Sometimes, you read a piece of research that makes you go back and re-test your assumptions. Momentum at Long Holding Periods (SSRN, alphaarchitect) assumes that momentum portfolios are constructed with a one-month lag (skip-month). However, it need not be.

If you separate out the stocks that are only in the no-skip-month portfolio and compare their returns to the one-month skipped portfolio, there doesn’t seem to be strong effect in favor of using a skip-month: Momentum Skip Month (II).

You’ll be fine either ways.

And if the the mean-reversion argument is weak, then how strong are the effects discussed in this paper? Something to think about.

Our earlier post on this topic:

Trust but Verify

The original Jegadeesh and Titman momentum paper (pdf) is often used as a template to setup momentum portfolios. Pretty much everybody follows the 12_1_1 config: a 12-month formation period that skips the closest month and rebalances every month. And looking at our own momentum portfolios, we somehow made the decision about a decade ago to having 20 sto…

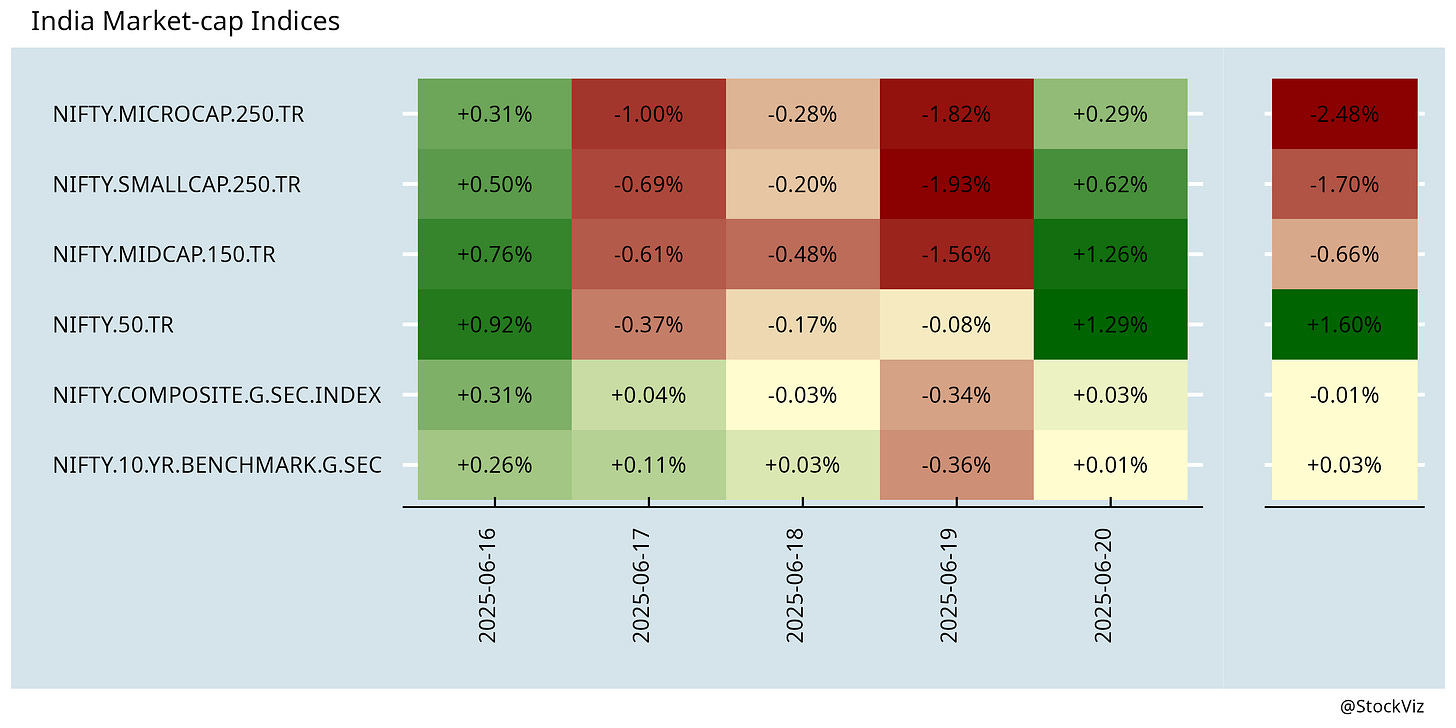

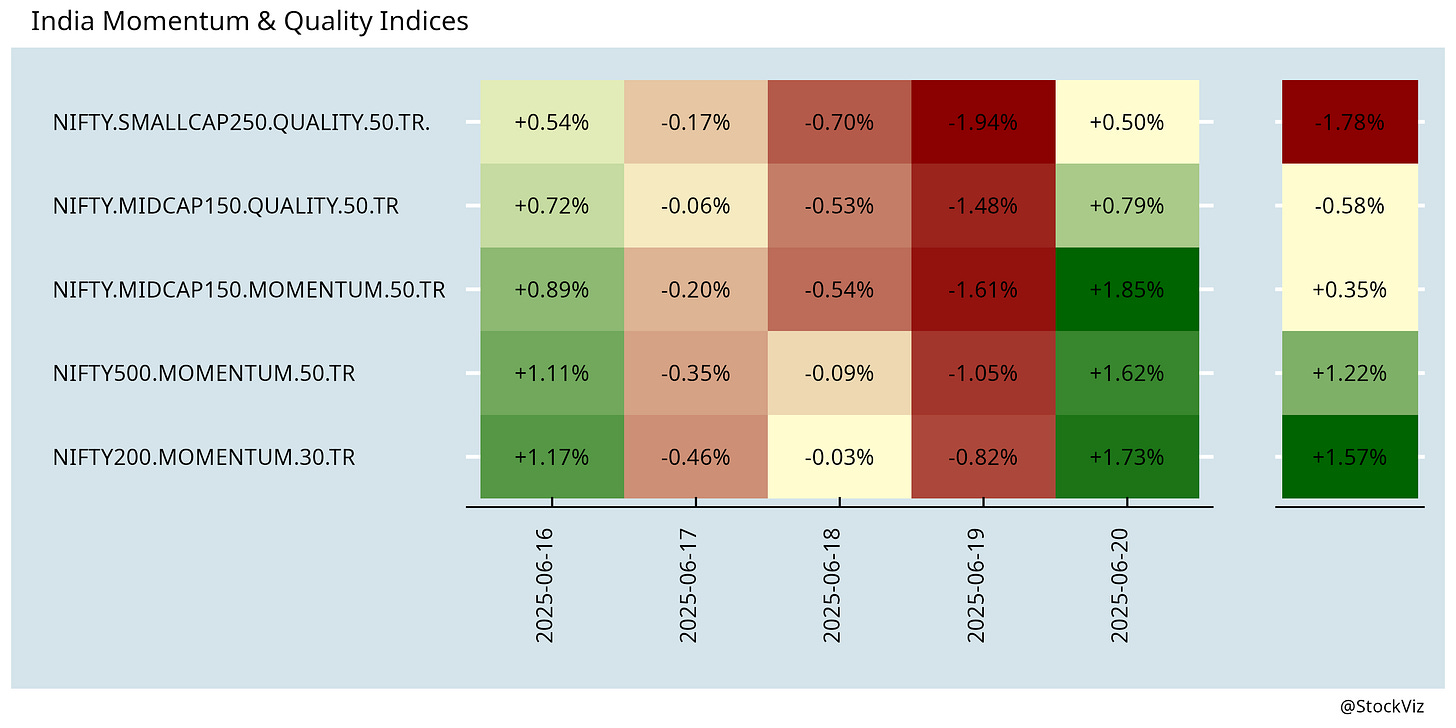

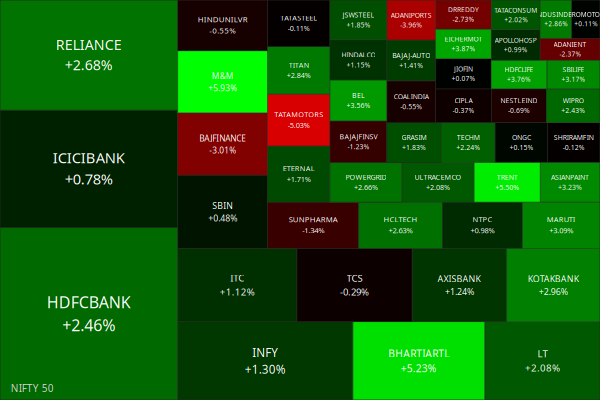

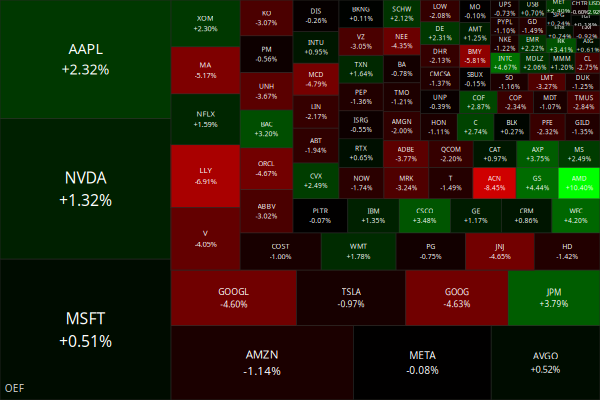

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Google effects on memory (frontiersin)

