ClusterVol

Volatility clusters both on the downside and upside

We often come across articles that warn us about missing the “good days”, asking us to stay invested no matter what.

What is left unsaid is that these good days tend to happen around very bad days. Both upside and downside volatility clusters.

Notice how close together the +ve & -ve outliers are?

If you are a buy & hold investor, your #1 job is to not get spooked by these down moves.

On the other hand, if you are running an active strategy, then you should be at peace when it misses some of the up moves as it tries to navigate volatile markets.

Notice how there are less of both +ve & -ve outliers in this example?

I guess the main takeaway is that you know your choices and be at peace with them.

Read more here: Large Moves Happen Together

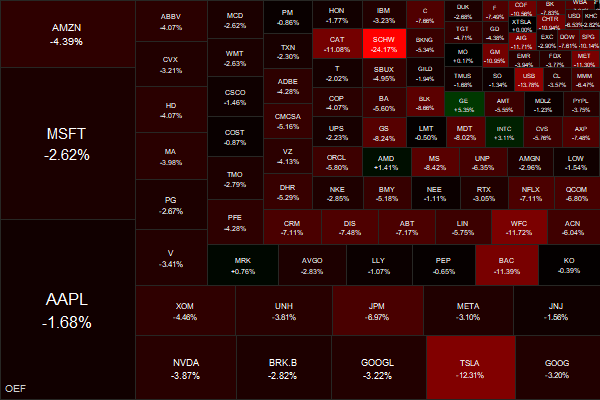

Markets this Week

Last week, we had flagged the ongoing problems at Silvergate Capital. It decided to shutdown on Wednesday.

The California lender, one of the crypto market’s top banks, said it would wind down and return all deposits following a run that forced it to sell off assets at a steep loss to cover billions of dollars of withdrawals.

Silvergate’s nearly 10-year crypto experiment collapsed in a matter of months (wsj).

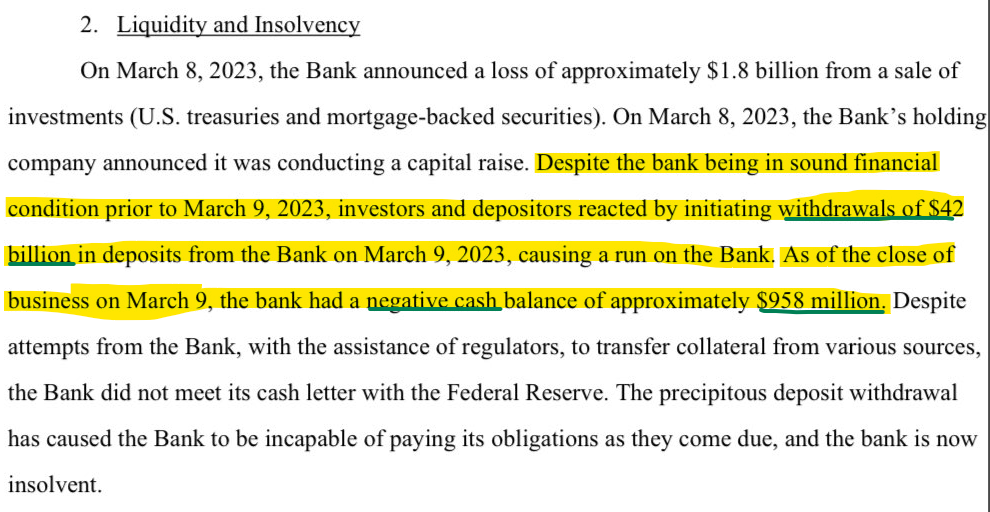

While Silvergate was a crypto casualty, the 40 year old Silicon Valley Bank (SIVB) collapsed on Friday in the second-biggest bank failure in U.S. history after a run on deposits. The bank was in sound financial condition on Wednesday, as per the Fed, their regulator. A day later, it was insolvent (wsj).

It looks like deposits should (eventually) be money good as the assets are unwound over time. Remember that even Lehman Brothers paid out their customers and secured creditors in full (reuters).

Investors are stampeding out of US regional banks ($KRE).

Indian banks got sold off in sympathy but I doubt there are any major fears of contagion.

Long bonds got bid.

More here: country ETFs, fixed income, currencies and commodities.

Crypto got crushed in a bizarre twist of fates.

Links

Silicon Valley Bank, R.I.P

SIVB rode the VC boom like a champ. It then used these inflows to:

- Increase loans 100% to $66B

- Go hog wild with its "held-to-maturity" (HTM) securities portfolio, ramping its mostly Agency mortgage holdings from $13.5B at Q4 '19 to $99B at Q4 '21.

SIVB's big problems are with its HTM portfolio.

The bank basically increased its security portfolio by 700% at a generational TOP in the bond market, buying $88B of mostly 10+ year mortgages with an average yield of just 1.63% at Sept 30th. Oops!(RagingVentures, Jan 18, 2023)

Silicon Valley Bank experienced $42B in withdrawals at the close of business yesterday (that's basically 1/4 of the bank's $161B in deposits at last regulatory filing)—and had a negative cash balance of nearly $1B (Joseph Politano)

The financial collapse was largely driven by a communication collapse. SVB took a hit to their balance sheet, like many others have, and they decided to raise some money. Where things went terribly wrong was the communication, specifically: (1) WHAT they said, (2) WHO the audience was, (3) WHEN they did it, and (4) HOW they framed it. (Lulu Cheng Meservey)

And, of course, Cramer asked you to buy it.

~

First Silvergate Capital, then Silicon Valley Bank, crypto becoming a victim of the very problem that birthed it.

~

Macro

Sales of luxury U.S. homes declined a record 44.6% year over year to the second lowest level on record during the three months ending Jan. 31, 2023. That outpaced the record 37.5% drop in sales of non-luxury homes. Redfin’s records date back to 2012. (redfin)

20 banks that are sitting on huge potential securities losses. (marketwatch)

China’s economic development model resembles that of Japan over 30 years ago with high savings, and high investment, but with restrained consumption and rigid institutions weighing increasingly on macroeconomic success. China’s chronic over-investment and misallocation of capital, particularly in the property sector, pose a potentially bigger economic problem than Japan’s banking crisis in the 1990s. (lse)

Labour data points to significant distress in the Indian economy. The absolute count of workers in agriculture stood higher in 2021-22 than in 2011-12, a decade ago, implying a declining per worker income in agriculture and worsening rural distress. (livemint)

The Swiss National Bank reported an annual loss of $141.54 billion. The loss, the biggest in the central bank's 115-year history, was caused by a plunge in the value of the SNB's investments caused by bond and stock market declines last year. (usnews)

The collapse of Silicon Valley Bank highlighted the risks posed by "underwater" long duration bonds -- particularly when those bonds funded with short-term liabilities. Who else in the global economy holds a lot of underwater bonds? (Brad Setser)

~

Research

Most stock pickers underperformed in 2022's 'stock picker's market' (tker)