Your Media Diet

... got simpler

Finance channels on TV are mostly useless. All they managed to do is increase your blood pressure with needless graphics, hyperactive anchors and inane interviews. However, the rare interviews with CEOs and knowledgeable analysts are actually useful. But to catch those, you need to have the TV on the whole day.

Not any more!

We have started summarizing videos posted by these TV channels throughout the day and posting them on a permalink here.

Over a period of time, we will have a fully searchable archive that we can then mine for alpha.

Currently, you can access past digests by date: https://stockviz.github.io/reports04/media/daily/<yyyy-mm-dd>.html

So, for January 1, 2026, go to: https://stockviz.github.io/reports04/media/daily/2026-01-01.html

Happy New Year!

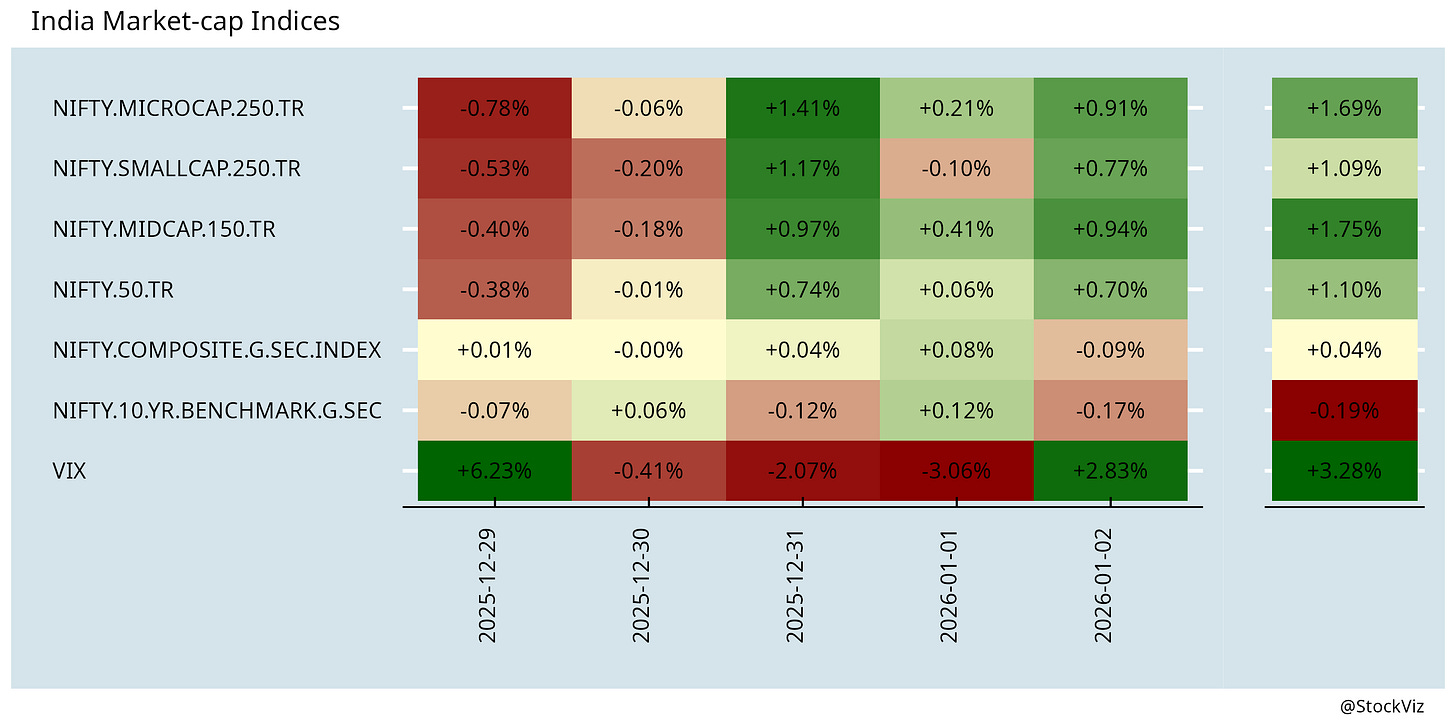

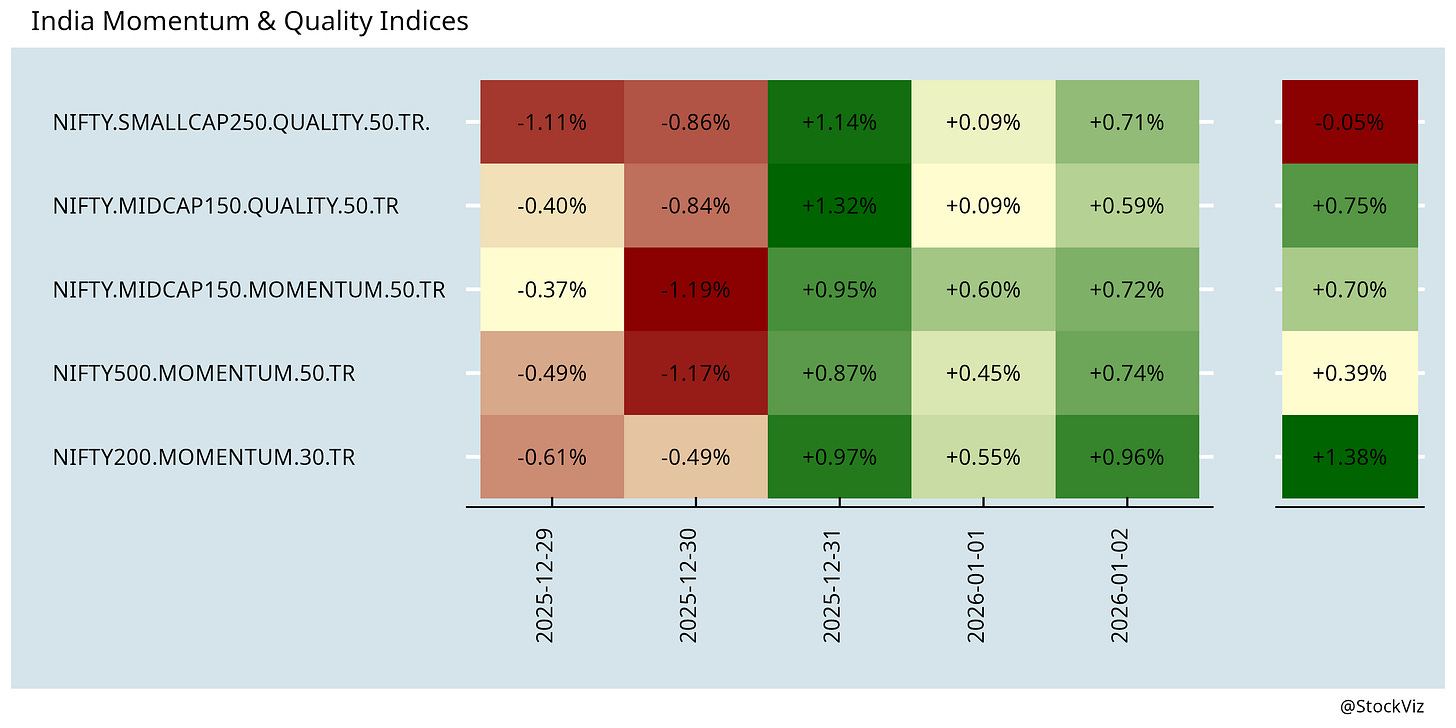

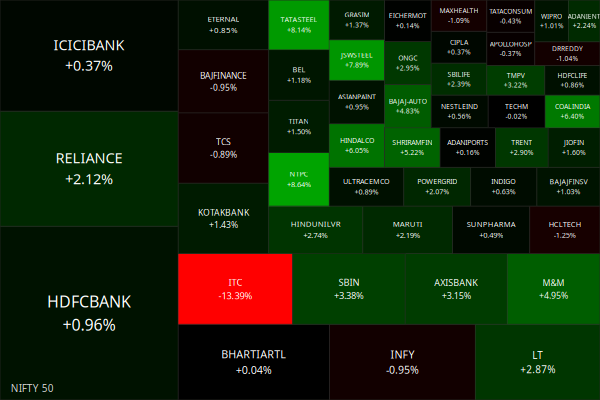

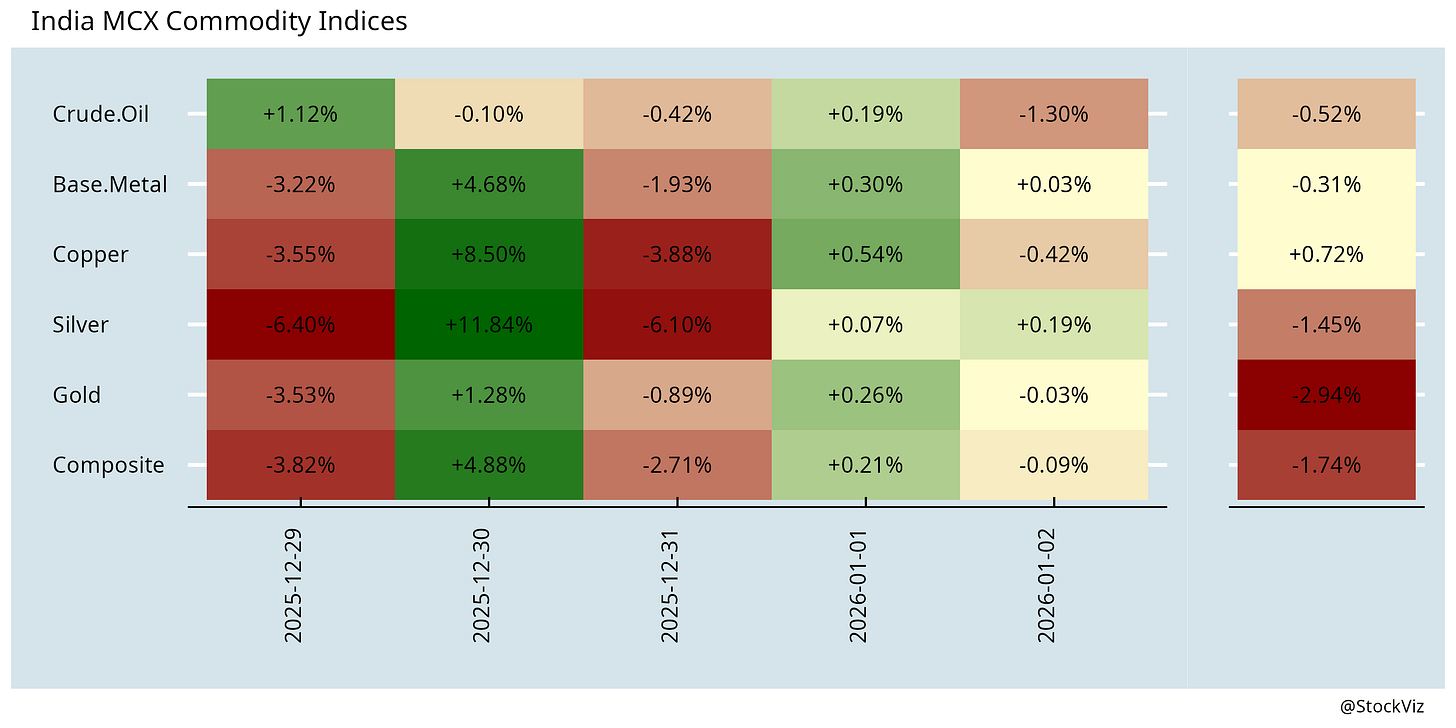

