It’s time for Cryptonite - our monthly roundup of all things crypto - with Dr. Tejaswi Nadahalli.

You can follow Tejaswi on twitter @nadahalli and he blogs at tejaswin.com

via summarize.tech:

00:00:00 Shyam and Dr. Tejaswi discuss the WazirX hack that occurred in July. WazirX is a crypto exchange based in India with founders living in Dubai. The exchange had a custody practice where crypto assets were held in a multisig wallet with six authorized signers. Three signers were from WazirX, and one was a custodian, Luminaire, to ensure checks and balances. However, the hackers upgraded the smart contract, bypassing the need for checks and balances, and drained $230 million worth of crypto. There was no communication from the hackers, and the suspicion is that it was carried out by North Korea or the Lazarus group. WazirX blamed the custodian, and there was a back-and-forth between the two parties, but no postmortem was published. Some people did forensics and concluded it was North Korea, but there is no confirmation if WazirX had insurance to cover the loss. The hack is likely an existential event for WazirX. After July, there have been no updates on the situation.1

00:05:00 We discuss the post-hack communication from WazirX where 60% of funds in a cryptocurrency exchange were taken, and the company proposed redistributing the remaining funds to those who were hacked. However, this proposal was met with backlash from those who were unaffected, leading to accusations of mismanagement and lack of transparency. The exchange, based in Dubai, was not regulated by the Securities and Exchange Board of India (SEBI) or the Reserve Bank of India (RBI), making it difficult for clients to seek recourse. Additionally, the key personnel were located in a non-extradition treaty country, further insulating them from angry clients. The exchange, WazirX, had been operating legitimately for many years, but the loss of $230 million was a significant blow. Tejaswi also mentions the case of the Canadian exchange Quadriga2, where the founder's death and the lack of a clear recovery plan led to the loss of around $500 million. He expresses sympathy for WazirX and hopes they can recover the funds and move on. We then pivot to discuss the widespread use of Telegram in the crypto community and the multiple issues surrounding it.

00:10:00 Tejaswi discusses the privacy concerns surrounding Telegram, a popular messaging app. Despite Telegram's history of having backdoors in its cryptographic algorithms, which were deliberately inserted, the speaker expresses doubt that group chats, one-on-one chats, or DMs are truly private. He also mentions Telegram's involvement with the TON blockchain and the recent outage following the arrest of its CEO, Pavel Durov, in France. Tejaswi criticizes the charges against Durov for using cryptography without permission and speculates that Telegram may have turned a blind eye to nefarious activities on its platform. Despite these concerns, he laments that the network effects keeping users on Telegram are difficult to unseat, as seen with other social media platforms like Twitter and Facebook. Tejaswi mentions various attempts to move users away from Telegram, such as Noster, Signal, and Matrix, but notes that these efforts have not been successful.

00:15:00 Shyam discusses the lifespan of social media platforms and the challenges they face in staying relevant. He uses the examples of Myspace and Snap to illustrate this point. Myspace lost its user base to Facebook due to better coding and product offerings, while Snap continues to struggle with attracting and retaining users as they age out of its demographic. Tejaswi then touches on Ethereum, a decentralized computing platform, and its struggle to balance decentralization with the need for liquidity. Ethereum's interoperability issues between different silos on its platform have resulted in a lack of smooth liquidity movement, making it a challenge for the network to thrive.

00:20:00 We discuss the ongoing debate between Ethereum and Solana, two major players in the cryptocurrency world. Ethereum, with its smart contracts, is restricted by the liquidity within its base, making it dependent on the development of interconnecting ecosystems. Solana, on the other hand, aims to keep all transactions on the base layer and make it faster and more high-performing. Tejaswi explains that when the Ethereum ETF launched, demand was lower than expected, causing a low dollar inflow to the Ethereum ecosystem. This led to a sideways movement of the Ethereum token while Bitcoin and Solana continued to rise. The Ethereum community grew frustrated as they believed Ethereum should focus on real-world assets and finance, not on the "crypto casino" activity happening on other platforms. The Ethereum Foundation, a not-for-profit body responsible for fostering the Ethereum ecosystem, came under fire for selling Eth tokens to fund initiatives, with some questioning the value they were getting in return. Tejaswi believes that this is a long-term game and that Solana's focus on engineering may help it overcome its constraints, but the sustainability of the platform remains uncertain.

