It’s time for Cryptonite - our monthly roundup of all things crypto - with Dr. Tejaswi Nadahalli.

You can follow Tejaswi on twitter @nadahalli and he blogs at tejaswin.com

via summarize.tech:

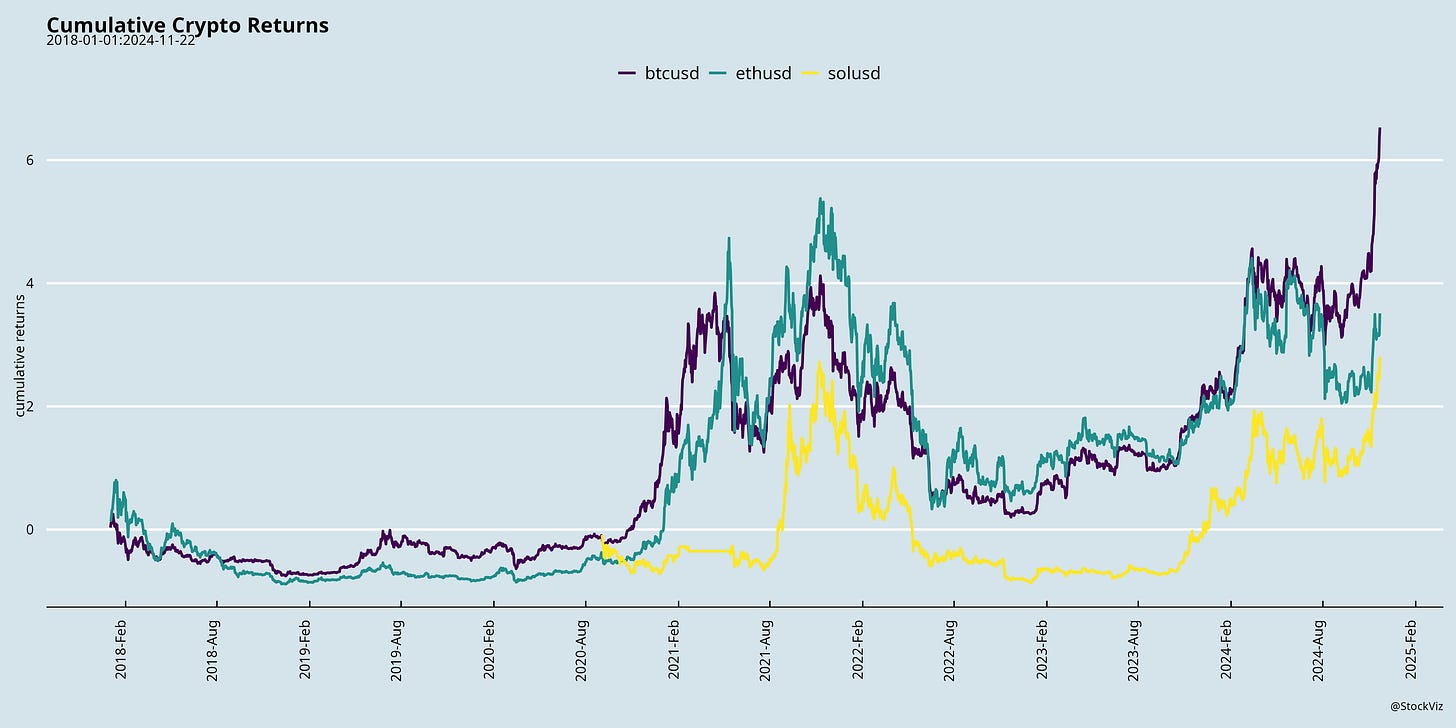

00:00:00 We discuss the significance of a crypto-friendly Trump administration and its impact on the crypto market. Trump's past involvement and statements in Bitcoin, as well as the ousting of anti-crypto figures like Gary Gensler from regulatory positions, have led to increased optimism among crypto enthusiasts. The crypto lobby's successful efforts to influence political campaigns1, along with Trump's pro-crypto stance, are seen as major factors contributing to the ongoing rally in both cryptocurrencies and traditional assets. Despite some regulatory challenges in the past, the prospects of a crypto-friendly administration under Trump are fueling positive sentiments within the crypto community.

