Ceteris paribus

other things equal

The default weighing scheme for indices is free-float1 market-cap. i.e., each stock in the index has a percentage allocation in proportion to its market capitalization. However, there is more than one way to skin the cat - make all the weights equal.

Cap-weighting is actually a slight of hand for reducing transaction costs.

In 1971, Wells Fargo launched the first index fund. Equal weighted, the fund held each of the roughly 1,500 stocks listed on the New York Stock Exchange. The fund encountered heavy transaction costs as it sought to rebalance the holdings. By the mid-1970s, the cap-weighted approach, which was a lot easier to manage, had taken over.

All Funds Being Equal (barrons)

India is a high-cost venue for trading. We have STT (Securities Transaction Tax - a sort of Tobin Tax) and a myriad of other taxes that penalize trading activity. Given that equal-weighting schemes typically rebalance once a month compared to simple entry/exit trades for cap-weighted portfolios twice a year, it feels like a waste of money just to keep allocations in sync.

Also, equal-weighting is a sort-of “sell the winners to buy the losers” strategy2.

What if there are a few tailenders that are severely lagging the market? It is painful to watch the equal-weight portfolio mechanically sell well-performing frontline stocks to buy minor stocks that are getting pummeled in the market.

So, cap-weighting makes sense most of the time. However, what if cap-weighting creates a severely lop-sided portfolio?

Currently, the Magnificent Seven stocks (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla) are about 30% of the S&P 500 index. And these are considered to be widely overvalued with P/E ratios roughly double that of the rest3. If this makes you nervous, then paying up for an equal-weight portfolio might make sense.

