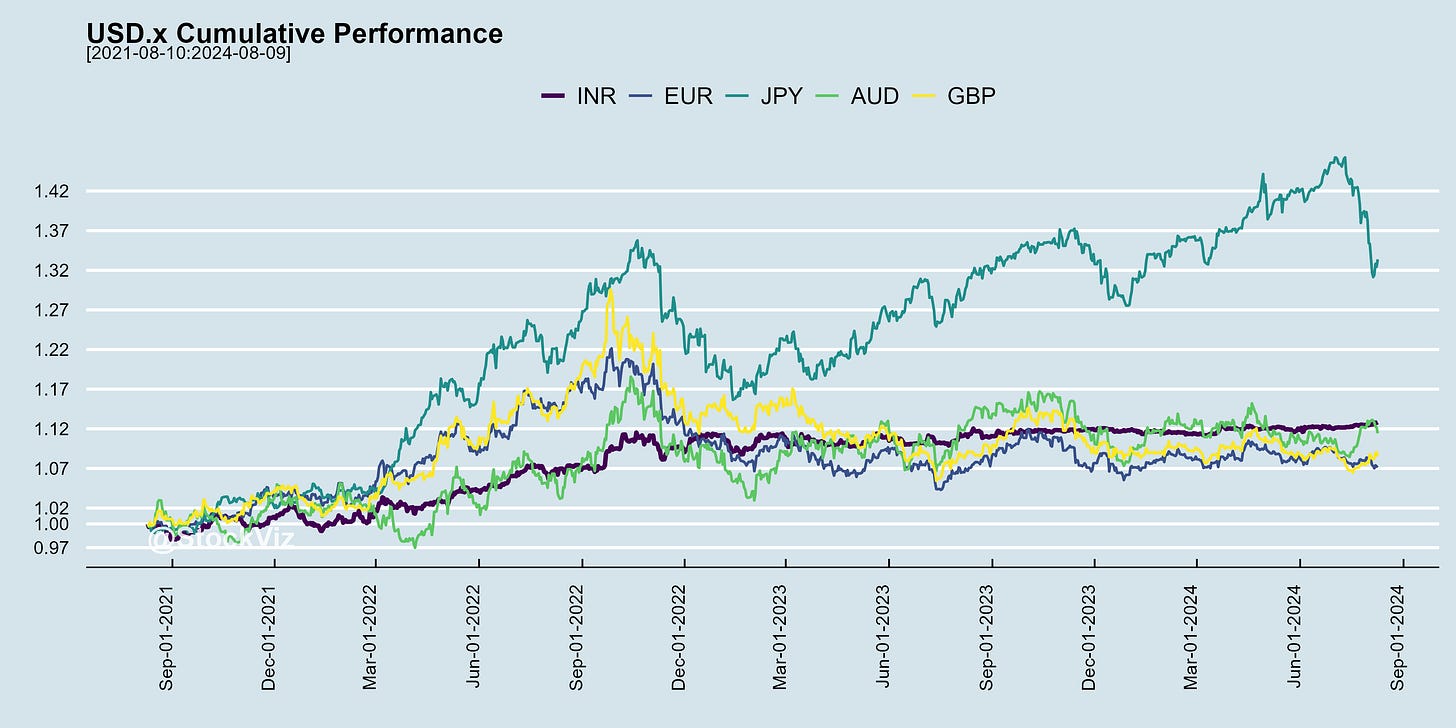

On Wednesday, the 31st of July, the Bank of Japan raised its benchmark interest rate to 0.25% (previously set between 0% and 0.1%) and cited concerns about the historically weak yen, leading to a jump in the Japanese currency. The yen started strengthening.

USDJPY collapsed and fears about a yen carry trade unwind gripped the markets.

Simplifying a bit, a carry trade involves borrowing in a low-interest rate currency, like in Japan where interest rates were negative/zero, and buying high yield assets, like in the US where interest rates were north of 5%.

Since Japanese rates were zero bound for more than two decades, the size of this trade was non-trivial.