00:05:00 Tejaswi discusses the potential regulatory changes expected under the Trump administration, suggesting a shift towards a more favorable environment for crypto assets in the US. This change could alleviate the uncertainty that has plagued crypto entrepreneurs and investors in the past, particularly due to concerns around US regulations and geofencing restrictions. With the looming prospect of a more supportive regulatory framework, the crypto market has seen a surge in prices, with Bitcoin approaching the $100,000 mark. Additionally, there is speculation about governments, including the US, accumulating Bitcoin as a strategic reserve2 alongside gold, potentially sparking an international arms race for the cryptocurrency3. Despite some governments already holding Bitcoin, like El Salvador4 and Bhutan5, the overall impact of governments entering the Bitcoin market remains uncertain, with transparency on chain not yet revealing major accumulation by unknown entities.

00:10:00 We discuss the need for clear regulations in the US cryptocurrency market, emphasizing that Congress must define how digital assets like Bitcoin are treated to avoid the chaos seen with meme coins skyrocketing in value. We highlight a recent incident where a young boy created a meme coin, duped investors, and made a profit6, showcasing the risky and speculative nature of some crypto investments. We note the shift from meme coins on Ethereum to Solana and reflect on the financial nihilism driving individuals to gamble in the hope of quick gains, contrasting it with the utility tokens that serve a purpose in the crypto space. This commentary sheds light on the dynamics between speculative meme coins and tokens with actual utility, revealing an ongoing struggle between investment frenzy and meaningful innovation in the cryptocurrency industry.

00:15:00 We discuss how the market is affected by the behavior of retail investors, known as "plebs," who are opting for meme coins over tokens with VC locks or uncertain supply waves. While meme coins are seen as pure gambling tokens, Shiba Inu highlights a shift towards a larger vision beyond just being a meme coin, similar to Disney's expansion from Mickey Mouse. The conversation also touches on the challenges Ethereum faces in the current market cycle, being caught between Bitcoin's clear monetary focus and Solana's high-performance goals, leading to a struggle to define its direction amidst philosophical tensions.

00:20:00 Tejaswi discusses how Ethereum's inability to prevent the deployment of risky assets like Tornado Cash7 on its platform is detrimental for its long-term success. He highlights how Solana, with its more controlled environment and centralized oversight, can avoid such risky assets, leading to a more stable ecosystem. Additionally, he mentions how Layer 2 solutions like Base, operated by Coinbase, are siphoning off value from Ethereum by offering cheaper fees and better performance, potentially challenging Ethereum's dominance in the decentralized finance space. The comparison is drawn to the evolution of the internet where higher layers often derive more value, leading to concerns that Ethereum may become obsolete if it fails to address these challenges and retain its core functionalities within its network.

00:25:00 We discuss the evolving landscape of DeFi platforms moving away from Ethereum towards other alternatives like Avalanche, Base, and Solana due to factors like improved efficiency and performance. Noteworthy projects on Solana, such as Jupiter and Camino, are gaining momentum, challenging Ethereum's dominance in the DeFi space. The speaker also addresses the concept of "Ethereum killers" and highlights that while projects like Sui and Aptos have emerged as potential competitors to Solana, they might not offer the same significant performance leap as Solana did over Ethereum. The imminent launch of Monad, another contender in the blockchain space, is being closely monitored for its potential impact on the industry.

00:30:00 We discuss upcoming blockchain projects like Monad and Berachain, highlighting that while they offer some improvements over existing platforms like Ethereum and Solana, none of them truly represent a paradigm shift in the industry. The conversation then transitions to the intersection of AI and cryptocurrency, pointing out that there are meme coins related to AI alongside purposeful projects like Bittensor, which aims to create decentralized AI task subnets. Although these AI-specific ventures are still niche and not as advanced as mainstream AI models like GPT, they show promise in experimenting with decentralized AI applications. The discussion also touches on the emergence of AI agent marketplaces, indicating that while the sector holds potential, investing in these projects remains risky due to their early-stage development and uncertain future outcomes.

