It’s time for Cryptonite - our monthly roundup of all things crypto - with Dr. Tejaswi Nadahalli.

You can follow Tejaswi on twitter @nadahalli and he blogs at tejaswin.com

via summarize.tech:

00:00:00 We discuss the Ethereum Community Conference (EthCC) that took place in Europe, which is considered one of the biggest crypto events in the world. Tejaswi shares that he was supposed to attend but didn't due to other reasons. The event, held in Brussels, was marred by a series of muggings, car break-ins, and general feelings of unsafe conditions. Crypto attendees were surprised by the turn of events, as Brussels was previously known for its good food, beer, and overall positive vibes. Some attendees joked about the situation, with robbers inviting victims to join their telegram group. Despite the jokes, the reality was much uglier. Tejaswi mentions that he didn't attend the EthCC because he was already at an unconference, an event where participants were brought together in a single location without internet access to foster connections and discussions.

00:05:00 The main topic of discussion shifts to the issue of liquidity fragmentation in the context of Ethereum's scalability roadmap and the concept of Layer Two Solutions. Shyam uses the example of two stock markets in a country to explain the concept and how it relates to the division of liquidity between different venues. He also mentions the historical example of BSE and NSE in India and how the latter monopolized the market by offering exclusive contracts. Shyam concludes by acknowledging the end user's desire for liquidity in multiple venues but also recognizing the exchange's need to hang on to revenue sources. The most interesting question raised in the conversation is about how a market maker would move liquidity between markets in case of a flood of orders in one of them.

00:10:00 Tejaswi discusses the challenges of moving liquidity between cryptocurrency exchanges, specifically when dealing with a surge of trading and the need to have cash on hand to offset trades. Shyam explains that market makers use dynamic risk management to move liquidity between exchanges, and that they may use a common clearing agent to manage transactions. Tejaswi explains the concept of liquidity fragmentation in the crypto world, where different layers of the blockchain capture some liquidity but are not immediately fungible due to the need to move assets between layers, which can cause transaction delays and potentially miss arbitrage opportunities. Shyam then explains the concept of American Depository Receipts (ADRs) as an analogy, where Indian companies list their stocks in the US to allow for trading by international investors, and the potential for arbitrage opportunities due to differences in market hours and currencies.

00:15:00 Shyam discusses the challenges of trading cryptocurrencies across different regulatory frameworks and liquidity pools. He uses the example of trading Indian Rupee stocks and US Dollar ADRs to illustrate the issue. Tejaswi explains that this situation is common in the Ethereum world, where liquidity is fragmented, and solutions are being developed to bridge the gap. However, there is a trust issue as each ecosystem doesn't trust the other, making cross-platform liquidity merger difficult. Shyam then shares his experience of trying to open a crypto account and the complications involved due to regulatory requirements. Tejaswi concludes by explaining why stable coins are popular in crypto as they offer an illusion of safety and dollar stability, but they are still dependent on trusted third parties.

00:20:00 Shyam expresses skepticism towards the notion that stablecoins have found a product-market fit in the crypto world. He argues that it's not the coins that have found a product-market fit, but rather the dollar that has found a place in the crypto world. Tejaswi then shifts the conversation to discuss fully homomorphic encryption (FHE), a new kind of encryption that allows computations to be performed on encrypted data. FHE was first proposed in a 2009 paper and has since become faster and more practical, with potential applications in privacy and data security. The crypto world is investing in FHE as a way to showcase the application of cryptography and incentivize the right actors. There are several startups working on FHE and showcasing their applications at events like ETC.

00:25:00 Tejaswi discusses the intersection of encryption and artificial intelligence in the context of cryptocurrency. He notes that while tech giants like Google and Microsoft have previously explored this area, the faster advancement of these technologies by the crypto community is noteworthy. Tejaswi also mentions that the encryption scheme in question, which comes from an AI technique, is homomorphic, allowing for adding and multiplication operations. This merging of domains in abstract mathematics is described as fascinating yet inexplicable. The speaker then touches upon the role of speculation in driving innovation in the crypto space, using the example of regulatory hurdles in listing derivatives. Despite these challenges, speculators will always find a way to engage in their activities.

