Did not have Indian stocks outperforming the S&P 500 this quarter in my bingo card.

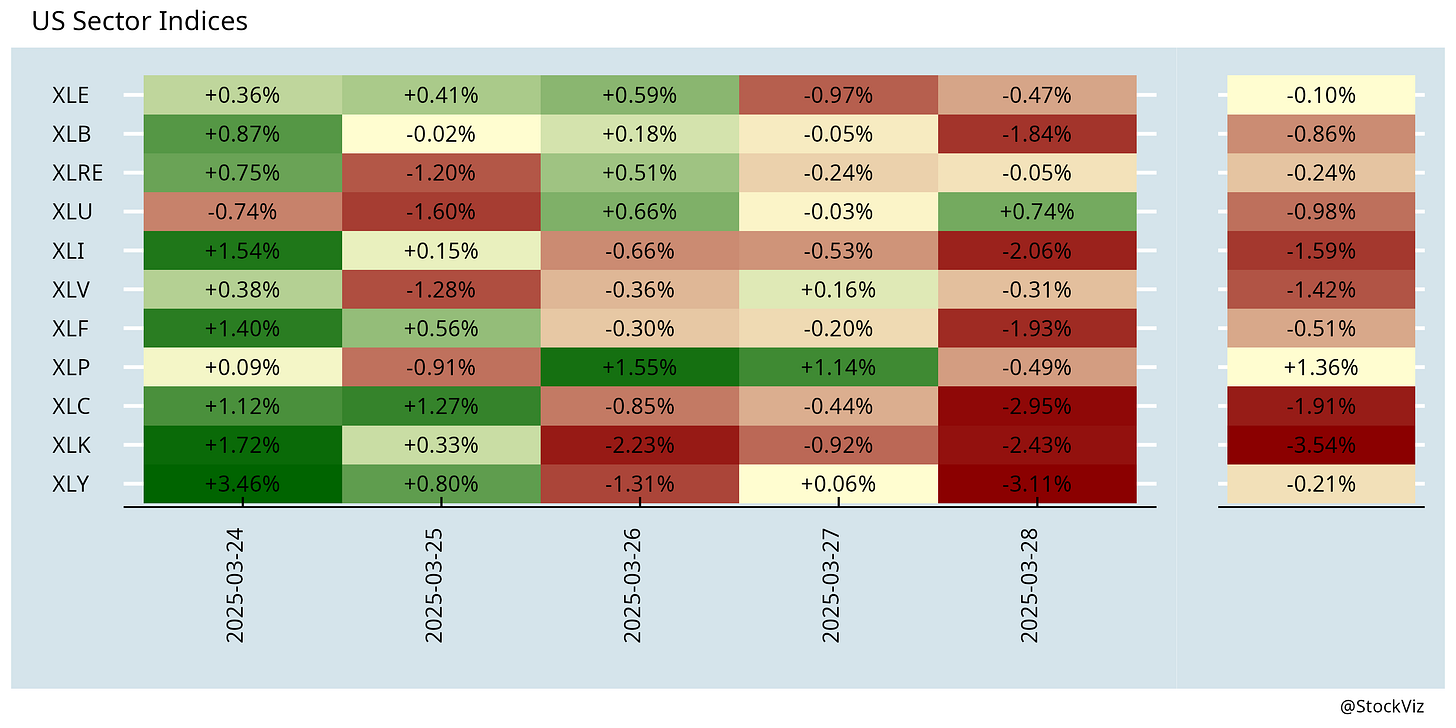

Most of the damage has been in the technology sector that lost its leadership ever since deepseek came into the picture on the 20th of January.

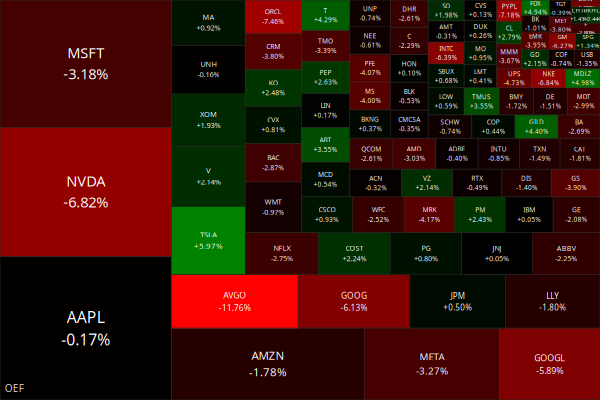

The “Magnificent Seven” stocks – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla - that were stock market darlings the last couple of years, have seen their fortunes plummet.