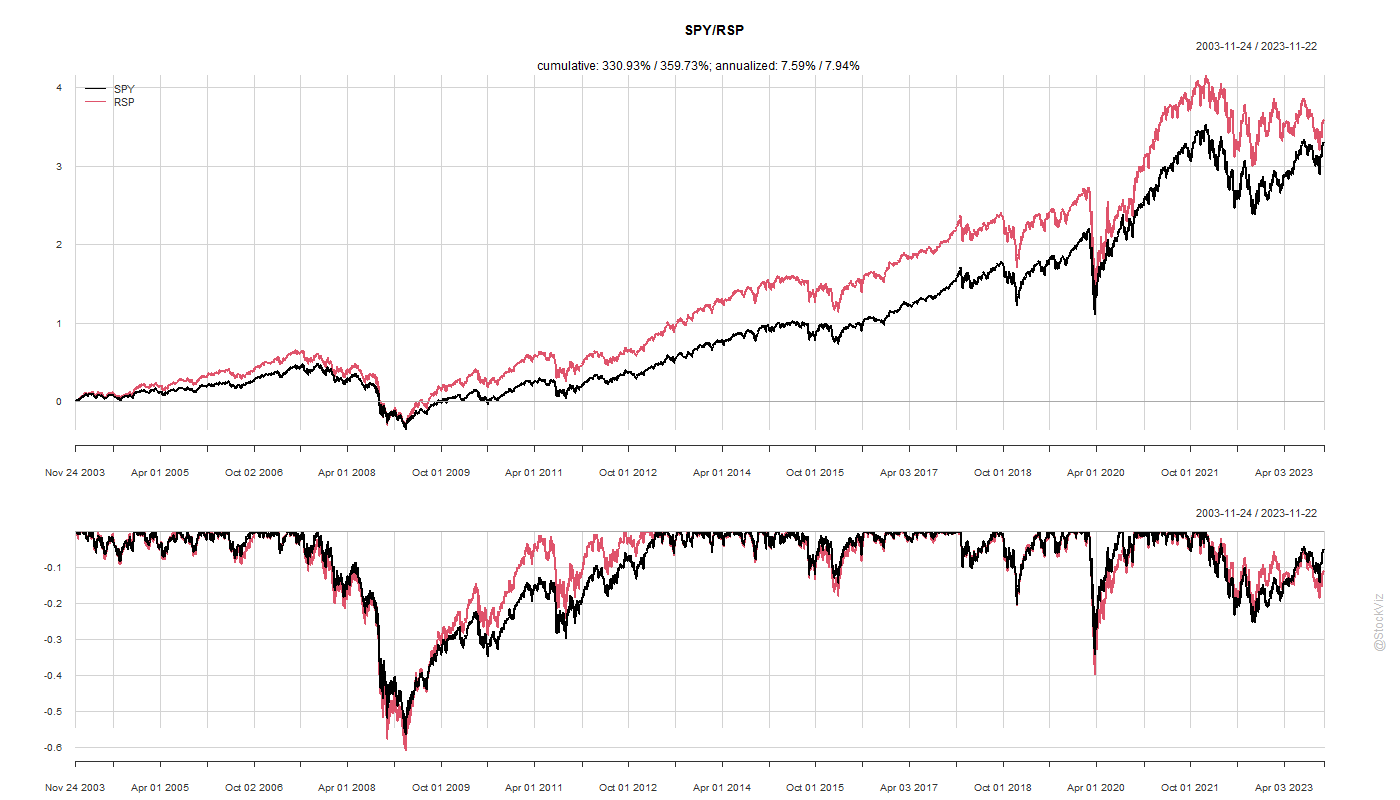

In spite of the costs, equal-weight in India has outperformed over the “long term”.

However, there have been consecutive years of under-performance that could test your patience.

The S&P 500 has a narrower performance gap with the cap-weighted portfolio catching up thanks to the Magnificent 7.