00:30:00 Shyam discusses the controversy surrounding Binance, a cryptocurrency exchange, and its potential regulatory issues in India. Nithin Kamath pointed out that while Zerodha has to follow regulations and act as a model corporate citizen in public markets, firms that offer crypto derivative trading have a "backdoor entry" that no one is looking at1. Tejaswi mentions that Polkadot raised billions of dollars during an ICO in 2017 and still has that money in their treasury. They have spent a considerable amount on marketing and developer relations, but some of their expenses, such as paying $100,000 for a logo rotation on a cryptocurrency listing website, are seen as questionable. Tejaswi criticizes Polkadot's spending habits and governance, suggesting that it is a reason why regulators are necessary to ensure accountability.

00:35:00 Tejaswi discusses the decentralized governance in crypto projects, using the Polkadot ecosystem as an example. He explains that token holders have a role in decision-making through voting on spending proposals, but there are concerns about the level of detail they should be involved in. Tejaswi also mentions the lack of accountability in some crypto projects and the potential for regulation to protect token holders' rights. Additionally, he touches on the concept of Treasury managers in crypto, who manage funds on-chain and provide transparency for token holders. The conversation then shifts to the topic of Mount Gox, the largest Bitcoin exchange during the Bitcoin era, which experienced a massive hack and lost around 750,000 Bitcoins worth of value. The customers of Mount Gox are now supposed to receive compensation, but in the form of dollar-denominated money instead of Bitcoin.

00:40:00 Tejaswi discusses the loss of half a million dollars in a crypto hack and how Mount Cox is paying back customers using funds from a saved treasury. He then suggests that those who only want to speculate in crypto without taking custody of the asset can do so through derivatives trading, specifically Perpetual swaps. However, there is a risk in trusting the exchange itself. Shyam also mentions the challenges of obtaining data from exchanges due to regulations and the lack of transparency in obtaining certain licenses in India.2 Additionally, Tejaswi touches on the German government's liquidation of Bitcoin and their potential interest in holding Euros instead.

00:45:00 Tejaswi discusses the German government's seizure of non-Euro assets and the subsequent sale of coins, with a focus on Saxony's delayed liquidation. Shyam also mentions the Russian Central Bank's recent decision to adopt crypto and the challenges they may face due to US regulations on stablecoins like USDC and USDT. Additionally, Tejaswi touches on the ongoing legal cases involving Tornado Cash and the Samurai wallet, as well as some VC gossip surrounding the project Eclipse and its founder's sexual harassment allegations.

00:50:00 Tejaswi discusses a controversial situation in the crypto world where a VC fund's General Partner (GP) raised money from Venture Capitalists (VCs) and distributed advisor shares or tokens to them, which were not visible on the cap table. The GP then pushed the deal through their own VC fund and received more funding for the company than the VC fund itself. He criticizes this behavior as bad and alleges that the VC fund has no legal defense against the GP who quit the company. Tejaswi also mentions that the Limited Partners (LPs) of the VC fund should be upset but it's hard for them to hold the VC fund accountable. He expresses skepticism about the crypto industry and wonders about the future of LPs and the industry as a whole. However, he also provides a counterpoint by discussing how Bitcoin's software has evolved and how bugs have been fixed quietly and responsibly over the years, making it more secure and harder to exploit. Tejaswi concludes by suggesting that Bitcoin is becoming more like a gold standard and that the software is hardening itself with each iteration.

00:55:00 Tejaswi discusses the importance of security in cryptocurrency projects and the risks associated with decentralized systems. He uses the example of AT&T's data leak to illustrate the potential dangers of centralized actors and the vulnerability of software to bugs. Shyam argues that while security is important, it is also a people issue, and decentralized systems are more resilient to single points of failure. However, Tejaswi also acknowledges the risks of malicious actors exploiting bugs in popular libraries or software, such as the recent compromise of a crypto project's library on the Python package manager. Tejaswi expresses concern that as more people explore cryptocurrencies and related technologies, the risk of malicious actors exploiting vulnerabilities may increase.

