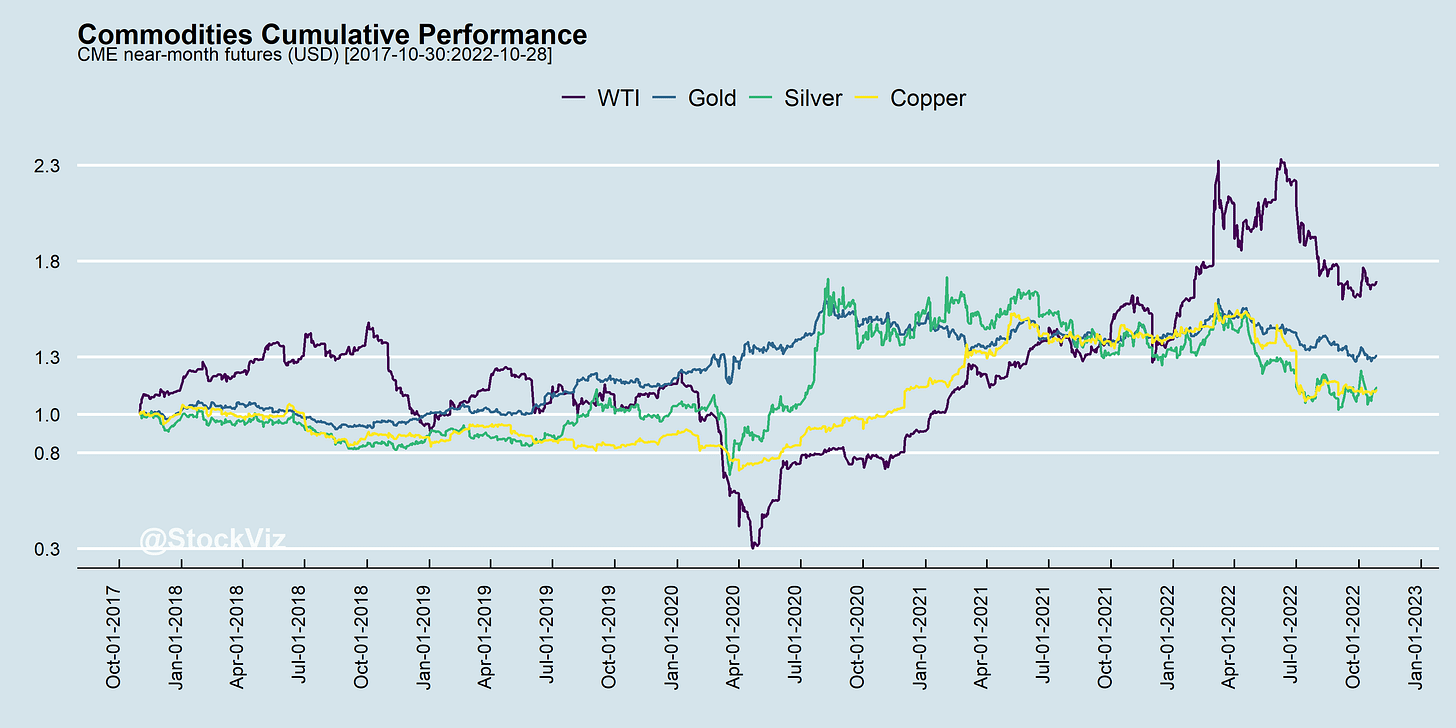

Markets this Week

Indian markets were shut two days for Deepavali.

Google, Apple, Microsoft, Amazon and Facebook announced results.