While nobody doubts that “AI” is going to have a large impact on the world, investors have turned vary of the CAPEX gone into datacenter build-outs required to keep these models powered and the eventual ROI.

A couple of crypto posts up on our blog: Buy Highs/Sell Lows and Bitcoin Volatility Seasonality.

Markets this Week

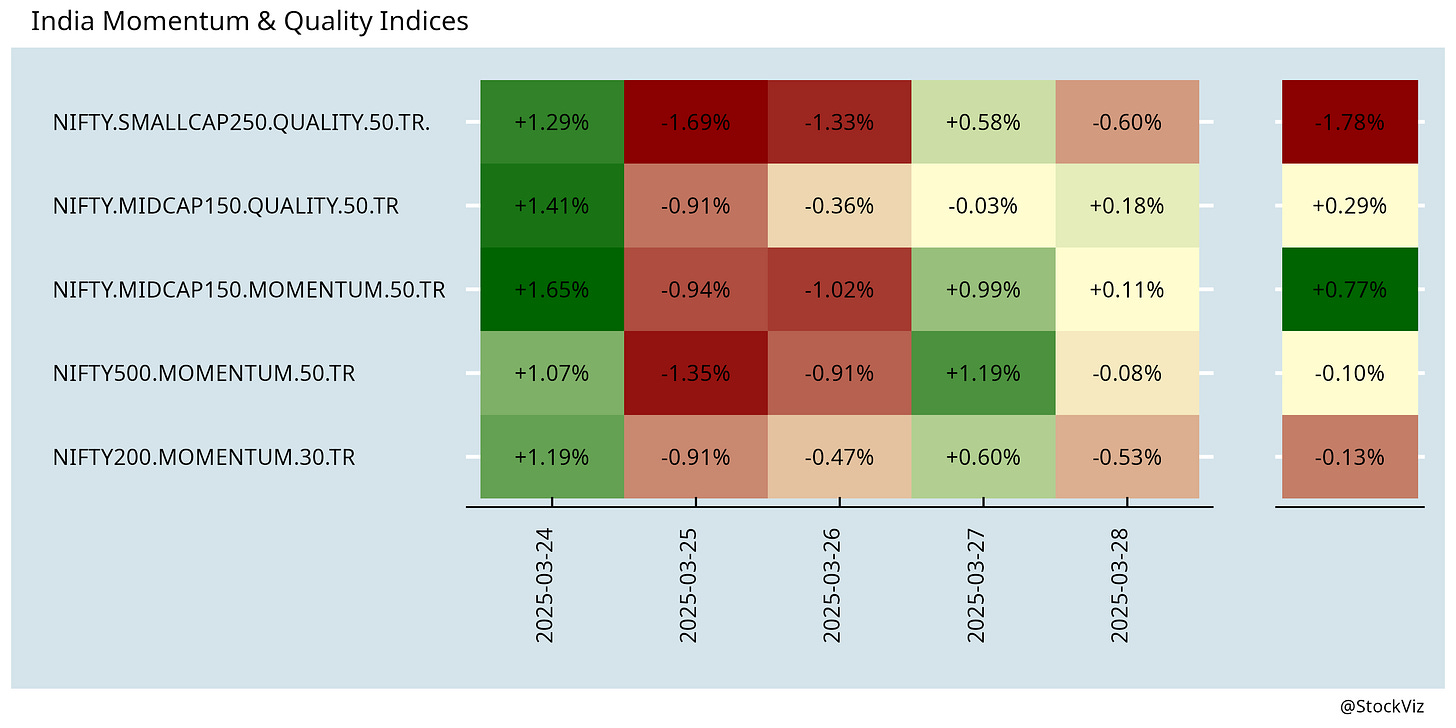

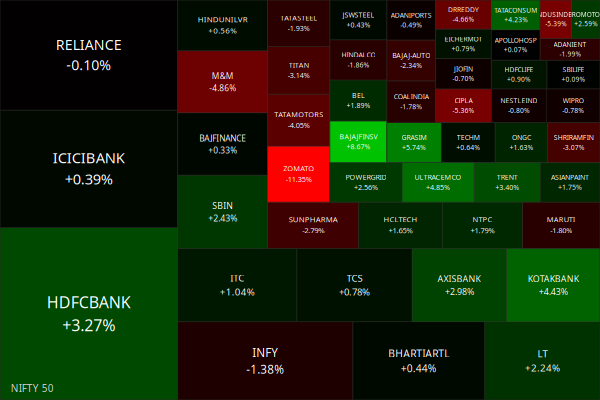

All it took was a little bit of FII flows for Indian equities to find their footing…

… with INR catching a bid.

