Last week, we presented a simple backtest to check if Mahalanobis distance can be used to detect regime shifts. This week, we added a trend filter to it.

tl;dr: the alpha seems to be in earning the risk-free rate when things are “bad” and getting long equities only when things are “favorable.”

More here: Mahalanobis Distance with Trend

Markets this Week

More pain, no gain.

US regional banks ($KRE) continued to be under stress with the Fed and the Treasury hemming and hawing about deposit insurance, banking system stability and rate increases. And with Credit Suisse out of the way, the market shifted its sights to the next weakest link in the network: Deutsche Bank ($DB).

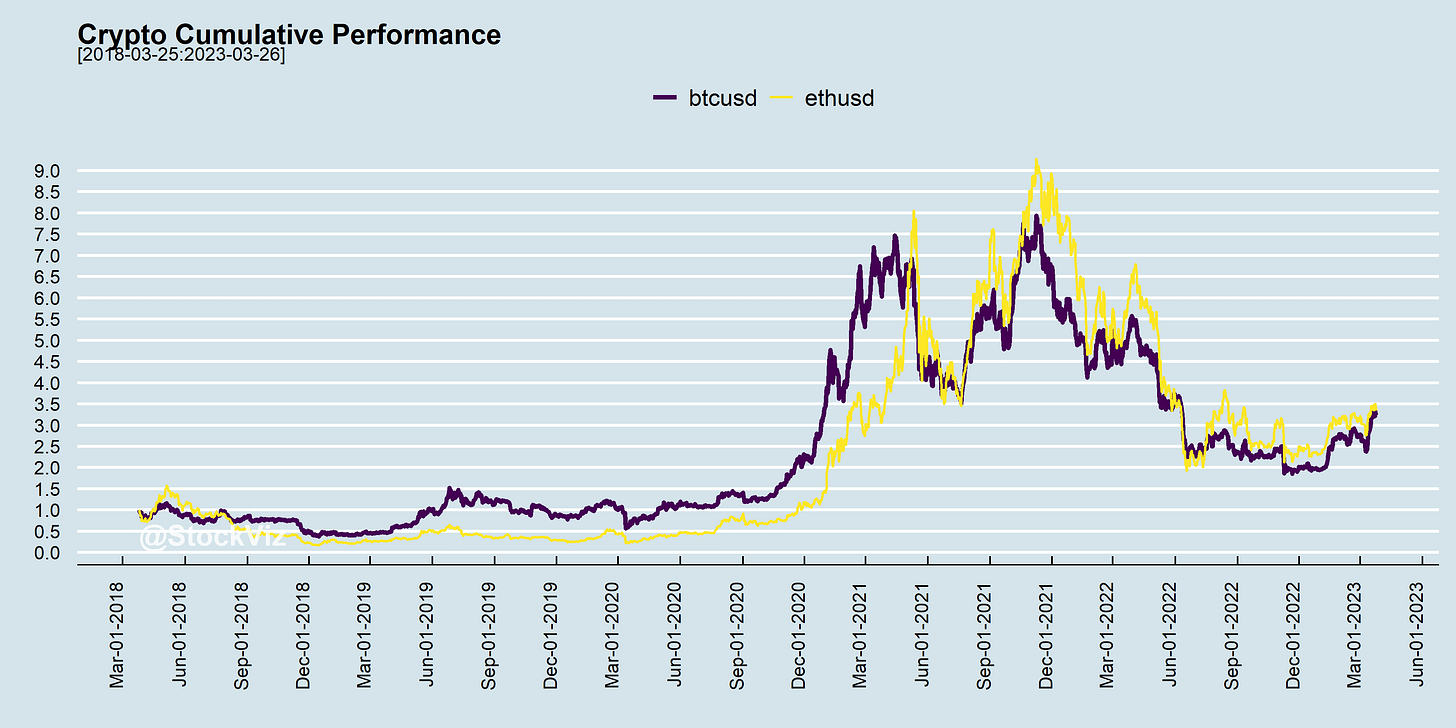

The last chance to get into crypto before the door closes?

More here: country ETFs, fixed income, currencies and commodities.

Links

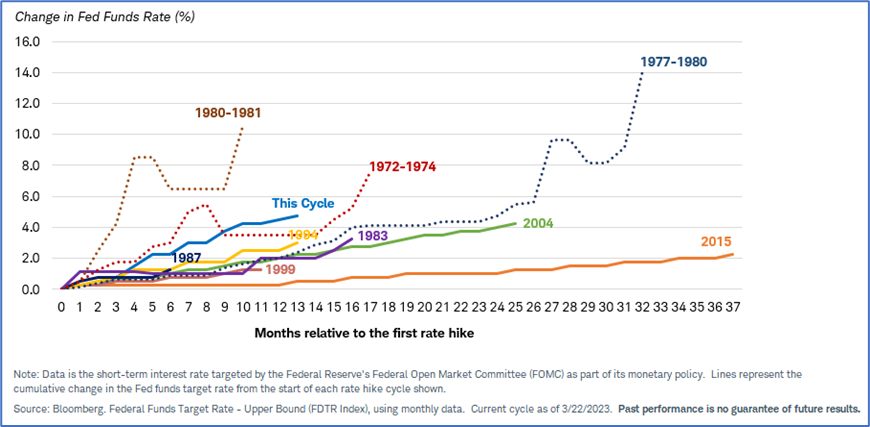

Rates!

Fed increases rates by 25 bps but signals hikes are near an end (economictimes)

Bank of England raises rates, says inflation set to fade (reuters)

Markets are betting on a Fed rate cut as early as June this year.

~

Banks!

Last Sunday, Credit Suisse and UBS merged to create a Goliath with combined assets worth twice as much as Switzerland’s GDP. (economist, ndtv)

About $17.5 billion of Credit Suisse bonds, known as Additional Tier 1 or AT1 debt, was written down to zero as part of a forced rescue merger with UBS. (reuters, reuters, cnbc, marketwatch)

After Credit Suisse’s demise, attention turns to Deutsche Bank (economist)

The global regulatory regime for “too big to fail” banks set up after the 2008 crisis does not work, according to Switzerland’s finance minister. (ft)

Banking’s last crisis featured subprime borrowers, specifically people with troubled credit who were given mortgages by bankers who ignored the risk that the borrowers wouldn’t realistically be able to afford them.

The current emerging turmoil is, so far, featuring the opposite. Banks such as Silicon Valley Bank and Signature Bank that catered to some of the wealthiest, most creditworthy clients—those with superprime credit scores—are the ones running into the biggest problems.

Rich customers came for the perks—then left with their cash. (wsj)

~

Taxes!

Budget delivers a last-minute blow to debt investors (livemint, livemint)

Biggest casualty of ending LTCG regime is not debt funds but the debt market (cnbctv18)

If inflation is 7%, bond yields 8% and your tax slab is 30%, is the risk worth it?

Nirmala Sitharaman hikes STT on sale of options and futures by 25% (economictimes)

Our FM hasn’t met a single tax she hasn’t hiked.

~

Investment Management

Since 2018 UC Investments has deployed over $800 million into Sequoia's funds and received only $43 million in cash distributions. Meanwhile ten of the Sequoia funds that UC Investments has invested in have been marked down in value on paper. (businessinsider)

Investors who chose managers with poor recent performance earned higher benchmark-adjusted returns than those who chose managers with superior recent performance.

If past performance is used at all in selecting managers, it is the best-performing managers who should be replaced, not the underperforming ones.

Asset owners should focus on factors other than past performance. (jpm.pm-research)