SEBI, accusing Jane Street of market abuse, has banned it from the market and impounded about $566 million, pending further inquiry (reuters, reuters). Apparently, what triggered the investigation was media reports claiming market manipulation by them.

Ever since the government imposed 0.1% Securities Transaction Tax (STT) on equities and jacked up short-term capital gains tax to 20%, traders have been migrating to the options market. Low cost and high leverage afforded by options, combined with 0DTE’s lottery ticket like payouts, drew retail traders like a moth to a flame. Now, retail forms 35% of premium turnover of index options on expiry-day (financialexpress). On the other side of these trades are mostly institutionals, Jane Street being one of them.

0DTE options have extremely high gamma1. Delta hedging2 a book of such options necessarily involves frequent trading in the futures market.

Index futures rely on arbitrageurs to keep prices in line with those of its components. And the prices of these single-stock futures need to be kept in line with those of their cash-equity prices. And so on.

So, if you are making markets on 0DTE, running an index-arb and cash-futures arb, your trades will look exactly like what SEBI is accusing Jane Street of (sebi).

In 2022, traders in S&P 500 index products made a big deal of the “JPM Collar3”.

The JPMorgan Hedged Equity Fund holds a basket of S&P 500 stocks along with options on the benchmark index and resets hedges once a quarter. The fund, which had about $15.59 billion in assets as of September 28, aims to let investors benefit from equity market gains while limiting their exposure to declines.

On June 30, the refresh of the fund's options positions involved about 140,000 S&P 500 options contracts in all, including S&P 500 puts at strikes 3580 and 3020 and calls at 4005, all for the September 30 expiry.

Options dealers - typically big financial institutions that facilitate trading but seek to remain market-neutral - take the other side of the fund's options trades.

To minimize their own risk, they typically buy or sell stock futures, depending on the direction of the market's move. Such trading related to dealer hedging has the potential to influence the broader market, especially if done in size, as is the case for the JPM trade.

How a massive options trade by a JP Morgan fund can move markets (reuters)

In this context, the fears around Jane Street trades sound legit. However, traders stopped talking about the JPM Collar after a few months. Why? Because they learnt to trade around it, attenuating its impact. Maybe, given enough time, Indian traders would’ve also come up with strategies to deal with Jane Street’s trades?

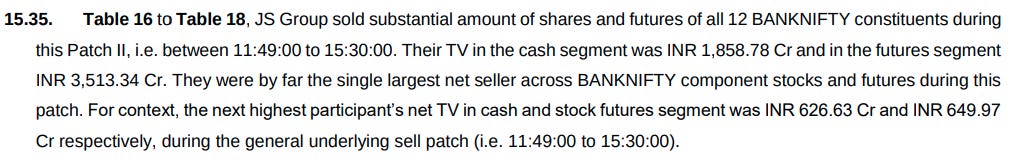

If Jane Street were to be accused of anything, it should be for ignoring signs that they were being a sloppy whale. They got so big that they were trading 3x that of the next guy.

And when the exchanges warned them about the oversized impact their trades, they kept going.

In February 2025, the National Stock Exchange (NSE), acting on Sebi’s instructions, issued a caution letter to Jane Street Singapore Pte Ltd and JSI Investments Pvt Ltd. The entities were advised to refrain from taking large cash-equivalent positions and from engaging in questionable trading patterns. However, the group continued the same behaviour.

Sebi bans Jane Street for stock market manipulation (indiatoday)

Or perhaps, they were making so much money (bloomberg), they thought that they could get away with it by paying a few million dollars in fines like what they are used to with the SEC? They are smart enough to have war-gamed this out.

This saga is going to make its way through SAT (Securities Appellate Tribunal) and India’s famously inefficient civil court system. By the time any of this is settled, IBGYBG4.

PS: NIFTY BANK, the index in question, is a degen favorite because of its volatility. Its an index of 12 stocks with the top 3 accounting for more than 75% of the index. The fact that this is allowed to trade is in itself a crime.

PPS: If regulators want retail participation to shift from options back to the cash market, they can do it by getting rid of STT and reducing STCGT on equities. But like a hobo hooked on crack, the government only wants more of it.