00:25:00 Shyam compares Ethereum and Solana, two blockchain networks, using the banking system as an analogy. Ethereum is seen as the central bank managing liquidity beneath all the banks, while Solana is like a central bank issuing currency and bank accounts directly. He argues that in a purely digital world, a centralized system like Solana might win due to the absence of physical constraints. However, the success of a centralized system depends on its benevolence, and the system can face political problems if it tries to censor transactions. Tejaswi uses the example of SEC’s rejection of a proposed Solana ETF in the US due to concerns about its decentralization and potential security status. Ethereum, on the other hand, is still considered decentralized despite its issues, and its validators used to censor transactions that violated US sanctions. He also mentions the efficiency of India's UPI system, which has made banks almost irrelevant in terms of payments but raises concerns about potential choke points. Overall, Tejaswi suggests that the success of these blockchain networks depends on their ability to navigate the complex political landscape of the digital world.

00:30:00 Tejaswi discusses the current state of censorship in Ethereum and Salana networks, and the concept of proof of work, proof of stake, and re-staking in cryptocurrency. Ethereum validators, who are mostly located in the US due to regulatory reasons, have seen a decrease in censorship, with around 70% of validators no longer censoring transactions. However, Ethereum's legal status remains unclear. Solana, on the other hand, faces a different challenge as its founder and validators are based in California. Tejaswi then explains the concepts of proof of work and proof of stake, which involve bringing computational power and money to validate transactions, respectively. Proof of work requires physical electricity costs, while proof of stake involves financial penalties for mistakes. He then introduces the concept of re-staking, a bootstrapping mechanism for new networks that uses an existing network like Ethereum as a crutch. He also mentions that Bitcoin does not support staking, and a new approach was proposed to use Bitcoin to secure a network by leaking a private key if a mistake is made.

00:35:00 Tejaswi discusses a new innovation in the Bitcoin world called Babylon, where a key that controls Bitcoin can be broadcast to the real world in plain text if one fails to meet certain obligations on another blockchain. This idea is compared to a bank that can take away one's collateral if they don't fulfill their end of a deal. He notes that this scheme went live a few days ago and over a thousand Bitcoin worth of value is being protected by it. Shyam draws parallels to Chinese loan apps in India, where users give the app full access to their phone and social media accounts as collateral, and if they miss a repayment, the app threatens to leak their personal information. He expresses concern over the potential consequences of linking one's financial future to the threat of personal information leakage.

00:40:00 Tejaswi discusses the challenges of creating market-based products in Bitcoin compared to other cryptocurrencies like Ethereum. Bitcoin's rigid system makes it difficult to code market-based ideas, leading users to resort to workarounds. He also touches on the issue of generating yield on Bitcoin, which is an inert asset in the Bitcoin Network. To address this, users are bridging Bitcoin to other networks, such as Ethereum, by trusting custodians like Bitgo to hold their Bitcoin and issue corresponding wrapped Bitcoin (wBTC) tokens. However, the custodian does not make any money from this expensive business, leading them to consider giving it to someone else or partnering with another company. The speaker also mentions the large amount of Bitcoin (approximately 300,000 Bitcoins) that is wrapped and minted on the Ethereum network as wBTC.

