Quantitative investing is an attempt at wrangling the infinite ways in which portfolios can be built. However, the application of statistical principles doesn’t mean that there is a “one true answer” that can be found. Terms like “quality” or “momentum” describe the journey, not the destination.

For example, MSCI has a few Indian factor indices. A cursory look has Quality beating Momentum.

However, if you look at the NSE indices that capture the same factors, you have momentum beat quality.

Also, NSE’s momentum index beats MSCI’s by a wide margin.

And so does their quality index.

Investors shouldn’t go only by what it says on the tin. They need to dig in and understand the processes and tradeoffs behind them so that they can withstand the inevitable periods of underperformance.

Most factors, we would have to live through several careers to finally witness enough evidence to dismiss them outright.1

So, know what you own.

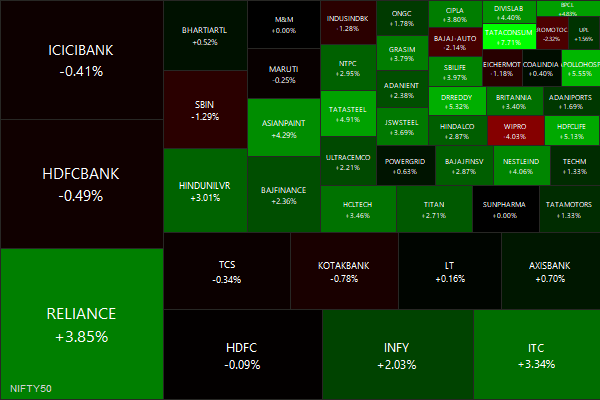

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

Links

Research & Investing

We study how passive investing affects asset prices. Flows into passive funds raise disproportionately the prices of the largest stocks in the index, while also making them more volatile. If, in addition, stocks are mispriced because of noise traders, then passive flows raise the most the prices of the overvalued stocks among the index’s largest. Passive flows drive the aggregate market up even when they are entirely due to a switch from active to passive. Underlying these results is that passive flows make prices more sensitive to idiosyncratic future cash-flows.

All factors were defeated by the SP500 the past 10 years. (tweet)

A war-related factor model derived from textual analysis of media news reports explains the cross section of expected asset returns. Our findings are consistent with assets that are good hedges for war risk receiving lower risk premia, or with assets that are more positively sensitive to war prospects being more overvalued.

Behavioral Biases Among Retail and Institutional Investors (SSRN)

Mutual funds are either run by a single manager or by a management team. Single-managed funds that changed management companies, on average, performed better than those that did not change. Also, single-managed funds outperform team-managed funds. (SSRN)

The wage-price spiral doesn’t exist. (nymag, economist)

Odds & Ends

India's government is planning to ask lawyers to keep a record of all transactions with their clients and share any suspicious activity with authorities. (reuters)

China's economy stumbled in May with industrial output and retail sales growth missing forecasts. (reuters)

India’s slow but sure de-industrialisation is worrying (livemint)

Ideas compound. Inventions compound. Education compounds. Small ideas mixing and compounding into big ones – that’s what really drives the world. (collabfund)