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

Some of you might prefer the recap as a video:

Links

Research

Measuring Effects of Public Schooling Expansions on Families (NBER)

Full-day kindergarten expansions were responsible for as much as 24% of the growth in employment of mothers with kindergarten-aged children.

Financing the Next VC-Backed Startup: The Role of Gender (NBER)

Despite robust evidence linking serial entrepreneurship to startup success, women comprise 13.3% of VC-backed founders but only 4% of those founding three or more startups. We find that women serial founders are penalized with smaller VC deals following failures of their prior startups but they are not rewarded with larger deal sizes following past successes.

What Are Skilled Investors Buying and Selling? (SSRN)

We construct a novel information factor (INFO) using the informed trades of corporate insiders, short sellers, and option traders. INFO strongly predicts future stock returns-a long-short portfolio formed on INFO earns monthly alphas of 1.07%, substantially outperforming existing strategies including momentum.

India

India Services PMI climbed to 60.4 in June from 58.8 in May - strongest growth in ten months (reuters).

Foxconn, Apple’s largest contract manufacturer, has withdrawn more than 300 Chinese engineers and technicians from its Indian iPhone production facilities over the past two months (economictimes).

India's aviation watchdog reprimanded Air India's budget carrier in March for not timely changing engine parts of an Airbus A320 as directed by the European Union's aviation safety agency, and falsifying records to show compliance (reuters).

July 1st: In its effort to curb air pollution, the Delhi government has enforced a fuel ban for 'end-of-life' or overage vehicles, that is, petrol vehicles aged 15 years or older and diesel vehicles aged 10 years or older (ndtv).

July 4th: Citing “critical operational and infrastructural challenges”, the Delhi government has put the fuel ban on end-of-life vehicles “on hold with immediate effect” (indianexpress).

row

Robinhood launches tokens allowing EU users to trade in US stocks (reuters, robinhood). This follows Kraken and Bybit launching tokenized stocks targeting global investors (ledgerinsights).

Stablecoin firm Circle is applying to create a national trust bank in the U.S. If the charter is granted by the U.S. Office of the Comptroller of the Currency, it would enable Circle to act as a custodian for its own reserves and hold crypto assets on behalf of institutional clients (reuters).

Crypto firm Ripple is applying for a national bank charter in the United States. The company is also seeking a Fed Master account that would give it access to the Federal Reserve's payments infrastructure and allow it to hold its stablecoin reserves directly with the central bank (reuters).

Some of the wealthiest universities in the US, including Harvard, Princeton, and Yale, are facing a new 8% tax on their investment income. This tax is part of a larger Republican tax plan and specifically targets institutions with endowments exceeding $2 million per student. The tax is tiered, with different rates applied based on the endowment per student, and the highest rate of 21% applies to schools with endowments of at least $2 million per student (thecrimson).

Some farms in England could be taken entirely out of food production under plans to make more space for nature (theguardian).

UK in dire straits after finance minister’s tears rattle markets (cnbc).

China tells EU it does not want to see Russia lose its war in Ukraine (scmp).

The EU may as well “apply to be a province of China” such is its inability to wean itself off that country’s supply of critical raw materials used in everything from electric vehicles to smartphones and wind turbines (theguardian).

To Compete Like China, America Should Build Like China (foreignaffairs)

As Mark Zuckerberg staffs up Meta’s new superintelligence lab, he’s offered top tier research talent pay packages of up to $300 million over four years, with more than $100 million in total compensation for the first year (wired).

Meme of the Week

Delta Hedging: Definition, How It Works, and Example (investopedia)

A collar involves: 1. Long Put (for downside protection) 2. Short Call (to finance the put) 3. Long Underlying or Synthetic Long Exposure

IBGYBG, an acronym for "I'll be gone, you'll be gone", became a popular saying among the hedge-fund managers who perpetrated the banking crisis of 2007-08. It refers to the many shitty deals and scams perpetrated by Wall Street on unsuspecting investors. Specifically, it means that the wheeler-dealers involved in a fraud plan to be on their yachts anchored off some private tropical island sipping cocktails before the shit hits the fan. That, or they'll be dead (rationalwiki).