00:45:00 The discussion revolves around the potential risks to the wBTC asset and the Ethereum ecosystem. wBTC is a Bitcoin token on Ethereum, and it has been a source of concern for some in the crypto community due to its close ties to the controversial figure Justin Sun. There are fears that if Sun gains control of the Bitcoin custody network backing wBTC, he could potentially misuse the Bitcoin collateral, causing wBTC on Ethereum to lose value and threatening the broader Ethereum ecosystem. This has led to some exchanges delisting wBTC in response to the news. The situation is currently in a state of limbo as wBTC tries to find support without compromising its ethos or falling into Sun's hands. We then pivot to discussing the concept of ZK TLS, a new innovation in the crypto space that aims to enable users to prove statements about facts in the digital world without the cooperation of the entities involved.

00:50:00 Tejaswi discusses an exciting new technology idea that allows individuals to prove the authenticity of digital information, such as screenshots, to others. This technology, which is not yet mainstream, uses a browser plugin or app to generate proofs that can be shared with others. He believes that this technology has the potential to be useful in both web 2 and web 3 environments, as there is currently a lack of infallible ways to prove digital information in the digital world. Shyam mentions that there are already some individuals, such as those who share their trading profits on social media, who could benefit from this technology. Despite the potential, the digital equivalent of a notarized letter has not yet taken off, and Tejaswi is hopeful that this technology will eventually fill that gap. We then conclude the episode of Cryptonite for August 2024.

Links

Research

The political, psychological, and social correlates of cryptocurrency ownership (NIH)

A review of the existing literature suggests that cryptocurrency owners may possess higher-than-average levels of nonnormative psychological traits and exhibit a range of non-mainstream political identities. We found that crypto ownership was associated with belief in conspiracy theories, “dark” personality characteristics (e.g., the “Dark Tetrad” of narcissism, Machiavellianism, psychopathy, and sadism), and more frequent use of alternative and fringe social media platforms. The variables that most strongly predict cryptocurrency ownership are being male, relying on alternative/fringe social media as one’s primary news source, argumentativeness, and an aversion to authoritarianism.

The Irrationality of Bitcoin in Portfolio Analysis (SSRN)

The paper demonstrates the nonsense of using Bitcoin in financial investments. By using mean-variance financial analysis, stochastic dominance, CVaR, and the Shapley value theory as analytical statistical models, I show how Bitcoin performs poorly by comparing it against other traded assets.

Lottery Stock and Bitcoin Comovement (SSRN)

We find that Bitcoin returns exhibit significantly stronger co-movement with lottery-like stocks (LLS). We identify the gambling propensity of retail investors as the underlying channel. We document that retail investors’ preference for speculative, high-risk, and high-reward investments intensifies the excess comovement. We find that the gambling sentiment significantly drives the Bitcoin-LLS comovement.

Exploring Ethereum Staking (SSRN)

This paper provides an analysis of staking Ether (ETH) within the Ethereum ecosystem, exploring the operational mechanics of Ethereum's Proof-of-Stake (PoS) consensus mechanism. It discusses the various staking options available, such as solo staking, staking pools, liquid staking, and exchange staking. The study examines historical and current staking yields, presenting a case study to illustrate the staking process and potential returns. Additionally, the paper evaluates the advantages and disadvantages of staking Ether and considers future developments and regulatory implications. This comprehensive analysis aims to offer insights into staking as a method for earning passive income and contributing to Ethereum's network security.

The Hidden Effect of Crypto “Whales” (SSRN)

Cryptocurrency markets are often characterized by market manipulation or, at the very least, by a sharp distinction between large and sophisticated investors and small retail investors. While traditional assets often see a divergence in the success of institutional traders and retail traders, we find an even more pronounced difference regarding the holders of Ethereum (ETH), the second-largest cryptocurrency by volume. We see a significant difference in how large holders of ETH behave compared with smaller holders of ETH relative to price movements and the volatility of the cryptocurrency. We find that large ETH holders tend to increase their ETH holdings prior to a price increase, while small ETH holders tend to reduce their ETH holdings prior to a price increase. In other words, ETH returns tend to move in the direction that benefits crypto “whales” while reducing returns (or increasing loss) to “minnows.” Additionally, we find that the volatility of ETH returns seems to be driven by small retail investors rather than by the crypto whales.

