When FOMO meets YOLO

Its not whether you'll survive a nuclear apocalypse. It is how rich you'll be if you did.

Aswath Damodaran, in his recent post (Russia in Ukraine: Let Loose the Dogs of War!) on the markets’ reaction to Putin’s war, concluded:

There is a worst case scenario in the Russia-Ukraine war, that few of us are willing to openly consider, where the conflagration spreads beyond the Ukraine, and nuclear and chemical weapons come into play. While the probability of this scenario may be very low, it is not zero, and to be honest, there is no investing strategy that will protect you from that scenario, but market pricing will reflect that fear. If we escape that doomsday scenario, and come back to something resembling normalcy, markets will bounce back, and in hindsight, it will look like they over reacted in the first place, even if the risk assessments were right, at the time. Put simply, assuming that crises will always end well, and that markets will inevitably bounce back, just because that is what you have observed in your lifetime, can be dangerous.

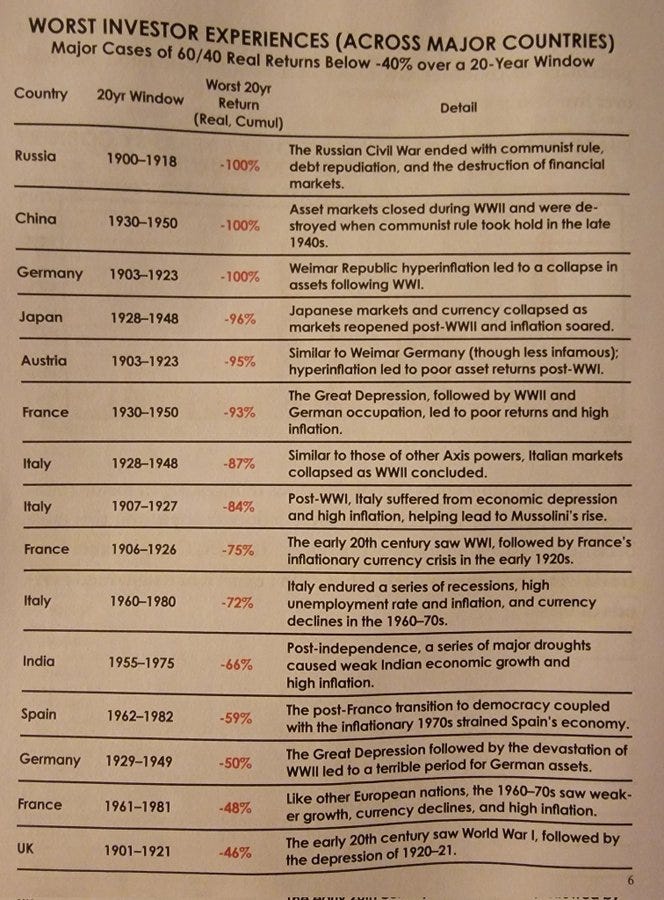

He is not wrong. There are plenty of instances where markets went to zero and took decades to recover.

Whether markets bounce or not in the future is not knowable. However, if there is indeed a WW3 and we get vaporized, how does any of it matter? And if we don’t, then wouldn’t have rather bought the dip?

This is where FOMO meets YOLO to BTFD.

But where is the dip?

The only thing with a drawdown greater than 20% is the MSCI Emerging Markets Index ETF (EEM) which is one-third Chinese stocks.

India, that imports 82% of its oil needs and has seen its oil import bill more than double, has held up remarkably well, all things considered.

Developed ex-US (SCHF) looks attractive but it is not really throwing off the “blood in the streets” vibe.

