A month ago, we introduced Volatility as Beta. It turned out to be a bit of fortuitous timing because nothing could shake the market out of its summer doldrums. Neither Trump’s tariff shenanigans, nor tech’s limp earnings announcements lead to any panicked moves. Short-volatility won.

Since its inception in mid-April, the strategy has accumulated about Rs. 20 lakhs in P&L on a capital of ~Rs. 1.5 crores.

Theoretically, since this is a widely known strategy, the P&L should revert to mean over a period of time. There could also be a seasonal factor at play here - VIX in June, July and August has weak seasonality.

Let’s see how things shake out.

Markets this Week

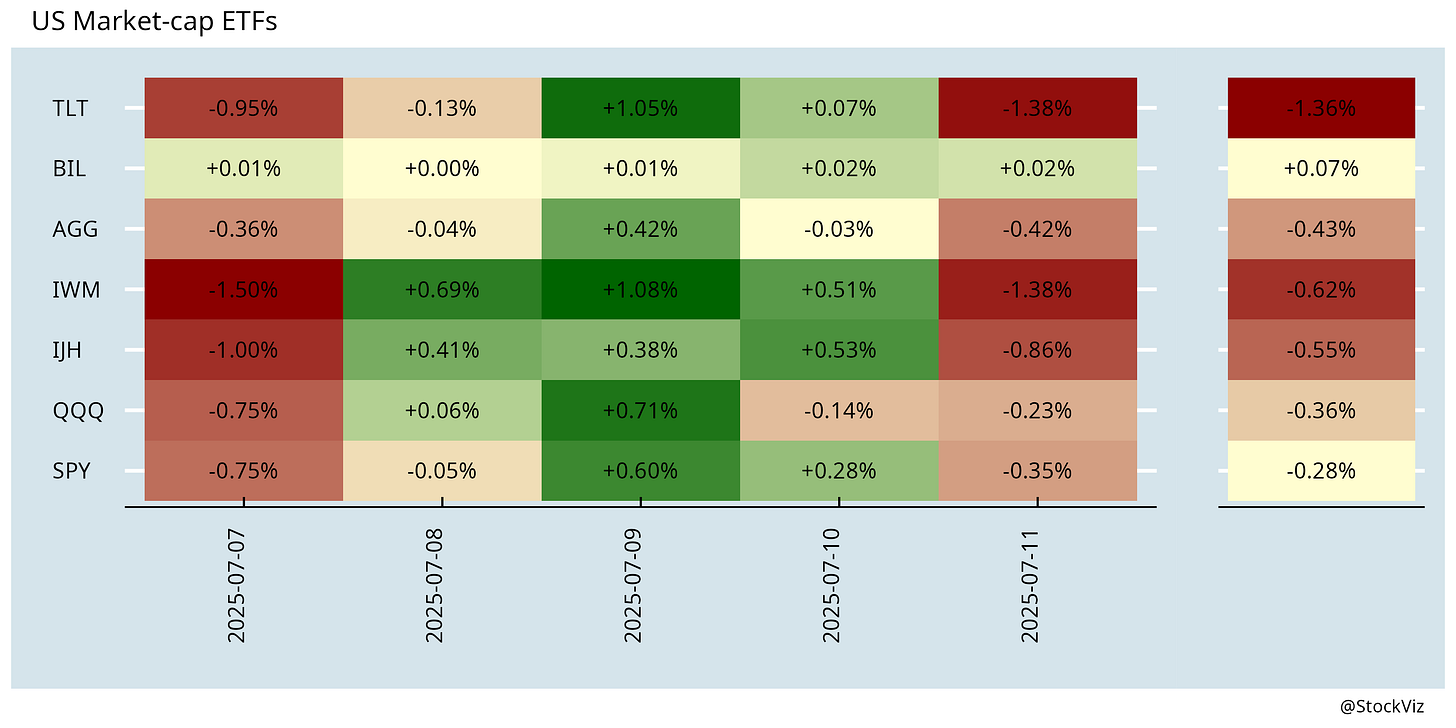

More here: country ETFs, fixed income, currencies and commodities.

Some of you might prefer the recap as a video:

Links

That taste for outsized risk has seeped into everyday culture. Wage growth has severely lagged compounded capital, causing ordinary people to increasingly see their best shot at real upward mobility in negative EV jackpots. Online gambling, 0DTE options, retail meme stocks, sports betting, and crypto memecoins all testify to the phenomena of exponential wealth preference. Technology makes speculating effortless, while social media spreads the story of each new overnight millionaire, luring the broader population into one giant losing bet like moths to a light (scimitar).

Research

Caveats of Simple Factor Timing Strategies (SSRN)

Some factor timing strategies have questionable after-cost profitability because of high turnover. Others suffer from substantial performance decay in recent years.

Revisiting factor momentum (SSRN)

Replacing the traditional one-year formation window with a one-month window yields significant alpha. We show that the positive autocorrelation between the one-month formation window and the subsequent month's return is twice as high as in the traditional one-year formation window.

Volatility: A Dead Ringer for Downside Risk (SSRN)

Despite its many shortcomings volatility is pervasive for two mutually-reinforcing reasons: First, it is very well known; and second, it is a very good proxy for the downside risk that investors really dislike. The evidence discussed here shows that a ranking of assets by volatility is very highly correlated with rankings made by different metrics that directly assess downside risk.

India

Why all Indians are rule-breakers (economist)

More than 125 chief financial officers (CFOs) have exited listed companies in the first three months of FY26 — a sharp 25% jump from a year earlier. Some of them walked out overnight, citing a cryptic phrase, ‘personal reasons’. Such exits have cast doubts about corporate governance and regulatory compliance (livemint).

Promoters sold shares worth ₹2.61 trillion in Q1 of FY26, a significant increase from previous quarters. Many promoters believe current valuations exceed the actual worth of their businesses, prompting a surge in stake sales (livemint).

India Inc sits on ₹5 trillion cash pile as firms hold back on capex amid uncertainty (livemint).

How Tamil Nadu turned ghost districts into industrial hotbeds (livemint).

Jio BlackRock Asset Management plans to introduce nearly a dozen equity and debt funds in India by the year-end, focusing on small-ticket investments and bypassing distributors to reduce costs (reuters).

row

Vietnam thought it had a preliminary deal with the U.S. to lower its tariff level substantially. Then, at the last minute, President Donald Trump raised the rate (politico).

Foreign officials, trade experts, lawmakers and even some White House allies have expressed a nihilistic view of the July deadline, questioning whether a deal with the Trump administration means anything at all given the president’s penchant for using tariffs as leverage to get his way (politico).

Trump’s second-term agenda is not only causing substantial near-term damage to the US economy, but also fundamentally threatening America’s global standing and competitiveness. The self-destruction of the past six months has been unprecedented – and is about to get worse (project-syndicate).

The US is a country that discovered debt as a natural resource around 2000, and has been exporting it ever since. The US has Dutch disease. Its export is the dollar (ft).

US fiscal folly could create big, beautiful debt spiral (reuters)

Britain’s public finances are bad. Their future looks worse (economist)

Prime Day is a scam (popular.info)

The End of Publishing as We Know It (theatlantic)

Inside the Media’s Traffic Apocalypse (nymag)

Landmark AI ruling is a blow to authors and artists (popular.info)