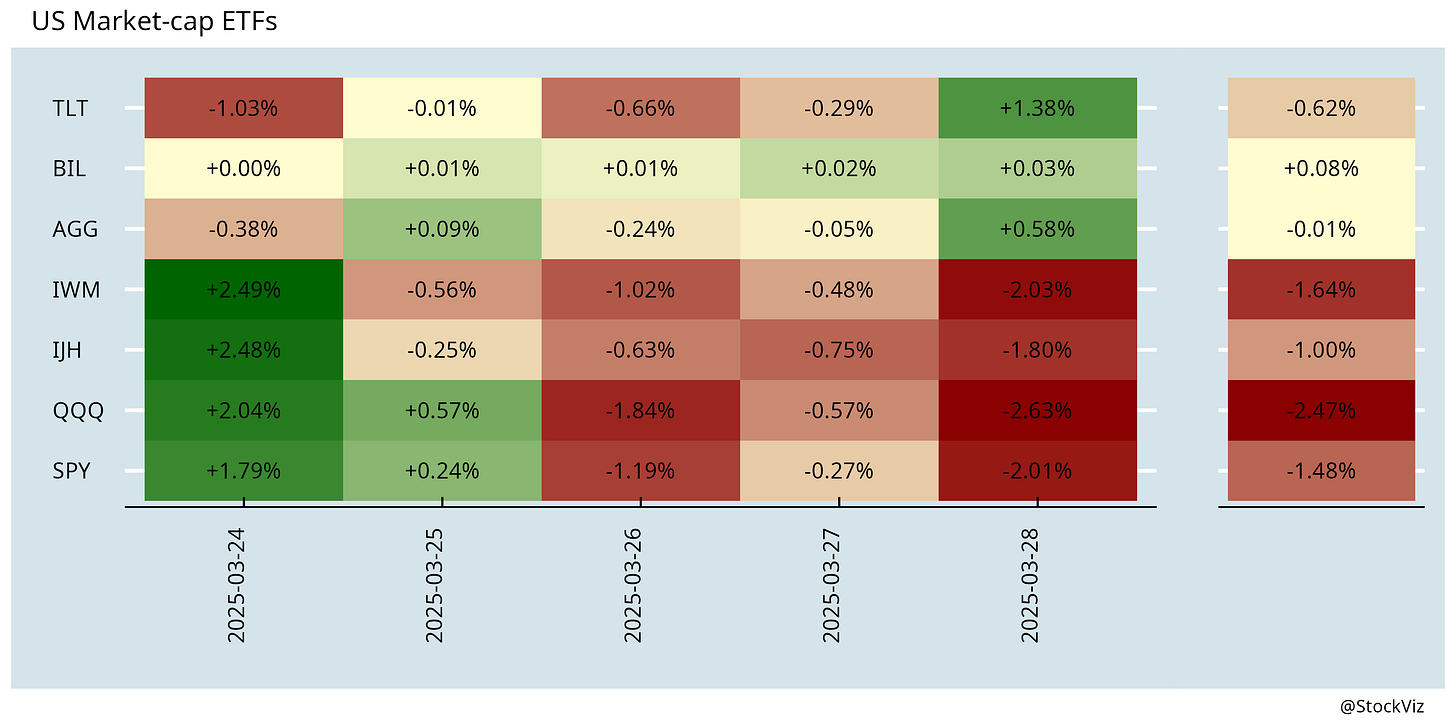

This week was Tariff ON…

… with most of the carnage in the technology sector.

Long-only trend/momentum crypto strategies got crushed.

Links

Research

On Inflation and Stock Returns (outcastbeta)

Historically, stocks have not acted as a hedge against inflation. Instead, they have provided a healthy risk premium, which has served as a buffer against inflation. On average, inflation has eroded that buffer, with higher inflation levels leading to lower real returns.

Local Labor Market Effects of the 2002 Bush Steel Tariffs (cato)

The Bush steel tariffs had large negative short-term effects on local steel-consuming employment but no notable positive effects on local employment in the steel industry. And, the negative effects on steel-consuming employment are highly persistent.

The Importance of Investor Attention (FEDS)

Investors' attention allocation plays a critical role in how financial markets incorporate macroeconomic news. Markets tend to overreact to announcements that attract high levels of attention.