Crypto

Cryptocurrency 'pig butchering' scam wrecks Kansas bank, sends ex-CEO to prison for 24 years (nbcnews)

Bitcoin miner Rhodium files for bankruptcy (cointelegraph)

There are more than 20 industrial-scale Bitcoin mining operations in Texas that can collectively consume up to 2,300 megawatts of energy a day — enough to power about 460,000 homes during times of high demand in Texas. But if the value of Bitcoin is low and the cost of electricity is high, crypto companies can make more money selling power than mining Bitcoin. In August 2023, Riot reported selling 300 Bitcoins for a net proceeds of $8.6 million. Meanwhile, the company said it earned $24.2 million in credits to its electric bill for selling power back to the grid (texastribune)

Economy & Investing

Fama is surprisingly phlegmatic when it comes to defending his life’s work, echoing the famous British statistician George Box’s observation that all models are wrong, but some are useful. The efficient market hypothesis is just “a model”, Fama stresses. “It’s got to be wrong to some extent.”

“The question is whether it is efficient for your purpose. And for almost every investor I know, the answer to that is yes. They’re not going to be able to beat the market so they might as well behave as if the prices are right.”

Lunch with Eugene Fama (ft)

India

After UPI success, RBI looking at nationwide launch of Unified Lending Interface (thehindubusinessline)

An SME with 2 Yamaha showrooms gets 400x IPO demand (economictimes). From Delhi bike dealer to Kolhapur saree depot, small IPOs lift mood in the market — and raise eyebrows (indianexpress)

Sebi updates eligibility criteria for F&O segment. 23 stocks face risk of exclusion (timesofindia)

Himachal Pradesh faces financial crisis (indiatoday)