On the same day, the US Fed indicated that they were leaving rates unchanged between 5.25% and 5.5%, a two-decade high. However, some leading economic data and corporate earnings were showing a weakening job-market and indications that consumers were tightening their belts. Was the Fed behind the curve?

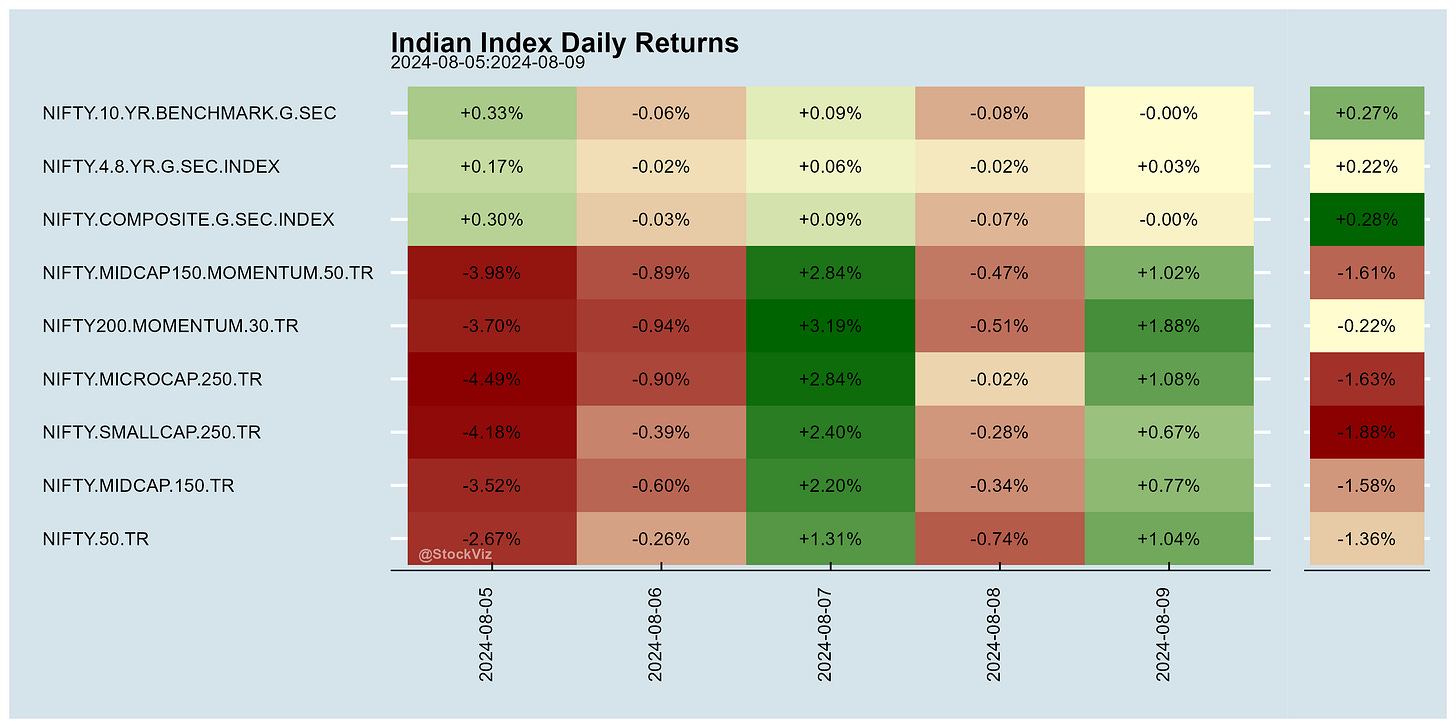

These two fears sent the markets into a tailspin.

EWJ, the iShares MSCI Japan ETF, collapsed 10% in three days. The whole US momentum complex, primarily mega-cap tech shares, sold off. Indian stocks sold off on Monday, the 8th of August, once the levee broke.