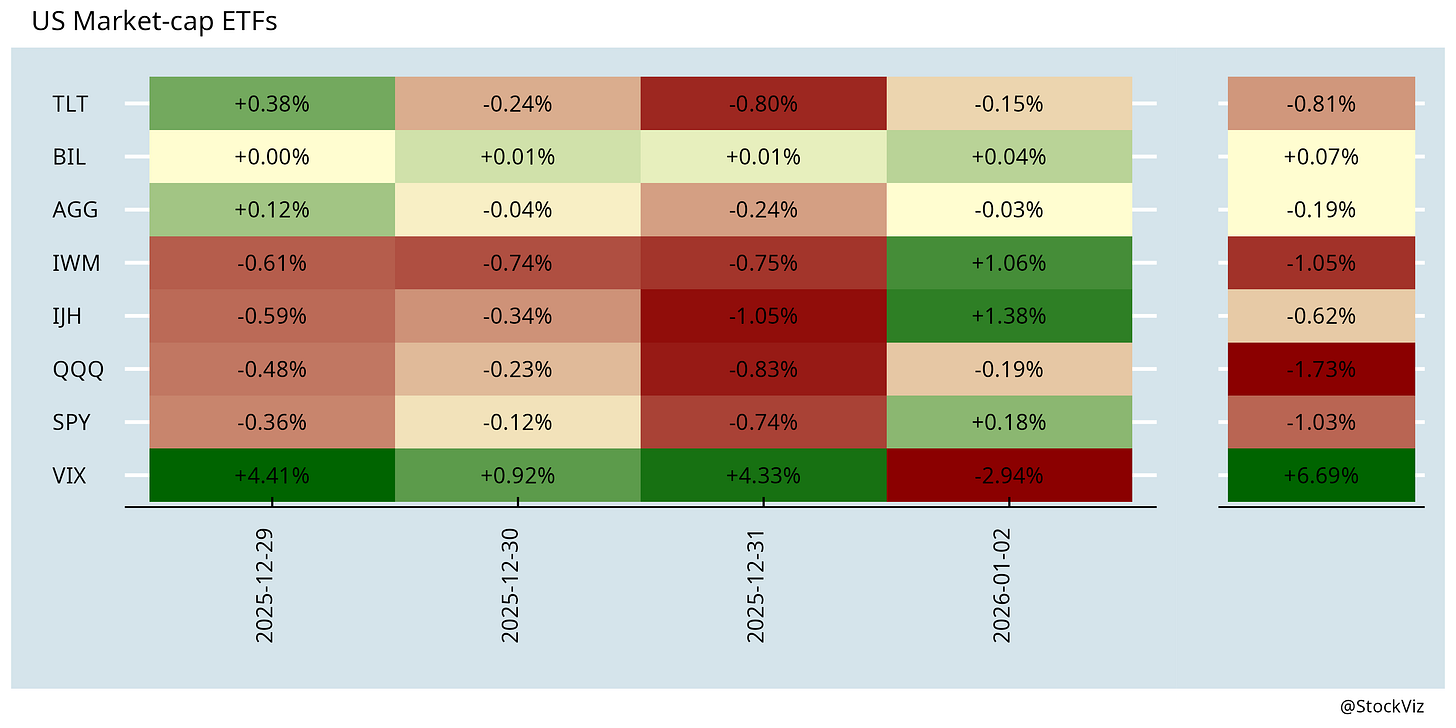

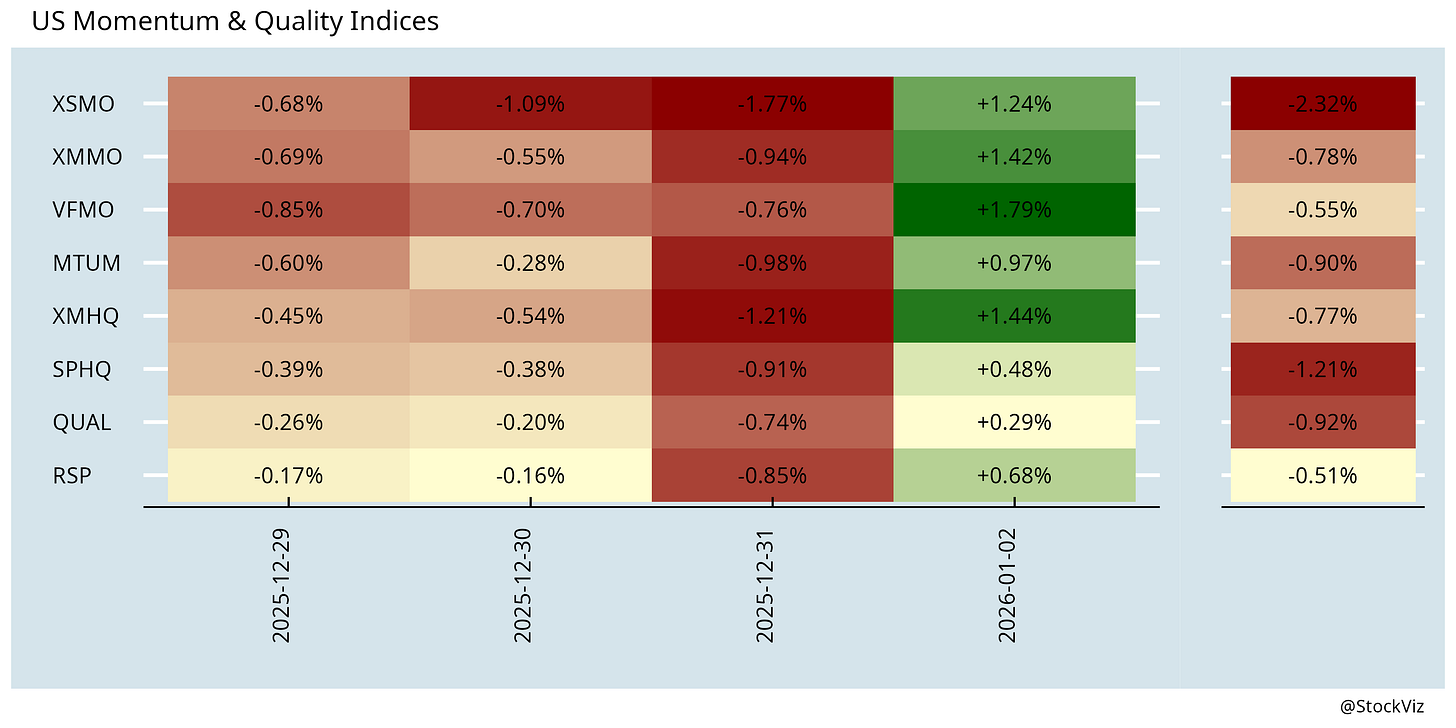

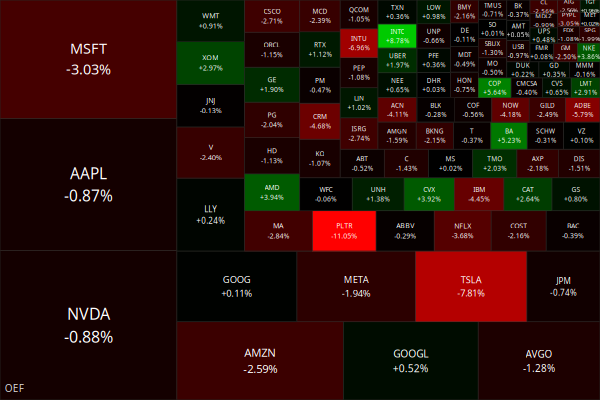

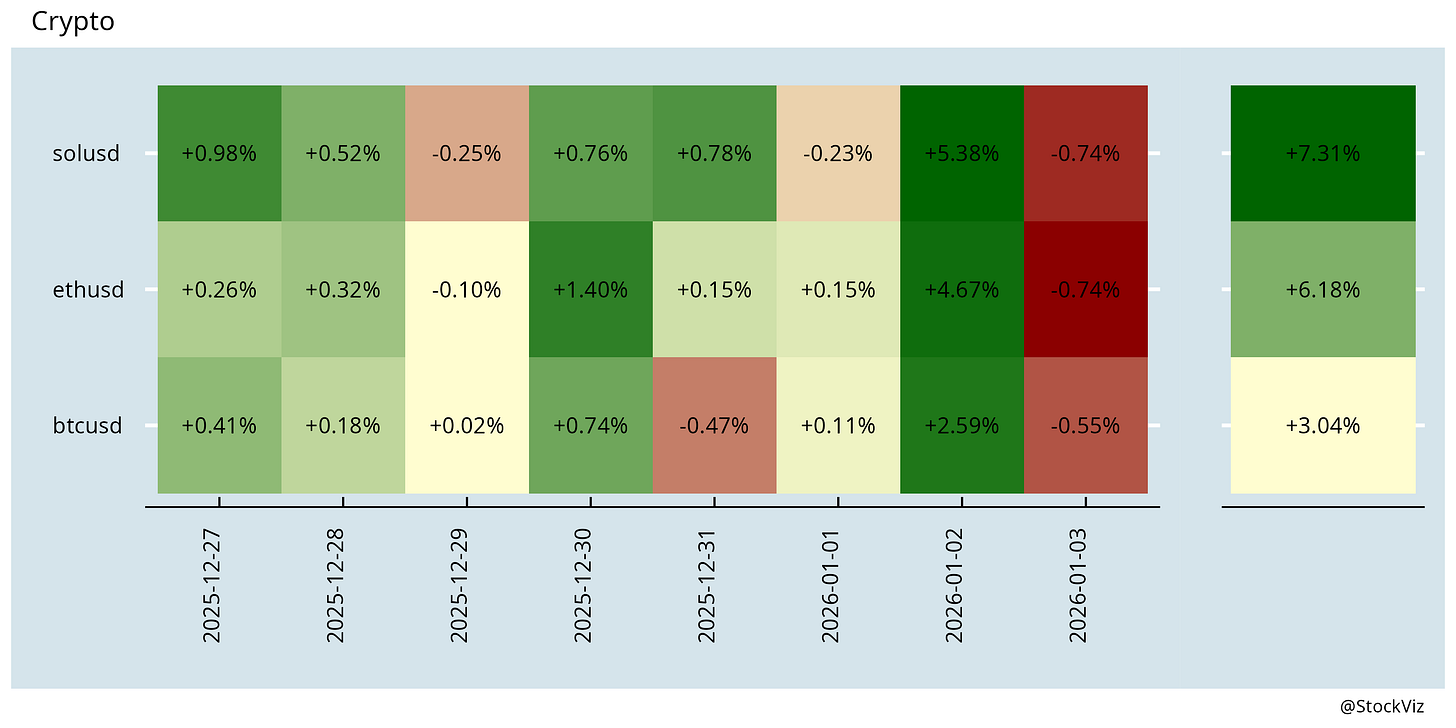

Markets this Week

Our 2025 Scorecard can be found here.