Links

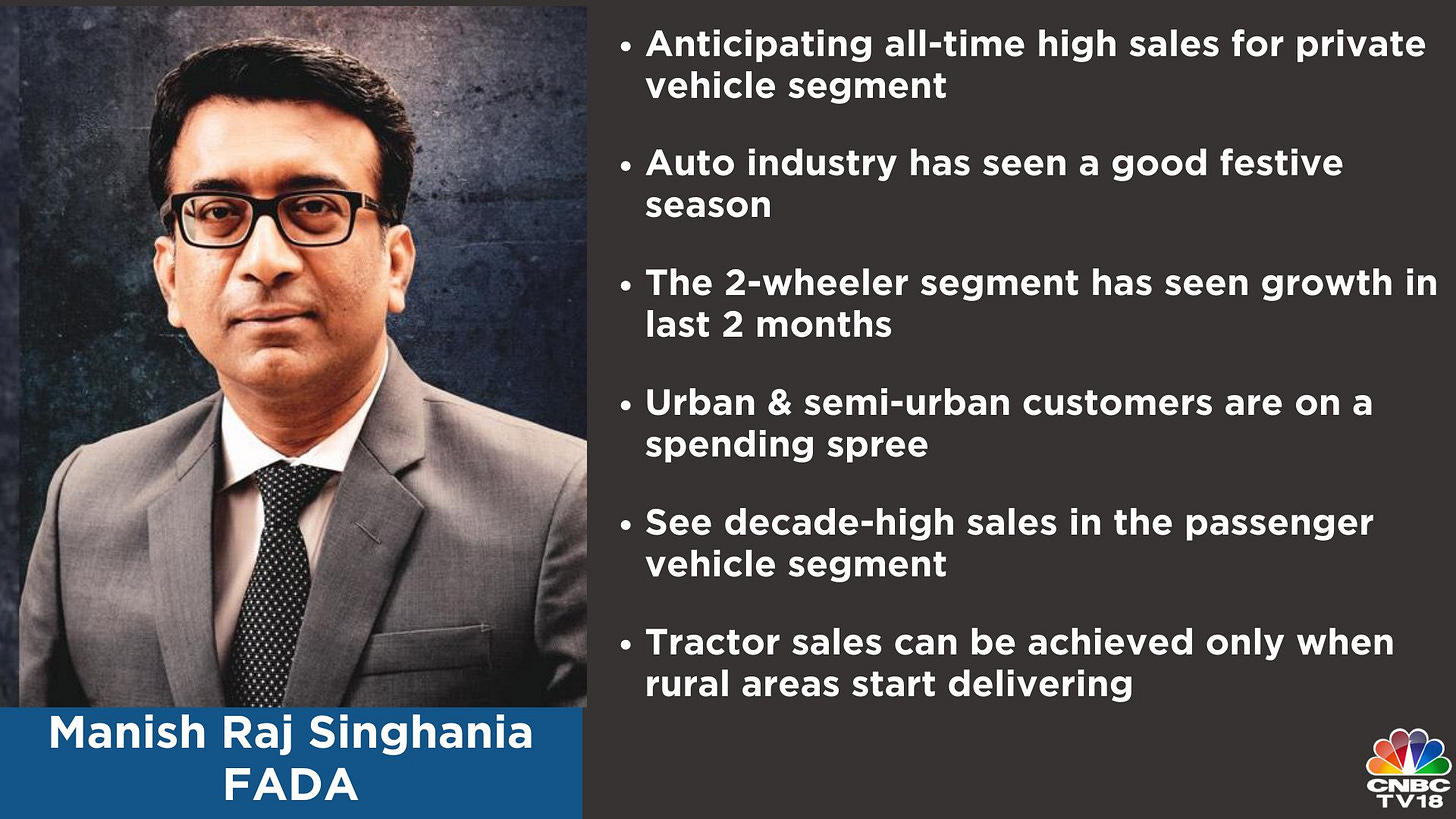

Indians went shopping the last couple of months

~

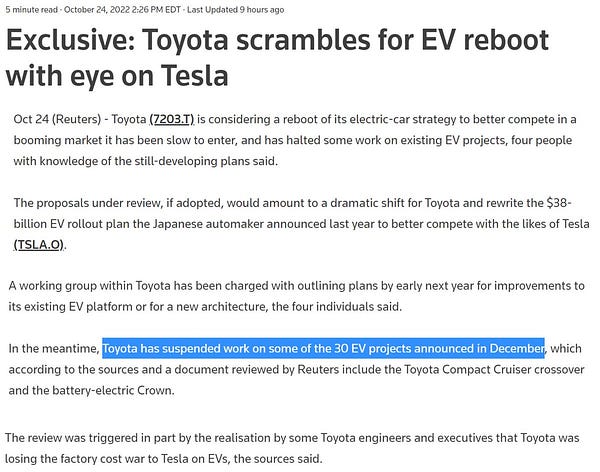

EVs are hard and its mostly software

~

Wait for the Fed to signal a pivot and go balls long

~

A beautiful liquidation

Markets crash when fast money investors are caught long and leveraged, panic sell together, and trigger forced liquidations and unwinds of other leveraged positions . . .

. . . Market dynamics are entirely different when investors are bearish, underweight, and running record low levels of net and gross leverage. When dangerous pockets of extreme tail risk selling have already been nuked in prior episodes of market stress. Then there is no rapid de-risking, no extreme forced selling, no vicious spirals.

~

Beat the index by leveraging concentrated positions in Chinese shitcos. - Munger, probably

~

They lie to us all the time

A new Senate report concludes that SARS-CoV-2—the virus that causes COVID-19—likely resulted from “a research-related incident.” (vanityfair)

Plastic recycling a "failed concept," study says, with only 5% recycled in U.S. last year as production rises. (cbsnews)

~

What Hu giveth, Xi taketh away

China’s wealthy activate escape plans as Xi Jinping extends rule. Rich citizens fearing high taxes and personal safety move capital out of country and arrange residences overseas. (FT)

~

We have been the cusp of AI disruption since the last 50 years