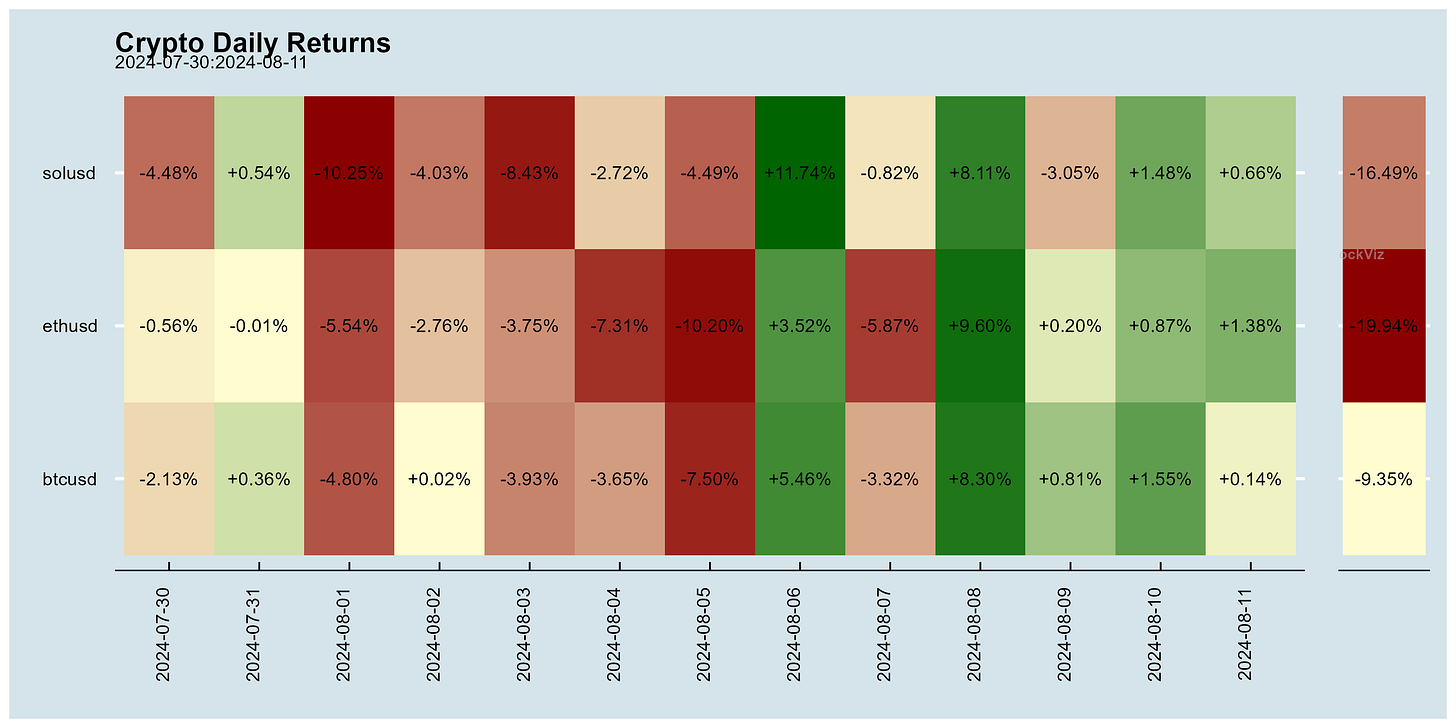

The crypto complex got clocked as well.

VIX spiked.

And total chaos ensured.

While this is a good story, there are certain holes in the carry-trade unwind narrative. The principal one being that, typically, you buy bonds, not equities, with your cheaply borrowed funds. So, an unwind should’ve hit credit (high-yield bonds or corporates) more than stocks.

Weakening US economic data was blamed for sell off on Thursday, the 1st of August, not the Bank of Japan. Apple’s iPhone sales slide, Amazon’s retail miss, Nvidia’s chip delays and Intel’s troubles, all added fuel to the fire.

The Wall Street Journal blamed the Japanese stock selloff on weakening US data.

By Tuesday, the 6th of August, markets started regaining their footing.

The next day, Shinichi Uchida, an influential deputy governor at the BOJ, said that the central bank will not hike interest rates when markets are unstable, playing down the chance of a near-term hike in borrowing costs (reuters).

