A short note about setting up a volatility beta portfolio: Volatility as Beta.

As an addendum:

Before you go all Black Swan’y on me, I’d like to disclaim that this is supposed to be “beta” just like how getting long the Indian Midcap index with frequent 30% drawdowns is “beta”.

You slice-and-dice ERP (Equity Risk Premium) to fit different risk/reward trade-offs. You can do the same thing with VRP (Volatility Risk Premium). And, just like how you use a simple market-cap index as a benchmark for your ERP based strategies, you can use a simple volatility “beta” portfolio as a benchmark for your VRP based strategies.

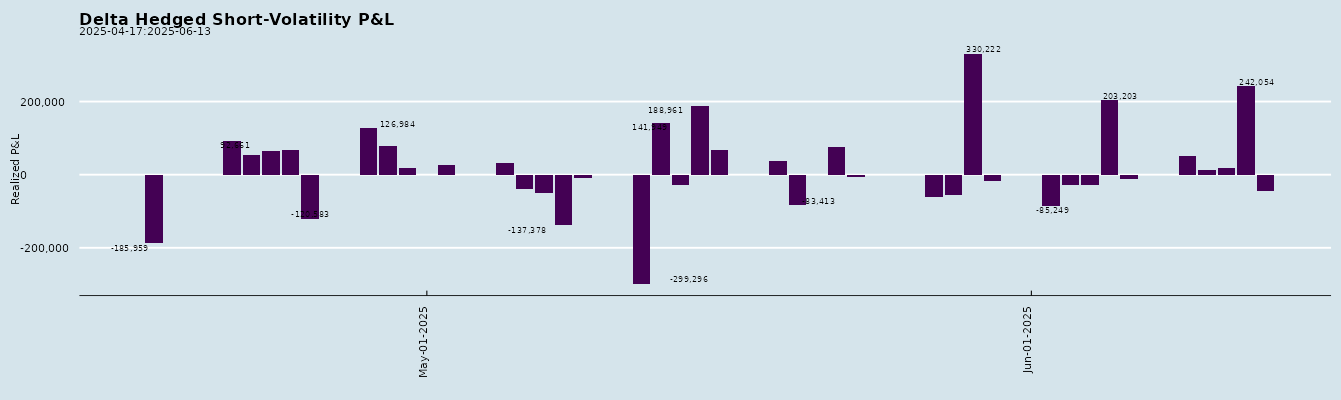

Over the last couple of months, short-volatility has posted decent returns.

On a ~Rs. 1.35 crore margin, it has generated ~Rs. 10 lakhs in P&L (after brokerage/STT etc…)

Future models should beat this “beta”.

Markets this Week

Markets got kneecapped by Iran-Israel war…

Oil!

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

The Volatility Risk Premium: An Empirical Study on the S&P 500 Index (SSRN)

We perform an empirical analysis of trading strategies based on the systematic selling of delta hedged options, aiming at capturing the so-called volatility risk premium. We compare the performance across different strikes and maturities, and perform a breakdown of the drivers of performance. We also examine how such strategies can be combined to extract other premia related to the profile of the volatility surface, e.g. the skew and the term structure.

Alpha in Analysts (SSRN)

This paper examines the investment value in sell-side analyst price targets. We treat each analyst as a portfolio manager and use their price targets to construct 12-month implied return forecasts. We invest in self-financing long-short portfolios for individual analysts, where we go long on stocks with positive forecasts and go short on those with negative forecasts, and the weights in the portfolio are proportional to the magnitude of the implied returns. Our empirical analysis shows that while the average analyst does not generate statistically significant alpha relative to the returns of a long-only portfolio benchmark, a subset of analysts exhibits persistent alpha. Motivated by this heterogeneity, we introduce a "fund-of-analysts" framework that first predicts analyst performance and then dynamically allocates weights across analysts based on predicted analyst performances. Our results show that this meta-portfolio strategy can yield significant alpha over long-only benchmarks, providing new insights into the role of analyst heterogeneity in equity market pricing.

Riding a Bubble: A Study of Market-Timing Trading Strategies (SSRN)

This paper characterizes the probability distribution of local martingale price bubble processes in order to construct profitable trading strategies which exploit price bubble dynamics. Various such market-timing trading strategies are identified, all are based on the idea of "riding a bubble" by holding a stock during a bubbly period until the time when the bubble's magnitude hits a predetermined barrier. We study these market-timing trading strategies via both simulations and back-tests using historical market prices. We show both in theory and practice that implementing such strategies in the presence of a bubble leads to increased performance relative to the traditional buy-and-hold trading strategy.