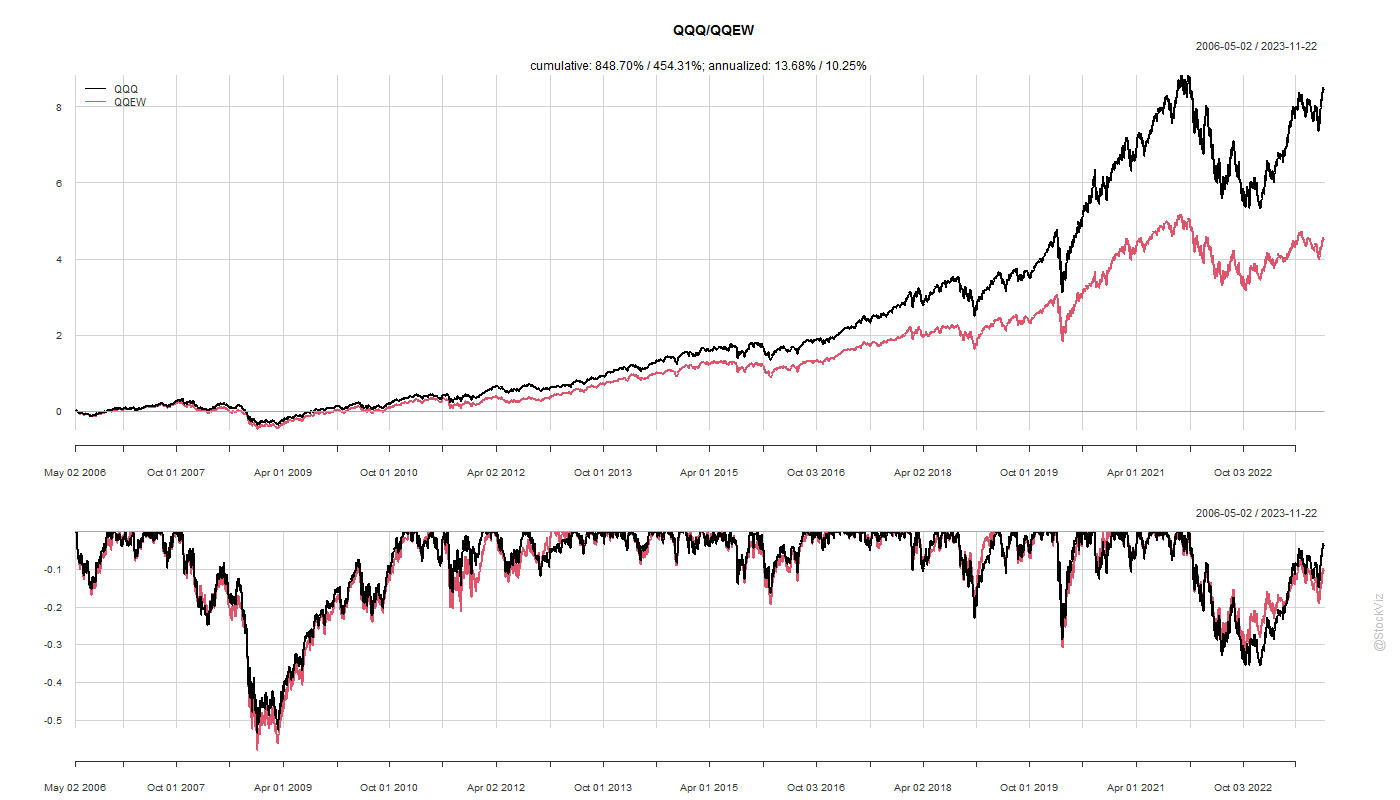

The Nasdaq 100 is where Magnificent 7 have their largest impact.

Ceteris paribus, it boils down to how comfortable you are with valuations on the index heavyweights and whether you are fine with an “anti-momentum” portfolio.

