The biggest advantage of systematic strategies is that the data that they themselves generate is valuable over time. You can analyze how your strategy behaved under different market conditions and check if you missed something obvious. One of our favorite things to do is to overlay different strategies that we’ve been running over the last decade to see how they behave in combination.

This week, we did a quick test on hedging our Momo strategies with NIFTY futures to see if that made sense. You can read about it here: Hedging Momos

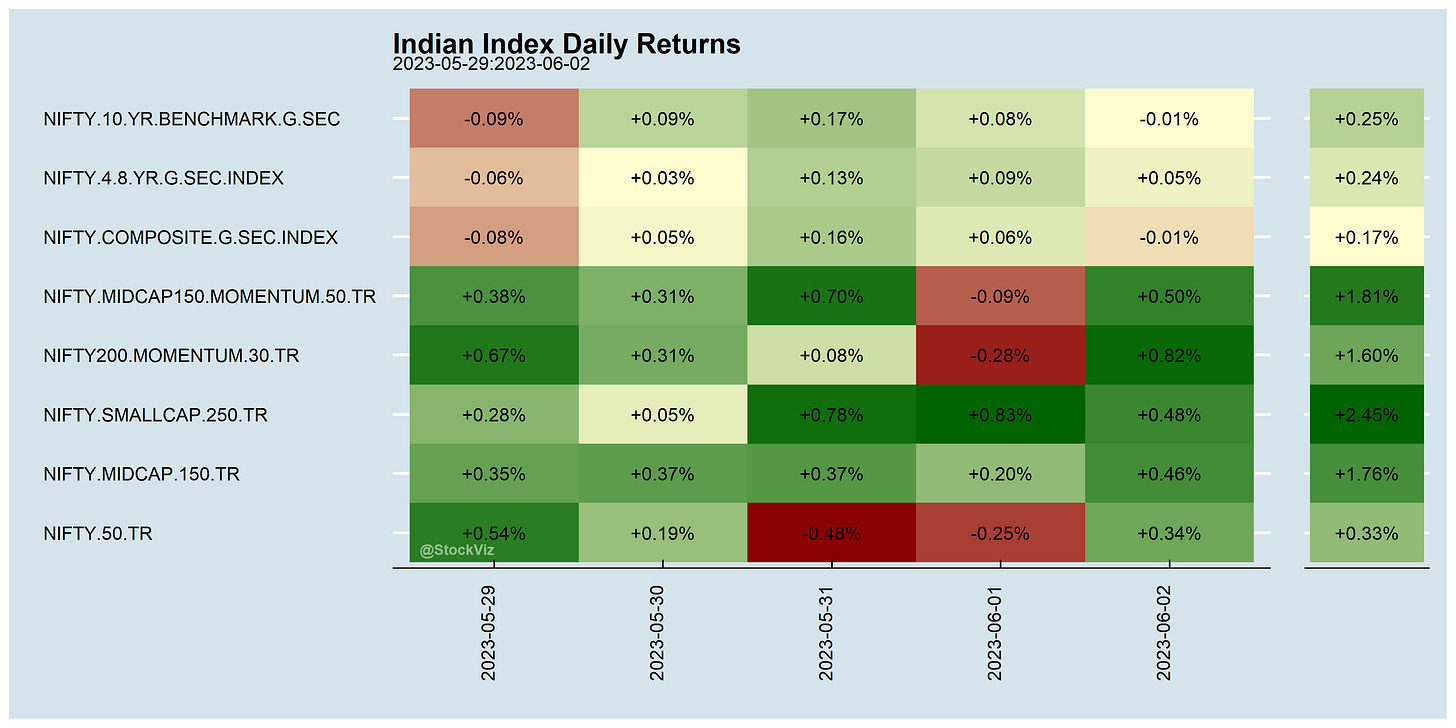

Markets this Week

Indian small-caps are on an absolute tear…

… while it’s all “AI” in the US.

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Financial inclusion presents a policy trilemma. It is possible to simultaneously achieve only two of three goals: widespread availability of services to low-income consumers; fair terms of service; and profitability of service. It is possible to provide fair and profitable services, but only to a small, cherry-picked population of low-income consumers. Conversely, it is possible to provide profitable service to a large population, but only on exploitative terms. Or it is possible to provide fair services to a large population, but not at a profit.

Financialization leads to a significant increase of the correlation between the commodity and stock market returns. This return correlation structure change is robust to different commodity and stock market return computation methods. After financialization, the importance of non-commercial traders elevates, the pairwise correlation between the indexed commodity futures increases, and the basis becomes more negative on commodity futures markets.

An investor’s organizational capabilities determine what asset classes are investable and how investors can invest in them. An investor’s identity is akin to a sort-of “‘kitchen” in that it refers to the specific manner in which an investor “cooks up” its risk-adjusted net returns. Identity thus reflects the true foundations of long-term performance: namely, how an investor organizes its capabilities to allocate assets and implement portfolio strategies.

Between 1000 and 1900, world population grew from under 300 million to 1.6 billion, and the share of population living in urban areas more than quadrupled, increasing from two to over nine percent.

To assess the magnitudes of our estimated effects, we calculate how much of the increase from 1700 to 1900 in Old World population and urbanization can be explained by the introduction of the potato. Our baseline estimates suggest that the potato accounts for approximately 25–26 percent of the increase in total population and 27–34 percent of the increase in urbanization.

Participants with higher intelligence scores were only quicker when tackling simple tasks, while they took longer to solve difficult problems than subjects with lower IQ scores.

Economics

Natural Gas Prices Could Fall Below Zero In Parts Of Europe (oilprice)

'Granary of China' braces for more wheat-damaging rain (reuters)

US Manufacturers are building:

China Is Drilling a 10,000-Meter-Deep Hole Into the Earth (bloomberg)

China keeps using the wrong tools to fix its economic problems (qz)

Investment more than consumption leading India's economic growth (reuters)

Computer software and hardware, and services dominated Indian FDI equity inflows in FY23 (bqprime)

Demographics are a headwind for emerging markets (reuters)

Uber teams up with Waymo to add robotaxis to its app (theverge)