Investing

India

With inflation close to the Reserve Bank of India's target and growth weak, the country's overnight indexed swap (OIS) markets have started pricing in far more aggressive rate cuts by the central bank than previously anticipated. OIS rates, the closest gauge of interest rate expectations, have eased by 10-15 basis points so far in March, with the absolute levels hinting at more than 50 basis points of rate cuts cumulatively over the next 12 months (reuters).

India's $23 bln plan to rival China factories to lapse after it disappoints. Many firms that participated in the program failed to kickstart production, while others that met manufacturing targets found India slow to pay out subsidies (reuters).

Demand slowdown and persistently-high food inflation are challenging the FMCG sector + disruption happening in the distribution segment of the sector led by quick commerce (thehindubusinessline).

One in five ultra-high net worth individuals want to settle abroad. Many UHNIs are acquiring residential real estate overseas as part of their migration and permanent residency plans (timesofindia).

Government to launch Ola, Uber-like 'Sahkar Taxi' (indiatoday).

China will have no choice but to dump products into the Global South as barriers in the West keep going up. We run the risk of deindustrialisation and lack of job creation if we let our industries get run over by the Chinese import surge (business-standard).

The United States is taking strict action against automated bots that have been blocking visa interview appointment slots in India (economictimes).

Young Indians are getting addicted to ‘opinion trading’, and losing huge sums. Opinion trading apps allow users to place bets on the outcomes of real-world events, ranging from cricket matches and stock movements to political results and cryptocurrency prices (livemint).

Survey reveals 73% users ready to abandon digital payments for transaction fee (livemint).

The National Consumer Disputes Redressal Commission dismissed a class action against WazirX regarding a $233 million hack, citing jurisdiction issues and a lack of legal status for cryptocurrencies in India (livemint).

India's government has told a court in Mumbai that agreeing to Volkswagen's demand to quash a $1.4 billion tax bill would have "catastrophic consequences" and encourage companies to withhold information and delay inquiries (reuters).

Questioning low fund withdrawals from bank accounts by some individuals, the income tax department has queried them on their monthly spending. The department has sent notices that seek a detailed breakup of expenses, including how much the household spent on atta, rice, spices, cooking oil, gas, shoes, cosmetics, education, restaurant visits and, yes, haircuts (economictimes).

row

U.S. national-security leaders included a journalist in a group chat about upcoming military strikes in Yemen (theatlantic).

Want good relations with Trump? Bring a gift (axios).

Trump’s Economics—and America’s Economy (thenation).

A historic global trade war, a proposed $1.2 trillion European fiscal bazooka and the emergence of China as tech race leader are upending global flows of money, marking a potential turning point for investor capital away from the United States (reuters).

China’s Industrial profits fell 0.3% in the first two months compared to the same period last year. Deflationary risks persist as factory-gate prices continue to drop, squeezing the profit margins of industrial firms (bloomberg).

China is suffering its own ‘China shock’. China shares of the export of 10 labour-intensive products — including home fixtures, furniture, luggage, toys and others — peaked at nearly 40 per cent in 2013. By 2018, it had fallen to less than 32 per cent (ft).

China Has Already Remade the International System (foreignaffairs)

A 25% blanket tariff on auto imports to the US will push prices up for consumers, impair profitability and weaken competition. But the most visible effect of stifling imports will be the increased dominance of large vehicles at the cost of smaller ones (livemint, reuters).

Trump's plan to revive U.S. shipbuilding using massive fees on China-linked ship visits to American ports is causing U.S. coal inventories to swell and stoking uncertainty in the embattled agriculture market, as exporters struggle to find ships to send goods abroad (reuters).

US tourism industry faces drop-off as immigration agenda deters travellers. Forecast visits to the country this year had been revised downward from a projected 5% rise to a 9% decrease (theguardian).

Germany Has Traded Austerity for a Mess (foreignpolicy).

Zyn and the new nicotine gold rush (newyorker).

Lead: the hidden villain behind violent crime, lower IQs, and maybe even the ADHD epidemic (motherjones).

Why America Struggles to Build (foreignaffairs).

Odds & Ends

New Nasa data hints we could be living inside a black hole (msn).

Birth rates are crashing around the world. Should we be worried? (newyorker)

There’s a vape with a Tamagotchi in it and if you do not hit the vape, the Tamagotchi will die (futurism).

Good meme...leonardo di caprios kantara moment, somehow that could be Shyam saying Ah!! Or Charles dickens telling us tales for free ;)