Markets this Week

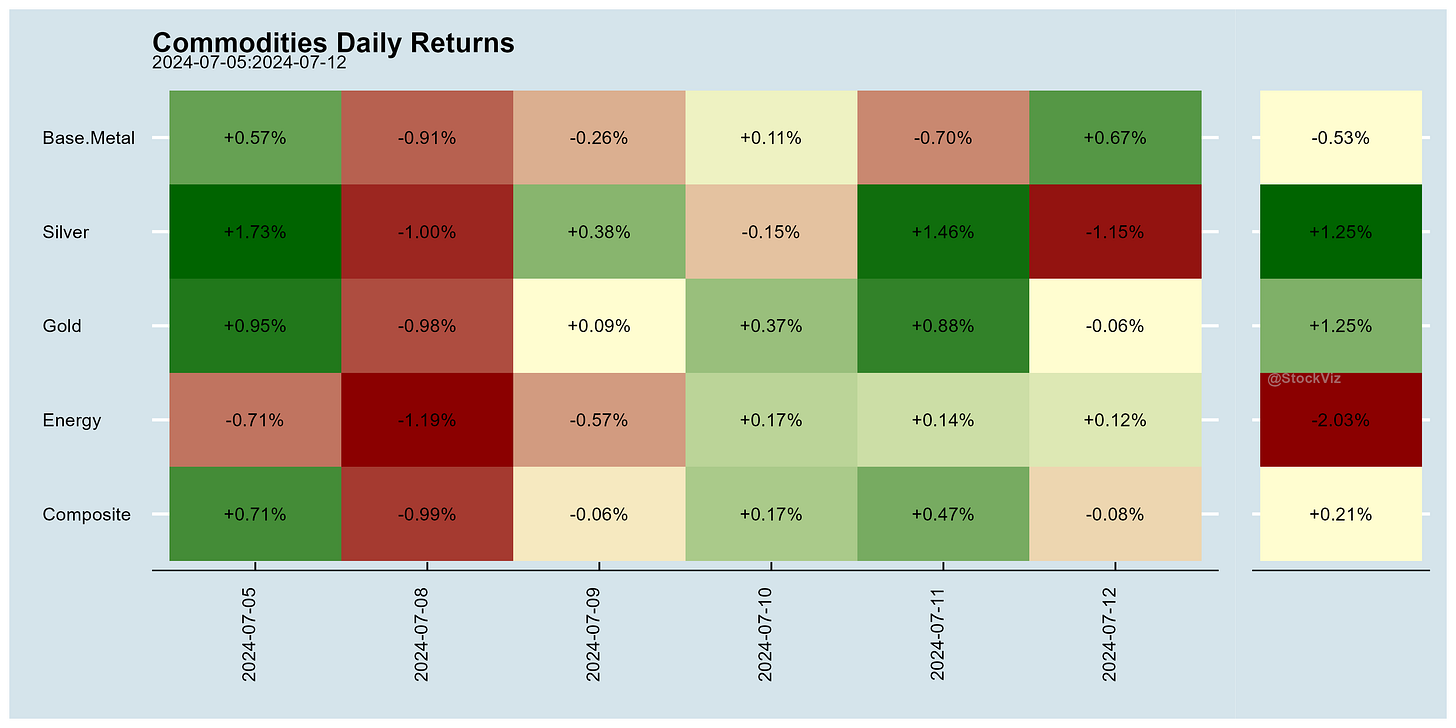

More here: country ETFs, fixed income, currencies and commodities.

Links

Even though total market capitalization of Indian listed firms have grown by leaps and bounds, the number of listed derivatives has barely budged over fifteen years. What gives?

India's Modi delays privatisation plans (reuters)

US needs stronger defenses against China's overcapacity, Treasury official says (reuters)

What we want from the butcher, the brewer and the baker are beef, beer and bread, not for them to be fabulously wealthy shop owners. What China wants from BYD and Jinko Solar (and the US from Tesla and First Solar) should be affordable EVs and solar panels, not trillion-dollar market-cap stocks. In fact, mega-cap valuations indicate that something has gone seriously awry. Do we really want tech billionaires or do we really want tech?

China’s subsidies create, not destroy, value (asiatimes)

The core question at the heart of the U.S. Department of Justice's case against Tornado Cash developer Roman Storm is whether he created software or controlled a service. (coindesk)

Iran's Crypto Economy (trmlabs)

Inside the Health Crisis of a Texas Bitcoin Town (time)

Global population to shrink this century as birth rates fall (ft)

Bangladesh students triumph as top court puts brakes on controversial job quota system (wionews)

A.I. Needs Copper. It Just Helped to Find Millions of Tons of It. (nytimes)

AT&T says hackers stole records of nearly all cellular customers' calls and texts (nbcnews)