00:35:00 We discuss the rapid emergence of meme coins like "Elonia" following cultural phenomena, such as jokes about Elon Musk. Memes can now translate into tradable assets, reflecting the inverted reality where social trends become financial gains. The conversation also touches on strategies like following projects like Numerai, which pivoted to crypto and offers users the opportunity to submit successful models for real-money trading in exchange for a cut. However, challenges arise due to regulations that push innovations like these into the crypto space. The unpredictability of trading meme coins poses risks, emphasizing the need for caution despite the allure of quick profits.

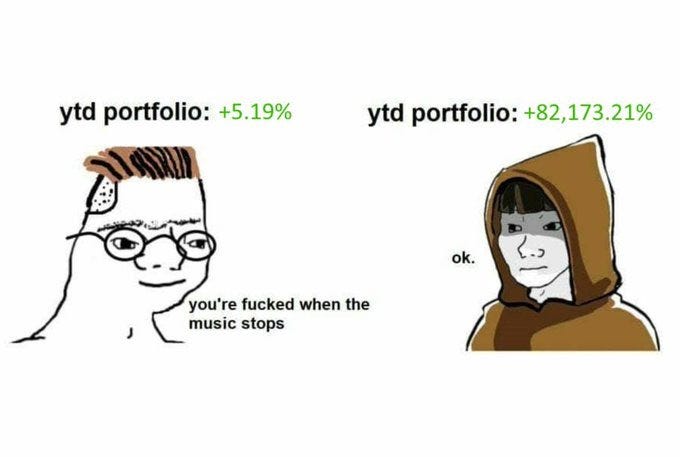

00:40:00 We discuss how platforms like Arkham Intelligence incentivize users to tag wallets on their platform by rewarding them with ARKHAM tokens. This tagging process helps track movement in wallets, as seen with the Bhutan government's Bitcoin wallet being tagged on Arkham. We also mention how Bitcoin's price surge towards $100K is partly driven by forced flows due to the trading of Bitcoin ETF options8 and companies like MicroStrategy investing heavily in Bitcoin9. MicroStrategy's approach involves issuing fixed coupon debt and aggressively selling equity to fund their Bitcoin purchases. However, concerns arise about the sustainability of the price surge10 once these forced flows diminish, especially if large holders like MicroStrategy decide to sell their significant Bitcoin holdings.

00:45:00 We discuss MicroStrategy's Bitcoin cost basis, suggesting it might be around 25 or 30k, making them vulnerable to margin calls if Bitcoin drops to that level. Expressing concerns about MicroStrategy's risky moves and the potential for market bubbles, Tejaswi indicates a preference for Bitcoin's price to drop, wiping out risky investors like MicroStrategy from the space. Shyam mentions the limitations Indian crypto enthusiasts face in trading due to high costs, expressing hope for better accessibility in the future. The conversation concludes with a mention of potential future developments in the crypto space under upcoming political changes and the promise to continue reporting on these trends in future sessions.

