Write it down

path or destination, not both.

Thesis drift: you enter into a trade with something in mind. You over-stay in the trade because of something entirely different. This is especially true if the trade starts going against you.

Pick one: path or destination. Most of the time, investors buy looking at the destination. 5-year CAGR of 25%! Sign me up! But end up exiting on a 30% drawdown. We can always reenter when the coast is clear.

The only way I’ve been able to manage this is by writing down the reasons why I did what I did. Keeping a diary and looking back on your decision-making process beats reading the next self-help book.

Also, whenever possible, always test if what your eyes see is backed by data. Whenever I have the price chart of NIFTY open, I end up seeing “patterns.” Especially around half-hourly/hourly boundaries. So, I finally blocked some time to explore these intraday patterns. Here’s the first, most simple/basic test: Adventures in Pattern Matching, Part I

My gut says that it is going to end up with some sort of intra-day trend-following. Let’s see what happens…

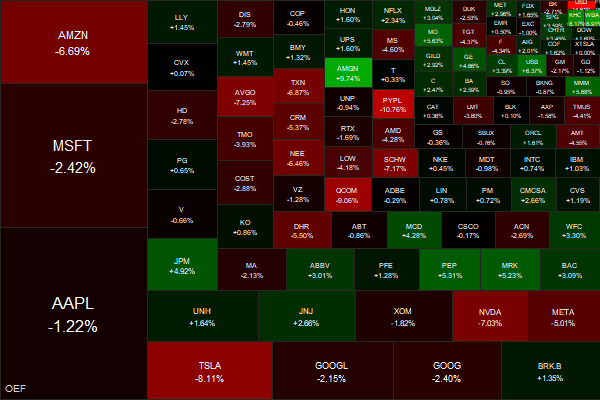

Markets this Week

An all-important, widely followed, well researched inflation print in the US came in hot on Thursday. And the markets didn’t know what to do with it. Pre-market, the Dow was down 500 points. It closed up 800. Wildest swing I’ve ever seen. Friday was worse - markets gave up all of Thursday’s gains. Mindboggling.

Links

This is a handy short-cut to calculate the VIX implied daily move of the underlying index.

~

Dollar dominance continues…

Global margin call hits European debt markets. Hedges blow up after risk gauges in Germany’s government debt market exceeded those of the 2008 world crash. (asiatimes)

~

If trend remains the same, bond yields could drop below zero for good in 2066. That will be Bitcoin’s time to shine.

~

As COVID-19 shutdowns threatened businesses back in 2020, the U.S. government began issuing nearly $800 billion in potentially forgivable Paycheck Protection Program loans. The program was designed to help small businesses keep workers employed during the uncertain early days of the pandemic.

More than two years later, the overwhelming majority of these loans have transformed into government grants, as 91% have been either fully or partially forgiven. The SBA expects that figure to grow to nearly 100% as more forgiveness requests are processed this fall.

Virtually all PPP loans have been forgiven with limited scrutiny

~

Electric cars, wind turbines and solar panels are made with a wide variety of minerals — from graphite to tellurium — that currently are only available in a few corners of the globe. Some of these minerals are not mined enough to feed a world powered without fossil fuels.

How much mining is needed to save the planet?

If one wants to reduce climate change, they should consider buying a solar farm instead of an EV.

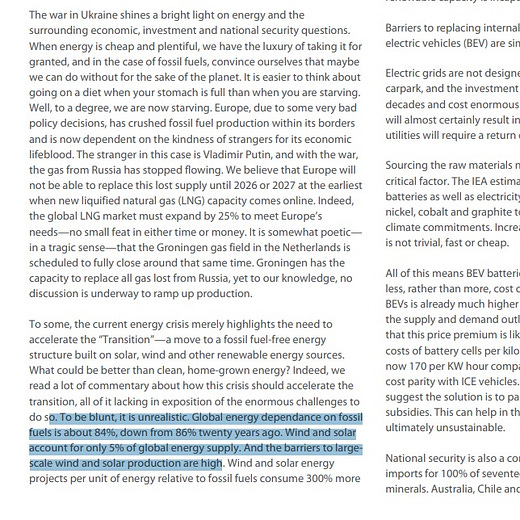

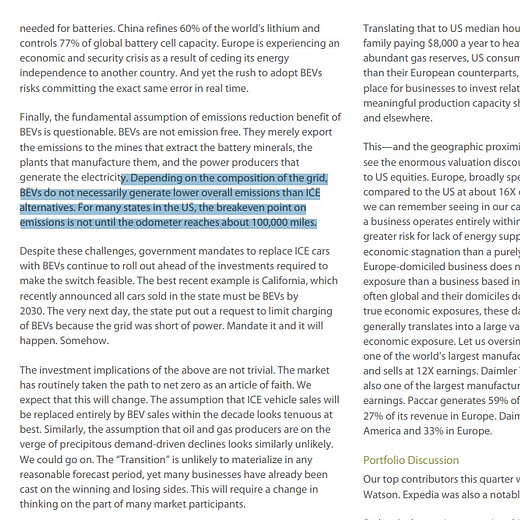

Exploring the Hidden Drawbacks of Electric Vehicles

~

Biden Is Now All-In on Taking Out China. (foreignpolicy)

China to be declared ‘threat’ to Britain in tough new stance after ‘aggressive’ presence. (thesun)

~

The only way to put the I in AI is by using our brains.

~

Woods and her fanbois should take notes - a good product is not “disruption.”

~