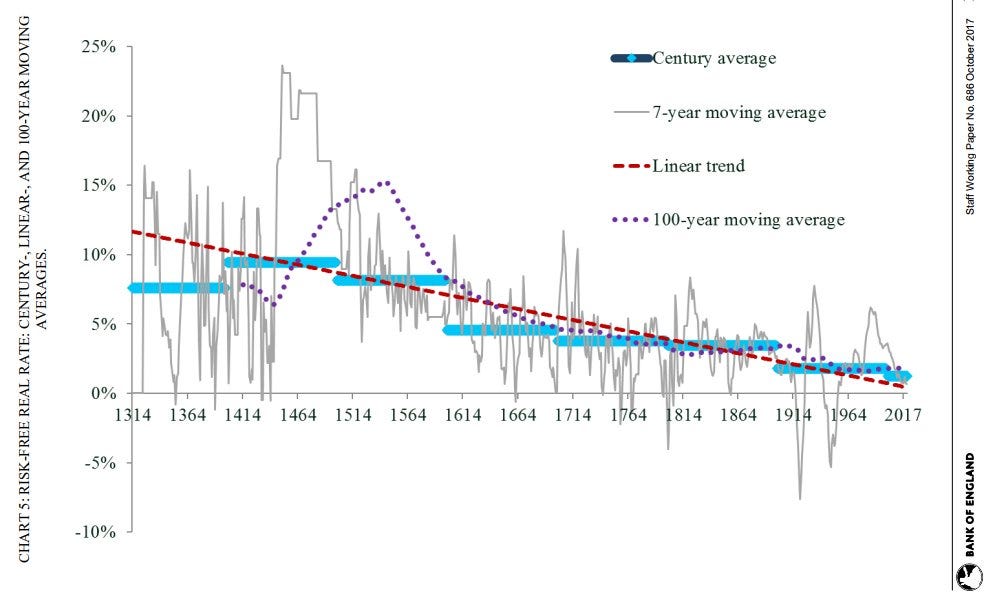

What if real interest rates are not mean-reverting? We are told that zero-bound rates are anomalies - emergency measures that will soon be reversed. What if, in the long run, rates keep trending down?

The “why” is debatable. My theory is that every time the economy slows down, central banks cut rates. But the pace of normalization lags economic recovery. i.e., the data showing recovery is noisy and comes with a lag. CBs don’t want to trample on nascent recoveries and inflation prints are yet to flash red. So, the real interest rate in the “real” economy is much lower than what the CB dashboard says. This incentivizes rational economic actors to go an a debt binge. By the time CB dashboards catch up, everybody is levered to the hilt. Now, the economy as a whole is a lot more sensitive to rates post the rate-cut cycle than it was before. So the ceiling for the current rate-hike cycle is much lower than the previous cycle. Rinse-repeat over a few decades and you end up with a system where real rates have to trend lower to maintain the same level of growth.

Besides, incentives matter. Corporate executives are often given stock options based on EPS targets. This incentivizes them to lever-up and buy-back their own stock. At an individual level, credit is more widely available now to fund consumption than it ever was in history. “Keeping up with the Joneses” fueled by easy credit means that consumers are much more sensitive to income shocks. On the whole, the dv01 of the system keeps increasing.

If you’d like to dig further, start with Dr. Paul Schmelzing’s talk:

We immediately reach for a pill of Dolo or Crocin the minute we feel a fever coming on. However, there used to be a time when doctors would routinely induce fever to kill off infection causing bacteria in the body. They call it pyrotherapy.

For example, before the introduction of penicillin, malaria-induced fevers were used as a treatment for neurosyphilis—the spiking fevers associated with malaria killed the bacteria that caused the syphilitic infection.

This is what a recession does to an economy - it kills of inefficient businesses so that the stronger survive and flourish. There needs to be a positive real interest rate so that bullshit companies can fail and release resources. Central banks seem to have forgotten that. Enter the zombies.

Aggressive unconventional policy runs the risk of introducing zombie lending and a “diabolical sorting”, whereby low-capitalization banks extend new credit or evergreen existing loans to low-productivity firms. In a dynamic setting, policy aimed at avoiding short-term recessions can be trapped into protracted excessive forbearance due to congestion externalities imposed by zombie lending on healthier firms. The resulting economic sclerosis transforms transitory shocks into phases of delayed recovery and potentially permanent output losses.

Zombie Lending and Policy Traps (SSRN)

In the US, companies that aren’t earning enough to cover their interest expenses have about a trillion dollars in debt. However with US inflation at new 40-year high, there may not be much room for monetary policy to rescue them. (T&R, AP)

There is a lot of speculation around whether the Fed will end up inducing a recession in the US. My take is that a mild recession will actually be a good thing. While it can cause a lot of pain in the financial markets, the overall system will emerge stronger.

Markets this Week

Its Indian retail investors’ SIPs vs. Foreign portfolio investors’ de-grossing. We just need retail flows to last a day longer than FPIs - once the outflows die down, its going to be one banger of a market.

Links

Falling equity values means employees who have a bulk of their comps coming from stock options or RSUs are facing a pay cut. The smart ones are jumping ship.

S&P 500 PE went from 31.6x a year ago to 16.3x (trailing) currently. Equivalent multiple compression took more than three years in the internet bubble burst. Now 17% of the SP500 trades at single digit forward PE.

Warren Buffett suggested that the ratio of the market value of publicly traded stocks to economic output could identify equity market mispricings. We extend the existing research from the United States to international equity markets by investigating the return-predictive characteristics of the market value of equity-to-gross domestic product for a dataset comprising fourteen countries. The findings corroborate that the “Buffet indicator” explains a large fraction of ten-year return variation for the majority of countries outside the United States. Low ratios have predicted above-average investment returns, while periods of high ratios have, on average, been followed by below-average returns over the subsequent ten-year period.

The Buffett Indicator: International Evidence (SSRN)

A thread on option selling to generate income. (@perfiliev)

Trading is the wrong term for what trading is. Trading is more accurately called positioning. (@AgustinLebron3)

The yen weakening to 150 against the dollar could spark a financial crisis in Asia. (Yahoo)

In every crisis, someone always benefits. In the case of Russia’s invasion of Ukraine, that someone is Indian Prime Minister Narendra Modi. (foreignpolicy)

Materials needed to build a 500MW Power Plant - Solar, Onshore Wind and Offshore Wind (@ayeshatariq)

Pipedream is building a network of underground pipes that robots can zip through to deliver anything, anywhere in a city. (singularityhub)

The Google engineer who thinks the company’s AI has come to life. (WaPo)

alice

nice