People are increasingly using the web for fact-checking and other forms of information seeking. The “Google effects” refers to the idea that individuals rely on the Internet as a source of knowledge rather than remembering it for themselves. Google effects on memory challenges the way individuals seek and read information, and it may lead to changes in cognitive and memory mechanisms.

Your Brain on ChatGPT (arxiv)

This study explores the neural and behavioral consequences of LLM-assisted essay writing. Participants were divided into three groups: LLM, Search Engine, and Brain-only (no tools). Brain-only participants exhibited the strongest, most distributed networks; Search Engine users showed moderate engagement; and LLM users displayed the weakest connectivity. Over four months, LLM users consistently underperformed at neural, linguistic, and behavioral levels. These results raise concerns about the long-term educational implications of LLM reliance and underscore the need for deeper inquiry into AI's role in learning.

How Size Matters: Traditional and Risk-Adjusted Reversal, Momentum, and Transaction Costs (SSRN)

We study the role of transaction costs in the persistence of reversal and momentum strategies across different size groups of stocks. Our findings reveal that Long-term reversal profits, which are strongest in small-cap stocks, decline sharply after accounting for costs, often turning negative. Similarly, momentum profits are eroded after trading frictions are included, with the extent of the decline varying across size groups. These results provide strong empirical support for the argument that, while idiosyncratic risk can be an impediment to arbitrage, transaction costs, alone, eliminate the reversal or momentum profit.

India

DRDO, IIT-Delhi demonstrate free-space quantum secure communication over 1 km (thehindu).

A series of measures to build, repair and finance ships in India are likely this year as the country aims to become a global maritime hub (livemint).

Half a dozen global trading giants, from Citadel Securities and IMC Trading to Millennium and Optiver, are ratcheting up their presence in India's booming derivatives markets, fuelling a hiring spree and pushing exchanges to improve technology (reuters).

Jane Street Under SEBI Scrutiny After Earning Over $2.3 Billion in India’s Options Market (rebellionresearch)

Tesla to open showrooms in July; ‘Made in China’ EV may cost more than $56,000 (timesofindia).

Union Commerce Minister Piyush Goyal has sharply criticised India’s past trade strategy with ASEAN nations, calling the approach “silly” and describing the bloc as the “B-team of China” (businesstoday).

Rs. 2000 Crore classroom scam just dropped (thehindu).

