Part IV for our trend-following series is up on Zerodha Varsity: Could Trend-Following Be A Successful Trading Strategy? (Part IV). We discuss asset selection and how one could avoid data-mining.

Markets this Week

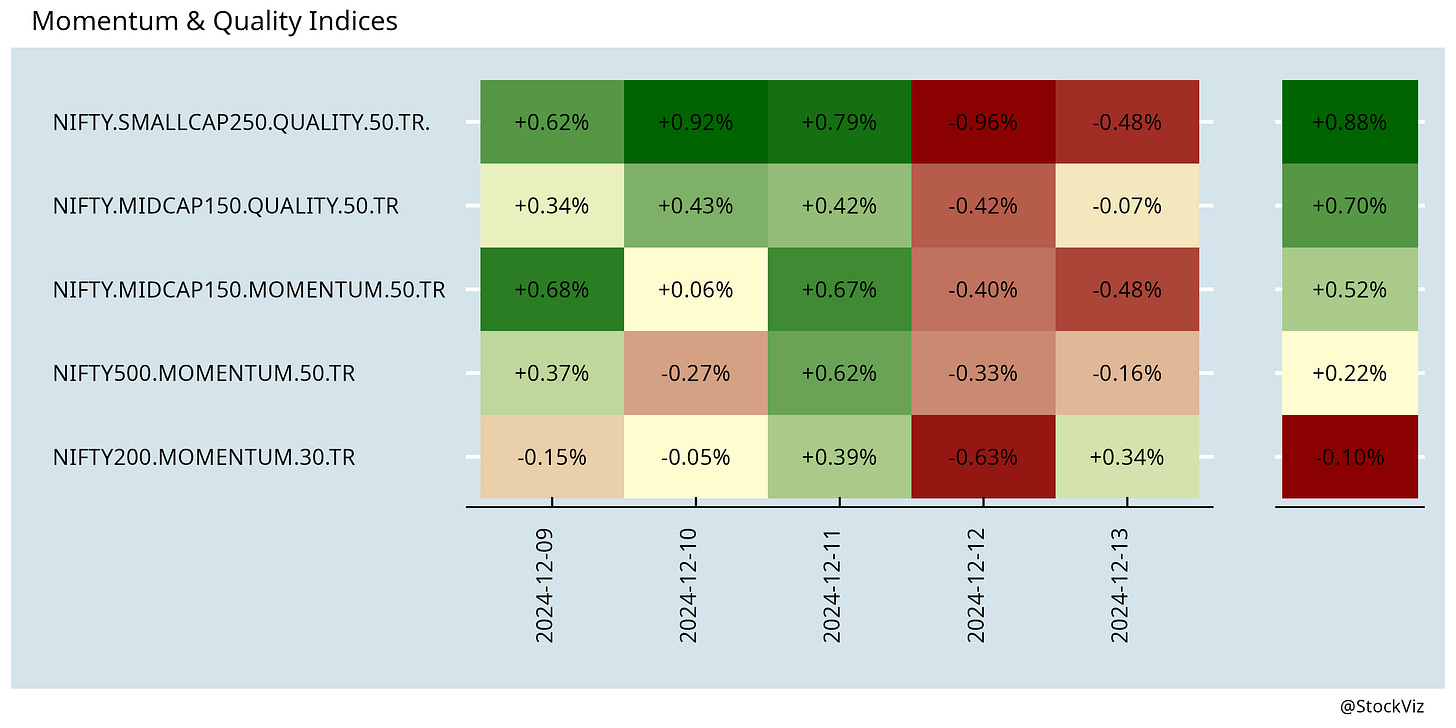

India

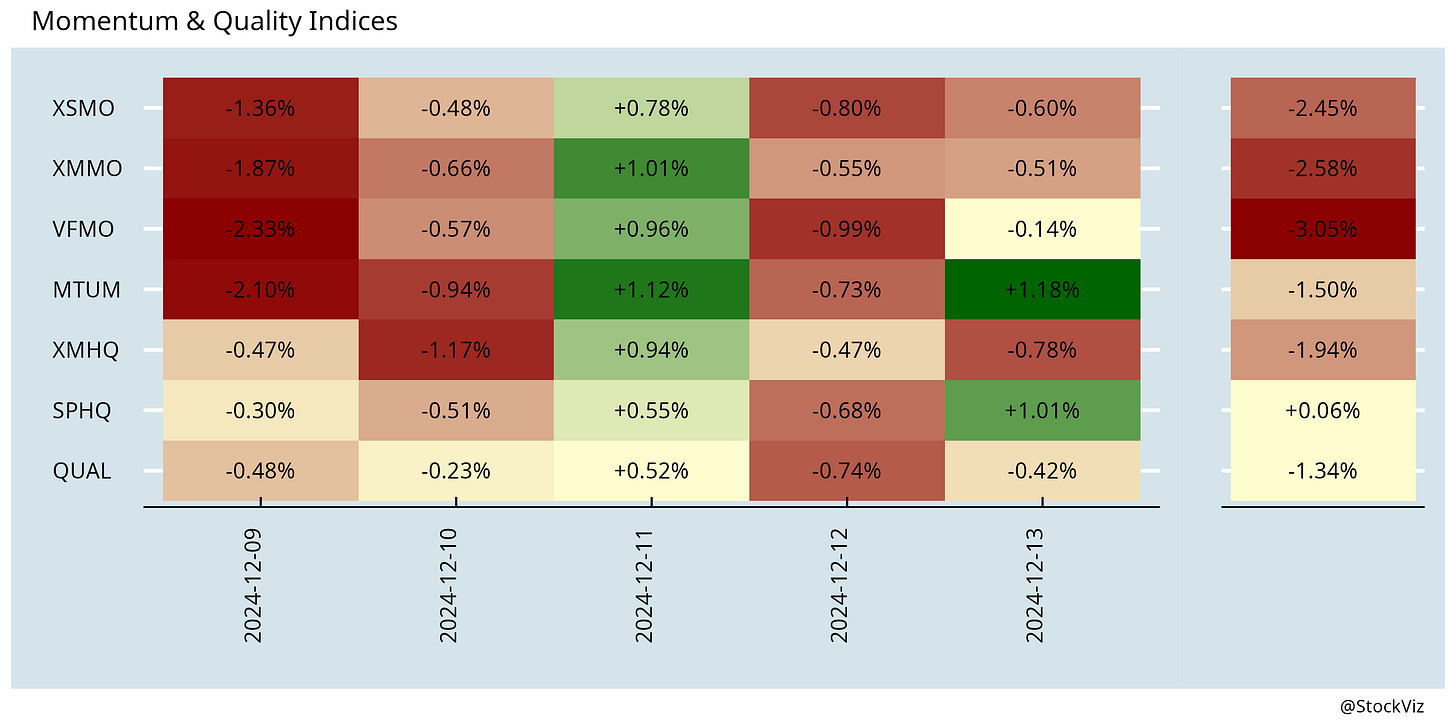

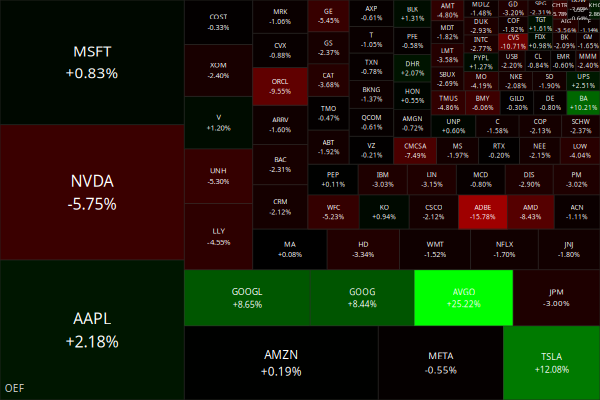

US

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Factor Selection and Structural Breaks (SSRN)

We develop a new approach to select risk factors in an asset pricing model that allows the set to change at multiple unknown break dates.

Decoding Investor Trading Strategies with Large Language Models (SSRN)

Using large language models, we analyze trading strategies expressed in over 77 million messages on a leading investor social media platform. We find that stocks experiencing bullish sentiment in technical analysis posts tend to have lower future returns and a higher likelihood of buy herding on Robinhood. In contrast, sentiment extracted from fundamental analysis related posts positively predicts future returns.

Risk Revisited (SSRN)

This study explores how the historical price path of a stock shapes investors’ perceptions of risk. Recency, clustering, and sign, can explain large proportions of the variation in risk perceptions. Using U.S. real stock and mutual fund data, we show that these three features help explain cross-sectional variations in returns, trading volume, and future volatility of individual stocks, and predict mutual fund negative flows.

Investing & Economy

How To Avoid Investment Fruit Loops (tonyisola)

Every Asset Managers’ 2025 Forecasts (behaviouralinvestment)

India

Bribery a way of life: 66% businesses in India paid bribes to govt officials in last 12 months (livemint)

Retail inflation eased in November to 5.48%, lower than 6.21% in the previous month and below a 5.53% forecast by economists. (reuters)

