This week, we continued our exploration of the volume clock that we started a couple of weeks ago.

The current volatility in the markets is, in some way, a blessing because it is allowing us to test our streaming and caching infrastructure.

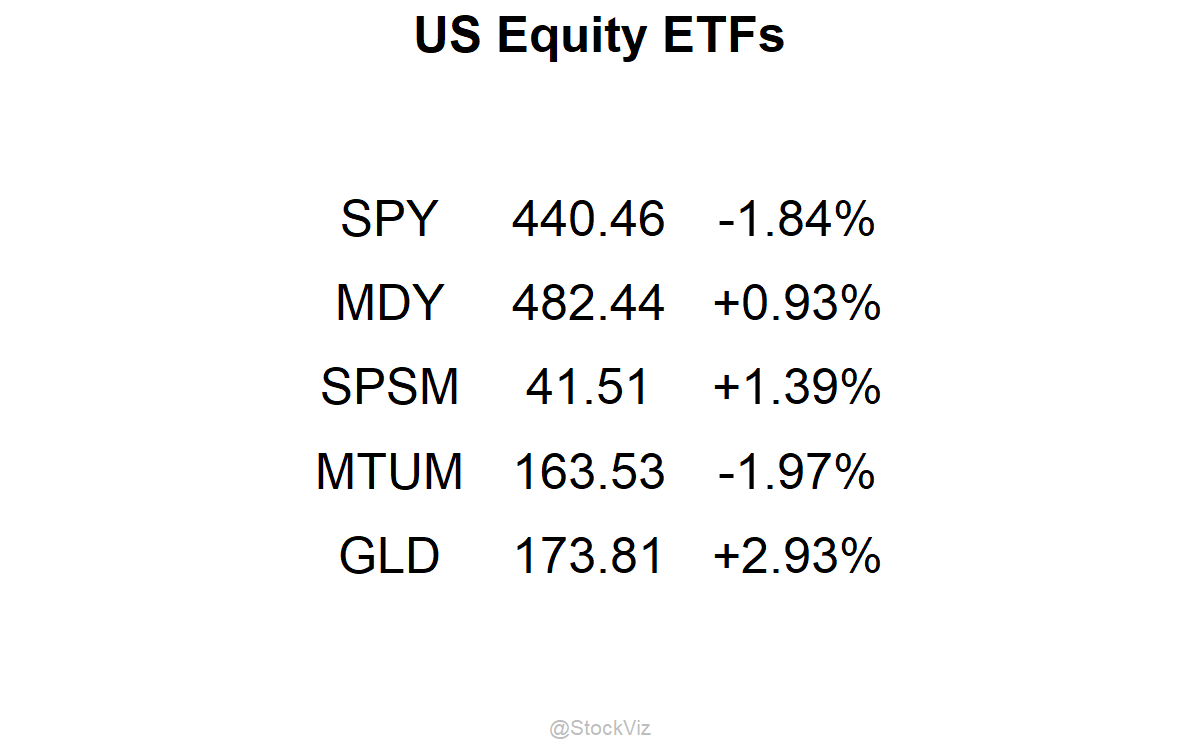

Markets this Week

Much to everybody’s surprise, the Reserve Bank of India decided to keep rates unchanged. It is a bit of a head scratcher because the US is on an accelerated rate hike path and EMs usually try to get ahead of the US.

The US markets were all over the place. Thanks to Federal Reserve Bank of St. Louis President James Bullard saying that he supported raising rates by a full percentage point by July, markets are now pricing a 100% probability of 50bp hike in March.

A dovish RBI and a hawkish Fed is ultimately going to pressure the rupee.

Links

Quick thread on "price" changes and market makers. (TRA)

You can replicate the performance of the stock market at lower volatility with a series of government bonds. (klementoninvesting)

So who’s really the greater fool? (davetrott)

Thorstein Veblen’s Theory of the Leisure Class—A Status Update (quillette)

No-code robots are here. (robotenomics)

Reduced access to contraceptives and the economic slowdown in 2020 induced a large increase in unplanned births for low-income families and a much smaller COVID-19 baby bust. (NBER)