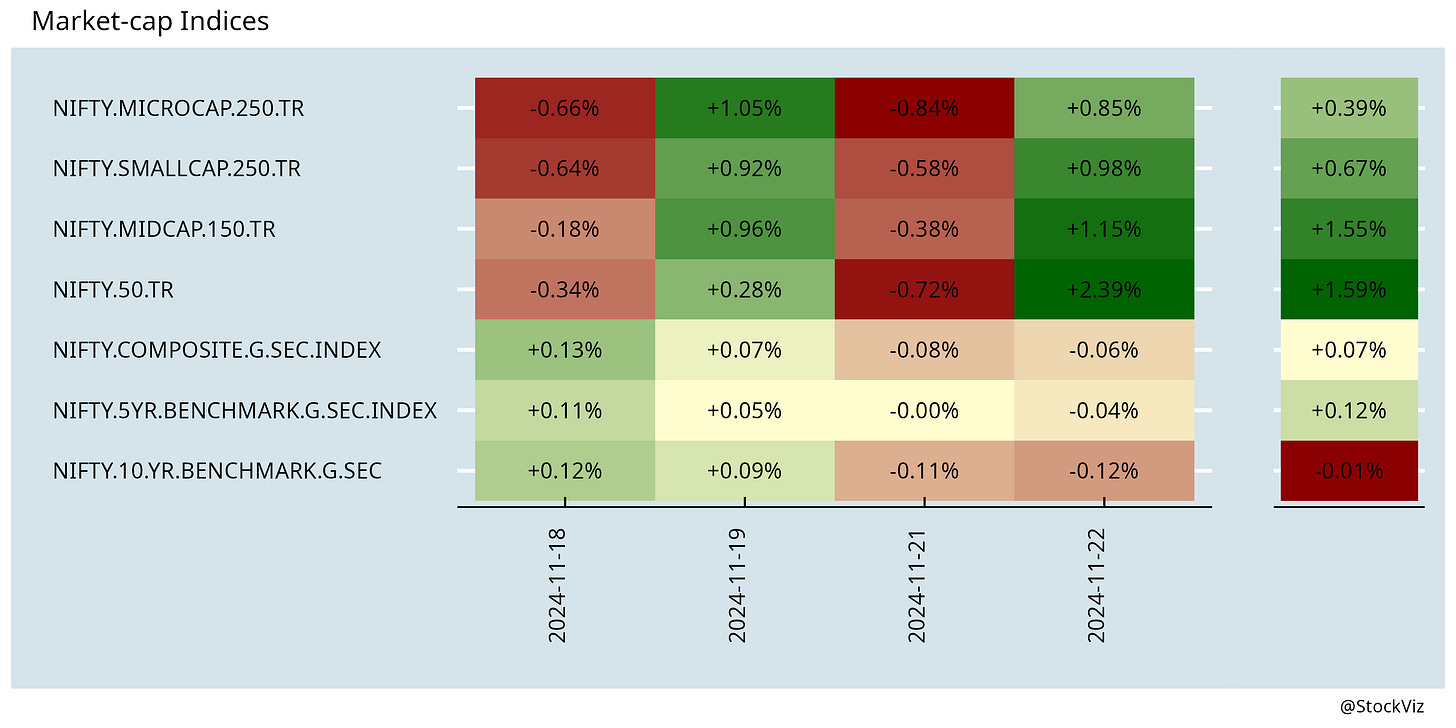

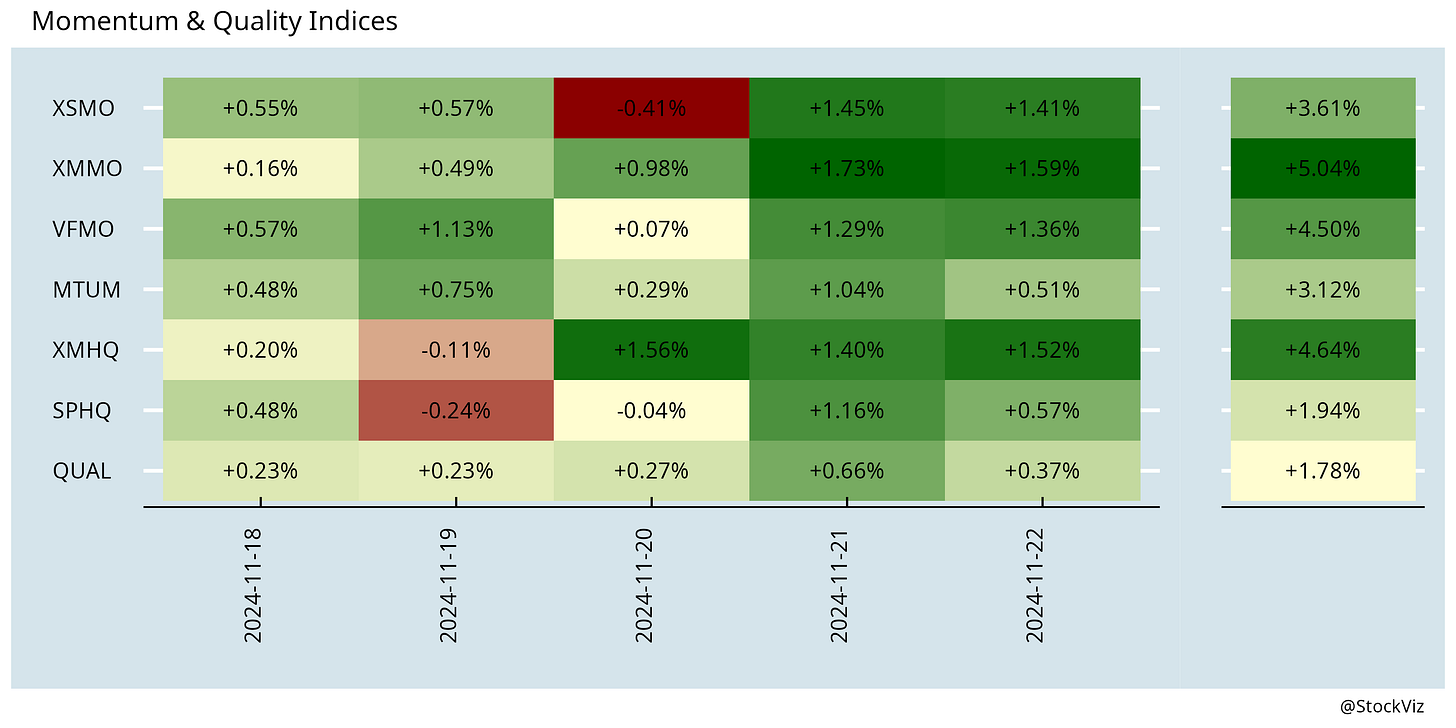

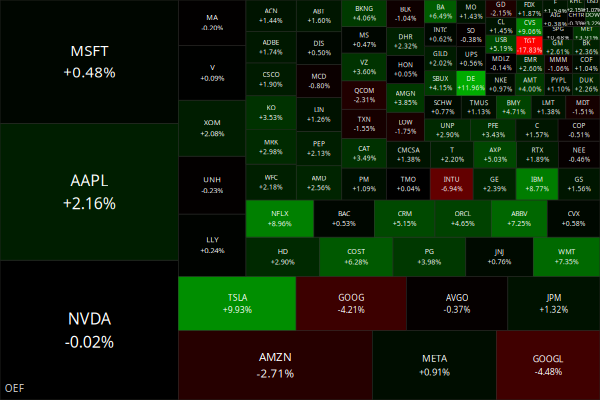

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

This week

One year

Since 2018

Links

Research

The distributional consequences of Bitcoin (SSRN)

The original promise of Nakamoto (2008) to provide the world with a better global means of payment has not materialized. Instead, the focus has increasingly shifted to Bitcoin as an investment asset promising high capital gains. Promoters of this investment vision put little effort relating Bitcoin to an economic function which would justify its valuation. While most economists argue that the Bitcoin boom is a speculative bubble that will eventually burst, we analyse in this paper the impact of a Bitcoin-positive scenario in which its price continues to rise in the foreseeable future. What sounds intuitively promising or at least not harmful is problematic: Since Bitcoin does not increase the productive potential of the economy, the consequences of the assumed continued increase in value are essentially redistributive, i.e. the wealth effects on consumption of early Bitcoin holders can only come at the expense of consumption of the rest of society. If the price of Bitcoin rises for good, the existence of Bitcoin impoverishes both non-holders and latecomers.

Pure Momentum in Cryptocurrency Markets (SSRN)

We use a unique feature of cryptocurrency markets: the fact that they are open 24/7, and report returns over the last 24 hours. Thus, the one-day return is subject to predictable fluctuations based on the removal of lagged information. We show that investors respond positively to changes in reported returns that are unrelated to any new release of information, or change in the asset fundamentals. We call this behavioral anomaly "Pure Momentum".

Industrial Policies and Innovation: Evidence from the Global Automobile Industry (NBER)

Our analysis finds a positive relationship between policy support and innovation activity. At the country level, a one-standard-deviation increase in five-year cumulative electric vehicles (EV) targeted (industrial policies) IPs is associated with a four-percent rise in new EV patent applications. Firm-level analyses indicate that a ten-percent increase in EV financial incentives received by automakers and EV battery producers leads to a similar four-percent increase in EV innovations. We confirm the importance of path dependence in the direction of technology change in the automobile industry.

Trade, Trees, and Lives (NBER)

This paper shows a cascading mechanism through which international trade-induced deforestation results in a decline of health outcomes in cities distant from where trade activities occur.

