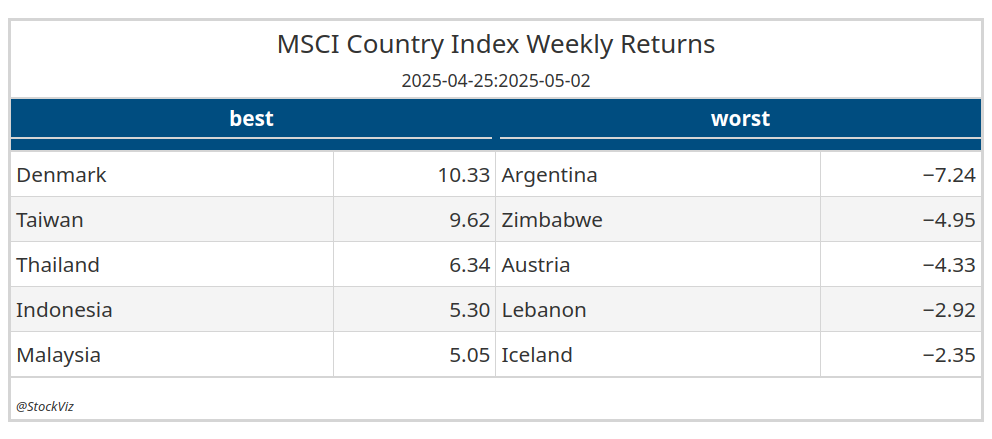

US markets have recovered all the losses since “liberation day” this week and all it took was an hint of a curled lip from President Xi.

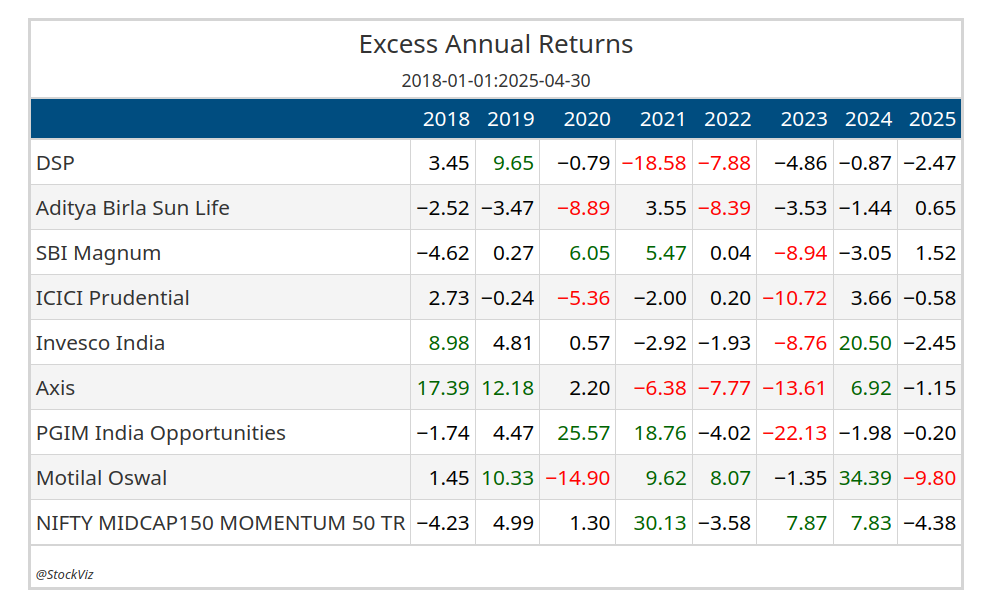

The whole tariff thing has become a reality TV show with Trump as its leading man. While it is supremely entertaining, we cannot allow it to detract us from work. So this week, we (again) ask the question: why shouldn’t we replace all our mid-cap funds with the mid-cap momentum index fund?

Its not like mid-cap fund managers have done much else other than take turns coming on CNBC and giving gyan on how they are “cautiously optimistic” about the markets and how everything is “over priced.” Ever since SEBI enforced the “true-to-label” and “one-category-one-fund” rules, managers have been in a pickle.

The common excuse is that you need to look at “risk adjusted” returns. So, let’s do that:

Where is the consistency? Two years out of eight, the momentum index had the highest Sharpe Ratio! And never was it ranked the worst.

The excess return between the momentum index and the base index has been around 4%. This allows you to de-risk the momentum index by adding bonds into the mix. Here are some scenarios:

MOM0.75 (75% momentum + 25% bonds) would’ve given you returns equivalent to the base index with lower drawdowns and out-performed half the active mid-cap funds here.