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Seattle’s Delivery Minimum Wage Failed Drivers and Raised Costs (reason)

Food orders plunged to unprecedented lows, delivery costs exploded, and driver earnings appeared to crater. The law had no long-term effect on driver wages.

Who’s Afraid of the Minimum Wage? (oup)

We find that on average, firms in highly exposed industries do not substantially reduce employment. Higher wage floors, however, forestall entry, particularly for less productive firms, reducing the number of independent firms operating in these industries by roughly 2%. Yet these industries do not shrink; instead, incumbent responses and strong positive selection among entrants reshape industries that rely heavily on low-wage workers, yielding fewer but more productive firms after the cost shock.

Brazil: The heart of the ‘zombie’ economy in emerging markets (fgv)

On average, static ‘zombies’ account for 7.58% of firms and dynamic ‘zombies’ for 5.49% across emerging markets. Brazil consistently exhibits the highest shares, with 16.75% for static ‘zombies’ and 13.94% for dynamic ‘zombies’, approximately 2.3 times higher than the emerging market averages, confirming its status as the largest ‘zombieland’ in the group.

India

We are going to replace MG-NREGA with VB-GRAMG and it is going to be glorious (swarajyamag). A key thrust of the VBGRAMGs is to create livelihoods that would not just sustain people’s lives but steadily improve it (thecapitalcalculus).

Everyone’s getting on the pill. Obesity drugs may spur licensing, distribution deals for Indian drugmakers after patent expires (theguardian, livemint).

India’s poor have been increasingly buying durable goods, and the number of poor households owning such goods has risen significantly over the past decade (economictimes).

Non-housing retail loans, largely for consumption, accounted for 55.3% of household borrowings in the first half of FY26 (livemint).

Capacity utilisation in manufacturing sector has struggled to break past 75% — widely seen as the level that must be crossed on a sustained basis for firms to invest. In the 53 quarters since the start of 2012-13, capacity utilisation has exceeded 75% on just 10 occasions. Since 2011-12, private corporate investment has flatlined at around 12% of GDP (indianexpress).

India just threw down $5.4 billion to crash the global shipbuilding party (gcaptain).

Rolls-Royce is considering India as its third home market, planning significant investments in various sectors (livemint).

India's textiles and apparel exports, including those of handicrafts, stood at USD 2,855.8 million in November 2025, registering a growth of 9.4 per cent year-on-year (economictimes).

New Zealand has committed to providing 100 percent duty-free market access across all tariff lines for India’s current exports. This covers 100 percent of Indian export value to New Zealand and eliminates earlier peak tariffs of up to 10 percent on key products such as textiles and apparel, leather goods, ceramics, carpets, automobiles, and auto components (india-briefing).

Australia to remove tariffs on 100% of Indian exports from January 1 (thehindu, indianexpress).

India gets unprecedented market access in Oman trade pact (economictimes).

US approves Holtec to build nuclear reactors in India (economictimes).

Zero To 394 million in Two Years: India’s 5G Takeover (openthemagazine).

What the H-1B visa looks like after the 2025 reset (economictimes)

row

The performance of AI machines tends to improve at the same pace that AI researchers get access to faster hardware.

Activist group says it has scraped 86m music files from Spotify (theguardian)

Iran’s currency ‘turns to ash’ as economy spirals (ft). Iran has been rocked by protests that started in Tehran and have spread to other cities (thehindu).

If Big Tech and data centre operators collectively spend around $400 billion on AI infrastructure in 2026, then, by our estimate, at least $80 billion in annual net income would need to be generated to justify that investment. The hurdle is high because processors, which make up the bulk of capex, have a useful life of only about five years. Back-solving this requirement implies that something like 333 million paying users of ChatGPT – roughly the entire US population – would be needed to support such economics.

More than half of young voters now back zero-sum parties of the right or left in the US, UK, France and Germany (ft).

we cannot allow meritocracy to be used as a justification to open America’s labor market to the world in the name of finding ‘global talent’ that undercuts American workers.

One of America’s Most Successful Experiments Is Coming to a Shuddering Halt

Leaving the EU has already reduced British GDP per person by 6-8% (economist).