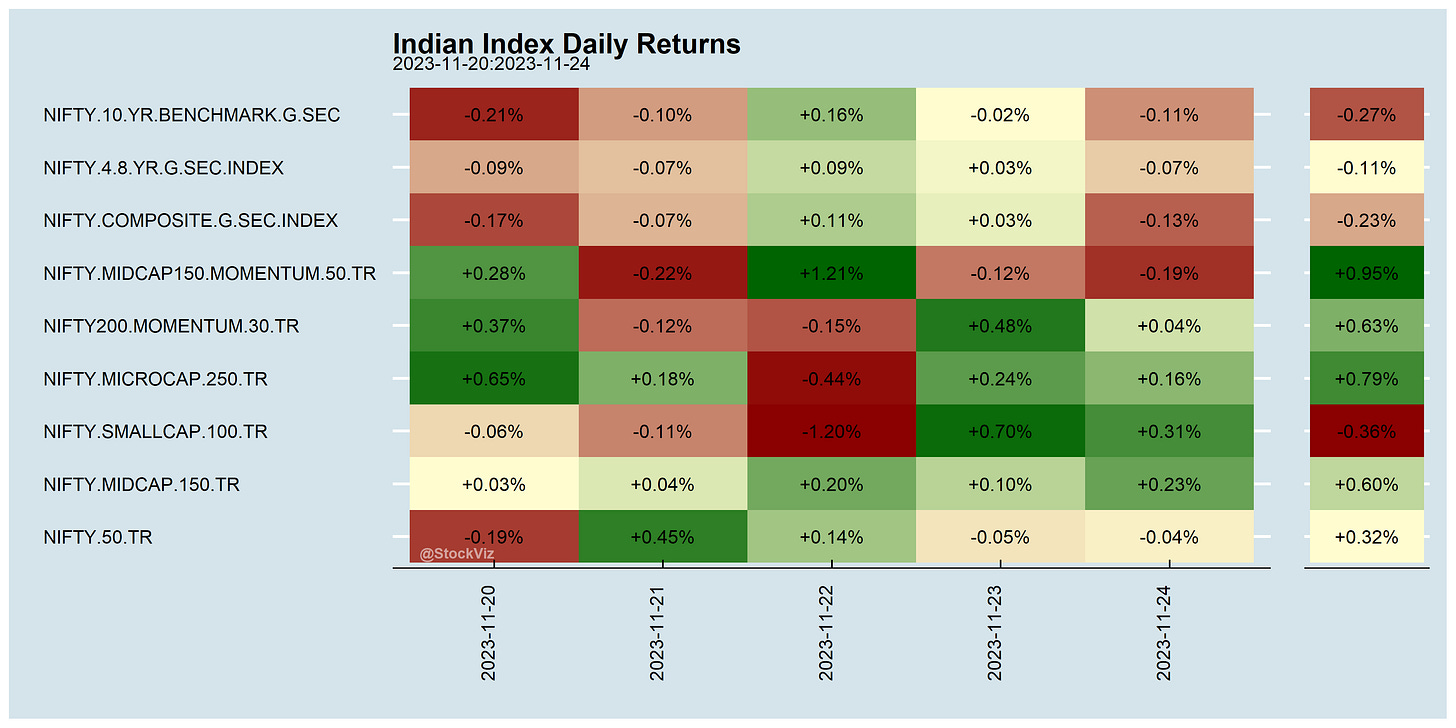

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

What Drives Booms and Busts in Value?

Value investing delivers volatile returns, with large drawdowns during both market booms and busts. This paper interprets these returns through an intertemporal CAPM, which predicts that aggregate cash flow, discount rate, and volatility news all move value returns.

Do Macroeconomic Experiences Affect Risk Taking?

Individuals who have experienced low stock market returns throughout their lives so far report lower willingness to take financial risk, are less likely to participate in the stock market, invest a lower fraction of their liquid assets in stocks if they participate, and are more pessimistic about future stock returns. Those who have experienced low bond returns are less likely to own bonds. More recent return experiences have stronger effects, particularly on younger people.

The Quarterly Journal of Economics (oup)

Large teams develop and small teams disrupt science and technology

Smaller teams have tended to disrupt science and technology with new ideas and opportunities, whereas larger teams have tended to develop existing ones. Work from larger teams builds on more recent and popular developments, and attention to their work comes immediately. By contrast, contributions by smaller teams search more deeply into the past, are viewed as disruptive to science and technology and succeed further into the future.

NSF (pdf)

The Power of Proximity to Coworkers

What are the effects of proximity to coworkers? We find being near coworkers has tradeoffs: proximity increases long-run human capital development at the expense of short-term output.

Counterproductive Sustainable Investing

A reduction in financing costs for firms that are already green leads to small improvements in impact at best. In contrast, increasing financing costs for brown firms leads to large negative changes in firm impact. Thus, sustainable investing that directs capital away from brown firms and toward green firms may be counterproductive, in that it makes brown firms more brown without making green firms more green. We further show that brown firms face very weak incentives to become more green. Due to a mistaken focus on percentage reductions in emissions, the sustainable investing movement primarily rewards green firms for economically trivial reductions in their already low levels of emissions.

Ten Facts about Son Preference in India (NBER)

Economy & Investing

India

Personal details of about 1.5 million people may have been compromised in a data breach at the Tata-owned Taj Hotels group earlier this month (timesofindia)

Warren Buffett’s Berkshire Hathaway exits Paytm at a 40% loss (techcrunch, reuters)

Domestic passenger numbers rose from 98m in 2012-13 to 202m in 2019-20. Already the third-biggest domestic aviation market by volume, India is projected to be the third-largest overall by 2026. (economist)

A new class of wealthy entrepreneurs, executives and dealmakers are muscling into India’s luxury market. (bloomberg)

Bangalore has gone from bucolic retirement community to overcrowded metropolis in just three decades. (bloomberg)

The agricultural system that feeds India’s 1.4 billion people — and many more in overseas export markets — still relies on tens of millions of ill-equipped smallholders. Urban populations are expanding and diets are changing on the subcontinent, demanding more from the land. Yet farm plots are shrinking, infrastructure remains rickety and climate change is only bringing more disruption. (bloomberg)

RoW

The United States is preparing to announce a pledge to triple the world’s production of nuclear energy by 2050, with more than 10 countries on four continents already signed on to the first major international agreement in modern history to ramp up the use of atomic power. (huffpost)

Sodium-ion batteries are becoming a thing. (northvolt, JW Insights)

The largest enforcement action in US Treasury’s history against Binance (treasury)

The Pentagon is moving toward letting AI weapons autonomously decide to kill humans (yahoo)

Meme of the Week

The last week in OpenAI history (@Birdyword)

refers to the shares of a company that can be publicly traded and are not restricted (i.e., held by insiders)