Entire academic careers are devoted to the study and forecasting of market volatility. These models range from the very simple to the insanely complex. No doubt, they are useful if you are running an options trading book but every time I’ve tried to use them for directional trading, typically to go long/short an index, the results have been disappointing.

The latest in the series of disappointments has been trying to use Realized Semi-Variance to go long/flat the NIFTY 50 & MIDCAP 50 indices (here).

Besides, volatility is calculated over a lookback period. How do you pick one? When I put this post up, what surprised me was that the volatility of NIFTY 50, the large-cap index, is more volatile than the volatility of MIDCAP 150. Maybe the smaller number of constituents is a factor?

The study of volatility is seductive. However, so far, it has proved to be a better ranking factor rather than a timing factor.

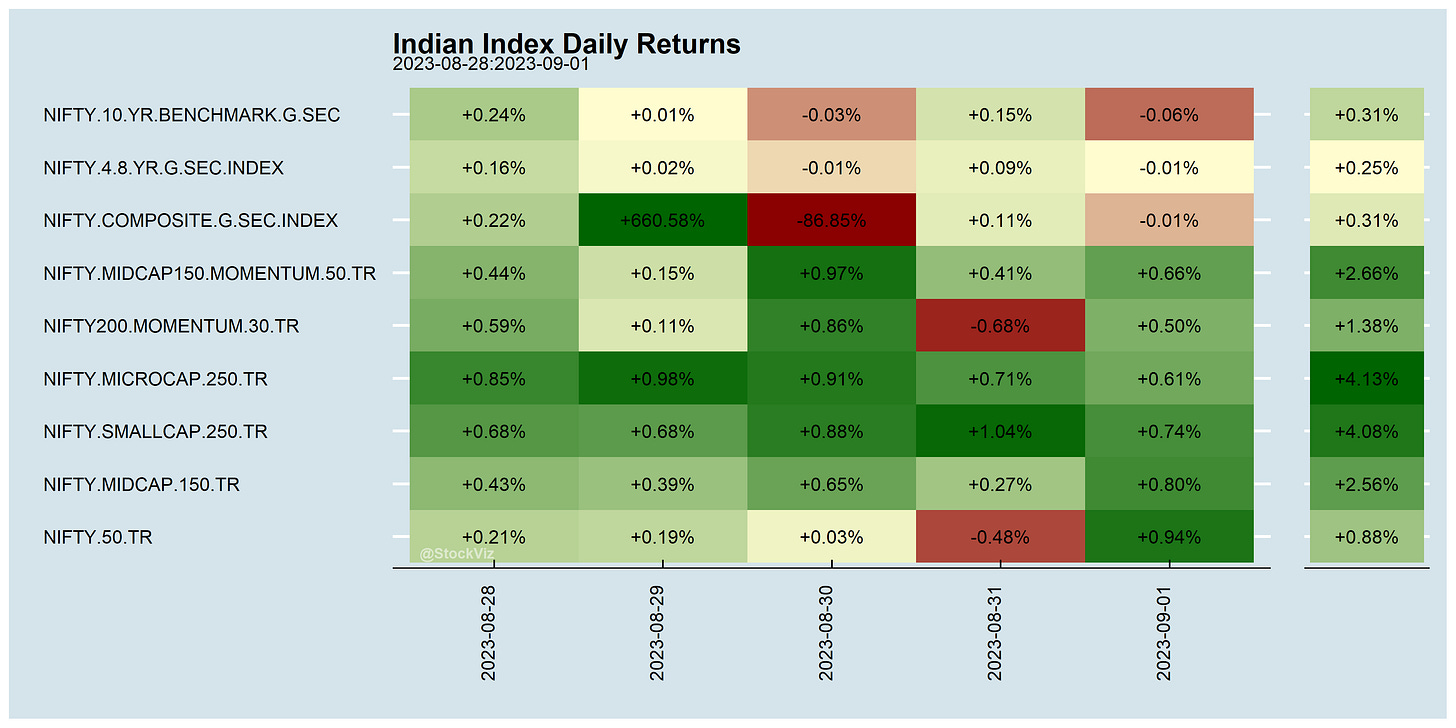

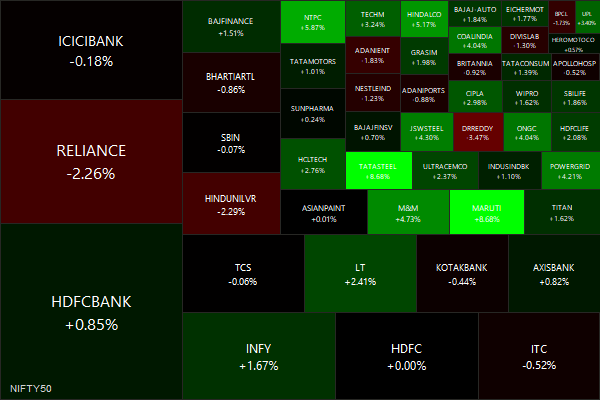

Markets this Week

Friday saved the NIFTY 50… Small caps and Micro caps are on fire.

Bad news is Good news on the economic front. Swap contracts are pricing in a less than 50% chance of another Fed hike this year — while bets on a cut were shifted to May from June.

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Investors are constantly re/up-skilling. Big data is a tool like any other.

Big data allows active asset managers to find new trading signals but doing so requires new skills. Thus, it can reduce the ability of asset managers lacking these skills to produce superior returns. Consistent with this possibility, we find that the release of satellite imagery data tracking firms’ parking lots reduces active mutual funds’ stock picking abilities in stocks covered by this data. This decline is stronger for funds that are more likely to rely on traditional sources of expertise (e.g., specialized industry knowledge) to generate their signals, leading them to divest from covered stocks. These results suggest that big data has the potential to displace high-skill workers in finance.

Yeah, don’t do this.

We propose a simple portfolio management strategy that gauges the leverage based on the observed implied volatility index (VIX). The strategy involves taking less risk when the cumulative previous-month VIX is high and more when it is low.

Strategies get crowded and fees eat away at excess returns.

Since the Global Financial Crisis of 2008, US public-sector pension funds realized a negative alpha of approximately 1.2% per year, virtually all of which is associated with their exposure to alternative investments. While exposure to private equity neither helped nor hurt, both real estate and hedge fund exposures detracted significantly from performance. Institutional investors should consider whether continuing to invest in alternatives warrants the time, expense and reduced liquidity associated with them.

Investing

15 Ideas, Frameworks, and Lessons from 15 Years (thinknewfound)

Money Is Pouring Into AI. Skeptics Say It’s a ‘Grift Shift.’ (institutionalinvestor)

Dividends cannot be the “only” filter:

Crypto has a bad rep for being a degen paradise. We forget that tradfi is the OG:

Simplify just filed for a TSLA Revolution ETF which will hold Tesla stock and Tesla derivatives actively shifting exposure to stock bt 25% and 200% depending on momentum.. so kinda like an actively mgd Tesla stock ETF trying to outperform Tesla. (tweet)

Economy

Beijing Is Worried Young Chinese Are Embracing Nihilism (foreignpolicy)

How Do We Manage China’s Decline? (nytimes)

Has Xi Jinping bankrupted China? (unherd)

Chinese banks post sluggish profit growth, warn of regional debt risks (reuters)

India August factory activity hits three-month high (reuters)

More dirt on the Adani bros (occrp, economist)

Problem of plenty - cash flow from operations post capex investment in Plant, Property & Equipment (PPE) for listed India Inc has now jumped to 6 lakh crores from 1sh lakh crore in 2019. (tweet)