HDF C-

A crowded growth story gets smacked down

For the longest time, the HDFC Twins were the very personification of the “India Growth Story”. Investors in the twins rode the rapidly urbanizing, formalizing, and aspirational India. HDFC Bank grew earnings by 20% every year like clockwork.

The combination of growth and steady earnings overrode the typical bear case: that, at the end of the day, it is an emerging market bank that has consistently underinvested in technology to meet its financial targets in an increasingly overbanked and competitive environment.

The bank’s tech situation was so bad that in December 2020, the RBI asked them to stop all upcoming launches and sourcing of new credit card customers.1 However, after a brief dip, the stock quickly recovered highlighting the faith that investors had in the story.

And then, the merger happened. While investors expected a few wrinkles post the HDFC Bank and HDFC merger, they weren’t quite expecting the gravy train to stop.2

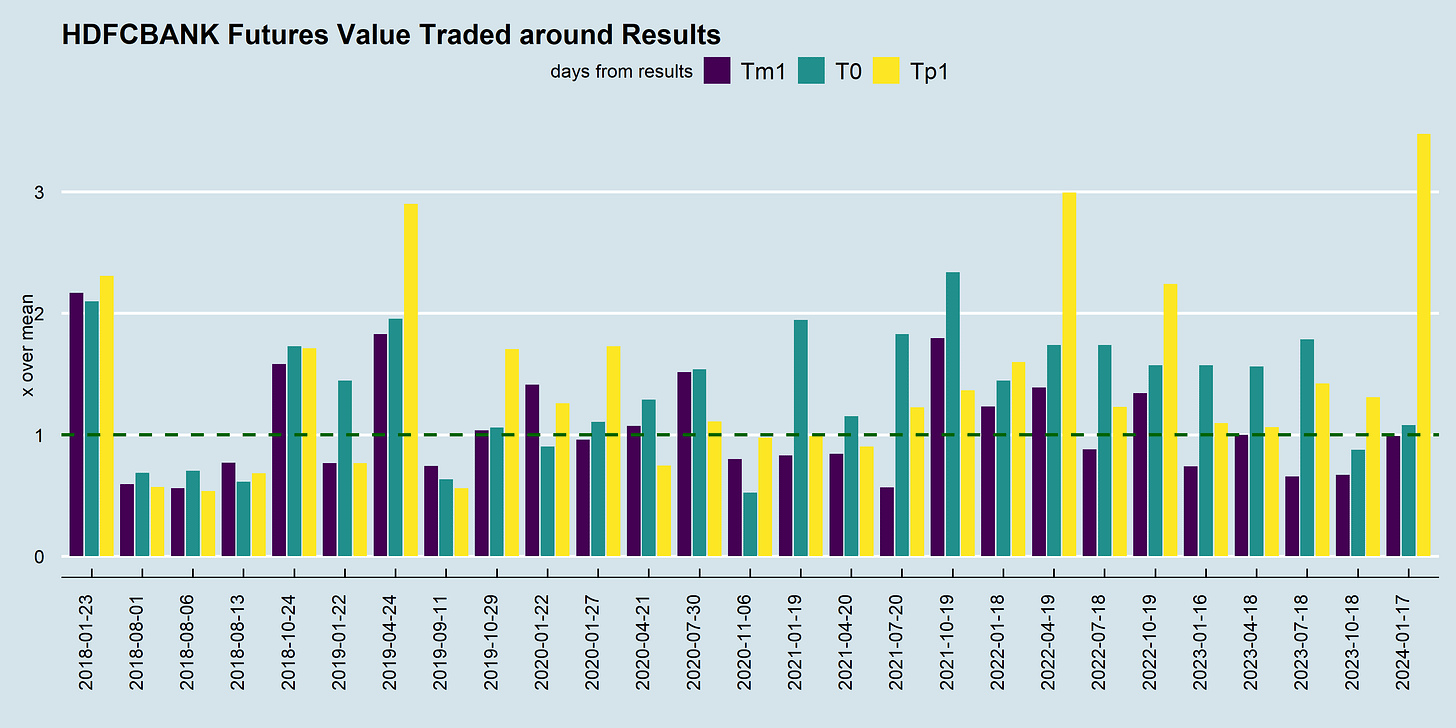

Investors got spooked with the continued shrinking of its NIM (Net Interest Margin) from +4% before the merger to 3.4% now.3 The post-earnings trading activity was one for the books.

The bank’s management seems to have hung their hopes on cross-selling magic to their already over-banked demographic. The combination of bank relationship managers with big targets to hit and poor systems doesn’t really warm the heart.