And if you roll your own momentum strategy, you can do a lot more on the risk/return spectrum as we’ve shown here.

Something to chew on this weekend.

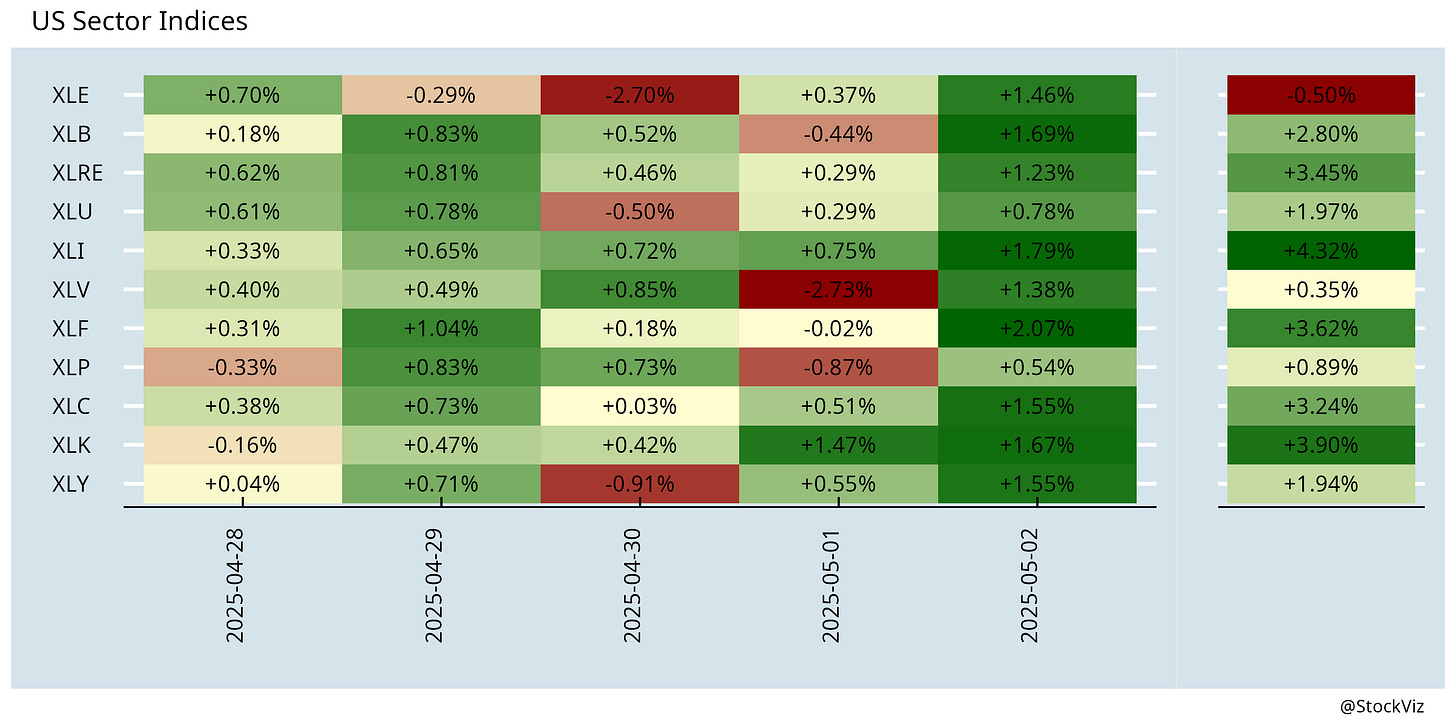

Markets this Week

Foreign investors dipping their toes back in India?

At least the rupee is stabilizing…

US markets got the Nadella bump…

Links

Research

St. Patrick's Day and Stock Market Returns (SSRN)

This paper examines the potential "St. Patrick's Day Effect," exploring how the positive mood and luck associated with the day impact investor sentiment and stock returns. Results show a significant St. Patrick's Day effect in the US and Australian markets, with abnormal positive returns on March 17.

How Costly are Trading Heuristics? (SSRN)

We analyze the large set of trading heuristics discussed in top finance journal articles over the past 75 years using both retail and institutional trade-level data. We find that retail investors use about 70% of the heuristics more often than would be expected based on counterfactual simulated trading data. Retail trades using more heuristics are associated with lower future returns, with more than half of stock selection heuristics negatively linked to future performance. Institutions, in contrast, use only 15% of the heuristics more often than in the counterfactual data and benefit from their use.