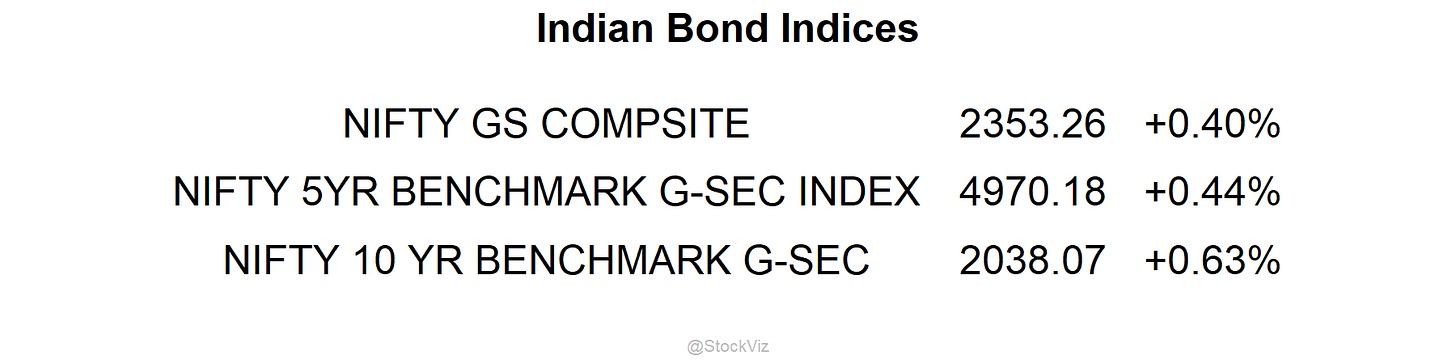

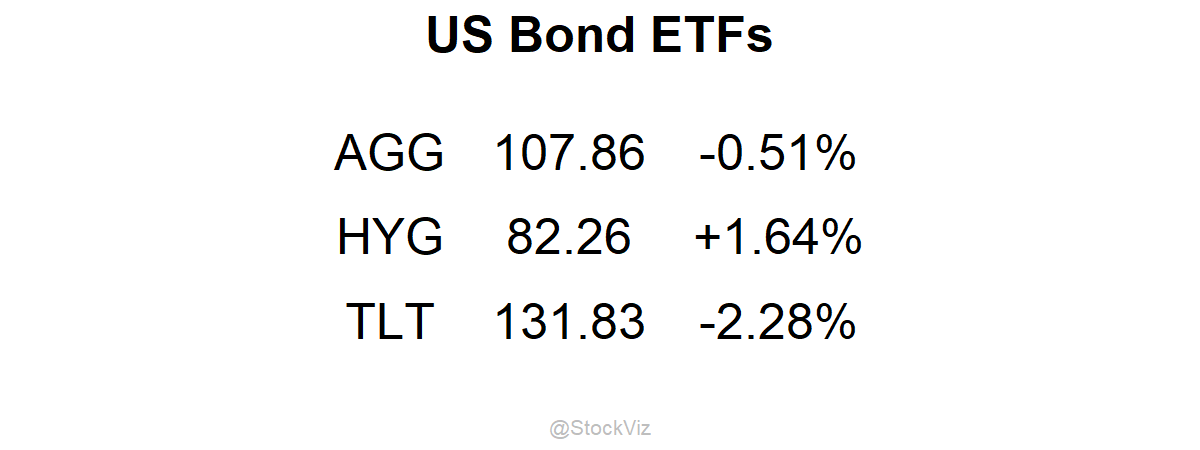

With real interest rates negative, are we really going to overweight bonds? Indian CPI is ~6% with 10-year bond yields around the same level. US CPI is ~8% with 10-year yields at 2.15%. If central banks hold off on rate hikes due to Putin’s war (BloombergQuint), then what is their message to risk markets?

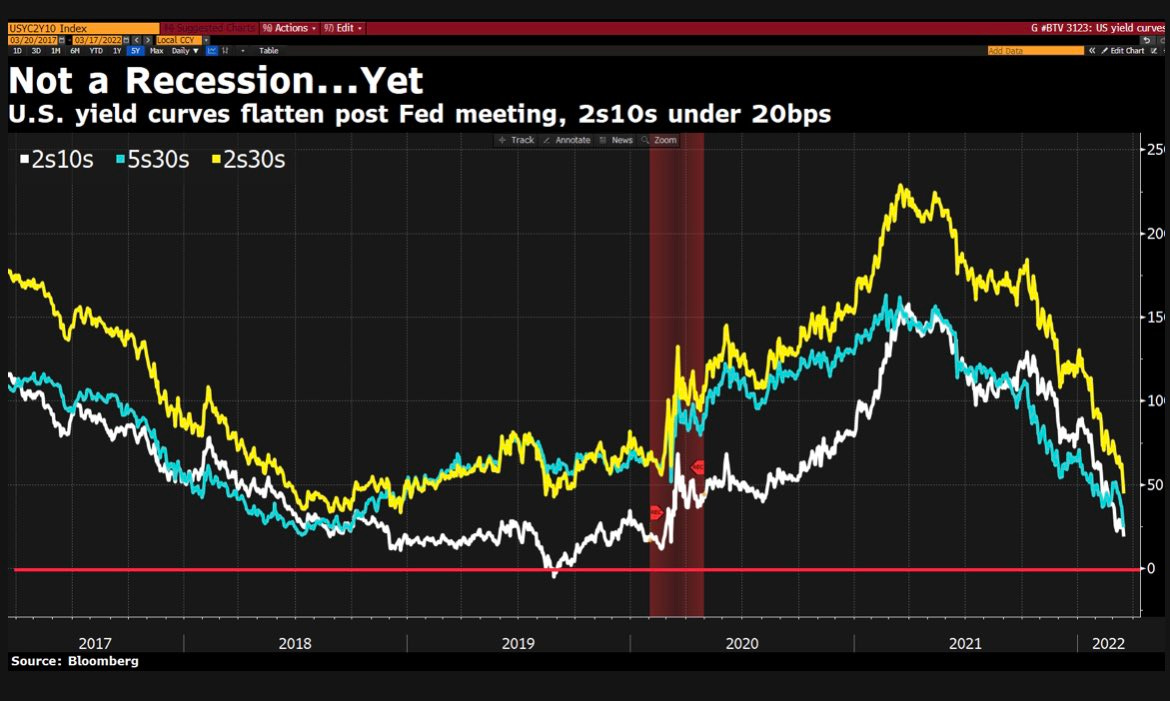

Meanwhile, rates are beginning to price-in a recession.

And financial conditions are tightening.

We seem to be trapped in some sort of lala land where in spite of possible thermonuclear destruction and recessionary vibes, equities are holding up, central banks are “looking through” and cash is slowly burning. Something’s gotta give.

Markets this Week

Links

The Sri Lankan economy is imploding. (Economist)

AI powered drug design software developed biological weapons on its own. (Economist)

Russia is the world’s largest exporter of fertilizers, accounting for 23% of ammonia exports, 14% of urea exports, 10% of processed phosphate exports, and 21% of potash exports. The primary destinations of fertilizers from Russia are Brazil (21%), China (10%), the US (9%), and India (4%). Farmers should expect higher fertilizer prices, leading to management decisions about the profitable use of fertilizers. Given the geopolitical consequences of the conflict, these disruptions could play out over many years. (farmdocdaily)

Russian Oil = Confederate Cotton (Roger Lowenstein)

CDC reports fewer COVID-19 pediatric deaths after data correction. (Reuters)

Why did France stay on the gold standard during the Napoleonic wars while Britain left it? (pricetheory)