As a laggard in critical technology advancements, New Delhi runs the risk of turning its foreign policy strategy of multi-alignment, into a "multi-dependent" one: dependent on China for upstream goods; dependent on the US for advanced technologies; and dependent on sanctioned nations such as Russia for energy and defense. This could be the price it has to pay for failing to address the domestic challenges hindering businesses. Until India fixes its challenges at home — government inefficiency and supply-side reform — indigenization is a pipe dream (hinrichfoundation).

row

President Trump’s tax policy encourages the very offshoring that his tariffs are intended to stop (nytimes).

Even as tariffs remain a threat to the economy, Section 899 of the One Big Beautiful Bill Act — passed by the House but not yet the Senate — is adding a whole new headache. Referred to as a “revenge tax” or “retaliation tax,” the proposal is designed to punish certain countries whose tax policies the U.S. government considers unfair. Investors will pay a tax up to a maximum of 20% on investments in non-U.S. companies held directly or in a fund, starting at 5%. The amount would increase annually, with the intent of pressuring the targeted country to repeal its tax laws (institutionalinvestor).

China produces the entire world’s supply of samarium, a rare earth metal that the United States and its allies need to rebuild inventories of fighter jets, missiles and other hardware (nytimes).

As President Trump’s tariffs start to shut China out of the United States, its biggest market, Chinese factories are sending their toys, cars and shoes to other countries at a pace that is reshaping economies and geopolitics. This year so far, China’s trade surplus with the world is nearly $500 billion — a more than 40 percent increase from the same period last year (nytimes).

How Mossad covertly prepared Israel’s attack from deep inside Iran (washingtonpost).

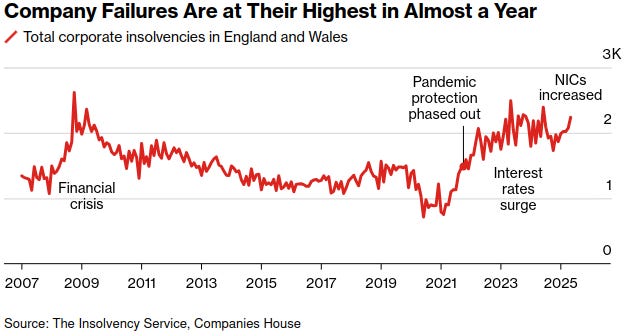

The number of companies going bust in England and Wales rose to the highest in 11 months as firms struggled with the Labour government’s tax hikes and a broader slowdown in the economy (bloomberg).

China floods Brazil with cheap EVs triggering backlash (reuters)

Trump's $499 smartphone will likely be made in China (cnbc)

‘Golden Share’ in U.S. Steel Gives Trump Extraordinary Control (nytimes)

Trump is turning out to be a liability for the Kremlin (theatlantic)

Secret Russian Intelligence Document Shows Deep Suspicion of China (nytimes)

Crypto

U.S. Senate passes stablecoin bill in milestone for crypto industry (thehindu)

Stablecoin adoption by corporates poised to grow after US Senate passes key bill (reuters)

The Genius Act Will Bring Economic Chaos (nytimes)

Coinbase seeking US SEC approval to offer blockchain-based stocks (reuters)

Pro-Israel hackers nab $90 million from Iranian crypto exchange - then burn it all in symbolic blockchain move (economictimes)

Odds & Ends

The future may be one in which AI creates ads, targets them—and then reads them too (economist).

In all countries, 39% of people said financial limitations prevented them from having a child. Only 12% of people cited infertility (bbc).

South Africa: A staggering 41% of low-income earners making between $432 and $810 a month are hoping their luck will pay the bills (focusgn).

Had the 19th century focused solely on better looms and ploughs, we would enjoy cheap cloth and abundant grain — but there would be no antibiotics, jet engines or rockets. Economic miracles stem from discovery, not repeating tasks at greater speed. AI primarily boosts efficiency rather than creativity (ft).

Generative A.I. chatbots are going down conspiratorial rabbit holes and endorsing wild, mystical belief systems (nytimes).