The Economics of “Buy Now, Pay Later” (NBER)

“Buy Now, Pay Later” (BNPL) is a key innovation in consumer payments. It bundles the sale of a product with a subsidized loan, effectively offering lower prices to low-creditworthiness customers. BNPL thereby allows merchants to price-discriminate among customers with different willingness-to-pay. Consistent with a price-discrimination mechanism, we show that BNPL increases sales by 20%, driven by low-creditworthiness customers and products where market power is larger. We find that the benefits of offering BNPL significantly outweigh the costs for the merchant.

Economy & Investing

India

FII selling continues…

India's central bank will launch a pilot programme in 2025 offering local cloud data storage to financial firms at affordable prices (reuters)

India will offer up to $5 billion in incentives to companies to make components locally for gadgets from mobiles to laptops (reuters)

The collateral damage in RBI’s crackdown on loan frenzy, KYC (livemint)

Commerce minister Piyush Goyal called upon RBI to cut rates, arguing that targeting food price inflation through interest rates was an “absolutely flawed theory”. (timesofindia)

In 2015, the centre introduced the Cotton Seeds Price Control Order, under which seed prices and royalty payments to the technology developer, Mahyco Monsanto Biotech, were fixed by the government. In 2020, royalties were altogether abolished. Now, India's cotton production is plummeting. (livemint)

How freebies are hurting already stressed state finances (livemint)

The current cumulative debt of discoms is Rs 6.84 trillion, and the accumulated losses stand at Rs 6.46 trillion as of now. The performance of discoms remains constrained by inadequate tariffs relative to the cost of supply, higher-than-regulator-approved aggregate technical and commercial (AT&C) losses, and a considerable debt burden. (business-standard)

Dabba trading in vogue again, draws in Rs 100L cr a day. Volumes equivalent to 20% of average F&O turnover. (financialexpress)

Billionaire Gautam Adani of India's Adani Group charged in US with bribery, fraud (reuters). The SEC’s argument is that the investors were defrauded because they thought it was ESG, but it was not because it involved bribery.

row

One of every three new cars sold in Mexico this year will be built in China. That’s up from just 4% in 2020. (mexiconewsdaily)

Charles Schwab Eyes Spot Crypto Trading Once Regulations Change (livemint)

Time to end the world’s most recent experiment with free capital flows (peofdev)

China military now a ‘significant threat’ capable of winning in a conflict with U.S. (washingtontimes)

Brazil’s federal police on Thursday formally accused former President Jair Bolsonaro and 36 other people of attempting a coup to keep him in office after his defeat in the 2022 elections. (apnews)

Odds & Ends

The Age of Depopulation (foreignaffairs)

A.I. Chatbots Defeated Doctors at Diagnosing Illness (nytimes)

Technology and loneliness are interlinked. (nytimes)

Three Earth plants will soon make a new home on the lunar surface.(worldsensorium)

How a breakthrough gene-editing tool will help the world cope with climate change (technologyreview)

The Myth of Moderate Drinking (columbia)

Meme of the Week

Presidential candidate pledges to create “strategic bitcoin reserve” in Poland (notesfrompoland)

After El Salvador’s success with Bitcoin, Argentina follows its steps (officechai)

Bhutan’s Bitcoin Binge: Country’s crypto holdings top $1.1 billion, valued at over a third of its GDP (theprint)

Teen created the memecoin $QUANT, rug pulled it & made $30K off of a bunch of “investors”. They got mad & ran it to a $75 million market cap. Kid then created another coin called $sorry & rugged it again, making $20K. (x)

The first levered single stock ETF referencing MSTR began trading on August 15th. On that date, MSTR closed at a market cap of $25.6 billion. BTC closed at $56.7k. The two levered MSTR ETFs have since grown to $3.8 billion in AUM as of yesterday’s close. Adjusting for their 2x target exposures equals $7.7 billion in exposure. Against MSTR current market cap of $86.5 billion, this represents a remarkable 8.9% of the company’s total market cap. In my opinion this has been a significant driving factor in MSTR’s outperformance. From August 15th through yesterday BTC is up 61%, while MSTR market cap is up 237%.