e-commerce, which includes quick commerce platforms, has recorded over 30% volume growth year-on-year across 32 FMCG categories in metro cities in the last five consecutive quarters. (thehindubusinessline)

An analysis of macro data on consumption for the last 10 years shows that many of recent setbacks to FMCG companies could be the result of changing buying habits. (thehindubusinessline)

Private sector profit at 15-year high but salaries stagnant (indianexpress)

India's finished steel imports from China reached an all-time high during the first seven months of the current financial year from April. (reuters)

Two leading auto industry bodies have urged the government to lift restrictions on certain steel imports, citing concerns over potential disruptions to automobile production in India. (business-standard)

India’s new RBI governor may not be as antagonistic toward crypto as his predecessor. (reuters)

Wealthy Indians are succumbing to wanderlust while fewer foreign tourists are showing up at Indian airports than before. Tourist arrivals in 2024 are unlikely to cross 10 million, which is below the pre-pandemic peak of 10.9 million. (livemint)

row

China’s electric vehicle capacity will soon match total Chinese domestic auto demand, and total Chinese auto production capacity is already over half of total global auto demand. (cfr)

China’s rise as an automotive superpower is not an anomaly—it’s a case study in the power of state capitalism, a system that marries ambition with strategy, and brute scale with surgical precision. (dunneinsights)

A climate nonprofit run by former Chinese Communist Party officials funneled millions of dollars to U.S. universities and left-wing groups to promote replacing fossil fuels with green energy. (freebeacon)

European equities won’t provide safety if US bubble bursts (reuters)

Odds & Ends

An AI companion suggested a kid that he kill his parents. (washingtonpost)

OnlyFans models are replacing human impersonators with AI to keep up with their DMs. (wired)

"Follow your passion" is terrible advice (hottakes)