Public and Private Transit (NBER)

Private minibuses dominate transport in many developing country cities. When the government enters a route, minibuses depart less frequently, driver profits fall, and drivers switch to connected routes, reducing prices. Overall, 10% of the commuter welfare gains of building the public transit system arise from the response of private transit. Drivers lose welfare equal to half of the commuter gains.

The wealth of working nations (sciencedirect)

Due to aging populations, the gap between GDP growth per capita and GDP growth per working-age adult (or per hour worked) has widened in many advanced economies. Countries like Japan, which have shown lackluster GDP growth per capita, have performed surprisingly well in terms of GDP growth per working-age adult (or per hour worked). Many advanced economies are also following similar balanced growth paths per working-age adult despite significant differences in the levels of GDP per working-age adult.

Capability Inversion: The Turing Test Meets Information Design (NBER)

This paper analyzes the design of tests to distinguish human from artificial intelligence through the lens of information design. We show that if an AI significantly overestimates human ability in even one domain, it cannot reliably pass an optimally designed test. Effective tests should target not what humans do well, but the specific patterns of human imperfection that AIs systematically misunderstand.

Tariffs

Beijing’s commerce ministry is asking for production details and confidential lists of customers as part of its export approval process for critical minerals and magnets (ft).

The EU has urged China to stop restricting the export of rare earth minerals and magnets, with the bloc’s trade chief saying its industries are in an “alarming situation” (scmp).

China Found World’s Pain Point on Trade — and Will Use It Again (bloomberg)

A range of imported household appliances including dishwashers, washing machines, refrigerators and more will be subject to President Donald Trump's expanded steel tariffs starting later this month (reuters).

India

For 15 years now, engineers and quality control specialists have implored regulators, journalists and airlines to take a closer look at the 787 Dreamliner. One of them just crashed (prospect).

India's central bank plans to tighten rules for overseas remittances by resident Indians, barring them from holding foreign currency deposits with lock-in periods (reuters).

Urban consumers are increasingly choosing unbranded goods over established brands. Urban unbranded products clocked 8.4% in volume growth in FY25, as against the volume growth of just 2.1% among 22 stock market-listed companies (cnbctv18, livemint).

Sebi set to launch new UPI mechanism for MFs, brokers (economictimes).

Customs department has issued show-cause notices to about 2,000 importers across the country, specifically targeting copper tubes and pipes. The focus is on copper and copper alloy imports that have benefitted from 0% concessional duties (cnbctv18).

Inflows in equity funds stood at 190.1 billion rupees. That’s the smallest in a year, and marks a 55% drop from the peak in October (bloomberg).

India’s population reaches 146.39 crore, fertility rate drops below replacement level (1.9 against 2.1). The population is expected to grow to 170 crore before starting to dip in about 40 years (thehindu).

row

Are atoms and alphas trade secrets? The prosecution of a trader could define how a quant algorithm can become stolen property (bloomberg).

China Forced to Keep Unprofitable Firms Alive to Save Jobs and Avoid Unrest (bloomberg)

Cheerleaders to critics: German machinery makers call for EU action on China (scmp)

Milan’s ‘Empty London’ Tax Bet Pays Off as UK Wealth Exits Soar (bloomberg)

Shopify partners with Coinbase and Stripe in landmark stablecoin deal (fortune). Why retailers are looking into stablecoins (axios).

SEC Aims to Ease Regulations on DeFi (pymnts).

‘Trump savings account’: US announces $1,000 government-funded accounts for American babies (indianexpress).

The World Bank has agreed to end a longstanding ban on funding nuclear energy projects in developing countries (reuters).

China’s “low-altitude economy” is taking off (economist).

Odds & Ends

The world's leading mathematicians are stunned by how adept artificial intelligence is at doing their jobs (scientificamerican).

Why is quality so rare? Technology makes it faster to build, but harder to care (linear).

The core functionality of Bluesky is not that it keeps information out; it’s that it keeps information in. Like the containment dome over a nuclear reactor, Bluesky serves the important safety purpose of ensuring that whatever meltdowns occur within produce minimal fallout.

Bluesky Isn't a Bubble. It's a Containment Dome. (joshbarro)