While the stock is not really a screaming buy trading at 2.76 P/B (Axis Bank is at 2.52 and JP Morgan trades at 1.62), you never know the true power of a meme until it has stomped through the market.

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Crowded Spaces and Anomalies (SSRN)

Overcrowding occurs when the number of investors chasing a similar strategy becomes too large given the available liquidity. Overcrowding increases the risk of crashes.

Echo Chambers (oup)

Self-described bulls are five times more likely to follow a user with a bullish view of the same stock than are self-described bears. Consequently, bulls see more bullish messages and fewer bearish messages than bears do. These “echo chambers” exist even among professional investors and are strongest for investors who trade on their beliefs. Finally, beliefs formed in echo chambers are associated with lower ex post returns, more siloing of information, and more trading volume.

How monopolists drive the world’s power and wealth divide (balancedeconomy)

A handful of individuals and their companies have built positions of market and strategic dominance where they've become too big to fail, too big to trust, and ‘too big to care’. They have accumulated so much strategic power that they make decisions that deeply affect the lives of all of us.

Loyal workers are selectively and ironically targeted for exploitation (sciencedirect)

Instead of protecting or rewarding them, loyal employees are selectively and ironically targeted by managers for exploitative practices. The targeting of these loyal workers is mediated by the assumption that loyal individuals are readily willing to make personal sacrifices for the objects of their loyalty. Furthermore, workers who agree to be exploited in the workplace acquire stronger reputations for loyalty. These bidirectional causal links between loyalty and exploitation have the potential to create a vicious circle of suffering.

Pity the Poor Teacher because Student Characteristics are more Significant than Teachers or Schools (cambridge)

Education has not changed from the beginning of recorded history. The problem is that focus has been on schools and teachers and not students. Over the last 50 years in developed countries, evidence has accumulated that only about 10% of school achievement can be attributed to schools and teachers while the remaining 90% is due to characteristics associated with students. Teachers account for from 1% to 7% of total variance at every level of education. For students, intelligence accounts for much of the 90% of variance associated with learning gains.

Investing & Economics

Would society and the economy would be off if money was a perishable good. (noemamag)

India

Goldman Sachs had a report out a couple of weeks ago about The rise of ‘Affluent India’. A small group of people who haven’t organized themselves to present a unified front are doing extremely well in India. What could go wrong?

The size of the Indian banking sector has barely grown in the last 10 years and much of its growth has been on account of an increase in retail lending. Also, non-retail lending by banks has shrunk from 39.9% of GDP in March 2013 to 35.1% in March 2023. (livemint)

India ETF flows hit record in 2023 (reuters)

RoW

On a bipartisan basis, Americans view China as a clear “enemy” of the United States that represents the country’s “greatest nation-state threat”. Wall Street is the laggard – still mostly viewing China as investable (if out of favor) and analyzing it through the traditional lens of valuation, sentiment, and macroeconomics. But something is missing – and it’s as foundational as it is blindingly obvious. China has rapidly become un-investable for moral reasons. Quite simply: we don’t invest in stocks of countries actively trying to harm us. Over time, companies operating in such countries will almost certainly face unpredictable and serious blowback.

The Problem with China (upslopecapital)

The US dollar has a significant impact on the performance of the EAFE and EM region against the US market. (quantpedia)

$FXI, the iShares China Large-Cap ETF, was issued in late 2004. Since then, $EWJ, the iShares MSCI Japan ETF, has outperformed it. The narratives couldn’t have been more different.

At the index level one big problem for investors in China has been that a lot of econ growth occurred via company creation rather than earnings growth in incumbents (which is not positive for shareholders). This in addition to large levels of share issuance means that the EPS of Chinese index investors are basically flat since inception even though China has had pretty much the best corporate profit growth out of any country.

Should Your Portfolio Be 100% U.S. Stocks? (ofdollarsanddata)

America’s economy is creating new businesses at a feverish pace (theglobeandmail)

Xi Jinping risks setting off another trade war (economist)

Western firms are quaking as China’s electric-car industry speeds up (economist)

China’s population is shrinking and its economy is losing ground (economist, reuters)

It is not exports that expand global production. It is trade, which means countries exporting and importing goods from each other to maximize comparative advantage and economies of scale. Large, persistent surpluses imply repressed domestic demand, not the benefits of trade.

In refusing to tell the truth about free trade, or engage the serious issues that have emerged, modern economists are repeating the mistake of the nineteenth-century British ideologues. (lawliberty)

South Korea Lays Out $470 Billion Plan to Build Chipmaking Hub (bloomberg)

Odds & Ends

Why America hates its children (businessinsider)

Meme of the Week

HDFC Bank shares tank post Q3 earnings. What irked investors? (economictimes)