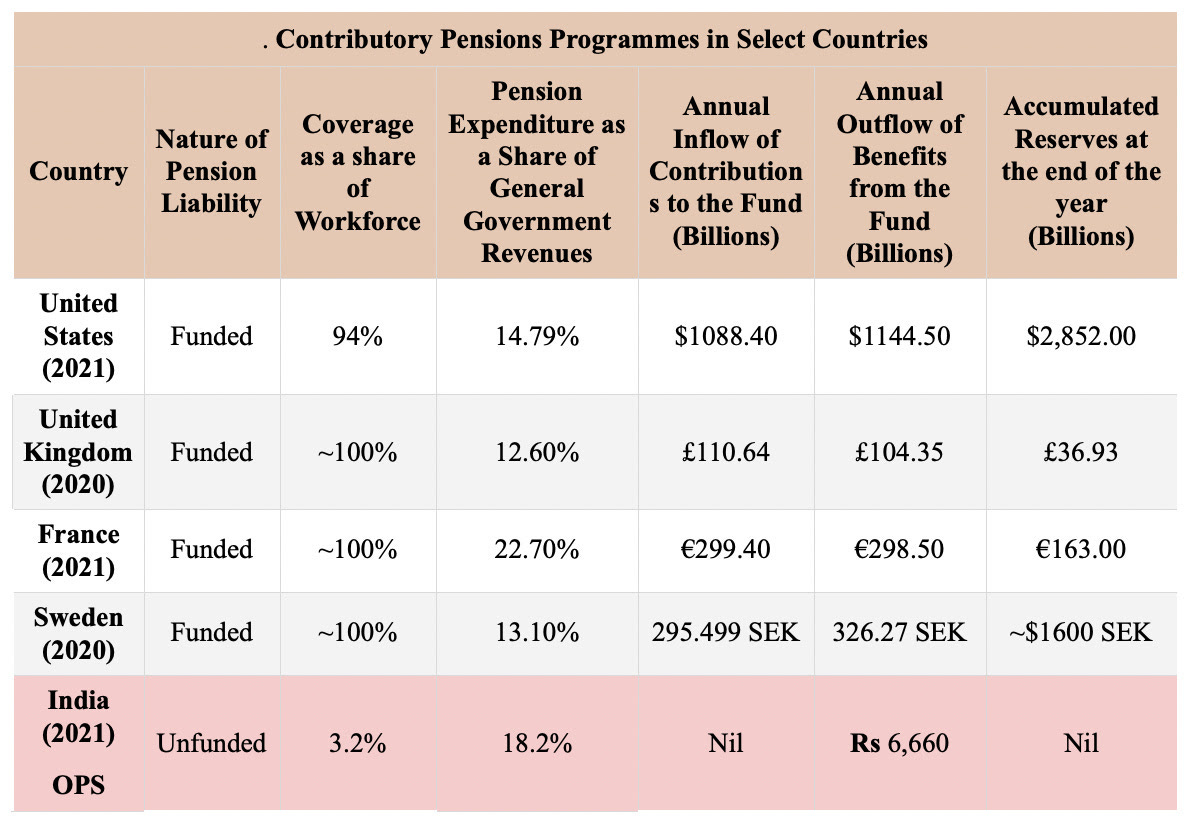

The government awards itself more pension benefits (indianexpress, indianexpress, indianexpress, thewire)

With an investment value of ₹80,000 crore, GQG Partners has become the largest institutional investor in Adani Group companies (cnbctv18). GQG's $11 billion India empire is growing fast beyond Adani (economictimes)

Why government might pause issuing Sovereign Gold Bonds (businesstoday)

Why RBI’s attempts to control the Rupee can have adverse consequences (indianexpress)

The retail sector is not expecting bumper sales in the festive season this year (cnbctv18)

RoW

California Senate passes 0 down, 0 payment home 'loans' for illegal immigrants (thecentersquare)

Canada to impose 100% tariff on Chinese EVs, including Teslas (reuters)

China’s industrial strategy on ‘collision course’ with top German export industries (euractiv)

China saw the world's biggest outflow of high-net-worth individuals last year and is expected to see a record exodus of 15,200 in 2024. Hong Kong lost around 500 high-net-worth individuals last year (nikkei)

Brazil started blocking Elon Musk’s social media platform X early Saturday (huffpost)

Doctors have begun trialling the world’s first mRNA lung cancer vaccine in patients. A new jab that instructs the body to hunt down and kill cancer cells (theguardian)

The staggering death toll of scientific lies (vox)

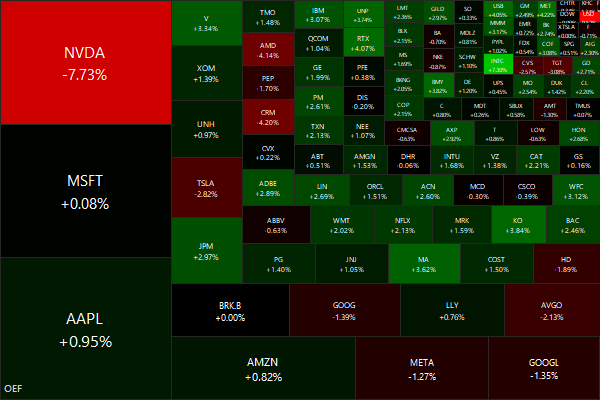

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

Meme of the Week

WazirX hacked; halts withdrawals as over $230 million stolen (July 27, hindu)

WazirX To Allow Users To Withdraw Up To 55% Of Available 66% INR Balances (Aug 23, abplive)

WazirX Parent Zettai Files For Insolvency After $235-Million Cyberattack (Aug 28, ndtv)

CoinSwitch to file lawsuit against WazirX (Aug 29, newindianexpress)

44 Days Post Hack, WazirX Silently Omits 218 Crores Of User Funds (Sept 1, cryptotimes)

Indian Investors’ Rs 4,782 Cr stuck as Crypto Platform WazirX seeks Protection in Singapore (Sept 1, sundayguardianlive)