Markets stabilized.

While there are a lot of commentators who will confidently pin the blame for the selloff on one single explanation neatly tied in a bow, the reality is a lot messier.

John Cochrane’s blog and Odd Lots episode are good places to go down this rabbit hole. In the end, I Can’t Explain.

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Valuing Stocks With Earnings (SSRN)

We show that commonly used aggregate earnings are several times as volatile as stock prices over the last three decades. Movements in the price-earnings ratio are thus entirely explained by earnings growth and unrelated to future returns. As an alternative to the commonly used GAAP earnings, we propose using Street earnings to scale stock prices. Street earnings are smoother than stock prices and contain more information about future fundamentals because they exclude transitory items. We show that the Street price-earnings ratio can predict stock returns out of sample, for both the aggregate market and the cross-section of stocks.

Investment strategies based on forecasts are (almost) useless (arxiv)

Forecasting the future development of stock returns is an important aspect of portfolio assessment. It is shown that there is no substantial difference between the performances of ``best'' and ``trivial'' forecasts - even under euphemistic model assumptions on the underlying price dynamics.

Overnight Returns: Investor Sentiment or Investor Attention? (SSRN)

We unveil that overnight trading activity exhibits behavioural elements of an investor attention rather than an investor sentiment measure.

Does ChatGPT Provide Better Advice than Robo-Advisors? (SSRN)

We develop three investor profiles with different risk attitudes and consult ChatGPT and 17 roboadvisors to recommend an investment portfolio. We compare the recommendations with a benchmark derived from academic literature. ChatGPT’s recommendations align with the three investor profiles and the benchmark. In contrast, only three out of the 17 robo-advisors come close to meeting the benchmark for all three investor profiles. Our findings reveal that ChatGPT provides better financial advice for one-time investments than robo-advisors.

Gender Conformity and Later-Life Outcomes (NBER)

Using thousands of essays written by 11-year-olds in 1969, we construct an index measuring girls’ conformity to gender norms then prevalent in Britain. We link this index to outcomes over the life-cycle. Conditional on age-11 covariates, a one standard deviation increase in our index predicts a 3.5% decline in lifetime earnings, due to lower wages and fewer hours worked. Holding skills constant, girls who conform less to gender norms live in regions with higher female employment and university attendance, highlighting the role of the environment in which girls grow up.

India

Hindenburg Research made it personal by going after the current chief of SEBI. Its latest report alleges that Madhabi Buch, the current Chairperson of SEBI, and her husband had stakes in obscure offshore funds used in the Adani money siphoning scandal (hindenburgresearch, reuters).

Like most Indians, I too believe that almost all government offices are corrupt, and it is impossible to get anything that without some chai-pani or sifarish. However, if you come for the king, you best not miss. And Hindenburg’s piece misses the mark by a mile. @BhagwaanUvacha provides the most level-headed critique of the report.

As an aside, the lack of opportunities to extract chai-pani from the formalized financial sector could also be the reason why it gets the long end of the stick from our netas and babus.

Indian government eases new property tax rules after backlash (reuters).

Lenders to India's Go First have decided to liquidate the company's assets (reuters). An engine maintenance agreement which could have kept Go First flying (economictimes).

Mahindra Group Cos Run into ‘Brand’ Tax (economictimes)

FM Sitharaman urges banks to boost deposits as lending surges, warns of liquidity risks (livemint).

After ₹32,000 crore demand to Infosys, government said to mull GST notices to other IT majors (thehindu).

Bridge built in open field at Bihar village, no road on either side (indianexpress).

RoW

Will Technology Differentiate China Today from Japan in the 1990s? (carnegieendowment)

A second China shock is rapidly unfolding, this time in the EU's key sectors. And the shock is much larger (@SanderTordoir).

ETFs are eating the bond market (ft)

Carbon capture and storage technology: Oil companies sold the public on a fake climate solution — and swindled taxpayers out of billions (vox).

There’s mounting evidence that GLP-1 drugs have health benefits beyond diabetes and weight loss, for conditions ranging from addiction to Parkinson’s—and scientists are evolving theories of why (wired).