Press Freedom as a Risk Factor: Effects on Volatility and Uncertainty (SSRN)

This study establishes press freedom as a novel financial risk factor by demonstrating its systematic effects on economic policy uncertainty and market volatility. The findings reveal that press freedom shocks systematically increase economic policy uncertainty, particularly in politically sensitive economies, while their effect on market volatility varies: some markets experience short-term stability due to information suppression, but instability rises in the long run.

Tariffs

A trade war is a stagflation shock (apolloacademy)

China has created a list of U.S.-made products that would be exempted from its 125% tariffs and is quietly notifying companies about the policy (reuters). The 131 items are worth about $40 billion, or around 24% of Chinese imports from the US in 2024 (bloomberg).

Lawmakers Are Growing More Skeptical Trump’s Tariffs Will Spark an Industrial Renaissance in the U.S. (notus)

Port of Los Angeles says shipping volume will plummet 35% next week (cnbc). Analysts see massive impacts on retailers and shipping stocks and a ripple effect through much of the U.S. economy (investors). Almost 400,000 fewer containers are booked on Asia-to-North America routes during the four weeks from May 5 than planned — a 25 per cent drop from the amount scheduled for the same period at the start of March, before tariffs were imposed (ft).

Trump China Tariffs Set to Unleash Supply Jolt on US Economy (bloomberg)

America may be just weeks away from a mighty economic shock (economist).

Longshore union blasts Trump tariffs, warns of massive job losses (freightwaves).

Massive financial losses are already racking up at farms, with cancelled orders resulting in layoffs, as China stops buying products from pork to lumber (cnbc).

More than 60% of CEOs expect a recession in the next 6 months as tariff turmoil grows (cnbc).

India

The Supreme Court rejected JSW Steel's resolution plan to acquire Bhushan Power and Steel four years after the takeover was completed, and ordered the liquidation of the debt-ridden firm (reuters, livelaw).

The cabinet approved the inclusion of citizens' caste details in its population census (reuters). Caste census could change cap on reservations set by Supreme Court in 1992 (hindustantimes).

New Delhi is prepared to include a sweetener in trade talks with Washington that would "future-proof" a deal by ensuring no other trade partners could have superior terms. The "forward most-favoured-nation" clause, rarely granted by India in previous trade negotiations, would automatically apply to the U.S. any more-favourable tariff arrangements that might be agreed with other countries (reuters).

India's payments authority, the central bank, and industry are pushing the government to allow a fee on digital payments to large merchants made via its homegrown network to help boost growth (reuters).

FDA uncovers ‘significant’ data integrity concerns at Raptim Research, an Indian CRO (raps).

Ola Electric’s slowing sales and widening losses have triggered a credit downgrade (livemint).

The Karnataka High Court has instructed the Union Government to block Proton Mail in India (livemint).

Foxconn India revenue rises to over USD 20 billion, employee count up at around 80,000 (livemint).

row

The Ukraine “minerals” deal is done (ft, bloomberg, reuters).

Secret Deals, Foreign Investments, Presidential Policy Changes: The Rise of Trump’s Crypto Firm (nytimes)

A stablecoin launched by Donald Trump's World Liberty Financial crypto venture is being used by an Abu Dhabi investment firm for its $2 billion investment in crypto exchange Binance (reuters).

Tesla's vehicles have the highest fatal accident rate among all car brands in America (roadandtrack). Also, Tesla is facing a proposed class-action lawsuit in California alleging the company is inflating odometer readings in its vehicles to void warranties and covering repairs (news.com.au). Ironic, given how the whole company is solvent only because of tax-payer funded subsidies.

Spain and Portugal blackout blamed by critics on solar power dependency (ft, siliconcontinent). A 100% renewable-powered system exists in activists’ and academics’ heads but not anywhere on earth, at least not at the scale of an industrial society (damagemag).

A judge just blew up Apple’s control of the App Store (theverge).

Donald Trump Jr. co-founds new private members club, Executive Branch, with a $500,000 fee (cnbc).

More Americans are financing groceries with buy now, pay later loans — and more are paying those bills late (cnbc).

As law firms leaned on AI for more paralegal work, and consulting firms realized that five 22-year-olds with ChatGPT could do the work of 20 recent grads, and tech firms turned over their software programming to a handful of superstars working with AI co-pilots, the entry level of America’s white-collar economy contracts (theatlantic).

Saudi Arabian officials are briefing allies and industry experts to say the kingdom is unwilling to prop up the oil market with further supply cuts and can handle a prolonged period of low prices (reuters).

Odds & Ends

For decades, Americans were covering their bodies with more and more tattoos. Now, they’re getting them removed as fast as they can (gq).